A couple days ago, I took a look at the returns I was getting from my Liquidity placed in a Balancer 60% BAL / 40% WETH pool. You can see that post for more info. The TL,DR is that the value went down a bit with a decline in the BAL price, but the income was nice, working out to be over 100% annualized.

Today, I'll look at how my stake in the RUNE/BNB pool on Thorchain is going.

On the 9th of October, I rearranged my assets, shifting to my ledger and then re staking. So these results are for a 2 week period. At that time, I staked 30.2 BNB and 1776.41 RUNE.

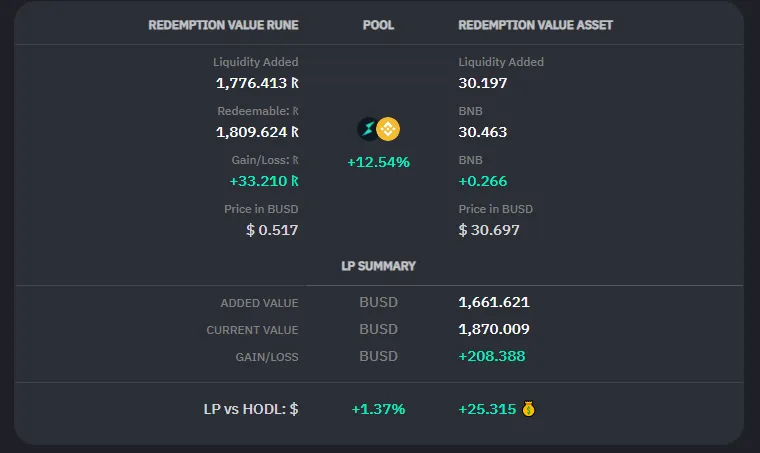

The first screenshot of my results is with the assets valued in BUSD.

Here you can see that in terms of USD (technically BUSD, but close enough) I am up 12.5% over the two week period. The main driver of this has been an increase in the RUNE price, but BNB has held up ok, and fee income and block rewards have helped the cause. In fact, the best thing in these stats is to see that i am better off in the pool than if I had just HODLed the assets. The goal is for fees and other rewards to outweigh Impermanent Loss, and that has clearly been achieved here.

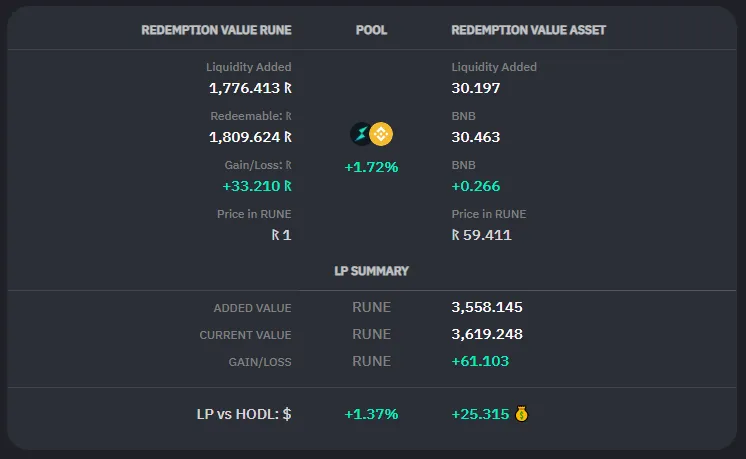

The next screenshot is the same asset performance, valued in RUNE instead of BUSD.

In this one, you can see that the RUNE value has gone up, but a lot less than the USD value above. That's obviously because the price of RUNE went up over the period. It's nice to see both assets in the green, and a gain in value.

Where to now?

Basically, this pool is just a holding location for my funds, until Thorchain get the native BTC pool up and running. Once that happens, I'll be removing the liquidity from this pool, and swapping the BNB for BTC. I'll probably wait a couple days to do it, and give time for the pool to deepen before I swap, so slippage is minimized. Then its add my RUNE and BTC to the pool, and sit on it for a while, adding more liquidity when funds are available.

Thorchain is a really exciting project, and I can wait till native BTC and native ETH / ERC20 tokens become available. Cross-chain liquidity pools are a step forward, and Thorchain is one of the most thoroughly planned out and tested protocols around.

Thanks for reading, remember this is "not financial advice".

Cheers,

JK.