Hey folks, so if you’ve been following me for awhile, you’ll know that I’ve long covered PerpDEXes, one of DeFi’s strongest usecases as people can trade nearly everything with crazy amounts of leverage. In today’s article, I’m going to be going into a deep dive on Zaros — a PerpDEX on Arbitrum that just opened up its testnet last week.

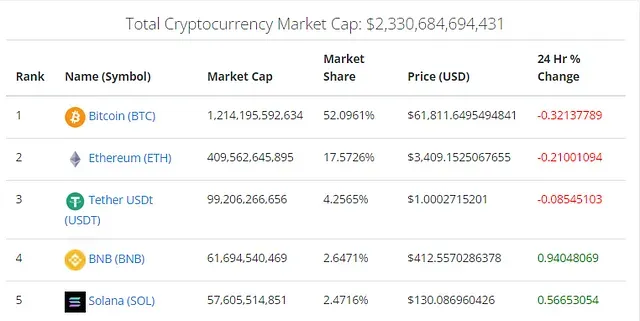

As I’ll go into further, unlike other platforms Zaros has possibly cracked the code as it has figured out how to draw liquidity not just from other protocols, but from the source that has the most liquidity of all — Ethereum. Apart from Bitcoin and stablecoins, Ethereum has nearly a 5th of total crypto-marketshare, a figure that’s more than 7x of its nearest competitor — Binance.

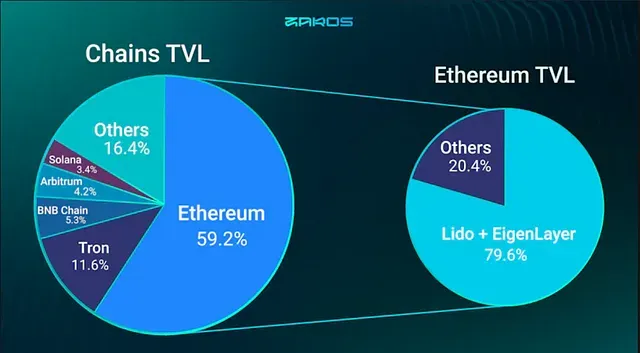

Yet as more of $ETH is being staked, liquid-staked, and even liquid-re-staked — as Eigenlayer has been able to discover this past year, there’s a great deal of untapped potential for those that don’t know what else to do with their LSTs and LRTs. Similar what Prisma finance did for $stETH, Zaros is creating a new case for these liquid staked tokens that has the potential to offer significantly higher returns for its liquidity suppliers than any other PerpDEX out there.

So how does Zaros plan to make this work? Let’s dig in…but first, let’s talk about why it’s important for PerpDEXes to have liquidity in the first place.

There’s two common actors in PerpDEXes — the trader(s) and the counter-party vault. When opening up a leveraged position, the trader essentially is opening up a borrowed position against the funds in the counter-party vault which is also the source of the PerpDEXes liquidity. In other words, like a casino, the counter-party vault acts as the “house” where it gains money when the trader loses, and loses money when the trader wins. Therein lies the risk of providing liquidity for a PerpDEX, but it’s a pretty lucrative proposition for liquidity providers as nearly 90% of traders end up losing money.

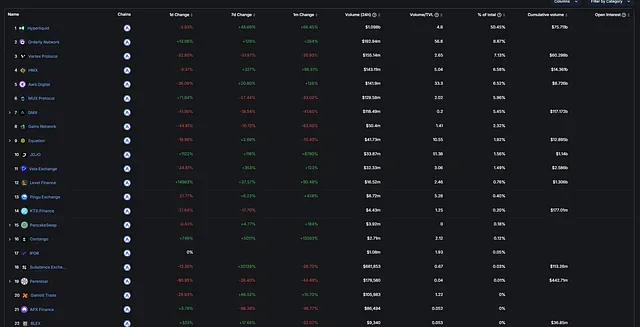

Being able to be part of “the house” seems pretty spectacular, yet one of the biggest hurdles for especially up-and-coming PerpDEXes is attracting the liquidity to come to their protocol in the first place. On Arbitrum for instance, unless you’re Hyperliquid, you’ll be competing for a very small slice of the liquidity pie. According to DeFiLllama, Hyperliquid has more than 50% of TVL across all derivatives platforms, with the rest — 27 different protocols — competing for the remaining 49.45%:

Without a significant amount of liquidity on the PerpDEX’s books, traders may be unable to conduct high leverage (100x+ trades) or even worse, they’ll believe that they won’t be able to get paid out properly if they score a big win.

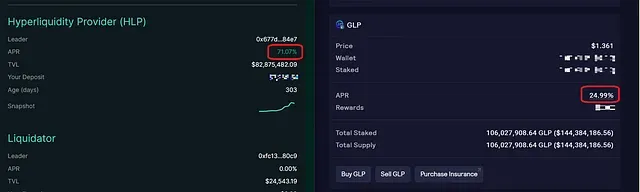

Low Capital Efficiency: On the counter-party’s vault side, with bigger protocol volume, chances are that there’s less utilization of the counter-party vault’s assets. In other words, you could have 100s of millions of dollars in the counter-party vault yet only a fraction of it that gets used, resulting in small yields for those supplying its liquidity. GMX for instance, who has one of the highest TVLs across all perpDEXes for all chains, has a Volume-to-TVL ratio of 0.18, meaning that very little of the value that’s held of GMX is actually being utilized in any trades. Hyperliquid on the other hand offers almost 3x’s the returns for $HLP holders, and it’s little coincendence considering it’s Volume-to-TVL ratio is 5.08:

So how does an up-and-coming PerpDEX offer high incentives for liquidity providers despite potential low utilization?

Unlike GMX or even Hyperliquid, Zaros sets itself apart from other PerpDEX platforms because it enables liquidity providers to earn native yield on their liquidity, regardless of whether or not there’s high or low utilization on the platform. By allowing liquidity providers to supply liquid staked $ETH and now liquid re-staked $ETH, users are able to earn #realyield on top of the gains they may be earning from traders.

Connecting to a Balancer Vault, tokens such as $stETH (Lido-staked $ETH), $sfrxETH (Frax-staked $ETH), $eETH ( ether.fi re-staked $ETH) are supplied to mint $zrsUSD, the native $ETH-backed stablecoin which is used by Zaros traders to leverage their trades.

Similar to methods from other protocols, LP providers will be able to gather traders’ fees and profits/losses, but on Zaros LP providers will at the same time be collecting the #realyield that they would have gained by staking it and hodling it otherwise. The exciting part is that with the incorporation of LRTs, re-stakers might be able to even more rewards. In the case of $eETH (Ether.fi’s LRT), you’d be able to earn $ETH staking yield, Ether.fi points, Eigenlayer points, and now Zaros points:

In actuality, this is more like sextuple rewards because by earning Eigenlayer points, you could be qualified for earning additional alrdrops (as we’ve seen for $ALT) and you’d be earning rewards from the PnL off of traders!

Although an exact date for a $ZRS drop hasn’t been announced, they did confirm in their last AMA that there would be an airdrop, and they’ve already instituted a Zaros points system for users of their recently launched testnet.

Personally I haven’t had the opportunity to access their testnet yet, as they’re only gradually releasing “alpha keys” which allow its access.

How can you get an alpha key? If you haven’t been a member of the community already, the admins of their Discord channel are giving out alpha keys every day, so I’d recommend camping out their general-chat room to see if they drop any.

Other ways you can possibly earn $ZRS points:

Completing tasks on their Zealy Questboard

Apply for their Trading League Pre-Season Registration

Participate in their Discord channel where you can earn Dragon coins

From a risk perspective, obviously leveraging your returns to more smart contract risk exposure will introduce more risk, especially when what you’re doing is going into uncharted territory. So please keep in mind that this is NFA and please DYOR before aping into Zaros, or even Eigenlayer for that matter. Additionally, there’s no guarantee that the house will always win, so like with any counter-party vault, understand that there might be a risk of losing your funds if traders end up doing phenomenally well.

All those things aside, the bet that Zaros is making is that it many people who are liquid-staking or liquid-re-staking their $ETH are going to want to capture as much yield as they can, and seeing as how much LRT-token holders are flocking to different strategies like with Pendle and Prisma, I’d say that it’s a pretty damn good bet.

As always thanks for taking the time to read this and be sure to follow me on twitter (https://twitter.com/CryptosWith) to get all my latest updates. Also, looking for a gift for your Crypto-loving/hating friend? Give them a REKT journal to cheer them up!

Disclaimer: This is not financial advice and this is for educational and entertainment purposes only. Please as always, do your own research and find what investments are best for you. Cheers everyone!