I came to learn about Orca some time ago and I have been using it to trade since then, thanks to the ACS drop via the Coingecko Candy. I forgot who recommended me to it but I'm sure it was via the Leo community. It sure is a source of information. But before that, let's take a closer look at what Orca is.

Accordingly, Orca.so is the first decentralized crypto exchange built on the Solana blockchain, the most user-friendly Concentrated Liquidity Automated Market Maker (CLAMM) on the network that offers minimal transaction fees and lower latency for token exchange. It's described to be providing the simplest trades, low fees (<$0.01), fast speeds (within seconds) best concentrated liquidity UX in DeFi, and the most efficient liquidity layer in Solana.¹

The DEX was launched in 2021. It supports a variety of cryptocurrencies and altcoins, it currently has 110 cryptos, and 438 markets (crypto trading pairs), the major markets being USDC, SOL, and USDT.²

Users not only can trade but also can farm (provide liquidity) and earn fees from millions in daily trade volume or farm rewards by depositing in Double-Dip pools (Whirlpools, akin to Uniswap V3) which offer multiple types of tokens as incentives.

Developers can also build quickly and easily using Orca's double-audited, open-source smart contract and open-source SDK and can tap on the Builders Program.³

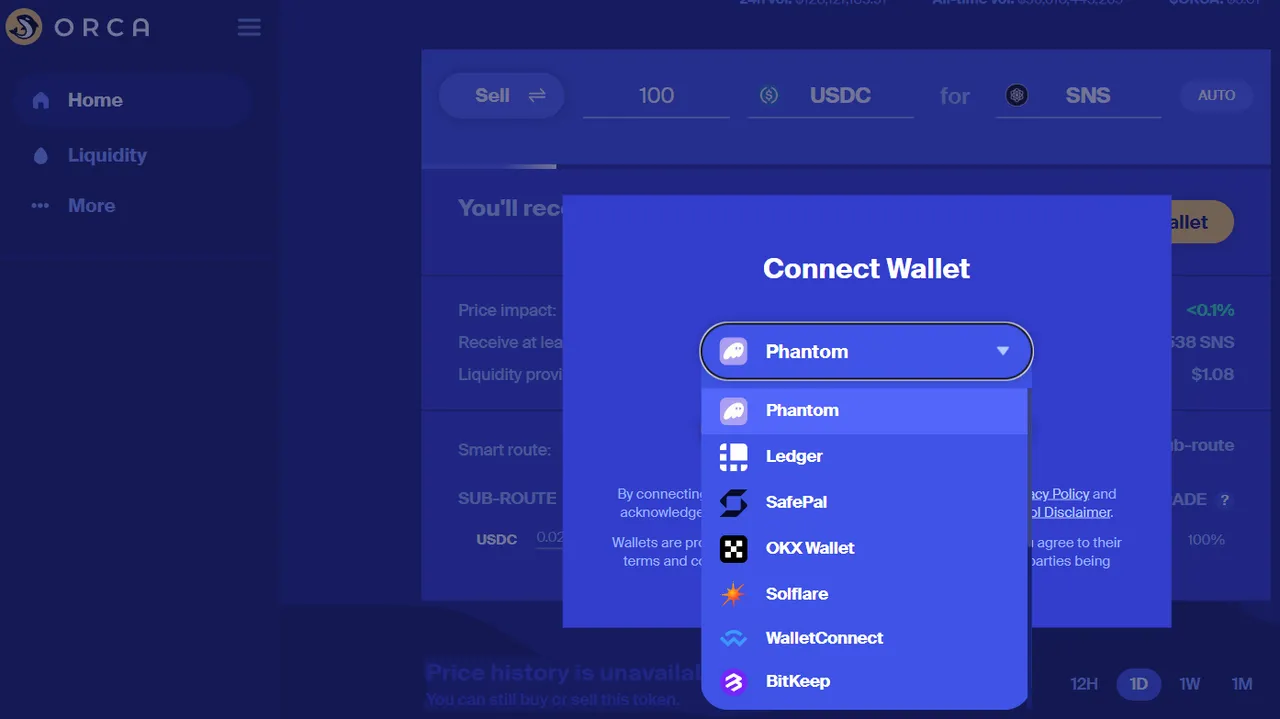

The exchange has an all-time trading volume of over $36 billion and a 24-hour volume of more than $130 million. Supported wallets include Phamtom, Ledger, SafePal, OKX Wallet, Solflare, Wallet Connect, and BitKeep. I'm personally using Phantom.

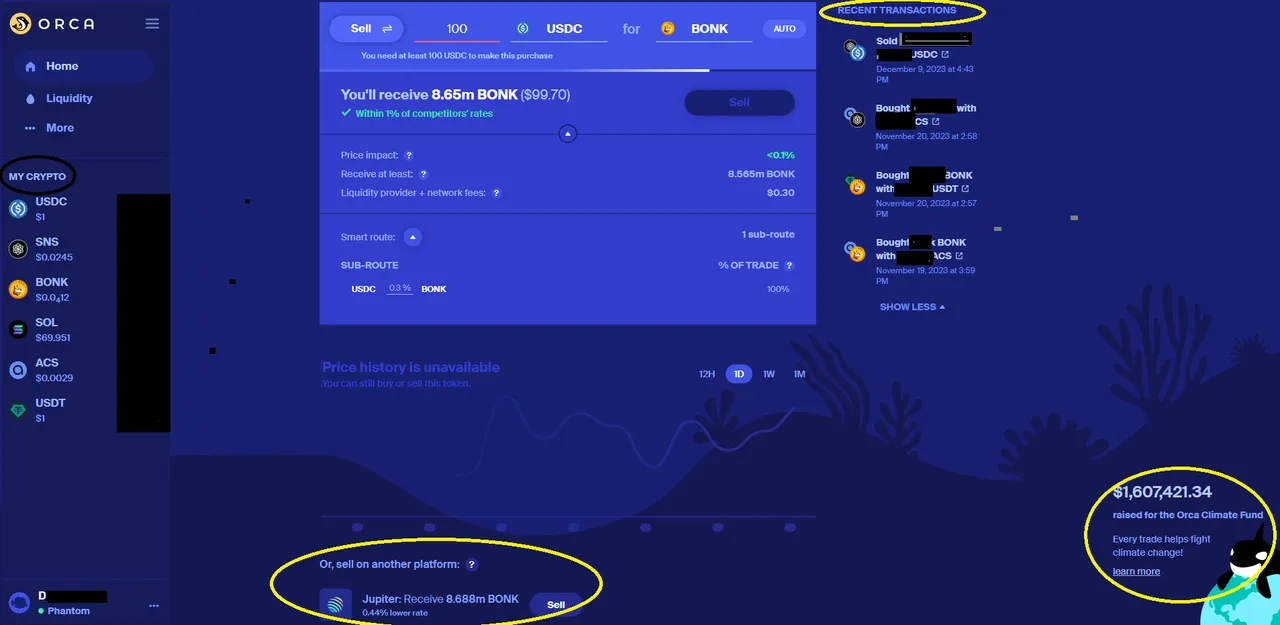

The UI is pretty simple yet cool, intuitive, and easy to use. Since it is an AMM, there are no order books. Recent transactions are shown on the right-hand side of the page, and the user's crypto assets at the left-hand side menu. When trading, the price impact, expected amount to receive, and fees are detailed in the trading window.

Per my experience, trading (swapping) takes seconds to process. I also like the feature where it shows at the bottom of the page the rate on another exchange which allows users to see and choose where to execute the trade better. As for the fees, it's a little over 1% which is cheap. And for every successful trade, a certain percentage of the fees go to the Orca Climate Fund which helps fund projects or start-ups related to Clean Water and Sanitation, Affordable and Clean Energy, just to name a few.

Ticker: $ORCA

Circulating Supply: 44,832,742 ORCA

Total Supply: 100 million ORCA

ORCA is currently trading at $5.65 and listed on different exchanges - Orca DEX, Coinbase, Gateio, Cryptocom, XT, Jupiter, Kraken etcetera.

ORCA is the native token of the Orca ecosystem and was issued in August 2021. It is a governance token and is used as an incentive for liquidity providers. "Orca is a DAO, with powers delegated to a DAO council, established through a vote. Holders of the ORCA token can engage with governance: formulate, discuss, and refine proposals and help plot Orca DAO's course through the DeFi seas."⁴

Orca has a private sale where it raised $18m from Polychain, Placeholder, Three Arrows etc.

ORCA has an initial circulating supply of 5.25 million (5.25% of total supply) and was all airdropped to liquidity providers and traders between the launch day and Aug 2, 2021, as follows:

All team members, advisors, and future investors will receive ORCA with a 3-year vesting schedule and a 1-year cliff or lockup.

Orca may distribute ORCA tokens as rewards on certain trading pairs to incentivize deeper liquidity. Token issuers may also provide reward incentives to attract liquidity to their asset pairs. The amount and duration of both types of rewards are subject to change at any time.⁵

There is also the so-called Orca Treasury that "ties the value of the ORCA token to Orca itself. The accumulated fees may be used to fund development, manage the token supply through buy-backs, or other initiatives that support the long-term health of the Orca protocol."⁶

Orca is a DEX that I would most likely be using over the years as I have had a smooth experience with it. I'm yet to dabble on the Whirlpools but might consider it one day. For now, I simply use the exchange to trade some Solana-based assets.

It would be nice if Orca would have a mobile app to allow users to trade while they are on the go. But overall, the platform seems to live up to its brand of being a user-friendly CLAMM in the Solana blockchain.

Info sources:

For infotainment only.

Lead image created on Canva. Image via Orca. Screenshots linked directly to their sources. No copyright infringement intended. 11122023/11:45ph