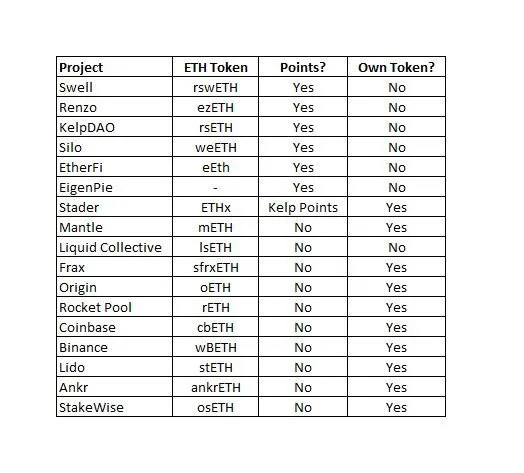

You may realize the ongoing trend of restaking, especially Ethereum, on EigenLayer and several other " Liquid Staking " (LS) projects. The restaking projects are used to create a peg among chains and layer 2s by using the wrapped forms of cryptocurrencies.

For now, the trend of Liquid Staking is limited to Ethereum, and the major project that investors farm points / future tokens is EigenLayer. Eigen is believed to change to whole sentiment in the DeFi ecosystem with its brand new system of staked coins. Though the staked version of coins is not something new because we have WETH on almost all chains, the new system utilizes the staking return of the token and add it up to its valuation in many cases.

As it sounds like a way of making passive income, the hype is on and growing. To be honest, I regret not following my friend when the hype first began. The staking on Eigen Layer had been paused for a long time and there is a rumor that it will be activated again ( I guess with more quota on the wrapped forms of ETH in projects like Swell, Lido and others) on February 5.

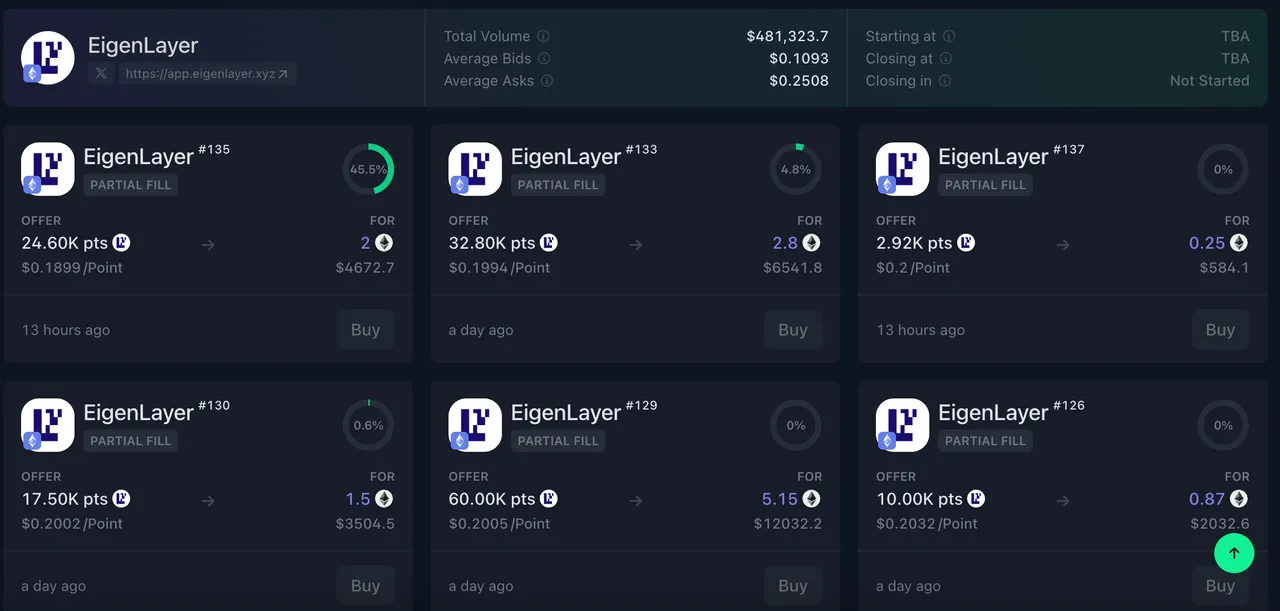

You might be shocked but you can sell your points, yeah not tokens; points, in OTC thanks to Whale Market - OTC Trades. Simply, your EIGEN points can be sold for around $0.20 as of today's price.

Also, the trading volume is not too bad so far. Around half a million dollars of trade has been actived though there is nothing about the project yet.

I think Eigen is one of the most hyped projects of 2024.

You may get 2 airdrops with liquid staking

Basically, people want to farm Swell and Eigen at the same time. Thus, Swell has one of the highest staking rates on Eigen Layer. If you want to do so, Swell, KelpDao, EtherFi are some of the ones that people talk a lot about.

Of course, you are taking the risk of " depeg " which means the holders sell off one of the parties and create an imbalance in the liquidity pools. As a result of a FUD, the token loses its value in a short time. This is the worst case scenario but you know that crypto is crypto 😅

On February 5, I'll be using Swell and Renzo because I do not want to use ETH mainnet only.

As EigenLayer on X posted, the projects Connext and Renzo will make it possible for investors to liquid stake their tokens. By using Arbitrum, I might be able to save tens of dollars that would be wasted in Ethereum mainnet transactions and approvals. Yet, if it does not work on Arbitrum, I'll definitely pay for that to utilize the hype on LST concept.

What do you think about the growth of Liquid Staking and EigenLayer?

Share your thoughts and strategies if any 👇

Hive On ✌️