The GRT (The Graph), which has been hotly discussed in various groups recently, has been online since December 18, and the highest price before publication is 0.78 US dollars, an increase of 2600%. It is not known whether this momentum will continue in the future, but investors Already looking for the next target.

Two days ago, the Inverse, which was madly admitted by a tweet by Andre Cronje, sent three disappointing announcements after the warehouse was full, and people just regarded it as an "AC Twitter".

Are there any good projects that can be pursued in the near future? I think it is 1inch.

I have done an overall review for everyone. I believe that after reading it, you will understand why I am optimistic about it.

Introduction

1inch is one of the world's leading decentralized exchange aggregators. 1inch was founded in May 2019 by CEO Sergej Kunz and CTO Anton Bukov. The platform aggregates liquidity from various exchanges and can split a single transaction and trade between multiple DEXs. Users of 1inch Exchange's aggregator can optimize and customize their transaction process.

timeline

On August 12, 1inch launched Mooniswap, a decentralized exchange that integrates AMM and DEX functions.

On October 14, 1inch integrated the Swap function in the Metamask wallet.

On November 18th, 1inch launched the second phase of liquidity mining, and 4 mining pool trading pairs were added to Mooniswap, whose tokens will reward liquidity providers.

On December 2, 1inch officially announced that it had received US$12 million in financing.

On December 5th, 1inch released a new feature, launching a private transaction that everyone can use. This feature can not only avoid early transactions, but also instantaneously connect to 10 Ethereum miners to broadcast user transactions directly to miners, thereby shortening transaction mining time.

Token model

At this point, 1inch's currency issuance plan has begun to take shape. I think it is very likely that the currency issuance at the end of the month mentioned above will be used for the following purposes:

1. Ensure that the interaction with the agreement maintains a permissionless interaction mode;

2. Raise funds for the development of the ecosystem;

3. Encourage users to participate in governance in the ecosystem;

4. Ensure the security of the network.

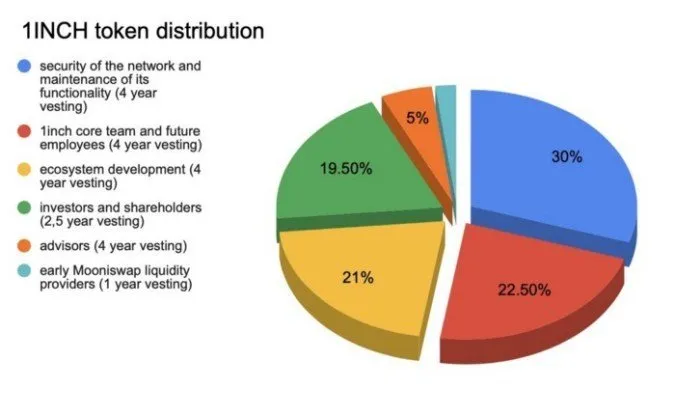

The distribution model is: 30% of the total tokens will be used to ensure network security (unlocked in 4 years);

22.5% is distributed to 1inch core team and future employees (unlocked in 4 years);

21% is used for ecological construction (unlocked in 4 years, part of which is used for liquidity mining plan);

19.5% is allocated to investors and shareholders (unlocked in 2.5 years);

5% is allocated to consultants (unlocked for 4 years);

2% is allocated to its Mooniswap-based early liquidity providers (unlocked for 1 year).

At present, all 1inch tokens are basically obtained through participation in liquidity mining. It can be seen that 1inch has made a big layout for this, and after updating the v2 version, it has established a decentralized transaction with privacy protection. Therefore, this is exactly the problem to be solved under the general trend.

1inch provides a good solution in this regard, which is why it can stand out in the decentralized exchange market. According to DeBank data, 1inch has a 24-hour trading volume of US$48,561,862. It currently ranks fourth, and it ranks in it. The previous Uniswap, SushiSwap, and Curve have all issued coins. In the face of this chaotic market, it can be said that 1inch's performance is very strong.

We can foresee that after it is issued, the market will bring a new wave of enthusiasm, and at the same time there will be more strong opponents. Many markets are already paying attention to it, why not look forward to it?