Hey All,

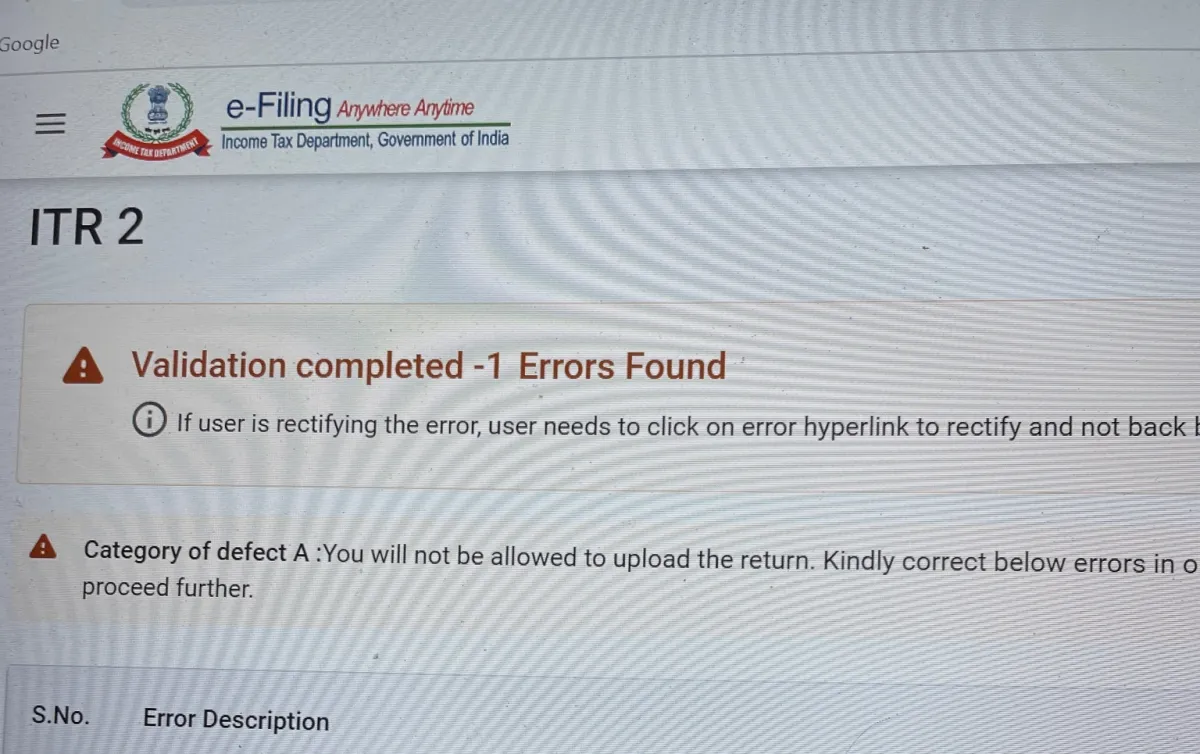

As promised in my post that I will be talking about how to resolve the validation error that I was getting when filing my Income tax return for this financial year 2024-2025. All was going smoothly until I hit this error stating - a Validation error found in section 10" there was a hyperlink but then clicking it doesn't take you to the right place so that's a bug in the web portal there itself. Here is the error how it looked like::

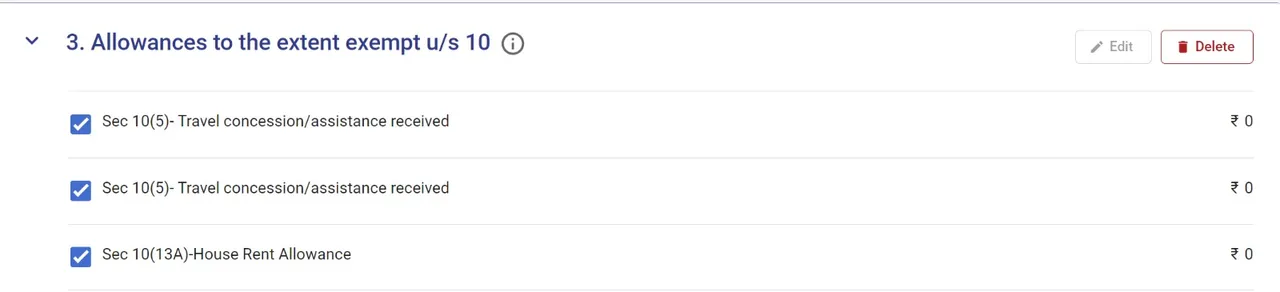

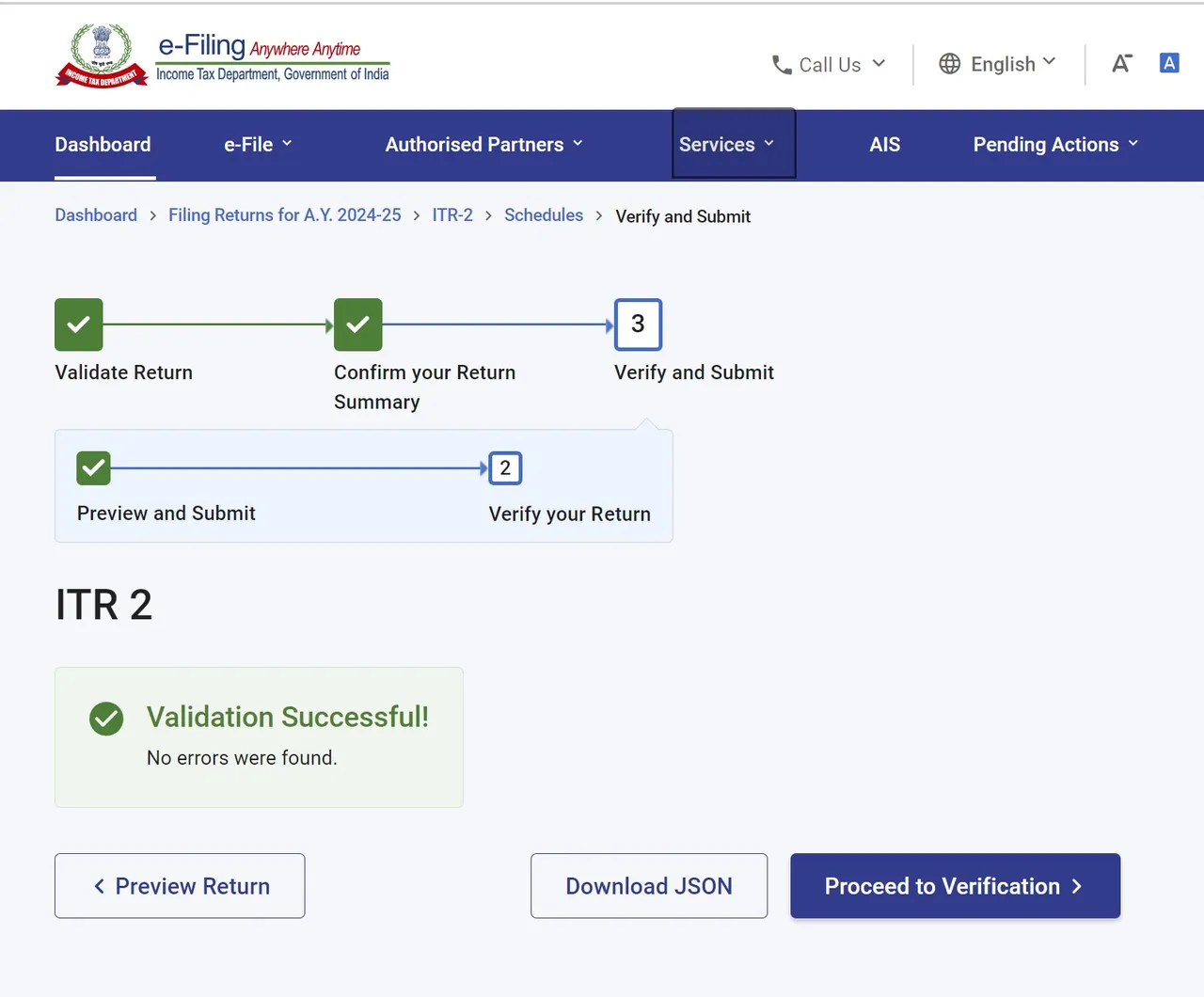

Upon further investigation, I came to know that there were some boxes which didn't have value in them and they need to be deleted to get rid of those errors. Here are is the snapshot that I took while deleting the boxes and when I saved it and when ahead doing the validation it succeeded with no errors.

As you can see those heads under the section 10 are having a zero value caused the validation to fail. Ideally it shouldn't be the case but a software can have a bug and we need to deal with some solutions that we have in hand. And this case deleting the exempt allowance provided under section 10 did the trick. So one tip here if you are also facing similar validation problem and you have a section head where the value is zero better delete that section and the validation should pass through. And the final moment for me seeing this "Validation Successful"

The next step was to preview and submit the return and then I verified it with my Aadhar [Unique Identification Authority of India] and now I am all done with India Income Tax Return Filing for this fiscal year. I must say that this time it was much easy as compared to filing it with the utility tool, that was more complex and required a lot of time as there where many steps involved. I would recommend folks try filing their income tax return by themselves and avoid paying heft fees to third party websites. First time it will be difficult but then you learn and for the next time you are ready to file it yourself with some help from the internet. Overall the Incometax filing process is a very daunting process when you do it yourself but at the same time you learn a lot as well while you fill out all the details provided in your Form16 and 26AS - one important point to note here is that please ensure that you are filling the right details as mentioned in Form16 that you receive from your employer and 26AS which can be obtained from incometax portal any discrepancy found will lead to a notification from the Income tax department.. That should be it for todays post. So be watchful and vigilant while filing your returns. Happy Income Tax filing mates.... cheers

#tax #income #incometax #india #taxfiling #incometaxfiling #utility #incometaxgov

Are you done with your incometax filing for this Year? Online Vs Offline? Did you explore the desktop utility for you tax filing. Let me know your views in the comment section below..cheers

Image Courtesy:: incometax, taxconcepts, timesofindia

Best Regards