I've just read an interesting article by @taskmaster4450 proposing the internal market as a good way to increase the HBD in circulation, if more people exchanged HIVE to HBD at a small premium at which the HBD stabilizer operates.

He also clarifies the distinction between exchanging HIVE to HBD (sell HIVE) or HBD to HIVE (buy HIVE) on the internal market and the conversion mechanism, something that was needed for many regular users of Hive.

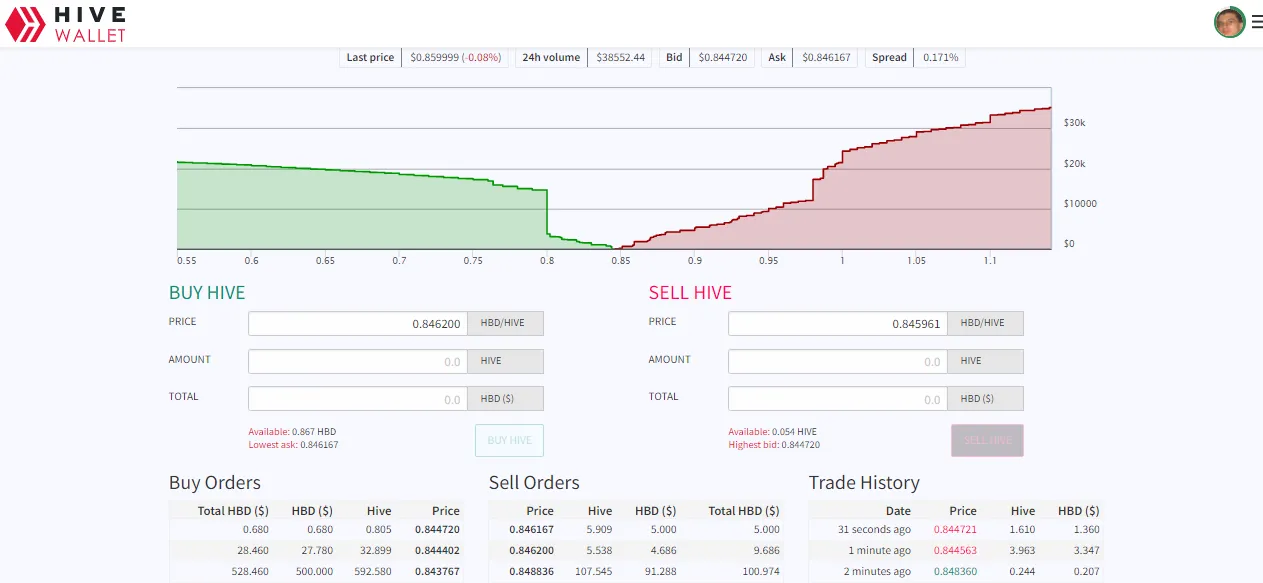

You are probably aware of how the internal market looks like:

It may not be the coolest interface around, but it does its job.

And unlike centralized exchanges with their points of failures, this is a decentralized exchange from what I see, apart from the front end.

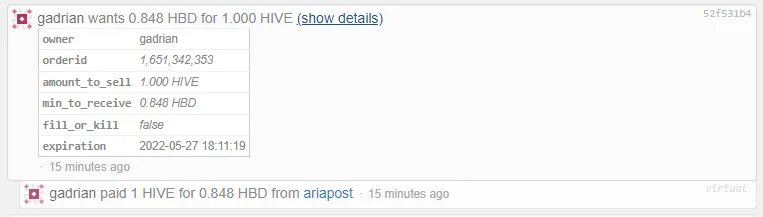

Look here, I made a test exchange so you can see:

It was all on the blockchain. A virtual operation that informs whoever reads the blockchain that I 'wanted' a certain amount of HBD for a certain amount of HIVE.

And a real transaction happening when someone took my offer, and the exchange happened. In this case it was almost instant, since I took the market price.

Someone could say, how is this internal market decentralized if you can only access it via one interface (and one domain)?

Well, that's a fair point, but transactions are on the blockchain (including when you add a new order), which means, technically, there are the low level operations necessary to interact with the blockchain this way. Maybe even APIs for them, I don't know.

The problem I would see in creating different interfaces for the internal market is managing order books separately.

If on one interface someone creates an order, when it gets filled (totally or partially), how do all the interfaces know it got filled? They can't know, unless they each keep an order book on the backend and reflect the internal market transactions that are broadcasted on the blockchain (in my example above, the second operation).

This could be problematic... Because it involves financial transactions with HIVE and HBD that are not based on the consensus of witnesses, but on order books kept centralized by various interfaces.

EDIT: Looks like I was wrong in my assumptions struck through above. In a comment, @ engrave said the information is fed to the interfaces via an API. I still asked who provides the API, the witness nodes or the operator of the hive.blog interface. If it's provided by the witness nodes, that makes the internal market even more decentralized.

Engrave also mentioned there was another internal market on Ecency and that he works on something too.

This may be or not the reason why we don't see alternative interfaces for the internal market on Hive.

But this was the extent of my insight on this matter on a late Saturday evening.