I use diesel pools on Hive-Engine intensively and have done so since very close to their launch.

I believe diesel pools were introduced at the same time as the new front end from the Hive Engine team, TribalDex, about 3 years ago, so they certainly have some history on Hive-Engine already.

After some brief research, looks like I was close enough. They were planned, but not yet released.

SEO note: interesting that the inleo.io domain was the first Hive front-end result for this post (on presearch/dsearch), despite being newer than other domains and, obviously, not the front-end used by aggroed to publish his post.

I know some people avoid diesel pools, for various reasons. Some of these reasons are legitimate and revolve around a lower risk profile of the user, others are because of the lack of understanding. It's the second category of reasons that I'll try to clear up, to an extent, in this post.

Before we start, if you are familiar with liquidity pools from other ecosystems, diesel pools are relatively similar. Where differences appear is in the way rewards are distributed (once a day) and the way they are added: someone (anyone!) has to add reward tokens to the diesel pool distribution contract; there is no inflation dedicated to LP rewards. Also, when the reward period expires, they need to be refilled. Liquidity providers also earn fees from transactions, as it usually happens in other ecosystems.

And now, for the people who know some basics about diesel pools but would like to learn tips and tricks, here they are:

Swapping in the Diesel Pool or Trading on the Tokens Market?

Swapping is one of the operations I do most often in diesel pools and on Hive-Engine, in general.

But when do you swap and when do you trade?

When the pair between the tokens that you want to swap doesn't exist as a diesel pool, you only have one solution: trade from the first token to SWAP.HIVE and from SWAP.HIVE to the second token (if the second token isn't SWAP.HIVE).

When you have both options to choose from, you have to take into consideration that swapping generally takes fewer steps, especially if you have to swap multiple tokens to the same token (like multiple tokens to SWAP.HIVE). So, it saves you time.

If you want to optimize for the price you get (especially if you have a higher dollar-worth amount to swap/trade), then you should check both options, swapping and trading. One of them will be better and that's the route you should generally choose.

For higher amounts, or in diesel pools with low liquidity, the price impact becomes a parameter you should watch carefully.

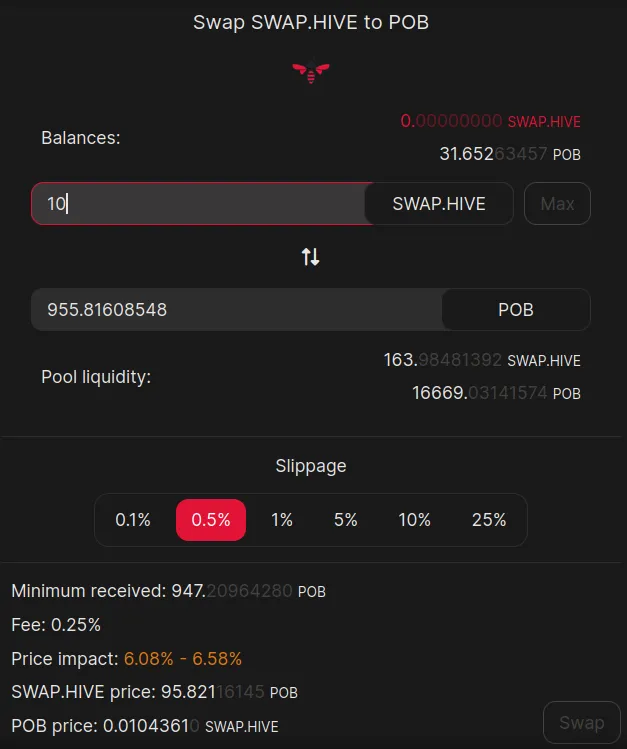

In the screenshot above, I want to point out exactly that aspect, the price impact. Note what happens if I would want to swap 10 SWAP.HIVE to POB. Look at the price impact at the bottom (in orange, in this case). It would be between 6.08% and 6.58%. That's a pretty high price impact, but it can be even higher, like 25% or even 50%. You can imagine anything above 10% generally isn't worth it, and more than a few percent rarely is (usually this should be below 1%).

The price impact can be lowered by doing multiple lower-sized swaps. But then you need to be careful about the accumulated fee, which for diesel pools is set at 0.25% for every swap. So, if you do 4 total swaps to complete your full swap, that's 1% in fees, plus the price impact on each swap. It might help if you leave some time between the smaller swaps to allow the arbitrage bots to rebalance the pool to some degree, so you won't have a higher price impact on subsequent smaller swaps.

If the price impact is still high, and you are not pressed by time, the best solution is to set limit orders and wait for them to get executed. Or if there is the option of an OTC transaction, maybe that should be considered.

What Parameters to Check for Diesel Pools?

We'll move here from the user's perspective of the diesel pool (swapping) to one of the liquidity providers, and analyze the most important parameters of the diesel pools to focus on.

I think this is a somewhat personal decision, it depends a lot on the risks you want to assume and the time horizon. For an up to medium risk the plan to build up (or hold) a position at least for the medium term, here's what I would consider:

Tokens from the Pair

There are multiple ways we can look at the two tokens from the pair that makes up the diesel pool.

Impermanent Loss (IL)

Not understanding how impermanent loss works is probably one of the main reasons why people avoid adding liquidity to diesel pools. There are two solutions to this:

- you either keep reading about the concept until one explanation finally makes sense for you

- you make it a non-issue

I'll discuss the second option and what does it mean. At the basic level, it means adding liquidity to a diesel pool where you like both tokens equally, and wouldn't mind being left with only one of them and none of the other (no matter which one it is), and you will be fine with however their number varies in time in the pool.

Let's say you have a position in the SWAP.HIVE:SPS diesel pool. If you like both tokens equally, you don't mind if you end up with more SWAP.HIVE or more SPS at any point in time.

Let's say, on the other end, you have the SWAP.BLURT:SWAP.BTC diesel pool. Would you mind ending up with more SWAP.BLURT and less SWAP.BTC than initially due to impermanent loss? Probably!

There is another catch when taking this approach. The dollar value of your position can still go down, in various scenarios. And if they both go down in price, the dollar value for something like SWAP.HIVE:SPS will go down much quicker than for the two tokens, separately. But it also goes up much quicker on the way up.

That why, I wouldn't keep a SWAP.HIVE:SPS in the crashing phase of the bear market if I care about the dollar value. But I would keep a SWAP.HIVE:SWAP.HBD, maybe (there isn't a diesel pool with two stablecoins on Hive-Engine anymore if we take BUSD out of the equation). If one side of the diesel pool is a stablecoin, it slows down the drop of the volatile token in dollar terms, but it also slows down the recovery.

Inflation & Utility

The second factor that is important for tokens that are part of a diesel pool is their inflation, and utility, respectively.

They come as a package because a token with many use cases that create demand can sustain higher inflation without affecting the price significantly than another with limited utility.

But if inflation adds a sell pressure that pushes the price down without any support, that's a bad choice for one of the tokens in the diesel pools, especially if the other token is one you'd like to keep, like SWAP.HIVE.

Let's call this token X, so we can refer to it more easily.

Let's say someone added 1000 X and 1 SWAP.HIVE to the pool.

If the price of X drops rapidly, after a while, you will end up with many more X tokens and fewer SWAP.HIVE, exactly what you don't want.

Liquidity and Volume

Another important parameter to consider for tokens that make up a diesel pool is liquidity.

This is actually an interesting game.

If a diesel pool has a decent volume (can be checked, along with fees, on TribalDex) but a lower liquidity, adding liquidity to it will make you earn a higher portion of the transaction fees.

If a diesel pool has almost no volume and low liquidity, you have to consider what it'll cost you to exit when the time comes: can you exit? how long it takes? with what price impact?

Of course, this is a fluid situation, but it doesn't hurt to check what you are getting into before you make the decision.

For exiting, the trade market for the tokens should also be considered, not only the diesel pool.

Trustworthiness and Reputation

This should have been higher on the list. Token creators on Hive-Engine have the ability to print tokens as they please. Do you trust them not to print tokens outside of what was planned/announced?

If you never heard of the token issuer, and they don't come forward after the token is created, maybe that's too much trust...

Diesel Pool Rewards

Inflation & utility, liquidity & volume, and trustworthiness & reputation we discussed above also apply to the reward tokens.

On top of that, I'd consider:

Understanding the Rewards

There are different types of rewards you can receive for being in a diesel pool, and they can't all be seen from the same place.

Every liquidity provider receives a portion of the fees accumulated. Although not clearly broken down by liquidity provider (as far as I know), you can find information about fees on TribalDex and make calculations manually, if you want to.

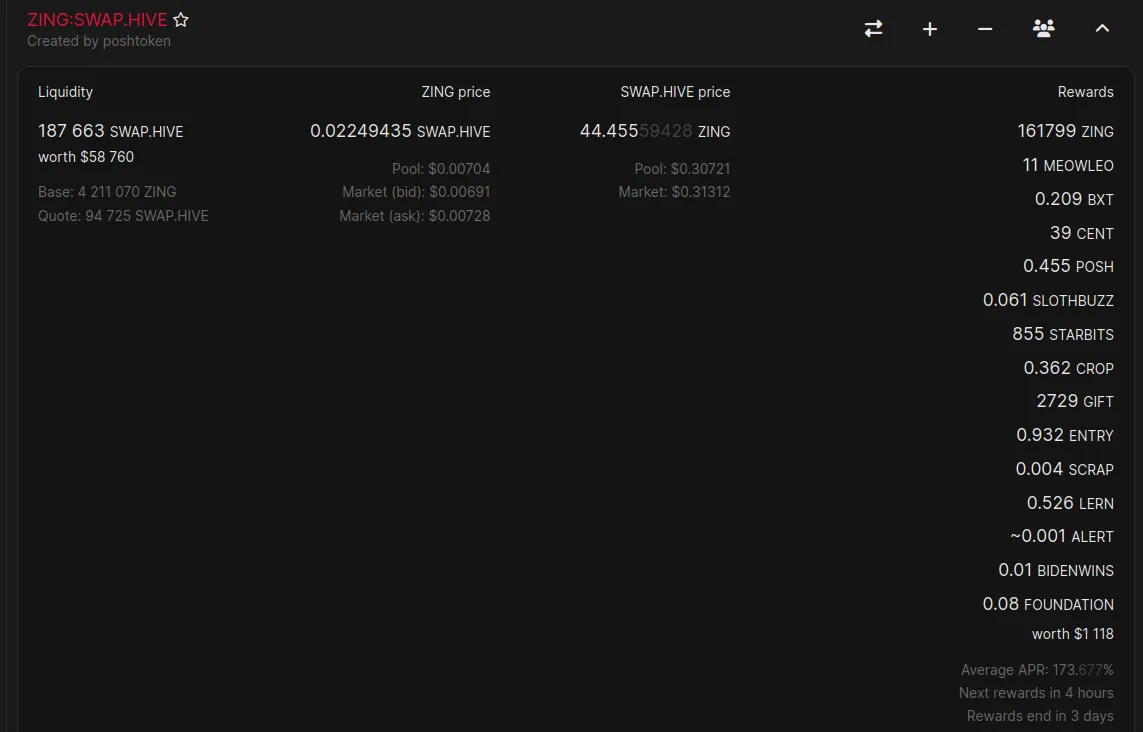

Then, we have the rewards added to the distribution contract, the ones we talked about at the beginning, and which are paid daily for a set period. They can be viewed from Beeswap (click on the small arrow at the right to see the reward tokens; APR is below):

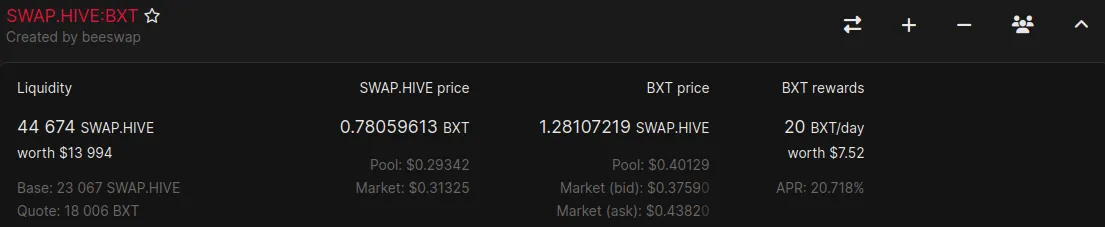

If a diesel pool doesn't have reward tokens, it might be incentivized with BXT tokens. Here's an example (you can only see this on Beeswap):

This is the only diesel pool that currently receives BXT incentives, but there used to be more. A diesel pool can have both BXT incentives from Beeswap and reward tokens added to the distribution contract. But in this case, the SWAP.HIVE:BXT diesel pool doesn't have reward tokens, apart from BXT.

That's not all though. Splinterlands diesel pools don't show any token rewards on Hive-Engine interfaces, but Splinterlands is paying SPS rewards to liquidity providers. The way to see and manage them is from the Splinterlands in-game interface.

Quality of Tokens

We can understand different things by "quality". Generally, you should expect that the reward tokens be of value to you, or, if not, that they hold their price in time, so they can be sold without issues and without a dropping APR.

Number of Tokens

It's one thing to receive 1-2 great tokens with a good APR, 5 ok tokens with a better APR, or 12 tokens you haven't heard of with a huge APR.

In my opinion, the last option is the worst (even if it has 1-2 great tokens, but in lower quantities).

It's the worst because the APR is likely to drop over time and because it gives you more work to do, to sell a bunch of tokens regularly. Plus, some of those tokens may not have buyers, and when they do, big spreads are to be expected. The huge APR is simply an illusion, in this case.

Note that sometimes small amounts (in dollar terms) of token rewards are added to popular diesel pools, as a way to advertise the respective tokens, since no one can stop anyone from adding reward tokens to any diesel pool, regardless of who created the pool. So, sometimes the number of tokens being rewarded can be deceiving as a way to decide on what diesel pools to provide liquidity to.

Reward Period

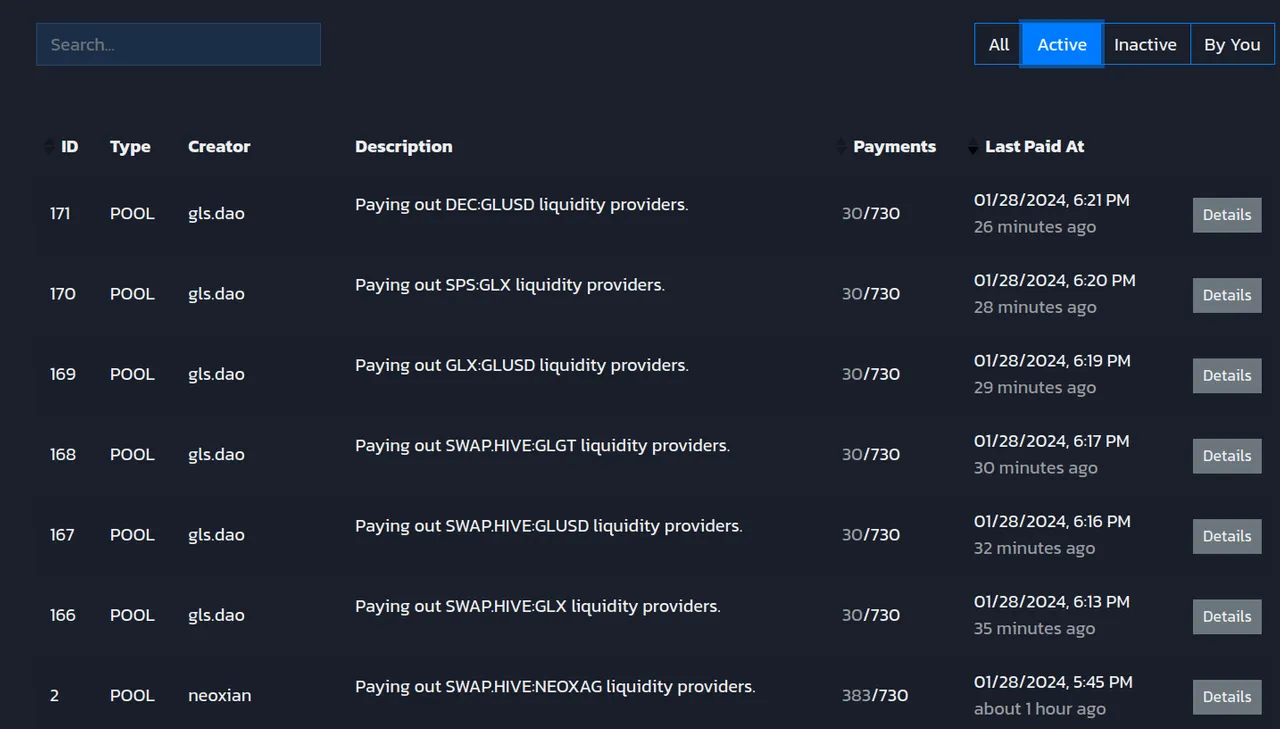

More important than the APR is how long it is until the current rewards run out. When they run out, sometimes you have the surprise they are not renewed. Sometimes the newly added rewards amount to a lower APR. That's why this is a much more important criterion than the APR.

You can see that from the Distribution Contract on TribalDex (Payments column):

Conclusion

This turned out quite long. I hope I didn't miss anything significant from what I intended to talk about. Let me know if you have comments or questions.