For some time I have been thinking about the idea of launching a side project whose purpose is none other than to accumulate Hive power.

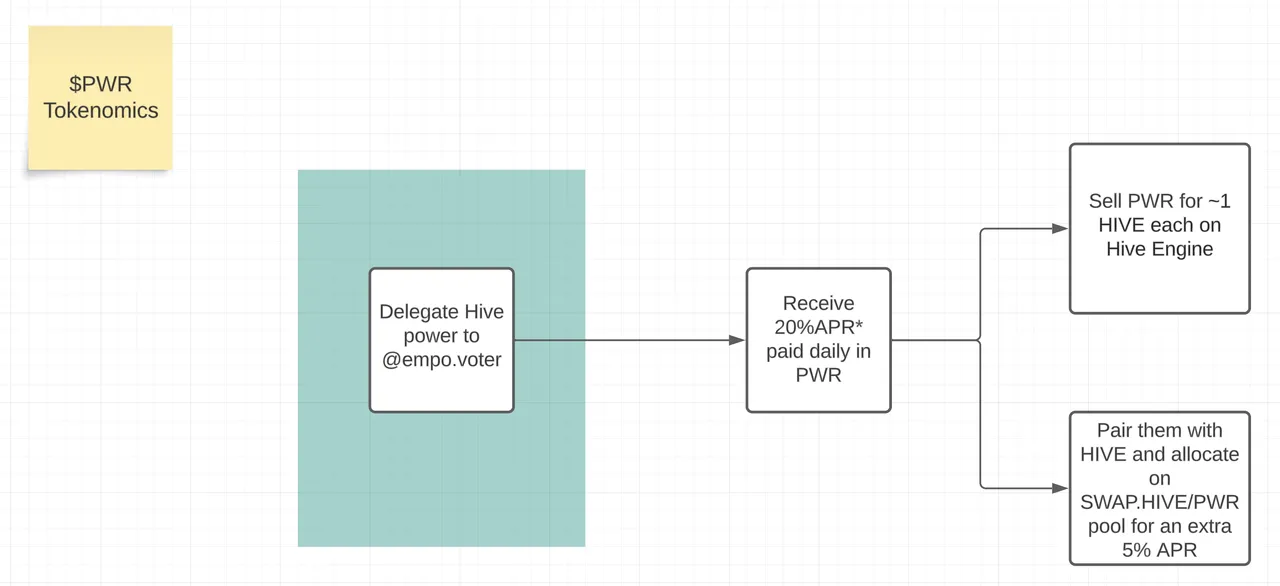

Think about your regular Hive Power delegation service. You delegate your Hive power, and you receive a token in exchange which you can sell for Hive, If you don't insta sell you get more APR later. Simple as that. This is the initial phase for Hive Power Ventures and the new upcoming token $PWR.

**In case you're wondering, this is NOT some kind of SEED relaunch. unlike the former, there will be no external deposits or movements between exchanges, so regulatory/KYC risk is vastly minimized. The sole purpose of the project is to accumulate as much Hive Power as possible and all the activity will be kept inside the Hive Ecosystem.

Hive Power Ventures

Hive Power Ventures ($PWR) is an HIVE derivative semi-backed by Hive(softly-pegged) whose long-term purpose is the maximum possible accumulation of Hive Power and future influence in the Hive ecosystem.

Tokenomics:

Initial Supply: 1000-5000

Max Supply: 1.000.000 (1 million)

The token will be launched on Hive-Engine under the ticker $PWR.

The initial supply will consist of a (yet undetermined) number (between 1000 and 5000) of tokens paired with Hive at a 1:1 ratio that will serve as the initial liquidity in the pool.

Other than that initial liquidity, there will be no pre-mine, airdrop, presale, or 'team allocation' of any kind of $PWR tokens.

Then, how to get PWR?

Initially, there will only be 2 ways to obtain PWR:

- The first and main way will be by delegating HIVE Power to @empo.voter, and $PWR will be farmed at an initial rate of 20% APR which will decrease as time goes on for HP delegators.

Delegators will get a decreasing APR for their Hive power delegations over time, according to the following epochs schedule:

--

Epoch1 - first 30 days - 20% APR

Epoch2 - days 31 to 180 (months 2 to 6) - 16% APR

Epoch3 - days 181 to 365 (months 6 to 12) - 12% APR

Epoch4 - Year2 - APR 6,5% 8%

Epoch5 - Year3 - APR 6%

Epoch6 - Year4 - APR 5,5%

[APR on Delegations decreases at a 0,5% APR/year from the third year, mimicking Hive Inflation.]

- The secondary way* will be providing liquidity to the SWAP.HIVE-PWR liquidity pool, which will pay a variable APR (initially about 5%) paid in $PWR.

This APR will definitely be flexible and will change according to the necessities and the overall health of the project.

(*Note that providing liquidity means you will have to get PWR somehow and it will simply be better to farm it rather than buy it for APR at the beginning.)

Long-Term Sustainability & $PWR Potential

Well, so let's say a bunch of users collectively agree to delegate their Hive power and start receiving a 12-20% APR paid in $PWR. How does the token sustain itself?

First, let me remind you that $PWR will initially be a soft-pegged token by $HIVE. That means there will be less HIVE than PWR at the beginning, and for that reason, although the price will probably be close to 1 HIVE, a slight discount is expected (5-10% should be ideal) in the first months of operation.

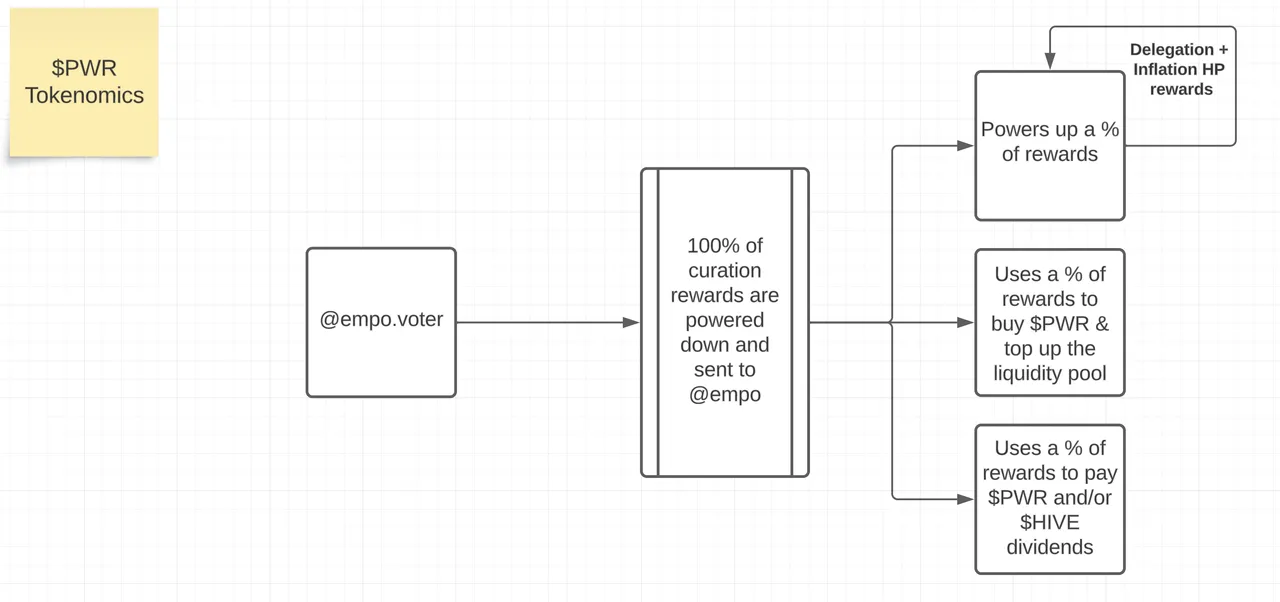

Remember that in exchange for receiving little drops of $PWR, all the users will be delegating their Hive Power, and an inflow in curation rewards is expected.

100% of all those curation rewards will be powered down and sent to a management account (@empo @vventures). This HIVE will be treated as follows*.

A big % will be powered up (this will be the main objective for the first year).

Another % will be used to buy up $PWR and/or add liquidity to strengthen the peg while offsetting delegator sales.

After the 1st year and after the delegation rewards come down to a more reasonable level (6,5% or less), another % of rewards will be used to pay a Hive dividend to $PWR holders OR increase the pool APR. which will increase as more Hive power gets accumulated.

*Again these ratios are variable and will depend on the needs of the project at any given time. For example, if $PWR is already on peg more Hive will be powered up.

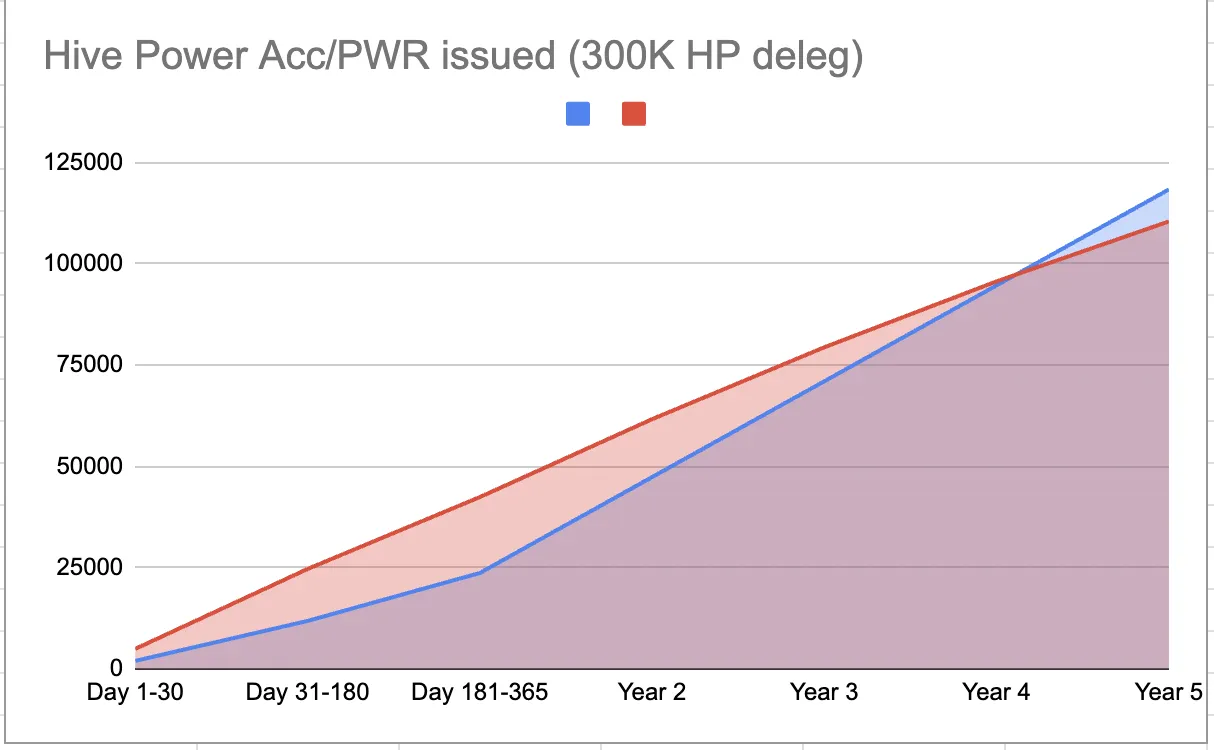

From modest calculations (worst case scenario) taking into account an 8% curation APR, HIVE will start to outflow $PWR supply entering the 4th year of operation. This is not counting HP inflation rewards and/or any excess profits from 8% curation APR (like post rewards or delegation income from other programs).

This model is with a 300K Hive power delegation but doesn't change much with a higher/lower number since everything is being priced in terms of Hive.

Game Theory

In the beginning, there will be no $PWR circulating and a rush for Hive Delegators to take profit from the initially high APR (20% for the first month).

After the first drops of the new token start landing in the wallets of delegators a couple of very basic options arise:

- To sell: and consequently realize a very nice profit for a very competitive HIVE delegation*

*(even selling $PWR at 0,9 SWAP HIVE results in a realized profit of 18% APR for a delegation in the first month).

or

- To hold: for a hypothetical promise of future APR.

The best way of holding and accumulating $PWR should be to pair it with HIVE and allocate it into the liquidity pool rather than simply hold it in your wallet.

This makes it harder for the dumpers to dump the price since you're deepening the liquidity pool while enjoying an extra APR (but also taking an extra risk in case the token dumps too much under the peg).

Vision & Curation Guidelines

EDIT 1: I had planned to address this topic in a post soon, but since you have asked me, I have decided to edit the post and add my view on the subject now.

Regarding curation, I recognize that neither discovering new content nor curing at maximum efficiency are my strengths.

But nevertheless, I do believe in and am greatly fascinated by Hive's ability to spread through the job of curators.

One of the things that 'clicked' me back in the day about Hive was the realization that 'it's not just inflation, it's a distribution system'.

''Hive is like water, and the curators are homologous to rivers and pipes.''

__

This is all well and good, but as I said I'm not the best manual curator. However, it is still necessary to balance not only the curation of good content but also to seek maximum efficiency from an economic standpoint.

For that reason, I thought about Hive Power Ventures being a proxy curator.

That means I'll be cherry-picking what I consider to be the best manual & automatic curators there and I'll be adding them to our personal curation trail.

Some of the names already added to the list are @acidyo, @ocdb, @dalz, and @blocktrades. This means that if you're delegating your Hive power to @empo.voter, you'll be supporting automatically a mix of all the curation patterns by these users/projects.

Notice that some of these accounts have voting patterns (especially the big ones) where they share a tiny percentage of his voting mana with a myriad of small to medium-sized authors. For me, this is what I consider 'good curation'.

I also want to make it explicitly clear that delegating any amount of hive power to the project will not entitle you to a certain amount of upvotes. As this one is not a buying votes service. If one ever comes, you can call it luck.

Conclusion & Launch date

Hive income & backed tokens performed well historically, look at $SPI or $BRO.

I won't deny that a big inspiration for this project has been @eddie-earner, under the @spinvest umbrella.

However, I think it is always healthy for an economy to offer more options and I think $PWR can be a very interesting option going forward in the Hive delegations market (obviously I'll be backing it with my own Hive power).

The launch date is not set yet, but expect no less than 7-10 days from the publication of this post.

This timeframe is basically to allow interested parties to prepare their Hive power in anticipation of the start of $PWR farming.

All the best.