Everyone is looking for the next x1000. Everyone wants to get rich. Everyone sees the people that are getting rich and think they can copy those strategies to do the same. Sadly, this is not how it works otherwise we'd all be billionaires. This is a classic example of survivorship bias. We tend to look at the winners and ignore the losers even when all the winners did was get lucky and act like geniuses.

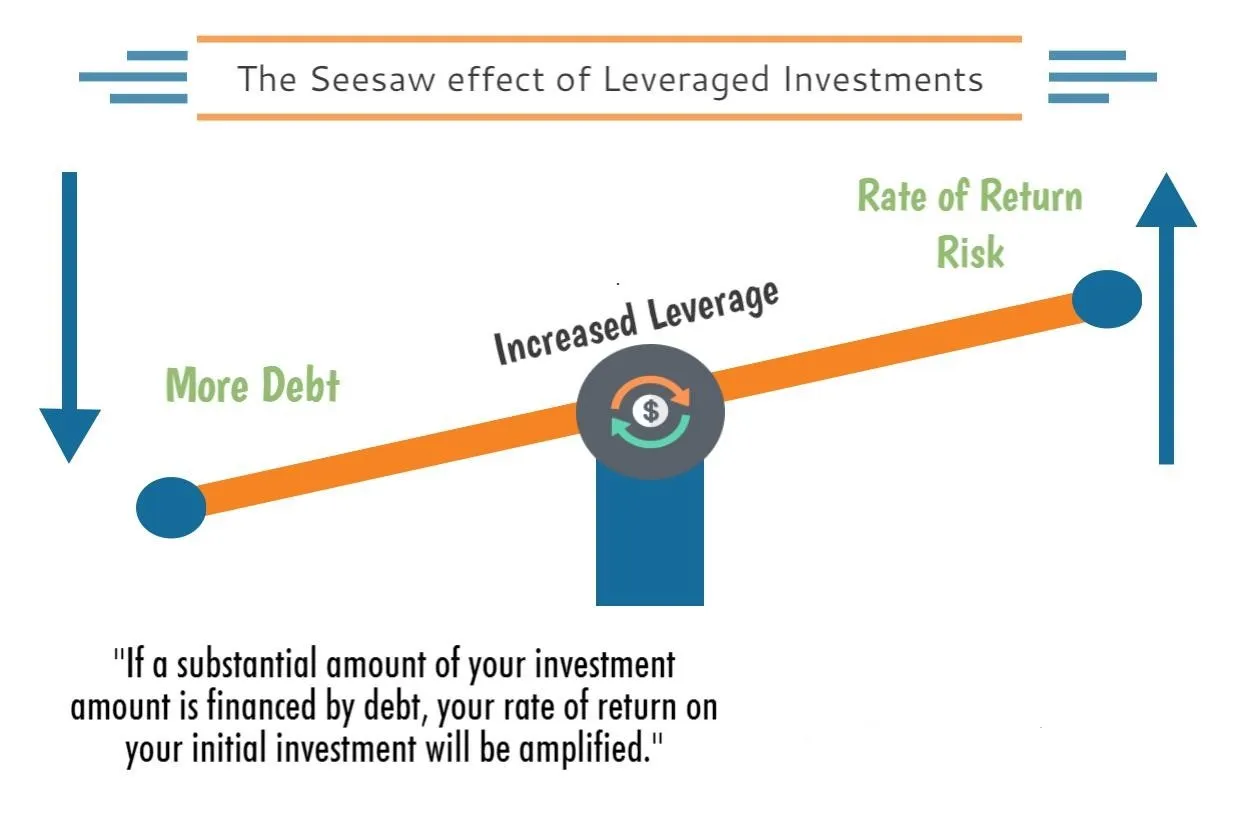

These two keywords get mixed up a lot and are often used to mean the same thing. Margin trading and leverage trading are the same thing. However, the words margin and leverage represent two completely different (however complementary) meanings.

Leverage allows you to trade a larger financial position with a smaller sum. Margin, on the other hand, is the initial investment you need to make to open a leveraged trade.

We can see from this Google definition that the margin is the smaller amount of the total position that is actual money. The margin is ultimately the collateral being risked. A margin-call is when you get an email from the exchange telling you your position has been liquidated. However, the term itself dates back to the days of actually being called on the phone and told by a person that you need to increase your collateral or decrease your risk otherwise the position is going to be unwound.

| Risk | Liquidation Long | Liqudation Short |

|---|---|---|

| x2 | 50% loss | 100% gain |

| x3 | 33.33% loss | 50% gain |

| x4 | 25% loss | 33.33% gain |

| x5 | 20% loss | 25% gain |

| x10 | 10% loss | 11% gain |

The very first thing we notice here is that going long and going short look completely different on paper even though the logic of them is exactly the same. We are borrowing assets with our collateral to make an overextended gamble in either direction. However, the problem here is that an asset going up in value is not the same as an asset going down in value.

For example, Bitcoin can go up 10000% but can only go down a maximum of 100% to $0. If the price goes up 50% and down 50%, the end result is that we lost money because when it goes down 50% is chops the principal amount in half in addition to cutting the 50% gain in half.

Price goes up 50% from $100 to $150

Price goes down 50% from $150 to $75

End result: 25% loss from $100 to $75

Alternately:

Principal: $100 ; Gain $50 ; slash both in half; $50 + $25 = $75

In the table above I actually got some of the liquidation percentages wrong on the first try from memory so I had to do some maths to correct them. Let's check x3 leverage together for both the long and short sides.

Combined, margin and leverage allow you to leverage the funds in your account to potentially generate larger profits than your initial investment.

Even Google tells us that trading on margin is a tool used to increase risk, but I'm here to point out that it can and should be used for exactly the opposite function.

Everybody understands that crypto is already one of the most volatile high risk high reward assets on planet Earth. Using crypto to increase that risk is greedy, irresponsible, and dangerous. Leverage can just as easily be used as a tool to confine risk and lower volatility. It's what all the hedge funds are doing and it's what we should be doing as well. In fact, this is even more useful utility for crypto users than anyone else in the entire legacy financial system.

I actually thought of this just last week. We can ironically use leverage to keep our Bitcoin off exchanges. For example, lets say I have one whole BTC in cold storage but I want to be trading that Bitcoin on an exchange for various other assets. If I put the entire Bitcoin onto the exchange there is no sugar coating it: I am completely at their mercy.

Many things can go wrong in a situation like this. Legally when we send any asset to a bank they own the asset and all we own is a pinky-promise IOU saying they're going to respect that agreement. If they go bankrupt/insolvent: we lose the money. If they just decide to freeze our account: we lose the money. If the government orders them to surrender: we lose the money. If there is simply a bug in their system: we lose the money. If they break the law on purpose: we lose the money. If they obey an unjust law: we lose the money.

Well I can send 0.1 BTC to the exchange instead of 1 BTC and leverage trade with it. Say I want to sell 0.3 BTC. No problem; that's just an x3 short position. Sell the 0.1 BTC and leverage it to sell 0.2 more. Say I want to buy 0.2 BTC. Same thing: x3 long position.

In fact I could even sell the entire 1 BTC virtually with an x10 short on 0.1 BTC. If the position gets liquidated because Bitcoin went up 11% it's no big deal. Because after all the 0.9 BTC still in cold storage just went up in USD value and the position is still worth exactly the same as it was before. This makes sense because we virtually sold everything, meaning we turned 1 BTC into USD so of course when BTC goes up we are still left with the exact same amount of USD, even though we got liquidated.

If we want to continue the short we just transfer another 0.1 BTC to the exchange and setup another x10 with it. Now if Bitcoin flash crashes 50% after a massive blow-off top the short position is up a huge amount of money even though the cold-storage position is down bad. We can then unwind the short and send it back into cold storage and we'll be left with significantly more than 1 BTC after everything is said and done.

So we can see even though we lost 0.1 BTC to a margin call here it didn't matter at all. We still were able to virtually sell our entire stack using leverage while reducing counterparty risk on the exchange by 90%. That's real utility. We can only lose whatever we send to the exchange, and nothing more. This is a tactic that very few of us are actually employing and honestly that needs to change. We're smarter than that.

When we go long on Bitcoin there is no cap to the upside. Nothing stops number go up and we can theoretically make millions on the position. This is not true when we short an asset. At best, when we go short, the asset crashes to $0 and we owe back nothing, meaning the absolute maximum we can possibly make is the amount we borrowed (which is an unreasonable expectation that almost never happens).

This simple fact allows short positions to be much more aggressive than long positions. Risk can be increased because the reward is capped, and shorting at the correct time will lead to a cascade of fear that allows bears to control markets. However, unlike legacy derivatives such as gold or silver, Bitcoin is a different beast and can't be dominated by bears. Eventually they all get wrecked, as the 4-year cycle proves over and over again. In fact we have front row seats to that right now as I type these words.

A lot of these exchanges are offering leverage positions of x100 or more, so when should we actually utilize such risky tools? The answer is very carefully and with small amounts. You have to know exactly what you're doing or you'll get smited by the crypto gods.

Best example I can come up with is my post from October 24th in which I correctly spotted a very obvious and hugely bullish flag. I made some good trades here but the leverage I was using was incorrect and I ended up only making a couple dollars from some really good and expertly called movements. It was very sad but also a hard lesson learned... well not too hard because I didn't lose money. Opportunity cost isn't so bad.

My expectation was that we would bounce around $35k to $33k inside of this wedge, which is exactly what happened as we can see in retrospect. The problem? The range between $35k and $33k is only 6% at a maximum, so it is legit impossible to make significant gains here unless we increase the risk:reward ratio using leverage.

If I had the opportunity to do this over again I figured out I would have been trading on something like x50 leverage with small amounts, meaning that if I was wrong and the price broke out even 2% I'd lose all my collateral, but if I was correct I'd double my money or even quadruple it as we swung into the other direction.

The amount of collateral that should be used in a situation like this is a tiny amount of our overall bankroll because we are risking all the collateral on small moves and we need to be able to make a lot of these bets without getting unlucky and going bankrupt. I probably would have been risking something like $100 to $300 per bet even though my overall position was many thousands.

Unfortunately I mucked it all up because I wasn't using isolated margin. My position was cross-margin (meaning all collateral is in a huge basket and everything is at risk at the same time). Isolated margin is an advanced play that I wasn't yet comfortable with so I made small bets and earned even smaller rewards. Lesson learned.

Another good strategy for bear market years is to avoid selling by paying for things on credit. We can do this on-chain in a decentralized manner with protocols like DAI and we can also do it on exchanges just like any other form of leverage. We can technically also do this with credit cards or personal loans but the interest rates are absurd these days.

The only rule here is to borrow stable coins and thus owe back stable coins. We then transfer the value out of the margin account and into our bank accounts to spend while the collateral sits within the loan contract paying back the stable-coins unlocks the crypto collateral. Last I checked DAI gives a much better interest rate for something like this then an exchange would so the centralized option may not be viable depending on the deal being offered.

We should only be using leverage to increase risk when there is a reasonable expectation that price movements are going to be very small (like single-digit percents over a short amount of time). In almost all other circumstances we should be using leverage to decrease our risk, both from price volatility and to mitigate our assets from counterparty exposure. Trade responsibly. Not not financial advice.