It's been a while since I talked about LEO.

For the most part I've been super annoyed about the bear market, illiquid bridges, depegged tokens, declining prices, buggy frontend, etc. Blah blah blah, classic fud stuff. Today I'm looking to talk about something a bit more optimistic. A lot of changes are being made to the platform.

For one I'm being told that a change to the reward pool is being made to financially incentivize the frontend. Basically no emissions will be allocated to comments that are posted from other frontends. I can't say I particularly agree with this move, but it makes sense on a certain level. Those who want LEO rewards should be using the inleo website. Simple enough equation.

I had a couple of follow up questions to this change that were answered yesterday. We'll still be able to distribute leo token rewards and earn curation with upvotes on other platforms. In addition, posting from other frontends are still eligible for ad-revenue sharing. So only earning rewards from the reward pool is being limited to inleo posts. Everything else should pretty much stay the same.

Ad revenue sharing

This is something that I haven't been really keeping tabs on but Khal and the rest of the community have been harping on it for quite some time now. Personally I have very mixed feelings on the whole thing. Ad revenue sharing is an extremely WEB2-type business model. It can't really be done in a decentralized way... or it could be, but creating that type of infrastructure from the ground up would be a huge pain and not really worth the effort within the current climate. That's more of a "this will happen when crypto goes mainstream" type of deal.

YouTube, Twitter, and Twitch do it; why not LEO?

Ad Revenue sharing is essentially a subset of affiliate marketing. When someone is an affiliate of another company they will sell that company's product and get to keep some of the profits. This is a business model that's been around a long time. Sign users up for a poker site and you'll make 10% of whatever they spend inside the casino. Sell products on Amazon and take your cut.

In fact affiliate marketing is so popular that more than 80% of all brands do it (more than 100k businesses). The biggest one unsurprisingly being Amazon with an astonishing 44% market share. The reason why this tactic is so popular is that the financial incentives synergize well and contracting work has a low overhead cost. It also can't be exploited easily because no one is getting paid by the hour and everyone earns their fair share based on what they brought in. In essence this tactic mimics a permissionless system because anyone can do it, so in that way it is compatible with crypto and WEB3.

Ad revenue sharing takes the affiliate marketing tactic and focuses it further into the attention economy. The idea being that users are creating content that people want to see (like YouTube videos). In order to financially incentivize those users to create better content and potentially even go pro: the platform has to share their ad revenue with them. Again, this is a very common tactic but it comes with some serious caveats.

The biggest one we've been seeing time and time again is that once a platform "makes it" they engage in corrupt behavior. Users will get demonetized by the centralized entity. Sometimes this action is justified, and sometimes it is not. The point is that the founders of the company get to decide who makes money and who doesn't. Using this leverage they often will censor certain points of view by scaring users away from talking about certain issues or just full on shadow-banning them from the algorithm.

Could something like that happen on LEO?

Hm, yeah it totally could, but the result would not be the same. First of all as a network that basically prides itself on free speech and decentralization a move like that would have exponentially more blowback than WEB2. It would also not be as effective because the users that get demonetized would still have a fully accessible Hive account and their associated followers list would remain unmolested. We've actually never seen something like this happen yet because crypto is simply way too new of a technology without mainstream adoption; So it would be hard to guess exactly how it would go down for real.

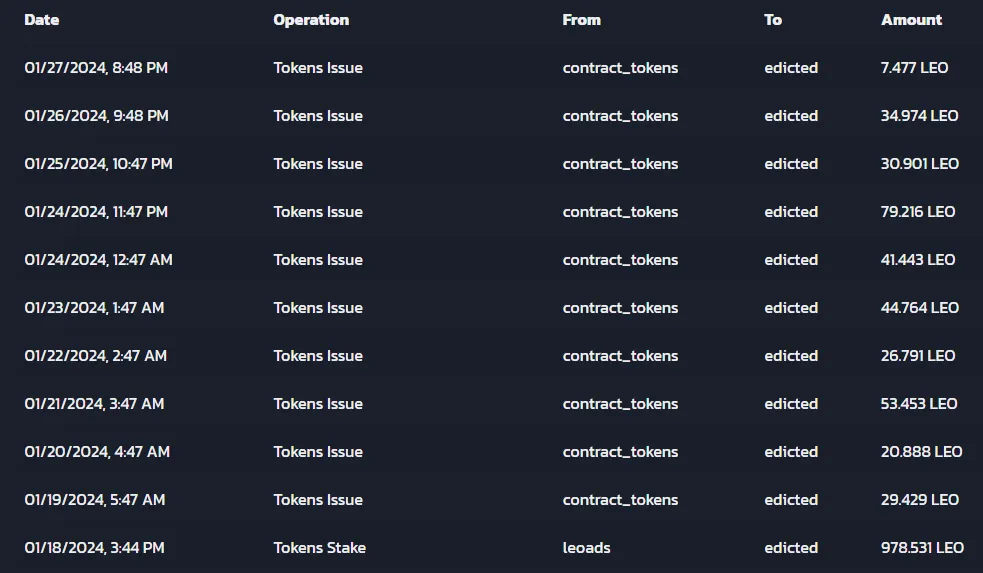

WoW... 1000 LEO... really?

Hm, so yeah I was just looking at my LEO rewards for the first time in a very long time and I noticed I got 978 LEO from @leoads on January 18th. That's basically my cut for one month if I'm understanding it correctly. Which, as the title of this post implies, is actually kind of impressive.

Basically the entire reason I never mentioned this type of revenue sharing on LEO is because I was highly skeptical of the whole thing. LEO is a tiny tiny platform. My posts are not going to get a lot of clicks. I just assumed the amount of money we were talking about was basically just going to round to zero and be completely meaningless. This has proven to not be the case so now I must admit my mistake and refactor my position.

$50 is not a trivial amount of money

This is especially true because that's the amount I earned without even trying. I don't pay attention to SEO. I don't try to inject my message across other platforms. I don't try to optimize my content for views or repost links on Twitter or where ever else. I still may just continue what I'm doing, but that's not the point. The point is that I now have a financial incentive to change my behavior.

Outward facing incentives.

That's the thing about affiliate marketing and why it's so powerful. The users suddenly have a monetary incentive to shill the brand and shuffle more people over to it. Within that context it makes perfect sense as to why the LEO reward pool would be changed to only reward inleo posts. If the platform is shifting to an ad-revenue model then it can't make that revenue is people are going to other sites. Fair enough; I will allow it.

Just imagine how much that would be at $1 LEO!

So imagine that during the bull market the LEO token spikes to $1 a coin. Now how much ad revenue am I generating? Like $1000 a month, right? Hm, nope, not how it works. It's still $50 (50 LEO per month). Obviously a company buying ad-space is going to be paying in USD. LEO takes that USD and distributes it as LEO via market buybacks from the spot orderbook. I'm not magically generating more ad revenue just because the LEO token price went up. However all the ad money I made during the bear market will be worth a ton if I just hold it into the bull.

Wait... does that create elasticity?

It does, actually, which is again kind of impressive and very good tokenomics. If the platform has a constant stream of USD coming in and engaging in token buybacks that's really good for the bear market and pretty much meaningless during the bull market when valuations are overblown and the price of the token is high. In theory this could make LEO have less volatility during the 4-year crypto cycle, which is always nice to see.

There are a couple problems with this theory (like assuming users are going to hold their rewards) but for the most part it should help even if it's just a little bit. More importantly: LEO will be much more visible to the outside world if content creators have a big incentive to engage in this particular flavor of affiliate marketing.

So how much is inleo sharing with users?

Affiliate marketers are lucky if they can make even 20%-30% of the product they are actually selling. Sometimes it's more like 5%-10%. Many would ask why so low and claim it's not fair, but if you sell computer for $1000 and the company that builds the computers only makes $200 off the sale, then a 10% commission of $100 is actually 50% of the profit.

Meanwhile, ad revenue models can share a bit more because everything is digital and delivering the service to the user has a lower overhead cost. Twitch.TV shares like 50% of their revenue through the subscription program, while YouTube gives their creators a 'generous' 55%.

Cool story, bro: LEO gives 100%

That's the magic of WEB3 I guess... by having a native token to govern the platform the LEO community can offer a 100% revenue sharing model, which is actually kind of insane when we realize that no WEB2 system would ever be able to match that on a fundamental business level. It's mathematically impossible in WEB2, but with LEO it's not. That's some serious competition right there.

Conclusion

I'm still not 100% sold on this whole idea but I definitely am taking it a lot more seriously. But you know what is 100%? The amount of revenue sharing inleo is offering to its users. Noice. Can't beat that.

If there's one thing this development should teach us it's that we need more outward facing incentives across the entire platform. We need a reason for users on Hive to actively engage with others outside the ecosystem to bring them in. Assuming that this revenue-sharing model actually has success going forward it's certainly something we can revisit and apply to other frontends should the situation warrant it.