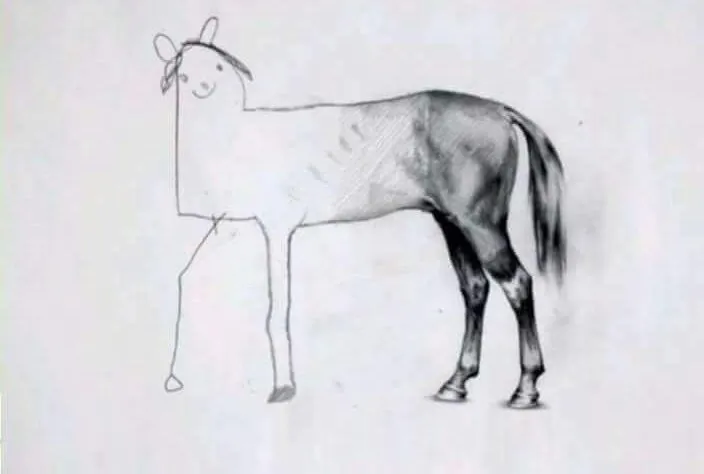

We have a way of planning out how things should work in our heads, and then when it actually comes down to it, everything just falls apart. This can apply to most things in life.

It seems that everything in this life is much easier planned than actually executed. Just take the Steem hostile takeover for example. We won. It looked like we won. As soon as we got a witness (@yabapmatt) into that top spot, we had done it. All that needed to happen was for everyone on the network to pull their heads out of their asses and vote the other 19 witnesses in so we could fix the damage that had been done.

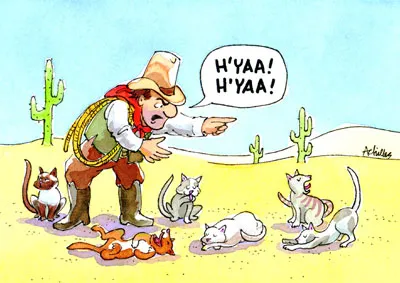

And guess what?! That never happened. We lost the vote war because consensus is difficult. It was like herding cats. We couldn't get people to just do the most obvious thing that needed to be done to save the network and our brand identity. If I'm being honest I'm actually glad it worked out the way it did, because if we had won the war, we would of had to delete, freeze, or transfer Stinc's ninjamine, which would have been a super awkward situation that would have been very hard to come back from on a reputational level. It's all very serendipitous.

The real reason I began writing this post is because account tokens on Hive haven't increased in cost, despite being told that they might increase in cost by fifteen fold. I continue to claim the exact same amount as I was before. The RC cost of everything else has gone x2-x3 (maybe more I haven't checked in a few days). Meanwhile today I can still claim 30 accounts with 100% of my RCs. Why did expectation not mesh with reality in this case?

The first thing that popped into my head was the nature of the testnet itself. A testnet, as you might imagine, is for testing. It's possible that a lot of accounts were claimed on the testnet... for testing purposes; more than would have been claimed otherwise.

Another thing that could be happening here is that bots are set up to only claim accounts at a certain cost. If the cost of accounts gets too high the bot would stop claiming them, and the price would drop back down to lower levels. Doesn't make a whole lot of sense because a bot wouldn't want to waste resources and allow whales to be sitting on 100% RCs.

I haven't verified this for myself on-chain but I did just do a rudimentary check, and there are a handful of whales that just sit at 100% RC and do not claim accounts. If the testnet was set up to assume that all extra RC would be used to claim accounts, this could have created a scenario where the account token pool was drained and price went x15. I'm actually not even sure how exactly the supply and demand of account tokens actually works, so perhaps it's a bit premature to mention that the price hasn't gone up yet.

Account tokens on Hive are pretty important. They are the metric by which we will almost get certainly bottlenecked when it comes to scaling up to mainstream adoption. If account tokens run out and 1 Hive = $10, who's going to pay $30 (3 Hive) to create an account? That's a huge burden to frontend dapps trying to get new users without charging them an arm and a leg to do it.

And yes the classic rebuttal to these problems is to issue more free account tokens or simply lower the 3 Hive fee to create an account. Okay, so we lower it to 1 Hive. Who's going to pay $10 to create an account; same problem. Make it too easy to create an account and we get Sybil attacked. There is no easy solution. Every solution is just a tradeoff into a different attack vector.

The Federal Reserve's 'solution' to 'inflation' is to raise the fund rate. How's that working out for the FED? Pretty good? We see that they are trapped between a rock and a hard place with no real power or ability to maneuver within the current economic climate. Tweaking variables on Hive to make it more "scalable" results in the exact same scenario.

We can fix one problem, but the solution creates another problem. We can increase the blocksize to allow more bandwidth, but that results in nodes costing more and potentially becoming unstable. We can mint more account tokens, but this makes it easier to Sybil attack the network with a bot army. We could add more consensus witnesses to make everything more decentralized, but then each witness has less resources to pay for infrastructure. We can lower our inflation but then it becomes harder to fund projects. We can increase inflation but then the currency gets more devalued. The key to all these variables is a proper balance.

Crypto... because crypto is the most volatile and quickly changing environment the world has ever seen. Everyone cheers when the price of their bag goes x10, and nobody stops to consider why that is a bad thing. Who is buying? Is it a billionaire? Are we undergoing a money attack? Is someone planning to pump the price only so they can create FOMO and dump on green users entering for the first time? That's bad.

Crypto has THE WORST new user experience of any product in history (short of the Crucifix). 95% of everyone in crypto has a bear market story. 95% of us entered during the bull market, got absolutely destroyed in the inevitable bear market, and the only ones who made any money were the ones who stuck it out for the next four years. To think that this is a smart way of doing things is nonsensical. Good thing no one is making this claim; they don't even consider it.

But it actually doesn't have to be that way. We need to be thinking of more ways to balance these things out and constantly be looking at the stacking long-term value we build. For example, if Hive pumps x20 because a bunch of people are buying and staking HBD into the savings accounts, we need to lower the 20% APR to a much lower number to flush people out.

This would, in turn, lower the price of Hive as HBD gets converted. People would complain that we hobbled ourselves. People are wrong. The debt ratio matters. Unsustainable debt to leverage a short term pump is the same as margin trading an already exponentially volatile asset. It is not acceptable that witnesses would consider degen gambling our future away with unsustainable practices. Now that we have increased the haircut ratio from 10% to 30%, these political & financial issues become much more relevant to long-term viability. This increase gives us more power, but is also a double-edged sword of responsibility.

Most things don't work out how we expect them to. The path to mastery is littered with a thousand failures. The biggest hinderance to success is the fear of failure, rather than actually failing. In fact, the most is learned through the process of failure and refactoring our strategies. On the flipside, success can often lead to stagnation and corruption as people tend to get lazy when everything goes their way.

Balance is key in most cases. We should always seek balances rather than ping-ponging to one side or the other in a never-ending fishtail scenario. Once we figure this things out as they pertain to Hive and crypto in general, we will find ourselves in much better positioning moving forward. But we should always be careful to not allow victory to make us soft. Once again: easier said than done. That is simply the expectation.