The second Hive token HBD has been a bit controversial in its existence. It supposed to be a pegged token to the USD and provide a method of stable payments on the Hive blockchain.

HBD is rewarded to authors (printed) when the debt ratio of the blockchain is bellow 10%. Meaning if the Hive market cap is 50M, HBD will be printed until there is less than 5M HBD in circulation. Ones this is higher than the 10% it stops being printed and authors are rewarded in Hive only.

Another source of HBD is the DAO/DHF fund.

Currently there is 4.5M HBD in circulation and the Hive market cap is 48M according to https://hiveblocks.com/. The thing is since the last hardfork the HBD in the DAO is not calculated as debt. There is around 800k HBD in the hive.fund now and growing, so the base HBD for calculating the debt at the moment is around 3.7M.

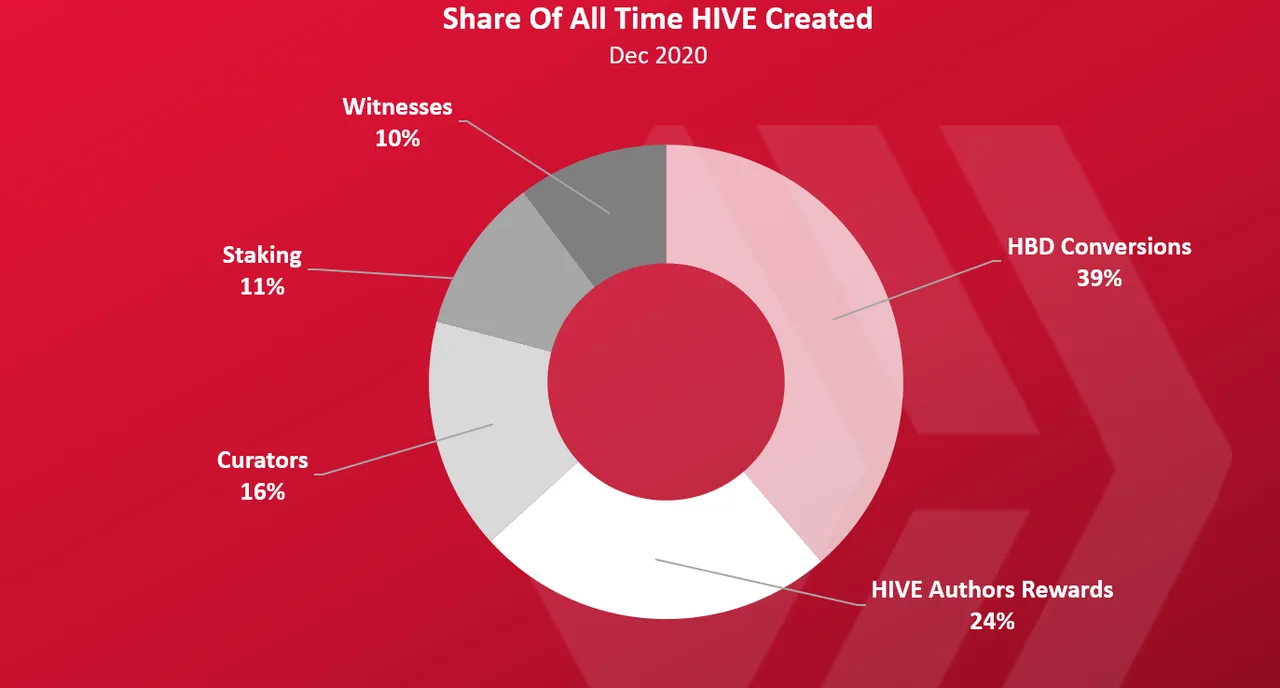

To get a better perspective on the HBD and the HIVE created from it lets take a look at this chart.

This is the share of HIVE being created since 2016, excluding the premine. Around 170M HIVE in total added to the initial premined supply.

The largest share of the pie is HIVE created from HBD conversions. A total of 39% of all the inflation comes from HBD conversions. This has pushed the Hive inflation above its nominal one that is around 7.5% atm, to more than 14% in 2019 and 2020. Almost doubling it.

When you have something that doubles your inflation its worth to take a closer look at it.

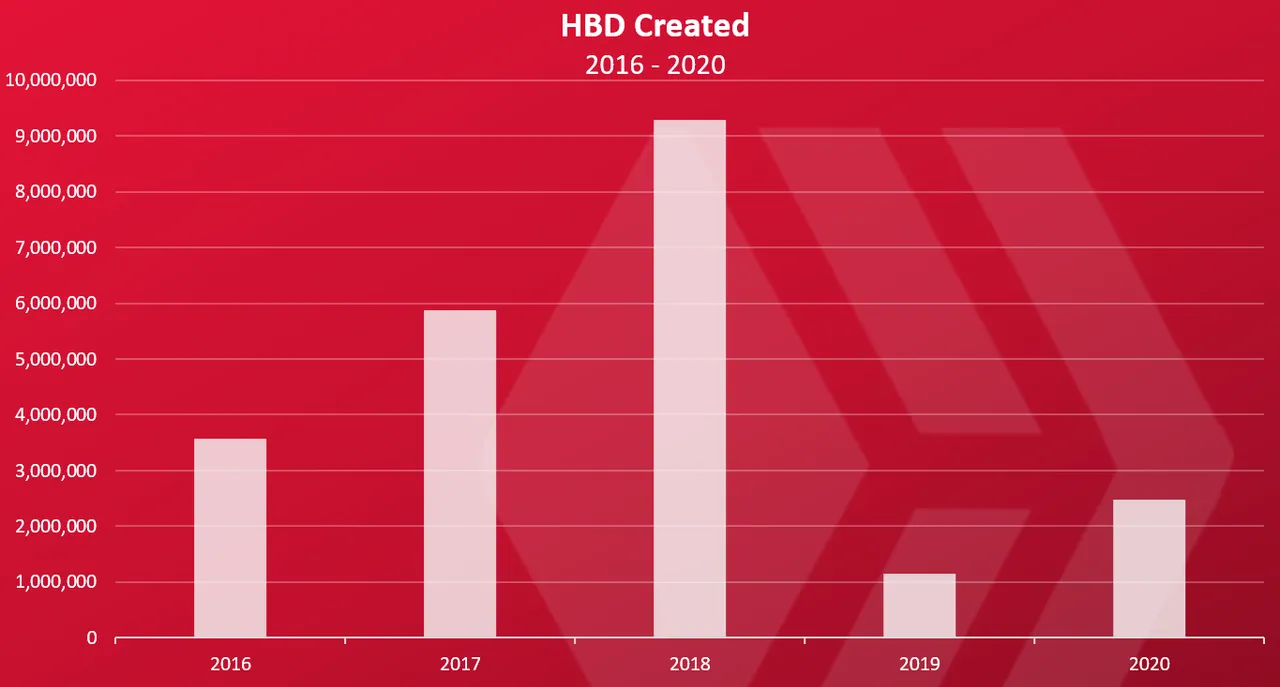

HBD Created

Here is the yearly chart for HBD created. We will take a look at yearly bars here, since we are looking at a longer period and the daily bars can be confusing.

As we can see most of it was created in 2017 and especially in 2018 with more than 9M HBD created in that year. Overall, around 20M HBD was created during the existence of the blockchain, but at the same time it has been destroyed and converted to Hive as well and we now have a 4.5M HBD in circulation.

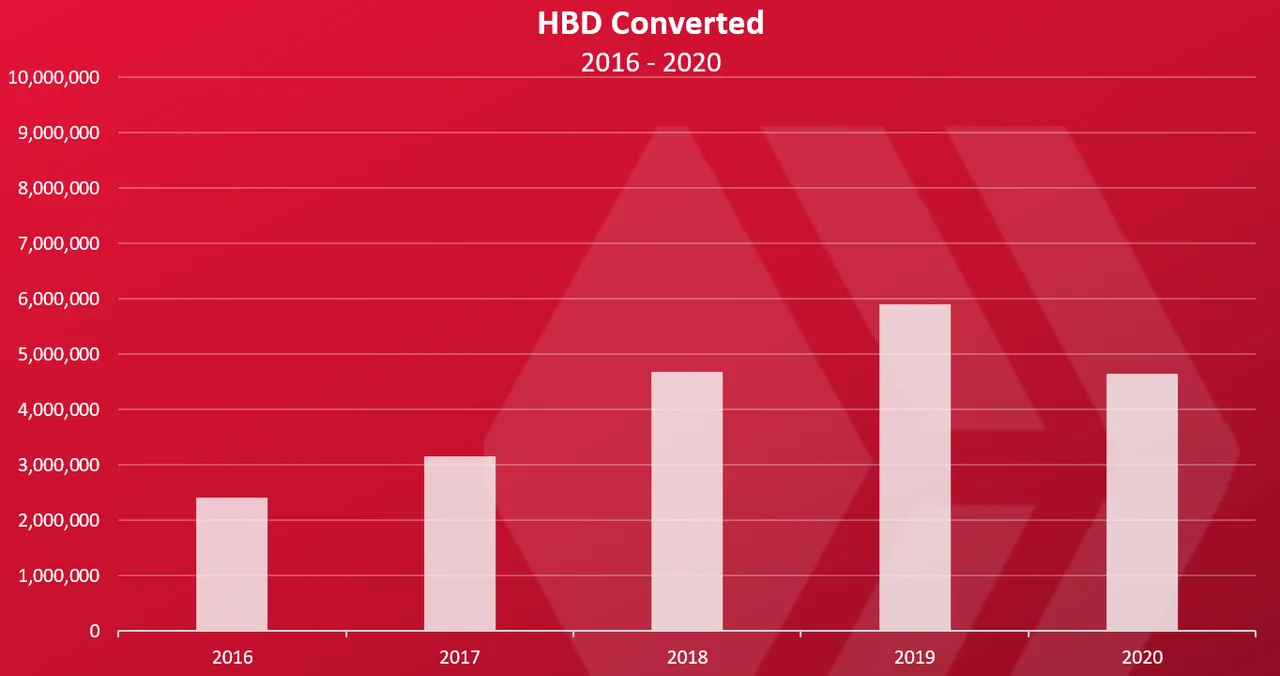

HBD Conversions

Here is the chart for the HBD conversions.

We can see that up until 2019 the conversions kept growing every year with almost 6M HBD converted to HIVE in 2019. In 2020 we have 4.6M HBD converted.

At first look it seems that the HBD conversions have dropped and less HIVE is created but have in mind that how much HIVE is created from HBD conversions depends on the HIVE price. If the price is low, more HIVE will be created from smaller amounts of HBD. We will take a look at the HIVE created from HBD conversions bellow as that is the main point of this post.

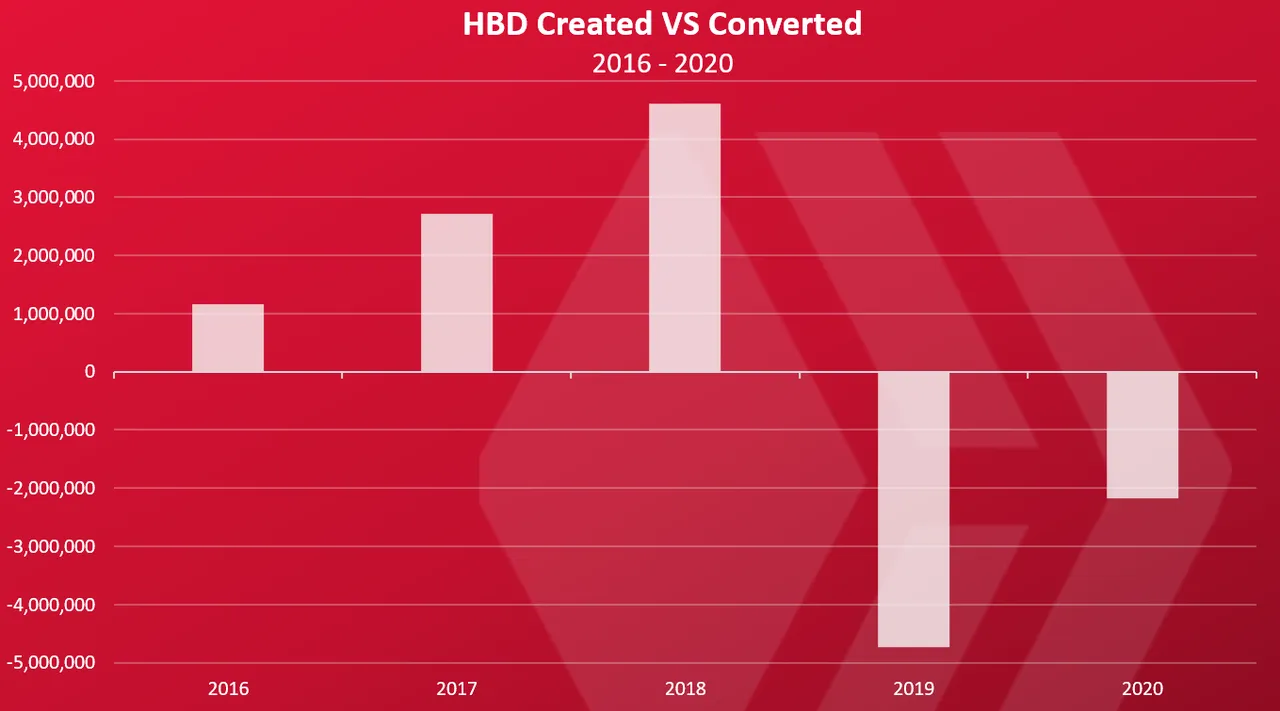

HBD Created VS Converted

When we put the two charts from above against each other we get this.

This is basically the difference between printed and converted HBD on a yearly basis. When bars are positive it means that in that year, more HBD was created then destroyed. When they are negative it means HBD is destroyed, reducing the supply.

We can notice a clear pattern here. A lot more HBD was created in the past during the bull run, and in the last two years a lot of it was destroyed through conversions.

2018 has the most net positive HBD created with around 4.6M HBD in positive. A large amount of HBD was converted in 2019, a total of -4.7M HBD, and 2020 has -2.1M HBD converted to HIVE.

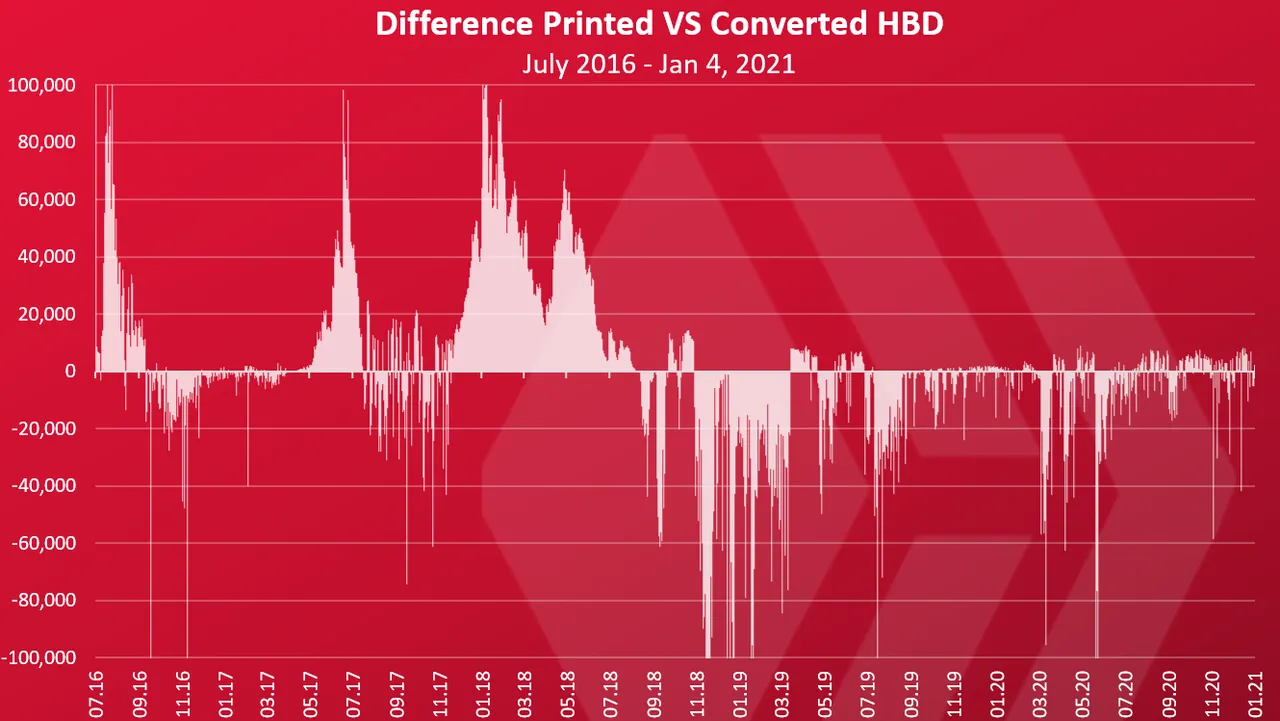

Just for illustration the daily chart looks like this.

We can see that a lot of HBD created at the end of 2017 and the begging of 2018. On few days there was more than 100k HBD created daily meaning that the overall payouts were double than that.

Then a large amount of HBD conversions started at the end of 2018 and continued in 2019. Since then more HBD is being converted than created.

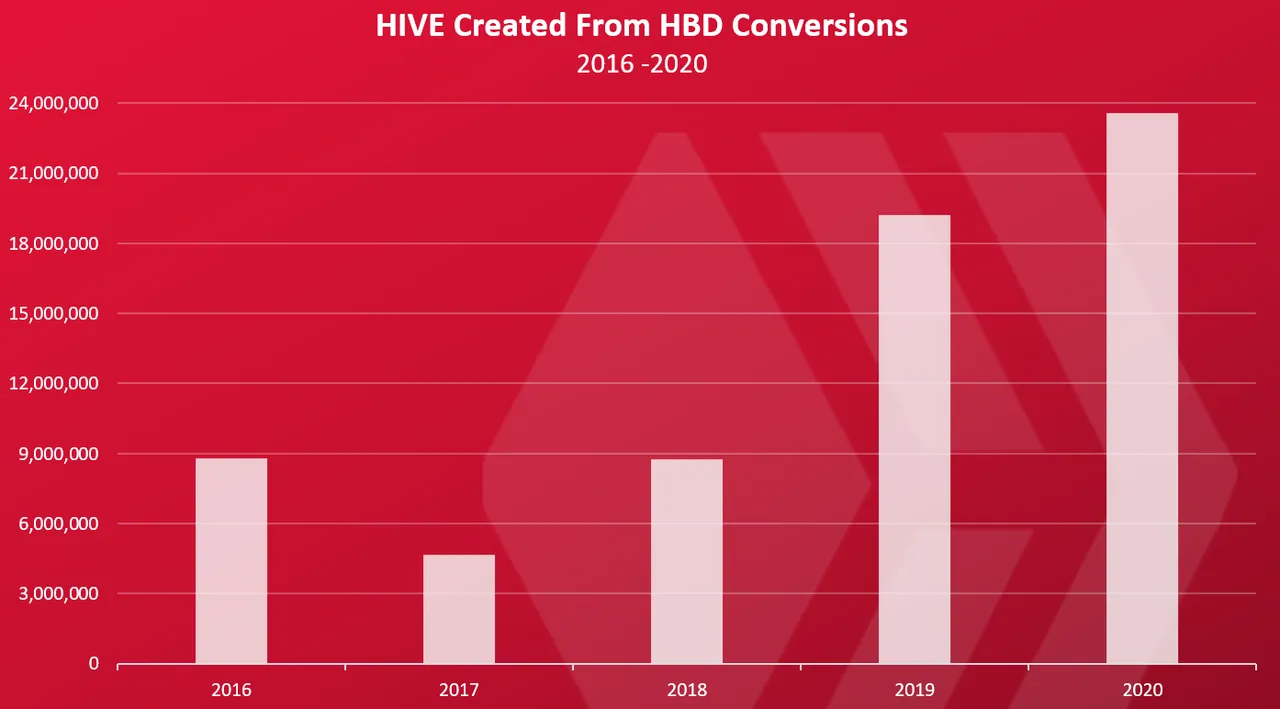

HIVE Created From HBD Conversions

The important thing is how much HIVE was created from the HBD conversions. Here is the chart.

2020 has been a record year in HIVE created from HBD conversions. Almost 24M HIVE was created from conversions. If we take into account that around 2M HIVE is created per month this is basically doubling the inflation.

Even with smaller amounts of HBD converted in 2020 then in 2019, there is still more HIVE created from conversions in 2020 then in 2019. This is basically because of the HIVE price. On average it has been lower than in 2019 and more HIVE is created because of this.

HBD conversions are acting in the totally different direction that we want. Lower price and increased supply. Usually you want the other way around. But this is the weight from a pump that happened two years ago.

A bit higher HIVE prices will help a lot in reducing the inflation from these conversions.

Thoughts on HBD

Having a stablecoin on the chain is not a bad thing, when done properly. The thing is HBD is accumulating when the prices are high constraining the supply in bull market, and then it gets converted during a bear market inflating the supply. Its not the best solution for a stablecoin.

The other major thing with the HBD conversion. They are acting as OTC trades and are not going trough the open market but bypass it with the internal blockchain conversion according to a price that is signaled from the witnesses. If the conversions from HBD to HIVE was going through the exchanges (or internal exchange) then we would have a buy pressure on HIVE. The way its done now its just skips the market with some internal blockchain math and add more HIVE supply without any positive effect on the market.

But if there is no HBD conversions and the exchange for HIVE is done trough and internal market, the HBD supply will just keep going up. Their needs to be a way to destroy HBD.

Well how does the other blockchains do it. Like DAI for example. You mint a stablecoin by putting a collateral in. In the case of HIVE the “collateral” is the whole market cap of the blockchain. The thing is this leads to a shared collateral where individuals don’t take responsibility for the debt, and we have these imbalances later. There needs to be a mechanics for putting in place an individual collateral if the authors want to paid in stablecoin. Also expose these conversions to the open market. If an author want to receive HBD as reward to his posts he will need to lock HIVE as collateral to be able to do this. Usually the ratio is 3:1 or 2:1 at least.

For example, an author receives a 100 HBD payouts per month. He will need to have a 200 to 300 USD equivalent in HIVE locked in order to do this. At the current prices this is somewhere above 2000 HIVE. As the author receives HBD as rewards this is calculated in his debt. If the HIVE price dropped the author will need to add more HIVE to his collateral to keep the HBD, or pay out the debt by destroying HBD and putting it in his collateral. If these things are not met then a penalty will be put in place, the collateral will be realised but with smaller amounts of HIVE. This can even create demand for HIVE if authors want to be paid in stablecoin. They will need to have collateral and balance their position as payouts come in.

The above might sounds complicated but it's one of the ways to be paid in a stablecoin on a blockchain that has its token that goes up and down in price. You need to put in some sort of individual collateral and open market forces. The other option is just taking the token as payment, no stablecoin. The current setup basically forces the authors to take stablecoin as payment with a shared collateral.

This is just some brainstorming and there are more ways to do this. What is your opinion?

All the best

@dalz