China has banned Bitcoin mining recently as most of the crypt people know. A major share of the bitcoin miners was located in China, and they need to move their equipment from there.

More than two months passed since the Chinese ban on Bitcoin mining. Miners should have moved by now. Let’s take a look how is the hash rate doing.

Here we will be looking at the long term data for the hash rate of Bitcoin and then take a closer look at the last month and year, to see the effect of the Chinese ban. For context we will have a look at the activity on the network as well.

Just a note for those that are not familiar the hash rate represents how much computation are being made, or in simple terms how much mining power is allocated to the network. The higher the hash rate the more secure the network is.

The data presented here is mostly gathered from the blockchains charts.

Hash Rate

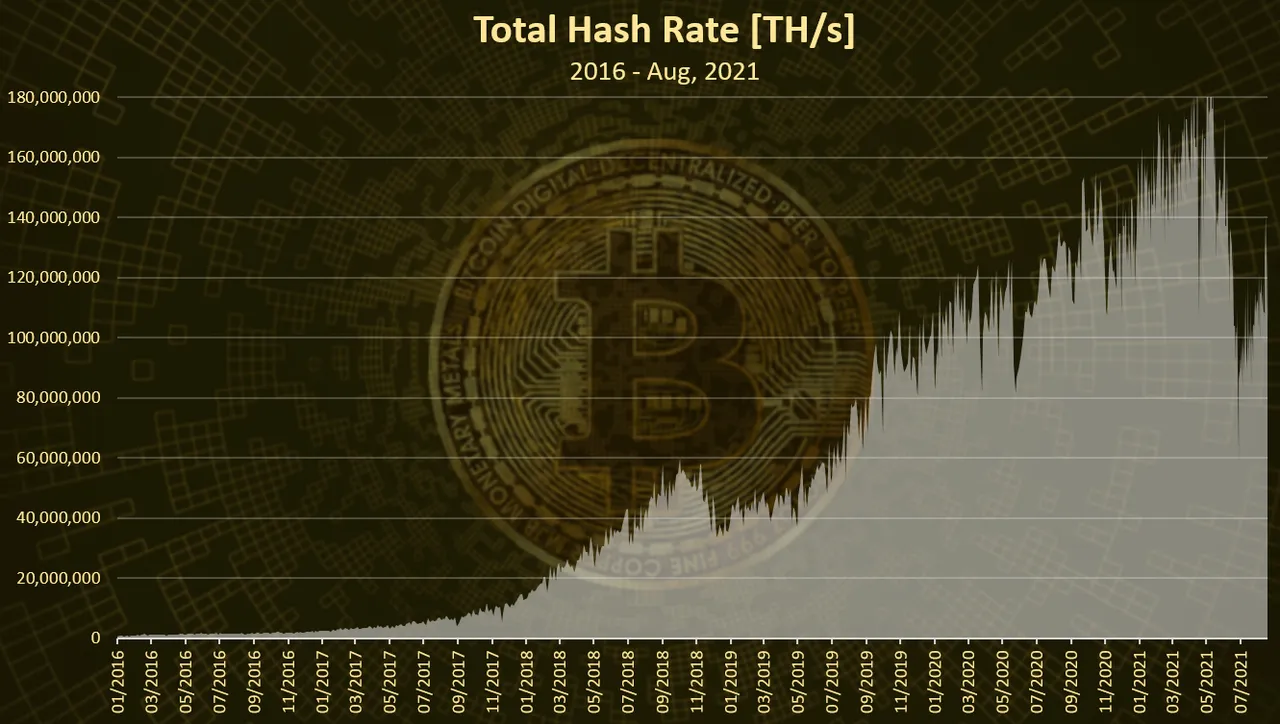

First the chart for the long term data.

The period looked at is after 2016, since before that the hash rate is barely visible on the chart.

The first major increase in the hash rate happened in 2017. After the bull marketed ended there was a drop in the hash rate but then it started to grow, and it reached new ATH in 2019. A lot earlier then the price increase in 2020.

As we can see the hash rate has been increasing steadily in 2019 despite the changing prices. In 2020 the growth continued and the same goes for 2021, up until recently when we can see a sharp drop in the last month.

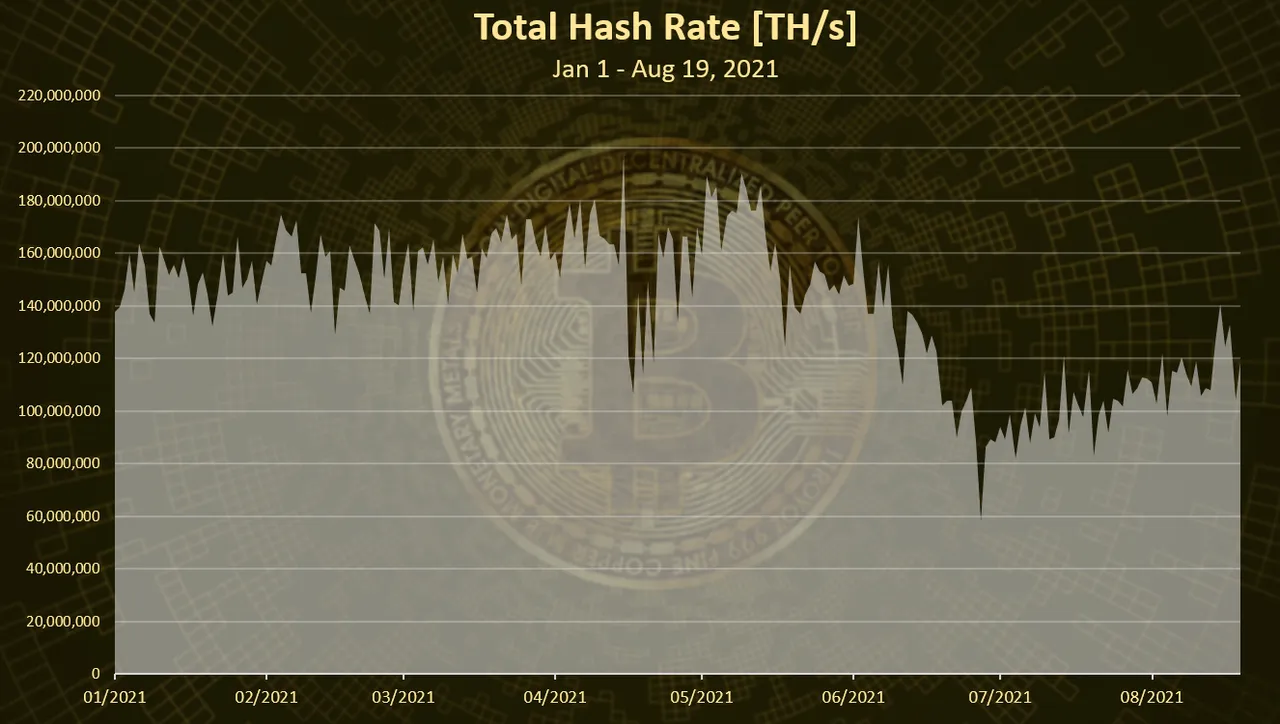

If zoom in 2021 we have this:

As we can see from the chart the hash rate has been growing up until May, when it had a drop, first most likely because of the prices going down, but then a more significant drop in June.

We can see that at the begging of June the hash rate was around 160M [TH/s] (million tera 😊) and in the last days it has dropped to under a 100. This is more 30% drop in just a month. Quite impressive.

After the drop, the hash recovered fast to around 100, and then it continued to grow slowly, reaching 140 on Aug 15.

Active Wallets

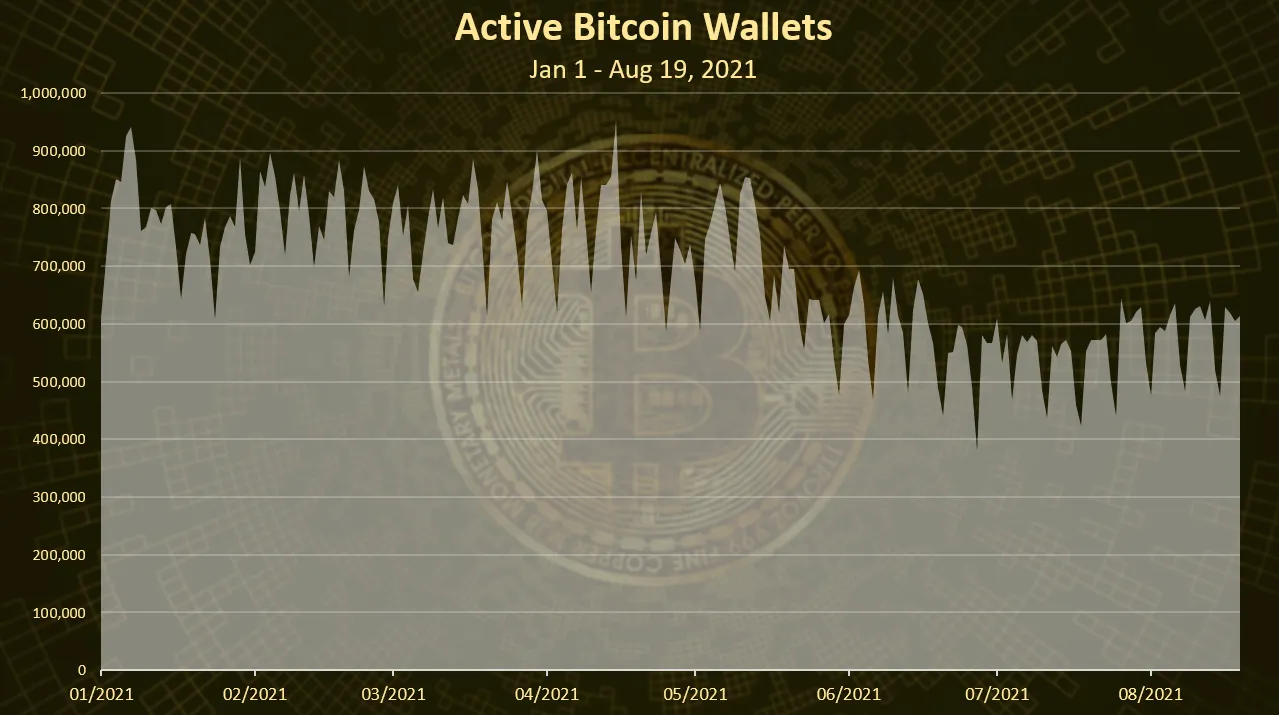

For context let’s take a look at the active wallets in 2021. Here is the chart.

At the begging of the year Bitcoin was pushing towards a one million active wallets per day, going more than 900k on a few occasions.

Then in May the numbers went down, as the price dropped as well, and it has been in a slow decline in the next period.

Now we are seeing a growth again, with more than 700k active daily wallets.

The number of active wallets didn’t drop as much in June as the hash rate. We can see that the impact on the miners is bigger than the active wallets.

Transactions

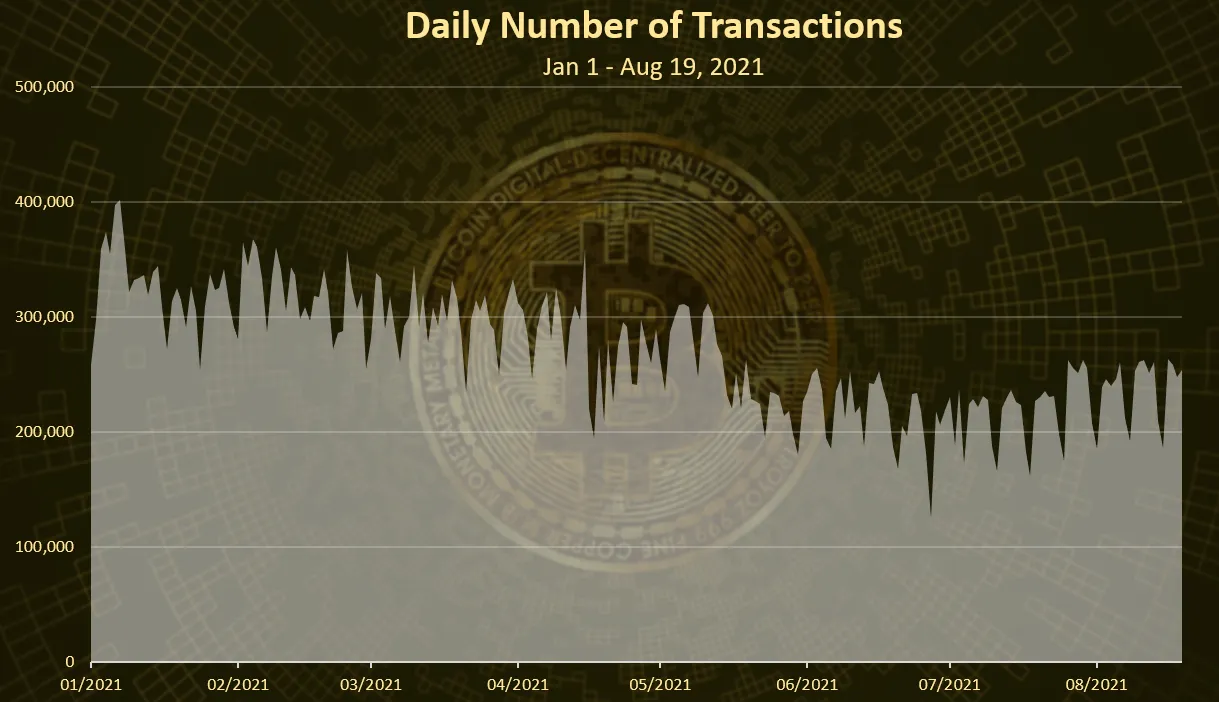

Another parameter for the activity are the numbers of transactions. Here the chart.

Here we can see a slow decline in the numbers of transaction over the whole 2021, with maybe just a slightly bigger drop in May. In the last moth the number of transactions has started growing again reaching 260k tx per day.

Mining By Country

Where are the Bitcoin miners located?

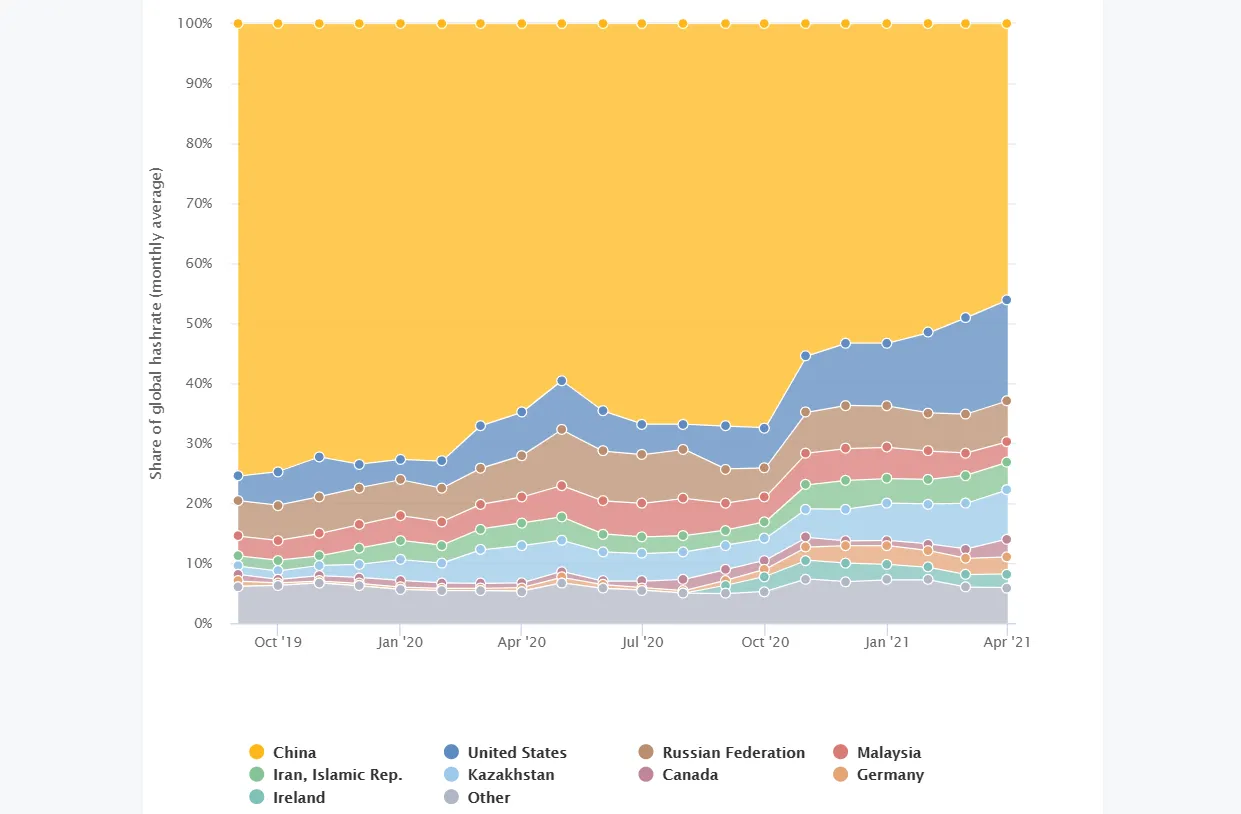

This is a chart by Cambridge that shows the mining power per country in time.

Now the bad thing is that the chart end in April 2021. But we can see that prior to April 2021 most of the mining was happening in China, with 50% to 75% share from the total hash rate. There was a declining trend in China dominance for BTC mining.

I haven’t found a reliable source about the current distribution of the mining power, but there are indications that US is now the number one country for BTC mining, followed by Russia, Iran and Kazakhstan. Kazakhstan has been an interesting story and there have been a huge spike in the BTC mining power there. Overall, all the country saw an increase in the BTC mining power.

We can now see that the mining power for Bitcoin has improved and growing steadily in the last month. It is still not at the levels it was before the Chinese ban. For that it will take probably a few more months. Unofficially US is now no.1 in Bitcoin mining.

All the best

@dalz