It's been an amazing month for CUB so far. What's happening is massive volatility across the entire cryptosphere.

This volatility = lots of trading volume for the CUB DAO.

The CUB DAO operates the Multi-Token Bridge which encompasses bHBD, bHIVE and bLEO.

The bHBD and BHIVE part of this bridge have seen all the benefits of increased volatility: higher wrapping volumes.

From my current estimates and projecting current volatility in the markets, I think we might see wrapping volumes grow to over $500k wrapped/unwrapped this month.

That is a HUGE number. Last month, we did $360k in wrapping volume. This would constitute a 39% increase in monthly volumes!

Growing this is highly important to the sustainability of CUB in the long-run. Keep in mind that all of this wrapping revenue ($2,500 in revenue from $500k in monthly wraps/unwraps) is 100% utilized by the DAO to buyback and burn CUB.

Follow along as I report daily on @cubdaily 🙏🏽

Focus of the Day

Let's get more wrapping volume! I think we'll see $500k this month but we need to continue this pace of growth. It's never been more important than now to advertise the usage of bHIVE and bHBD.

The team recently announced the potential for bHBD and bHIVE bonds. This would greatly increase wrapping volumes and also oracle staking. I'm excited to see what they come up with on this front.

At the end of the day, the focus of all of us is on growing the liquidity and usage of bHBD and bHIVE.

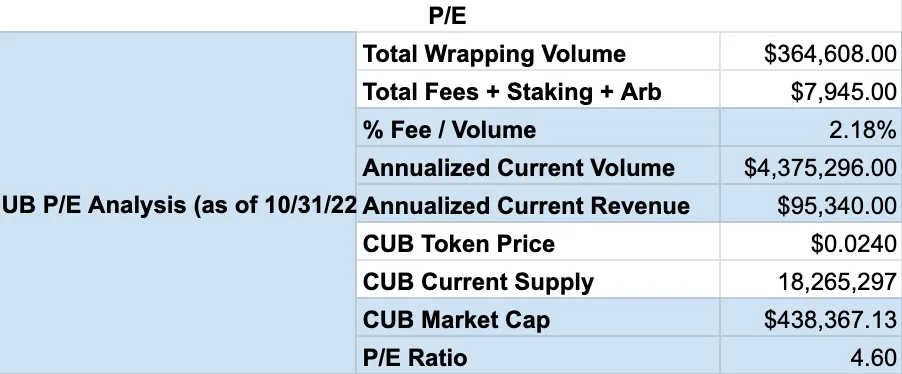

P/E Analysis of CUB

Here's a new section I'm trying out. I decided to run a P/E analysis of CUB using data from each Monthly Burn Report posted by @leofinance. Check out the second analysis I ran and leave a comment below with your thoughts.

Keep in mind that a low P/E ratio is good. It means that the revenue that CUB is generating each month is increasing faster than the CUB price is increasing (more revenues earned per share of CUB).

CUB Token

- Price: $0.02137

- Total CUB Supply: 18,685,376

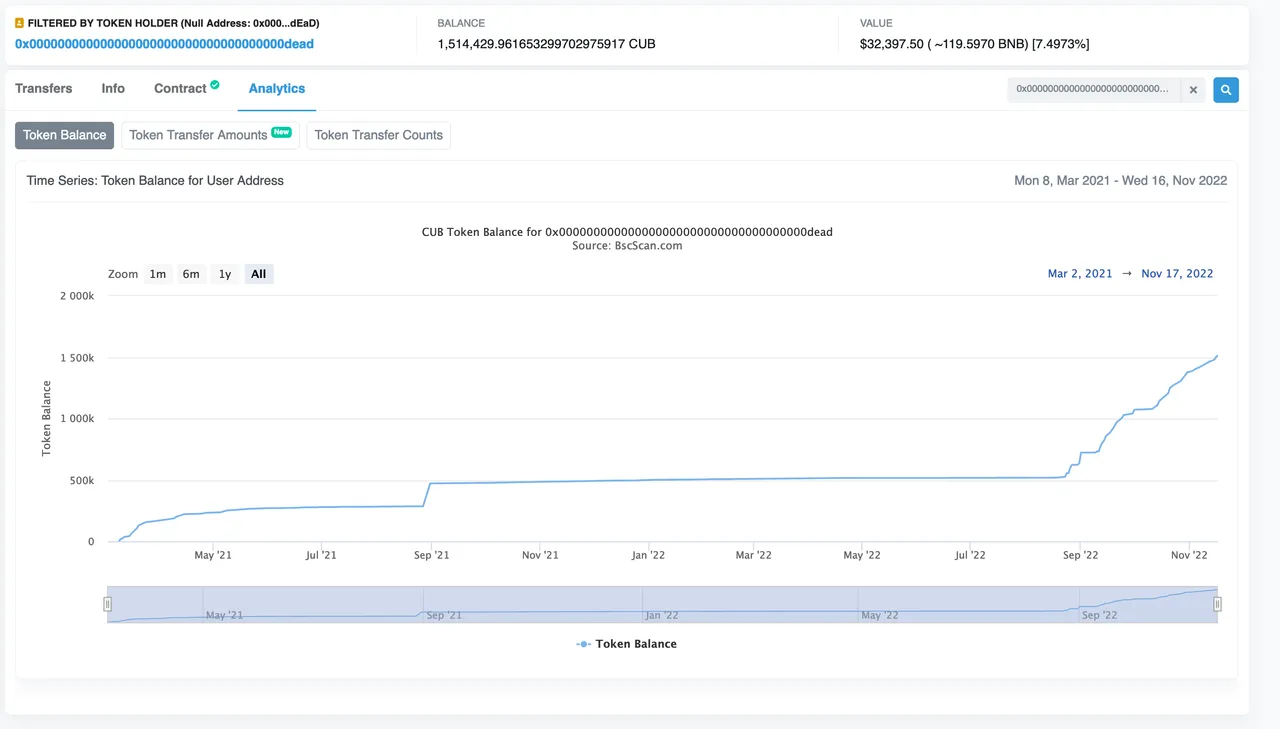

- Total CUB Burned: 1,514,430

- Total Market Cap: $398,917

- Total Value Locked: $1,364,593.80

TVL still steadily growing after the recent drop in value of assets across all of Crypto. What you want to see is that slow and steady trendline. Even if there is a sudden drop, the trendline is still positvely up and to the right.

Multi-Token Bridge Stats

- bHBD-bHIVE: $144k

- bHBD-BUSD: $235k

- bHBD-CUB: $131k

- bHIVE-CUB: $124k

- Total: $634k

Up over 20k since last report! This is a good sign. Keep in mind that we crossed $700k previously but then we saw the value of assets like CUB and HIVE drop alongside the rest of the crypto market. This led to a small drop in Multi-Token Bridge (BHIVE AND BHBD) TVL but the trendline, just like the total TVL on the platform, continues a positive up and to the right trend.

CUB Burns

Speaking of up and to the right... CUB Burns are ever-increasing! We're seeing more and more of the supply get eaten away. This is what we want to see!

Further Reading:

- Latest Reports From this Account: @cubdaily

- Latest CUB Burn Report From the LeoTeam: @leofinance/cub-monthly-report-or-october-2022-350k-cub-bought-and-burned-bhbd-and-bhive-liquidity-depth-grows-30

About CubDaily

I'll be using this account to report on the CUB stats each and every morning. Together we'll track the growth of CUB under the completely revamped ecosystem that LeoTeam has built called the Multi-Token Bridge.