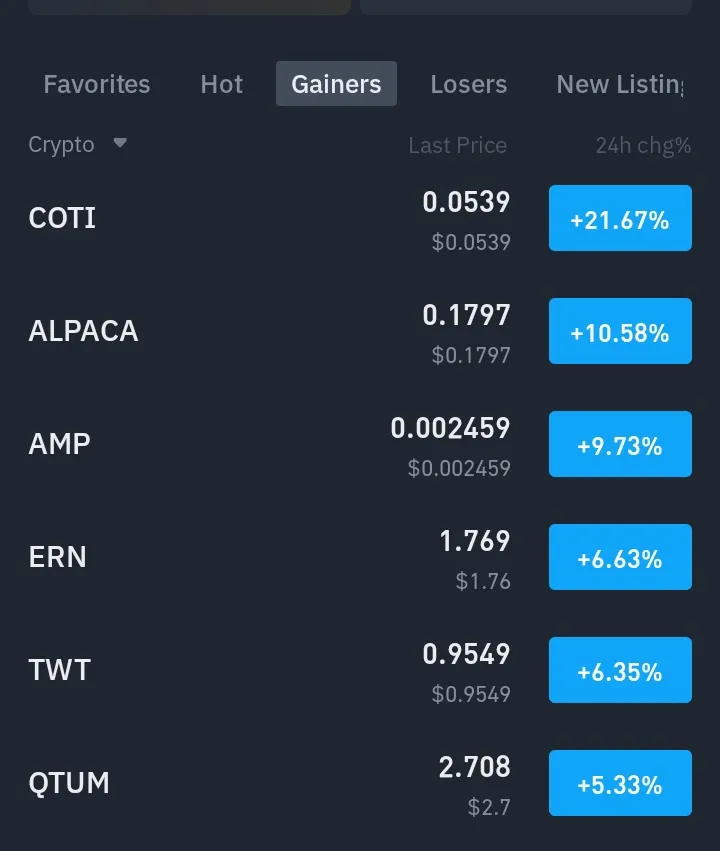

This was expected due to COTI revenue from their various projects being used to buy back COTI and then using that to increase the APR on offer in the Treasury. Sometime this week the COTI purchased will be boosting the APR even if it is only for a good 5 days which has been about the average time span thus far. When you are involved in various projects you do get to read what is going on and why this was expected.

The exciting part is this is only with 1 project currently and as more are released this will happen continuously removing liquidity off the exchanges. COTI at 5c is still very cheap for what the project offers and will continue to accumulate as many as possible over the coming months.

The team did a recap for the first 6 months this week and also what lies ahead for the remainder of 2023. Due to the SEC calling COTI a security due to trade washing on the US Binance COTI have been keeping a low profile. The trade washing had nothing to do with COTI itself as this was done by a third party.

The updates we used to receive on a monthly basis dried up and it was good to hear that the first Enterprise token is still due this year. This Enterprise will be using COTI as a PPN or Private Payment Network. The first one will always take longer than those that follow due to having multiple levels of approvals and cannot be sped up. Once you cross all the barriers and jump all the hurdles you are ahead of the game.

One has to consider developing a custom PPN is a huge task and one could build a full start up around just this infrastructure. This involves many crucial elements like a crypto gateway, a bridge , stablecoin mechanisms and support and full cashier services (PayPal equivalent) along with security. This is very complex and why these PPN's take time as many people are involved making sure it fits all the criteria. This will be revealed shortly before the launch day.

We know of various Enterprises and who some of them are so we will find out soon enough who the first one is. It will either be gaming or the musical royalty revenue company they discussed in March as the others mentioned were still too far off.

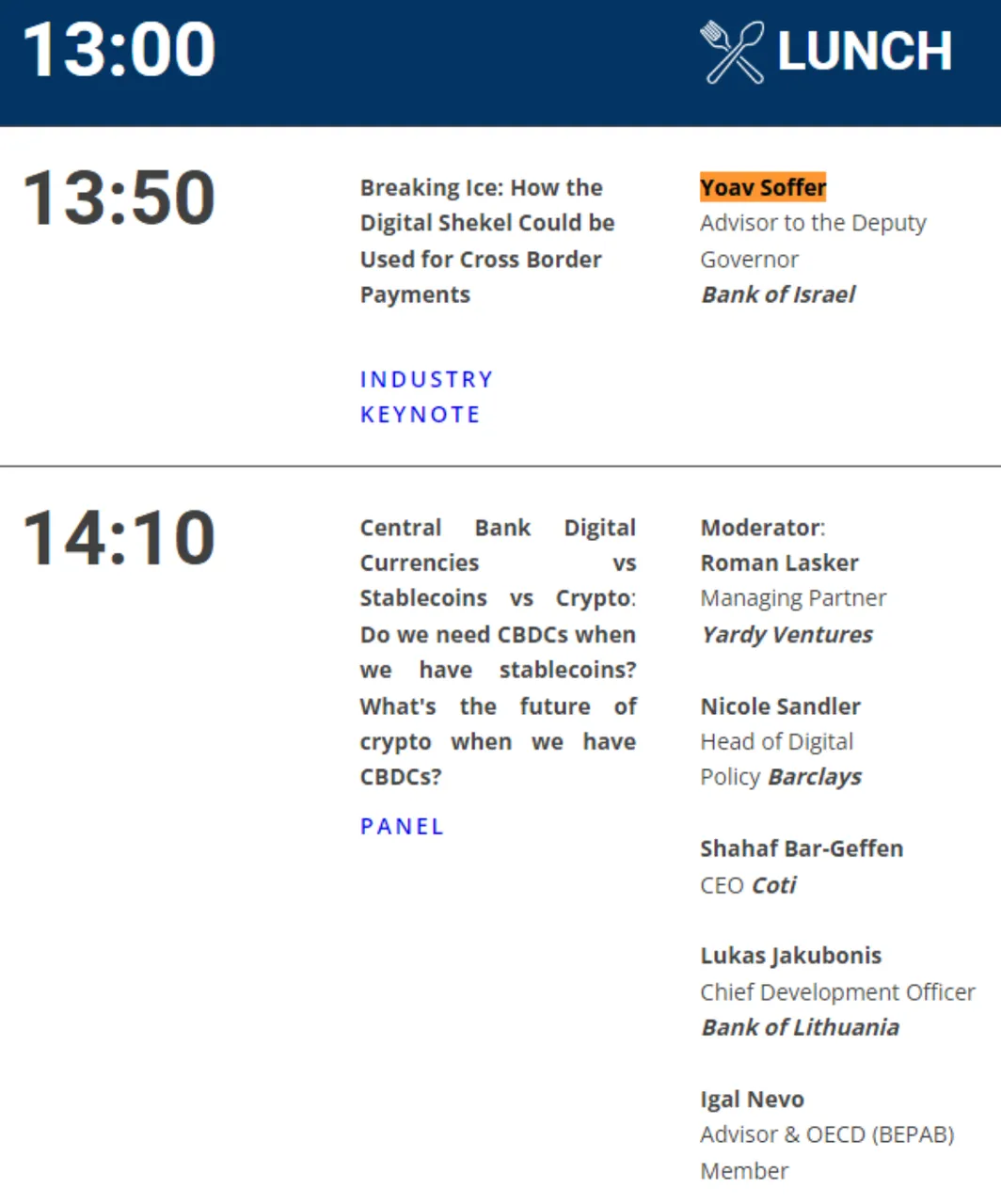

The other project COTI are busy with is the Digital Shekel working on the Israel CBDC. COTI were the only crypto on this panel at the Fintech week so I do think they are the project handling this. Remembering what they have been doing and with who is part of your research understanding how all the pieces fit together.

The way I see the next couple of years play out is there will be multiple service fees flowing continuously feeding the treasury removing the liquidity off the exchanges with much bigger numbers involved. The use cases of the project will drive the COTI price higher and will not be relying on what the market is doing.