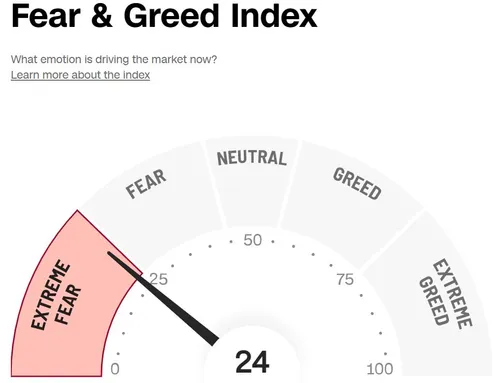

Source: CNN Fear & Greed Index as at 23 Sep, 7:58pm EDT

The Fed once again communicated its aggressive stance in the fight against inflation, with most of them seeing the rate climbing above 4.5% in 2023, higher than the prior estimate. The 2-year Treasury yield, often seen as an indicator of the fed-funds rate in the future, is continually climbing too.

With these, the equity markets took another fall, with technology stocks leading the plunge. Although there's no direct correlation between economies and the crypto markets, I am not hopeful that crypto markets could pick up anytime soon when market sentiments are very low.

I really wonder how 2022 will end off for all markets.