Hey Jessavers

As the US government continues to break out the money printer and let loose on the next round of stimulus cheques and debate the 6 trillion dollar roll out to rebuild their economy, all that printing not only affects its market but markets around the world.

The US dollar is the world reserve currency, and countries like my own are beholden to it; when we borrow money, exchange goods and services via import and export, all of it is settled in dollars.

South Africa has a massive amount of US dollar debt close to $170 billion as you can imagine that weighs heavily on the shoulders of the South African consumer and taxpayer.

You're either paying that debt back through your purchases to repay corporate debt or your tax to repay government debt. As the US continues to print, they flood the market with dollars; the more dollars, the cheaper the dollars. The cheaper the dollars, the easier they are to purchase and then pay down your debt.

Naturally, this decrease in dollar value allows currencies to borrow more, which is hotly debated in South Africa right now, but that's a story for another time.

South African premium

Now South Africa's currency, the Rand, is by no means good; apart from it being one of the most liquid in Africa, it has very little going for it.

In my lifetime, I've seen prices of things like bread and petrol shoot up well over %1000 as the country continues to struggle under corruption and mismanagement as well as few legacy issues.

Now there is nothing I can do about the absolute purchasing power of the Rand other than getting into assets that better hold value over time. All fiat money loses purchasing power, but because they all measured against the dollar, this floating devaluation seems less obvious.

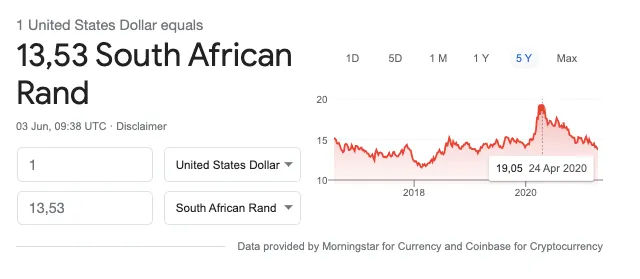

As of late, the US dollar has come down against the Rand from a high of 19.05 Rands to get you 1 USD to 13.53 today, which's a drop of 29%.

So why is this important to me? Because I buy Bitcoin. Like it or not, Bitcoin is primarily measured in US dollars; as the US dollar devalues against my currency, it, in turn, means I get more Bitcoin for my Rands as the relative price increases.

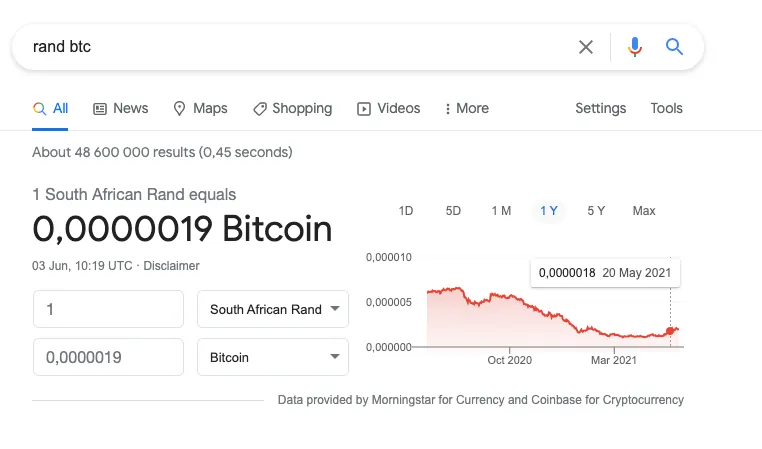

Since I purchase Bitcoin every day at small set amounts, I can see how many Satoshis I get. Bitcoin has been flat of late, bouncing around the 33-38k range, which has exposed me even more to the 29% premium I am getting buying Bitcoin now.

Emerging markets getting a greater stake

What I am thinking is that if this is to continue, then buyers in emerging markets like my own can compete better against US dollar buyers in securing more Bitcoin. This redistributes wealth better around the world and makes other countries holders more competitive.

Since Bitcoin is down 50% from its highs and the US dollar is down 29% from its highs against my local currency, someone like me can now gobble up sats at an absolute steal.

I can now get 190 sats for ZAR1 and 2021. I was only able to pick up sats at a range of ZAR to 110 - 120 sats, so I'm getting 37% more sats since this dollar dump.

What is the premium you're getting in your part of the world? I'd be keen to find out.

Have your say

What do you good people of HIVE think?

So have at it, my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem, and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Safely Store Your Crypto | Deposit $100 & Earn $10 | Earn Interest On Crypto |

|---|---|---|

|  |  |