Hey Jesstock traders

The stock market in the US has been on a 40-year bull run of sorts, headed up by the FAANG or technology stocks. These names can do no wrong and have become the darlings of many investment portfolios. The "can't lose narrative" of the stock market continues to sucker in larger swaths retail investors who have no idea what they are getting themselves into and are totally besotted by the number going up.

The Japanese stock market has been in a lull for over 30 years, and the European stock market has been sedated for the last decade, so the US stock market has become the casino of choice. The Fed and the US government stop at nothing to maintain the stock market and ready to step in big time for any big correction.

As long as there is confidence in the stock market, it's seen as confidence in the economy, even when the fundamentals are totally out of whack, and the real economy is pretty much in shambles.

The idea of number go up and avoiding a crush down at all costs is making the chances of a crash up all the more likely, the longer the markets are artificially propped up.

Not about access to capital but a store of value

Traditionally stocks are an investment based on accessing either the free cash flows of the business and tapping into those dividends, or you're betting on the future growth of the company.

In today's market, it's me of an alternate store of value where investors want to hold anything but a currency that is losing its purchasing power as they try to beat the hurdle rate of debasement.

The more dependant the economy becomes on the stock market to store their value, the more a crash up becomes a real possibility.

What exactly is a crash up?

A stock market crash up is when the rate of return of the stock market cannot outpace the rate of inflation. While the figures go up, the purchasing power goes down.

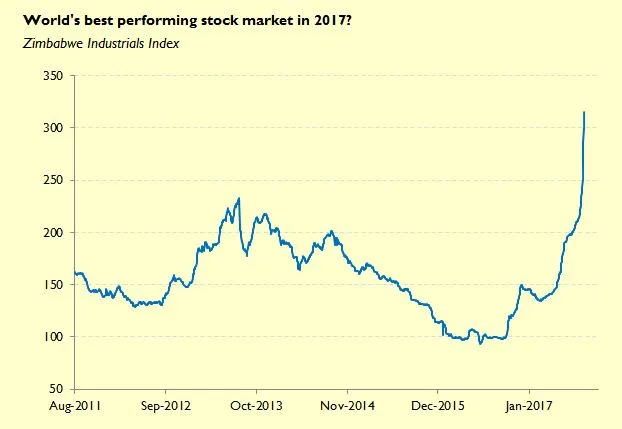

If you want to see an example of a crash up we can look at what happened to the Venezulean and Zimbabwean stock market where the currency was used to try and paper over the cracks.

Even with investors gains increasing in the stock market it wasn't enough to outpace inflation and they ended up with stocks worth very little in terms of purchasing power but the value measured in the currency was astronomical.

Image source: - frontera.net

Image source: - jpkoning.blogspot.com

A crash down can trigger a crash up

The crash up can be gradual, as each year stock market gains reduce and inflation increases, this can be a slow process that takes years. However, it can also be triggered by a crash down, as fear takes over the market and net buyers become net sellers pushing the stock market down violently.

Central banks may overreact and pull the trigger on a level that runaway inflation occurs.

I am not saying a crash up is in our future, but this stock market frenzy is delicately poised. For those who may think it's always up, all-time high after all-time high based only on inflation could sucker in more investors and destroy many peoples investments.

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, comment "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Safely Store Your Crypto | Deposit $100 & Earn $10 | Earn Interest On Crypto |

|---|---|---|

|  |  |