Hey Jessatoshis

As the price of Bitcoin continues to rise, so does the number of transactions on the network. The competition for block space as people want to put their Bitcoin in cold storage or move it between wallets and exchanges means the price of transaction fees skyrockets.

We've already seen transaction fees as high as $55, and that's when people turn their noses up at Bitcoin and head off to the hand of cheap altcoins. If transaction cost is the make or break value proposition for you, I get it, but I guess value storage is not what you're in it for, which Bitcoin is about.

Each chain and coin make certain trade-offs, and this is Bitcoins trade-off. As someone who still thinks Bitcoin is the go-to asset. I've tried to use the proposed solutions we have now instead of running off to altcoin land, where I am taking on even more risk than I am personally comfortable with keeping any real value around.

Lightning still needs time

Previously I've been messing with the lightning network. It does show some promise, but managing your inbound and outbound liquidity can be a problem for normies, so I don't think it's ready for mass consumption yet. I store a few sats in lightning, and I use it to play around with the various wallets, games and Lapps (lightning apps) that are making their ways around the internet.

The tech is only 3 years old, and I don't expect it to shoot the lights out yet, but from what I can see on the roadmap, solutions are coming for the problems we face on lightning right now.

Getting liquid

As I hit some roadblocks with lightning, I decided to get involved with the liquid network. The liquid network is a Bitcoin-based side chain that is run by a centralised federation but allows you to lock up Bitcoin and get L-BTC that has 1-second block times and fee management, which is really cheap.

You remain in the custody of your L-BTC using apps like Green wallet or your Ledger Nano which I am using. I can then ping Bitcoin between exchanges that support liquid and swap it between stable coins available on liquid.

Some exchanges support liquid BTC for De-FI, such as Liquid.net and HODLHODL, which I am still experimenting with and earning a return on my Liquid Bitcoin.

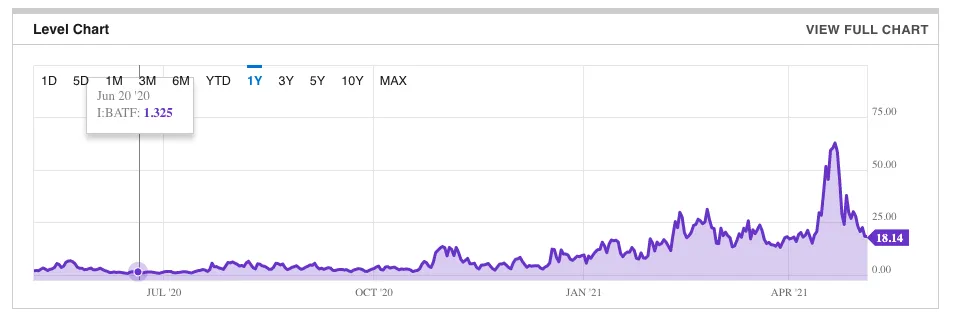

If we take a look at the overall trend for Bitcoin fees, as a small trader like myself, you are going to have to factor this in if you want to use Bitcoin in the future. Proper UTXO management is important, and that's why I am using liquid and lightning to consolidate on-side chains before removing them to the main chain for long term storage.

It not only saves me on fees, but future fees if I move my Bitcoin as my UTXOs touching the chain are smaller and would cost less to process.

Source: - ycharts.com

Downside of L-BTC

Liquid Bitcoin is not perfect by a long shot,

- It adds additional key management to handle

- It adds a new layer of complexity using a side chain

- It is not as widely accepted as Bitcoin, so you need to use exchanges that support it

- It is centralised as the federation running the nodes are exchanges. I do still feel okay with using it, as I would using crypto on an exchange. Even with the key management, I still don't have the real Bitcoin.

I think that liquid will be the more DE-FI ready side of Bitcoin, and lightning will be the eCommerce side. Eventually, they will merge into one interoperable layer, and you can swap between them without touching the main chain until necessary.

Bitcoin and being your own bank requires brains

Bitcoin is still a very complex financial tool if you opt for the non-custodial version of the asset class. It takes time and a lot of reading to understand how to use the various products plugging into the mainnet, but I am willing to do the work.

I've chosen to focus on Bitcoin, and I think it has more than enough complexity for me to learn still before I can even think of looking at altcoins.

I have dived into Ethereum, but honestly, not the other chains, and I don't think I will as long as there is so much to learn and do on Bitcoin.

I've taken my first steps into liquid and now on 3 different Bitcoin, mainchain, lightning, and liquid types. As I research, I realise how little is known about these solutions and why people dismiss Bitcoin and head off to altcoins that are advertising like crazy.

There's no sense in advertising these solutions yet since they are not fully ready for adoption, and I get that, but neither are many of these other chains, and they'll soon realise this as onboarding becomes a burden to their chains it has with Bitcoin.

It's always easy to claim you have scalability without the numbers, but when you do, it shows what you're made of and if you can compete with Bitcoin.

Have your say

What do you good people of HIVE think?

So have at it, my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem, and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Safely Store Your Crypto | Deposit $100 & Earn $10 | Earn Interest On Crypto |

|---|---|---|

|  |  |