What was once designed to be a permissionless financial system, accessible to anyone, anywhere in the world (regardless of social class), is becoming more and more permissioned as time goes on.

Aside from the learning curve involved with setting up your own wallet, mining, purchasing, and receiving Bitcoin used to be a relatively frictionless process. These days though, the red tape and bureaucracy surrounding crypto is reaching all-time highs.

Most banks and governments severely underestimating the power of cryptocurrency in its early days, and only thought to add new rules and regulations after it skyrocketed in value. As the overall value of the crypto market continues to increase, obtaining it using the old banking system will only get more difficult.

Mining

Back in the early days of Bitcoin around 2009 and 2010, anybody could permissionlessly mine Bitcoin by simply downloading and installing the open-source client. That meant that anybody, anywhere in the world (even poor people without ID) with a personal computer and an Internet connection could have participated in the network, and earned Bitcoins.

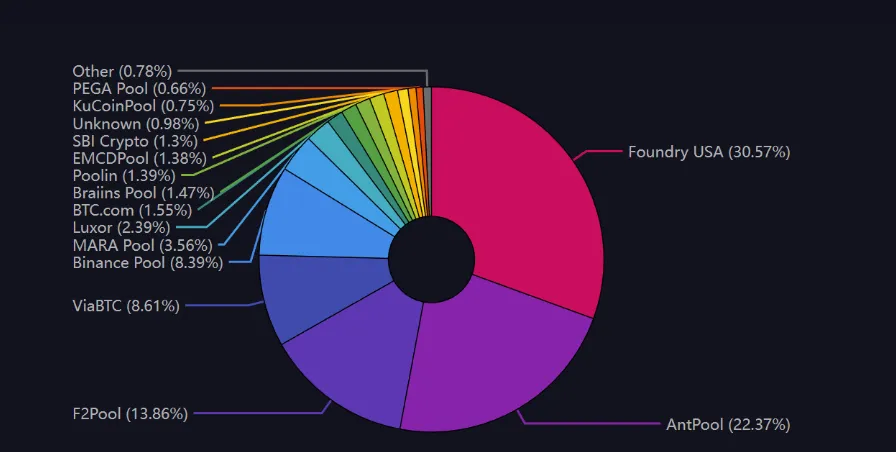

While it's still possible to install a Bitcoin client on your home computer, mining it alone is nearly impossible, so most people join mining pools. Nowadays most Bitcoin and Ethereum mining pools (including AntPool and Foundry USA) require KYC to onboard, closing the network off to many would-be participants.

Faucets & Events

In Bitcoin's early days there were also online faucets, where you could obtain a small amount of Bitcoin for free, without providing any form of identification. Additionally, there were conferences where the speakers would hand out free Bitcoin to the attendees after a short seminar, with zero hassle.

ATMs

No more than ten years ago, there were ATMs where you could insert cash and get an equivalent amount of Bitcoin in return, with very little friction. These days it's usually only possible to buy a small amount if you provide a phone number. Otherwise, KYC is required to obtain more.

Banks & Credit Cards

Banks have started limiting the amount of money you can transfer to and from exchanges, or in some cases are outright blocking you from purchasing crypto. Many banks that used to allow their customers to buy crypto with their credit cards, will not allow it anymore.

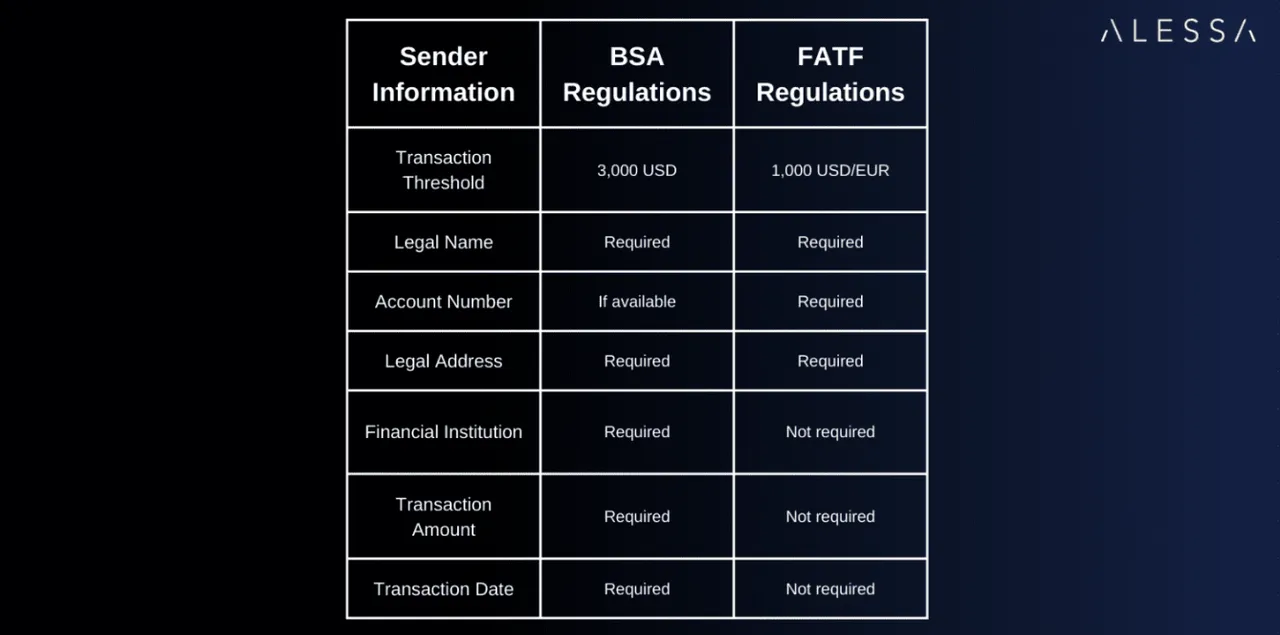

Even getting your crypto off of an exchange into your own self-custody wallet can be cumbersome with the latest travel rules, which require you to fill out information such as the recipient's full name, legal address, purpose of transfer, etc.

Building A New World

The people in power have finally realized the potential that crypto has to subvert the banking system, and are implementing these measures primarely to prevent too much liquidity from flowing out if there's a panic.

Ultimately, decentralized blockchains are new technology that we are trying to fit into an old regulatory system. However, instead of putting the old world on top of crypto, what we should be doing is building a new world based on the foundation of crypto.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me on InLeo for more frequent updates.

Until next time...

Resources

Mining Pools Graph [1]

Crypto Travel Rules Image [2]

Bitcoin ATM Image [3]