So I've been playing around with AAVE recently and finding a great way to short the market without too much risk. And during the dumps ... this strategy was placed into action and true enough .. it was really a nice little bump in profits.

This was how I did it .. and its just a sharing ... not any financial advise. I've been monitoring the 3 day charts on TV for ETH and it had blown pass the Key Levels and RSI was high , MFI was high and the Red Dot has appeared based on Vumanchu Divergence B indicator.

TV Charts for ETH/USD

What to do ... using Binance Chain in this scenario

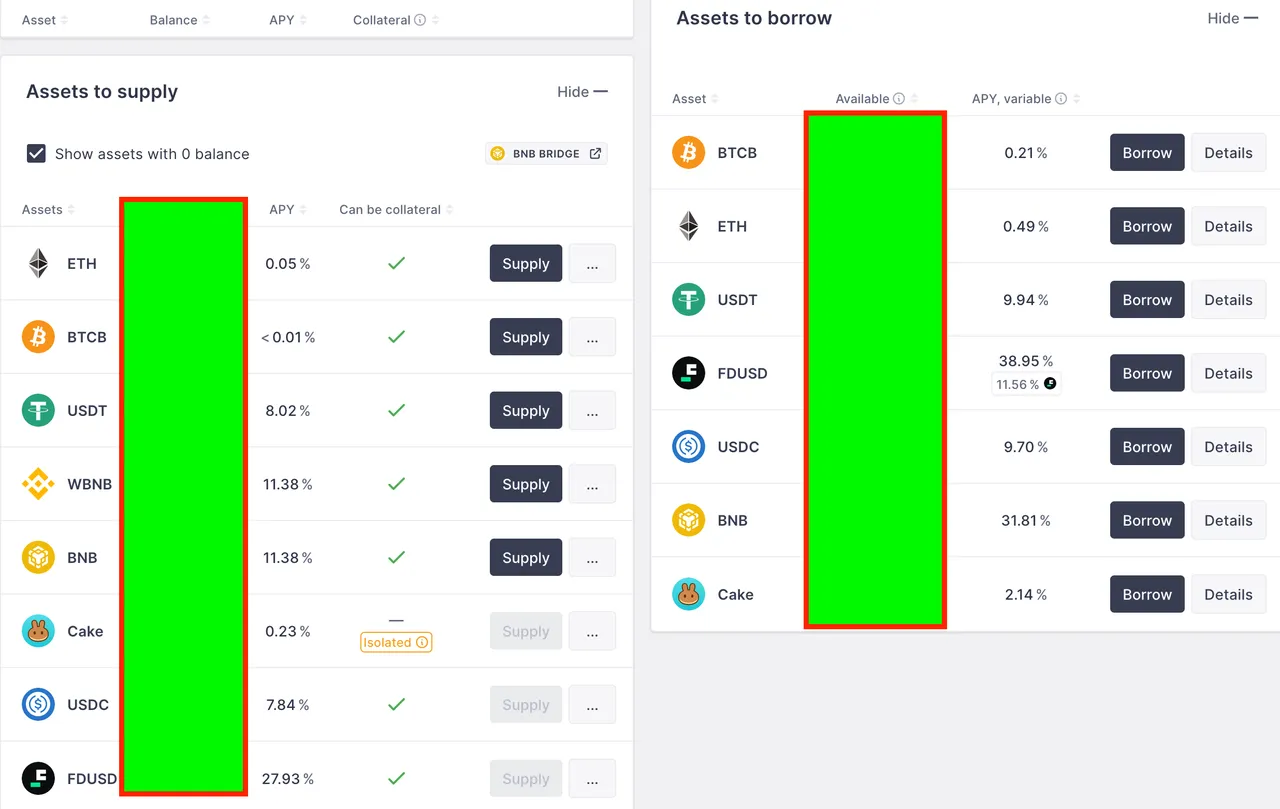

Head over to AAVE app and deposit/supply your ETH . Lets take for example 10 eth here

Your MAX LTV on ETH as collateral is around 80%

This meants you can borrow up to 8 ETH at this point.Take a loan of 8 ETH and then swap it for FDUSD. During this time the price of ETH was around 4k so you would get around 32k FDUSD.

Supply the 32k FDUSD into the market for now as we know FDUSD interest rates goes from 5% all the way up to 93% and receive those sweet interest.

... now sit down and wait for price to drop.

The reason I took a look at 3 days chart and not lower timeframe is because it does take awhile for this to work and not a "daily" trade.

Once the price drops .. eg. ETH dropped to 3.2k from 4k.

- Withdraw your FDUSD from AAVE and then swap 8 ETH which would now cost you 25.6k. Then repay back your 8 ETH

You would be now left with $6.4k in total profits PLUS interest earned from your staked FDUSD for you to do whatever you want to do with it.

Now this strategy works in downtrending markets for uptrend markets the methods are different however that would be another story to tell.

Cheers all and remember .. this is just my method and i'm sure there are better ways of doing this with controlled risk, if you know how .. do share.