The State Of Crypto and Blockchain in 2023

Crypto has been on a wild ride as of late and it's always funny to step back and look at what people are saying. From $16,000 to nearly double that in a short few months people are still on edge about bitcoin and crypto in general. In this article I'm going to go over a few fundamentals of how the blockchain and crypto look.

Fees Are A Major Issue

When talking about crypto the two cores that people talk about are Ethereum and BTC but both of these platforms really haven't done much of anything in order to reduce fees and make things more efficent on those fronts.

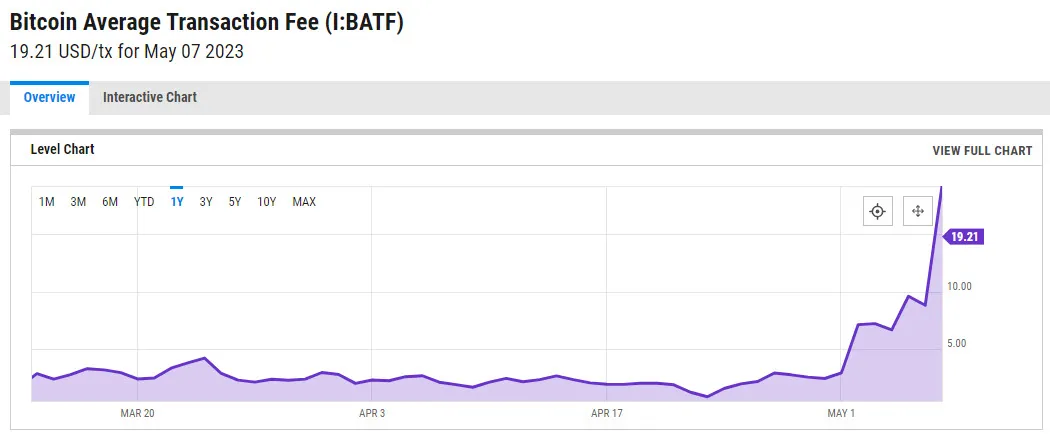

Sure there are layer two tokens and side chains but a vast majority of people still use the core chains to do business. BTC fees have exploded in may going up 10x

Comparing these fees to the last major bull run we can see we are almost right back up to the start of the bull run standards in terms of fees. The amount of on chain activity is growing. This is primarily from two things.

The first being BRC-20 which is an experimental token standard which was launched in March of this year. These spurred the dawn of more meme coins but not only that they also have released the second major spike.

Bitcoin Ordinals which allows people to launch non-fungible tokens for bitcoin base assets. This is creating NFTs directly on bitcoin itself.

I think it's clear to see that people don't care all that much about side chains and instead want to primarily deal in ETH and BTC.

If we look at Ethereums chart however we are seeing higher fees but some of those fees seem a little out of context as a transaction on Ethereum right now should cost you $5 or less which is a small blip on the radar compared to where it was during the last bull run where $50-$100 was standard for a while.

We can see that the two new changes to BTC recently are gaining traction but the fees are massive. Who benefits from those large fees? The miners and you can bet ya that they wont be missing out on this new trend.

The hash rate for Bitcoin has been skyrocketing as of late just take a look at this chart.

To me all of this adds up to two very clear things.

The first being people really don't care in terms of the masses to trade and do things on side chains. They want their ETH and their BTC.

There's a lot still being developed on these chains however with more development the growth of the blockchain itself is falling far behind and is causing massive fees.

These high fees are what stall out bull runs and it looks like to me we are already going to see this stall out and it shows in the prices as of late.

The real question might come down to will people start using side chains more now and continue the bull run or will we see a third repeat in history of the same exact issue. High fees an extremely congested blockchain that stifles and kills progress.

To me I'm leaning towards BTC and ETH either having to up their game to allow more transactions to take place or for these projects to get smarter with how they use the main chain to keep fees down. Without doing so I see every bull run stalling out.

What are your thoughts?