Stable Coins Could Be Killing The Crypto Dream

As much as we have all started to love stable coins I question if it's starting to lead us down the wrong path. Bitcoin was born from a dream of having a decentralized currency that was a borderless and trustless system. Fast movement of funds large or small anywhere in the world. What use to take days now takes 10 minutes.

Since then cryptocurrencies have evolved to have larger blocks and faster block times allowing for even lower fees and faster turn arounds. That's all well and good but besides that they haven't really evolved much more than that.

The First Stable coin

The first stable coin to release is Tether which was launched in late 2014. It remained the largest and only real stable coin for years until just recently when nearly ever chain started to release their own stable coin.

These stable coins are suppose to be backed by FIAT or assets that hold the $1 USD value peg. (Note this clearly shows the USD is still the primary de facto when it comes to trading above any other world currency) However there's really nothing saying that this people or companies have to actually be holding these funds. It's decentralized and unregulated so pretty much anything goes without any repercussions)

Volumes Matter

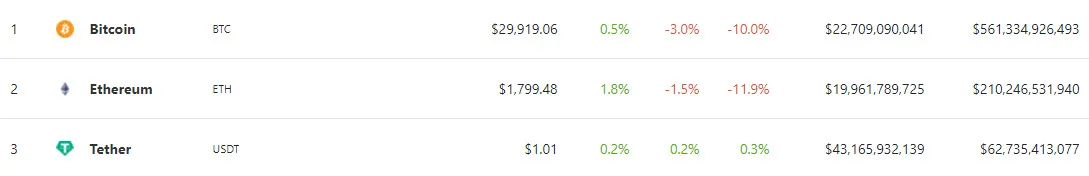

If you start to take a look at volumes and velocity of stable coins over crypto currency coins such as bitcoin we can see a clear trend happening right now. More money is being funneled and used in stable coins over Bitcoin and Ethereum to change hands.

Just Tether alone is crushing the two top cryptos in terms for volume in the last 24 hours and this trend doesn't seem to be slowing.

Combining Bitcoin and Ethereum 24 hour volume is $42,670,879,766

Tether by itself $43,165,932,139

Fueled By DeFi and Interest

Stablecoins offer a lower risk as they should hold their $1 value. When you start throwing around massive interest rates like 10%+ into a stable coin what you get is a massive demand from it and a flood of new money coming into these stable coins.

Why would someone for example keep their money in a transitional bank that fees you and offers you a slap in the face interest rate of 0.5% when you could take that same money and put it into a stable coin and collect interest on it of 10% or more likely putting it into coinbase and earning 4% APY what most people are use to for a savings account. Plus coinbase is highly trusted now that it's gone public. That's 8x earnings with very little risk.

The Shift

This is why the FED is currently in a panic. Floods of money is being moved out of their centralized trackable system into a non trackable system that's unregulated. This shift if it goes on for long enough will see floods of money enter cryptocurrency but instead of traditional cryptos like Bitcoin, Ethereum it's instead being injected into stablecoins.

This could prove to be an issue for cryptos like Bitcoin and Ethereum in the short term but long term it very well could mean that there are stacks of money ready to be quickly traded in and out of these currencies. It's going to be interesting to see what happens over the next few months. Will these interest rates stay at these crazy high levels or quickly tapper off? Or will they end up sucking all of the funds out of bitcoin, ethereum etc into these stable coins and stablecoins will become the main platform of choice over these other crypto assets? It could be actually killing the dreams and vision of Bitcoin, Ethereum etc.