So, before the crypto markets, there existed something called the stock market... a weird beast, I have had some experience with it before and it is quite primitive compared to the centralised and decentralised crypto markets that we are ordinarily used to. Of course, being a pragmatic person, I don't like to have everything in a single basket, and so I have had some exposure to stocks and have rebalanced some crypto money towards the old fashioned stuff as well. Sure, I'm hopeful for the decentralised sphere of things... but even if the experiment is successful, there will still always be stocks in companies... even if they are traded on decentralised infrastructure.

... and honestly, I can't wait for that decentralised and truly digital infrastructure to come into being. Interacting with the traditional stock market is an exercise in frustration and amazement about the sheer primitiveness of the entire system!

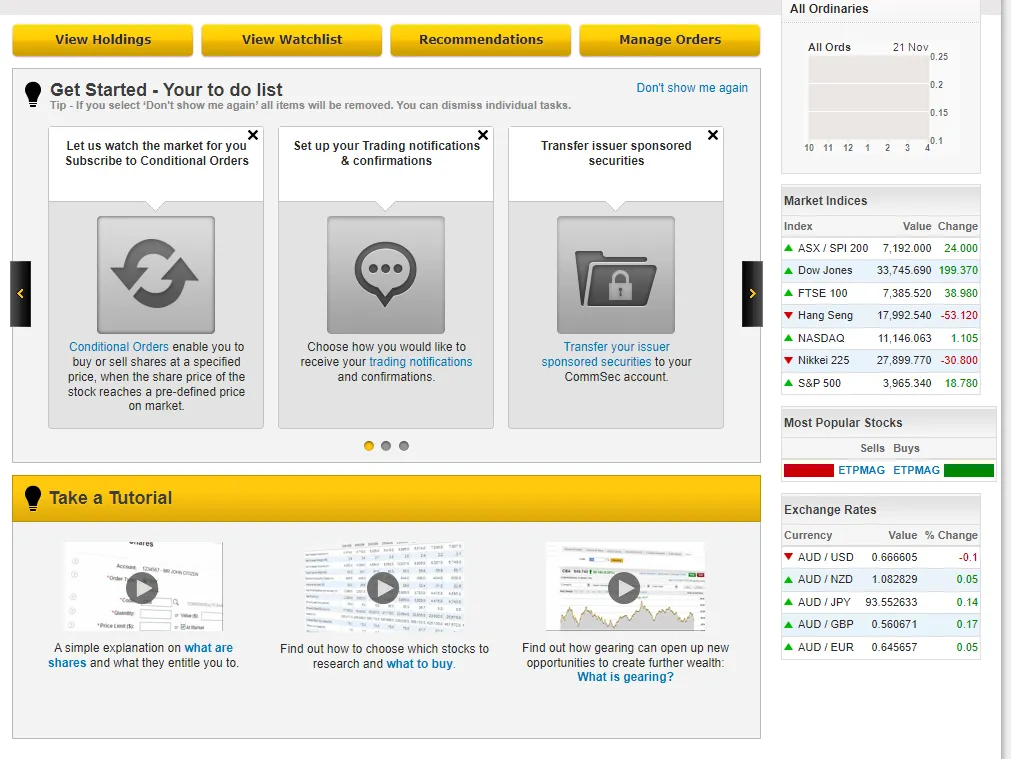

So, to begin with... you can't interact directly with the stock market as a small retail investor... you need to have a broker that interacts with it on your behalf, someone to bundle your orders and then pass it on... for a fee.

The minimum purchase is 500 AUD which is okay, but it does really preclude those who might not even have that much to play around with. And keep in mind that that is the minimum purchase for each stock! And the settlement time is 3 days! Seriously... not an instant trade at all... despite the fact that the digital interface looks like it is done instantaneously! In those 3 days... well, a lot of shenanigans could be happening... and does happen.

Then there is the opening hours... seriously... weekdays only, from 1000-1600! Sigh... sure the crypto markets are a real wild-west, but there is REAL digital infrastructure there with instant settlement. Well, as long as you are avoiding those dodgy black-book centralised exchanges!

Anyway, gripes to one side... and back on topic. A few years ago, I had made some long bets on some Lithium exploration companies... and it turns out that two of them had managed to pay out quite well! So, good fortune and a tiny bit strategic positioning... and I figured it was a good time to take some of that good fortune and rotate it back into other things to try and keep the ball rolling. I ended up selling off about 25 percent of the Lithium stocks, which left me enough to seed back into other long shots and some stable blue chip type stocks. Again... very boring sorts of investment strategies... take profit, seed back into long shots whilst keeping some dry for later and some into blue chips. Sort of what I try to do with crypto as well... but there, everything is a hell of a lot unclearer!

So, for the long shots, I invested in two hydrogen startups that had survived the initial hype season for hydrogen projects in Australia. Sure, I think that electric cars and batteries are really a good thing... and I had reflected that in investing in Lithium exploration... but unless there is a real battery technology breakthrough, I think that smaller batteries backed by hydrogen fuel cells is the way to go for geographically larger countries like Australia, plus the energy is stored in an exportable form. So, a little bit of a bet on the future there...

Meanwhile, a large mining company that I am quite fond of the social and future vision of... well, I put something there. And a large tech company that also has similar goals and ideals as well. So, two medium risk investments... again with a sort of future focus, but they are also currently both firmly grounded in their core business.

Finally, I was a bit humming and hawing about two more things... Australia has a bit of a supermarket duopoly that has also branched out into various things like petrol and a good chunk of retail fronts as well. I figure that food distribution and basic consumables on a mass/city scale are always going be in demand... and I figure that the largest scale of disruption would be from an off-shore competitor that is large enough to wipe out the two big chains. However, Australia does have a pretty strong (sometimes...) national interest test that has protected many local companies in the past by restricting overseas competitors. And if there were any sector that would attract a huge outcry... well, I figure it would be the food distribution network where it touches the consumer. So... these are weird but interesting bets that the food distribution network will remain in Australian hands under the current duopoly.

So... who knows whether any of this will pay off? I'm not an investment guru by any means... but I just follow my own interests and gut feeling... no real "investment" analysis. I think that the next time, I will purchase something that is a general ASX exposure.... on the other hand, perhaps large blue-chip mining stocks will be interesting again.... or maybe banks/real-estate?

I can also be found cross-posting at:

Hive

Steem

Publish0x

Handy Crypto Tools

Ledger Nano S/X: Keep your crypto safe and offline with the leading hardware wallet provider. Not your keys, not your crypto!

Binance: My first choice of centralised exchange, featuring a wide variety of crypto and savings products.

GMX.io: Decentralised perpetual futures trading on Arbitrum!

Coinbase: If you need a regulated and safe environment to trade, this is the first exchange for most newcomers!

Crypto.com: Mixed feelings, but they have the BEST looking VISA debit card in existence! Seriously, it is beautiful!

CoinList: Access to early investor and crowdsale of vetted and reserached projects.

Cointracking: Automated or manual tracking of crypto for accounting and taxation reports.

Account banner by jimramones