Today on the Synthetix (SNX) Discord there was a long awaited announcement of a retrospective airdrop of the THALES token for SNX stakers. This has been quite some time in the making as Synthetix has started spinning out projects and platforms so that the core Synthentix platform stays as crypto-collateralised synthetic issuing platform. The plan is to spin out all the other parts that have been built out around the core (like binary options and trading) so that the various teams can concentrate on their own products.

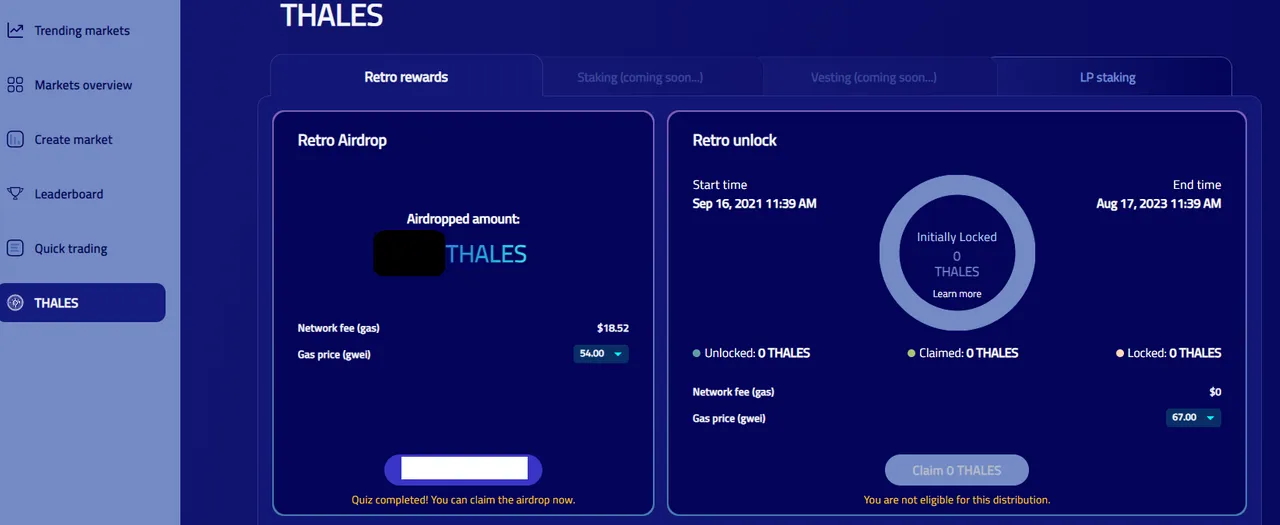

So, this appears to have been a long-running plan, and it is something that has been made known to the SNX community for a while in the Discord. It was also made clear that SNX stakers would also have some sort of stake in the new platforms through a retrospective airdrop of the platform tokens due to the linked nature when the decision was made. Of course, it is always a long time between annoucement and eventual airdrop... and the implementation. Today, we are at the airdrop stage for SNX stakers... and from the dashboard, the implementation will still be coming in the future.

No problem for me, as I have used Synthetix as a place to stake and park my SNX. I've been doing this for quite some time on the Ethereum mainnet, but then lost track of the project when it was impossible to justify the weekly claim of SNX rewards (eth gas prices...). However, I rejoined when Synthetix was one of the first (the first?) dApp to launch on Optimistic Ethereum. I immediately bit the bullet and moved over to the L2 staking program where I could again be an active member of the protocol. It didn't hurt that the Synthetix team had thought things through and removed the vesting lock on all of our tokens in order to help us cover the unstaking and bridging costs!

... speaking of which, when Optimistic Ethereum announced that the subsidy period for the L2 was finished, Synthetix dropped all L2 SNX stakers enough ETH to keep going for a few more weeks of claiming rewards and readjusting our collateralisation percentages. Honestly, I have to say that I am pretty impressed with this team (doesn't hurt that they are Australian either!).

...plus, this isn't the only benefit that being a SNX staker has had. A nice Illuvium (ILV) drop a while back was a very nice surprise!

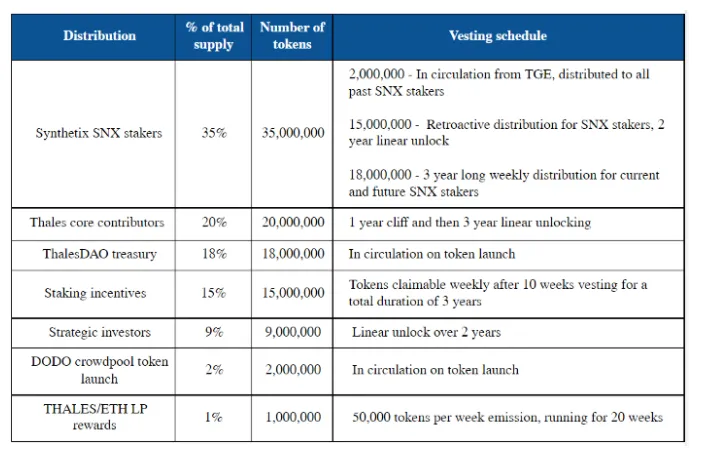

Anyway, back to the point. To claim the airdrop, you need to have been staking SNX on either L1 Ethereum Mainnet or L2 Optimistic Ethereum. The exact details are here:

https://thalesmarket.medium.com/thales-tokenomics-introducing-thales-token-3aab321174e7

As far as I could see, I don't think that there was any decay time on the airdrop... but I have to say that I didn't really read it that carefully as I was planning to claim this as soon as possible. Other retrospective airdrops have sometimes included a decay period after which the unclaimed tokens would be folded back into other uses.

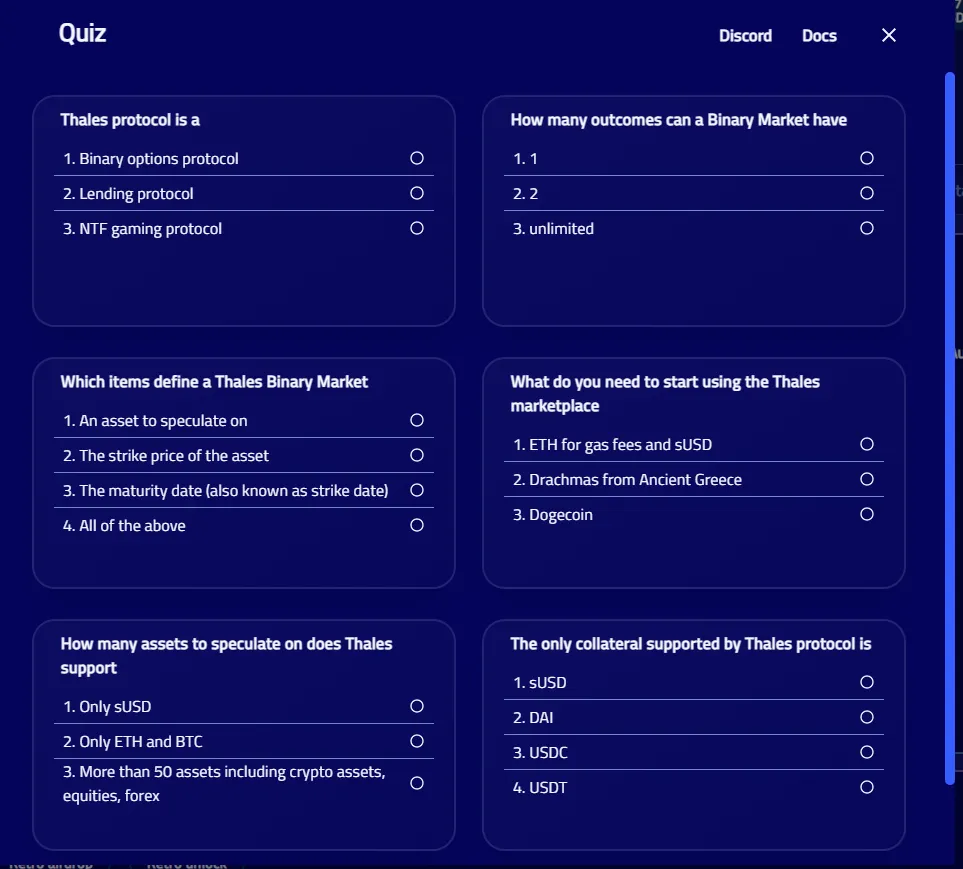

There is a little quiz that needs to be completed before you can proceed to interact with the smart contract... although, it is possible that you could go around this by directly interacting with the contract. That said, it isn't too difficult... if you have a basic knowledge of binary options and how the Synthetix system works then it should be pretty straight-forward! And people who invest in funny internet magic money ALWAYS know what the tokens and projects do... right?

It is likely that I will not be using too much of the THALES platform. I'm not really a big active DeFi person, so when the staking section becomes available, I will just stake my THALES tokens and leave them there to surprise me in the future...

As you can see from the distribution table above, a good chunk of the distribution will be going towards the stakers of the parent SNX token. From memory, this was one of the critical points... for both the founders and the existing stakers of the SNX tokens, as the projects got spun out into semi-independent platforms, that they retained some sort of linkage back to the original community and platform.

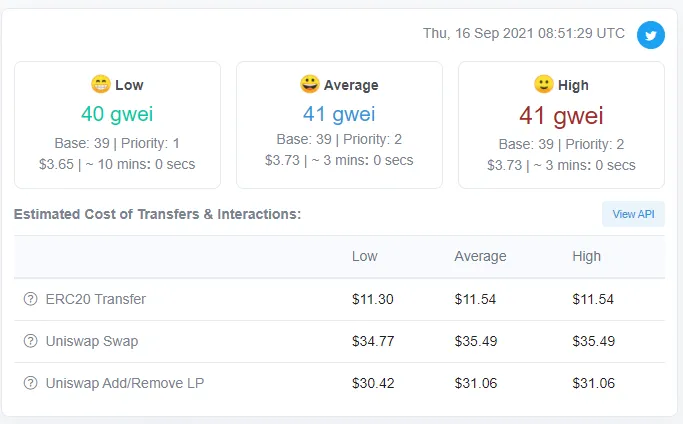

So... I noticed that the NFT craze has died down a little bit. Much less in the way of 10k mints and all of that sort of buzz... still, OpenSea is still leading the leaderboard in gas guzzlers (I will write about that tomorrow..). This makes for much more tolerable gas prices and transaction costs... it has been a while since I have seen 40 gwei... so I figured I may as well send this transaction on its merry way. I did see previous days had the occasional 20-30 gwei range... but it is a minor quibble and I don't want to have an awkward hanging transaction. That said, I don't have anything else pressing to do on Ethereum... so leaving it hanging for a week or two wouldn't kill me... unless it started to become a month!

I can also be found cross-posting at:

Hive

Steem

Publish0x

Handy Crypto Tools

Ledger Nano S/X: Keep your crypto safe and offline with the leading hardware wallet provider. Not your keys, not your crypto!

Binance: My first choice of centralised exchange, featuring a wide variety of crypto and savings products.

Kucoin: My second choice in exchanges, many tokens listed here that you can't get on Binance!

FTX: Regulated US-based exchange with some pretty interesting and useful discounts on trading and withdrawal fees for FTT holders. Decent fiat on-ramp as well!

MXC: Listings of lots of interesting tokens that are usually only available on DEXs. Avoid high gas prices!

Coinbase: If you need a regulated and safe environment to trade, this is the first exchange for most newcomers!

Crypto.com: Mixed feelings, but they have the BEST looking VISA debit card in existence! Seriously, it is beautiful!

CoinList: Access to early investor and crowdsale of vetted and reserached projects.

Cointracking: Automated or manual tracking of crypto for accounting and taxation reports.

Stoic: A USD maximisation bot trading on Binance using long-term long strategies, powered by the AI/human system of Cindicator.

StakeDAO: Decentralised pooled staking of PoS assets.

Account banner by jimramones