FEI-TRIBE is a project that I've been interested in for a little while. It is a stablecoin that is native to cryptocurrencies and uses a direct burn incentive on DEXs to attempt to maintain a peg. So, in a nutshell, a DeFi based stablecoin (FEI) that uses DEX trading and a burn incentive to keep trading within a narrow range. If you are interested in the exact details, you can read them here: https://fei.money/

Why another stablecoin you might ask? Well, the existing stablecoins fall under two broad brackets, fiat backed stablecoins and crypto-collateralised stablecoins, both of which have their underlying structural problems.

Fiat backed stable-coins (like USDT and USDC) are a bridge to the banking system from the crypto world. Unfortunately, they rely on third party trust (in the issuers of the tokens) that the coins ARE actually backed and redeemable on a 1:1 basis for USD or equivalents (and the equivalents is a critical part of that!). It is next to impossible to get a transparent audit of the banking accounts, as that would ALSO require third party trust in the auditor and the banks that are holding the accounts. So, basically breaking with one of the cardinal pillars of cryptocurrencies, which is trustless networks (no third party trust required for transactions)....and things are okay, until they AREN'T okay!

It also introduces weakness at the bank system interface, as these accounts can (and have) been shut down and moved at times. More to the point, if some cryptocurrencies are aiming to be a different form of currency... well, it makes no sense to back it with fiat in the long term!

So, crypto-collateralised stablecoins (like DAI) would seem to be the better option. However, that is incredibly capital inefficient, as you need to often overcollateralise in order to take a loan in the stablecoins (on the order of 500-700%). Plus, it leaves your collateral at risk and locked up over the duration of the loan... and flash price movements can get your collateral liquidated over night (see March 2020 for examples). These are rare but disastrous events... mostly, the big problem is the capital inefficiency.

So, FEI aims to rectify this by burning (and minting?) tokens with each transaction on a DEX (like Uniswap) to maintain the peg. So, if it is off peg, transactions are "taxed" with an additional token burn... so, users need to keep an eye on this additional burn as it can be quite severe if the peg is really off!

This only happens on participating DEXs, every other transaction is NOT affected (nor CEXs). However, it does have a cascading effect to pull other transactions on CEXs in line with the peg via arbitrage.

So, the initial sale event is seemingly a pleasant affair on the Ethereum network. After the recent debacle of the Coinlist sales (I have been a loyal user of Coinlist, but the recent Casper sale was pretty horrific!), the FEI-TRIBE launch seems positively relaxed!

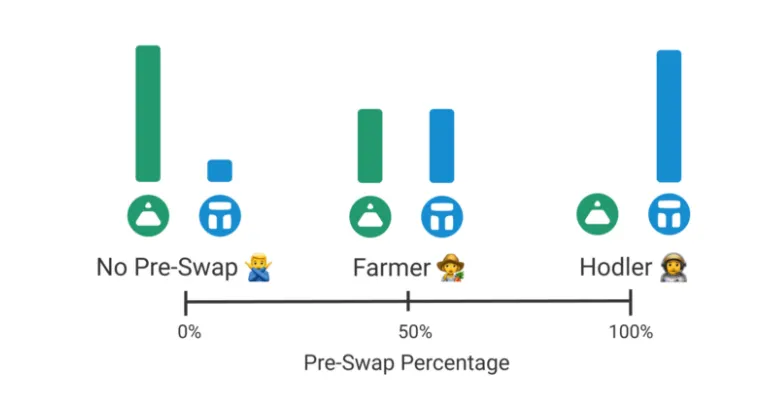

You commit ETH over the three day launch window, which is pooled and converted to the FEI stablecoin when the token goes live. Due to the way FEI works, the maximum that you will pay for FEI will be capped at 1.01 USD. You have three options for what happens at the genesis block... either 100% FEI, 50/50 FEI-TRIBE or fully into the governance TRIBE token. This FEI->TRIBE swap is done BEFORE the liquidity pool goes live, saving on stress and gas fees.

Each has its benefits according to the graphics above, and as it is a pre-swap included on the genesis block, there is no crazy rush for transactions on the initial liquidity pool like most on-chain IDOs.

In the end, I'm more interested in the project rather than the actual use of the stablecoin, and I have no real interest in farming either. So, I will likely go with the 100% conversion to TRIBE... this is the option that backs the project over the long-term. Much more interesting to me!

Meanwhile.... tonight, I will try for the next Coinlist offering, a discount sale on Rally (RLY). Hopefully less of a poop show than the previous week... but I'm not hopeful!

Handy Crypto Tools

Ledger Nano S/X: Keep your crypto safe and offline with the leading hardware wallet provider. Not your keys, not your crypto!

Binance: My first choice of centralised exchange, featuring a wide variety of crypto and savings products.

Kucoin: My second choice in exchanges, many tokens listed here that you can't get on Binance!

Coinbase: If you need a regulated and safe environment to trade, this is the first exchange for most newcomers!

Crypto.com: Mixed feelings, but they have the BEST looking VISA debit card in existence! Seriously, it is beautiful!

CoinList: Access to early investor and crowdsale of vetted and reserached projects.

Cointracking: Automated or manual tracking of crypto for accounting and taxation reports.

Account banner by jimramones