When we are Liquidity Providers on a DEX we often find ourselves in an impermanent loss position which might be scary and trigger unexpected exits with a loss if we panic. The Impermanent Loss occurs when one of your assets appreciates or depreciates relative to the other asset, it opens up an arbitrary opportunity for others to profit from because they are incentivized to equal the pools. And to counter these effects, ThorChain came up with an innovative way to keep investors at peace while the market moves in one direction and the other - Impermanent Loss Protection.

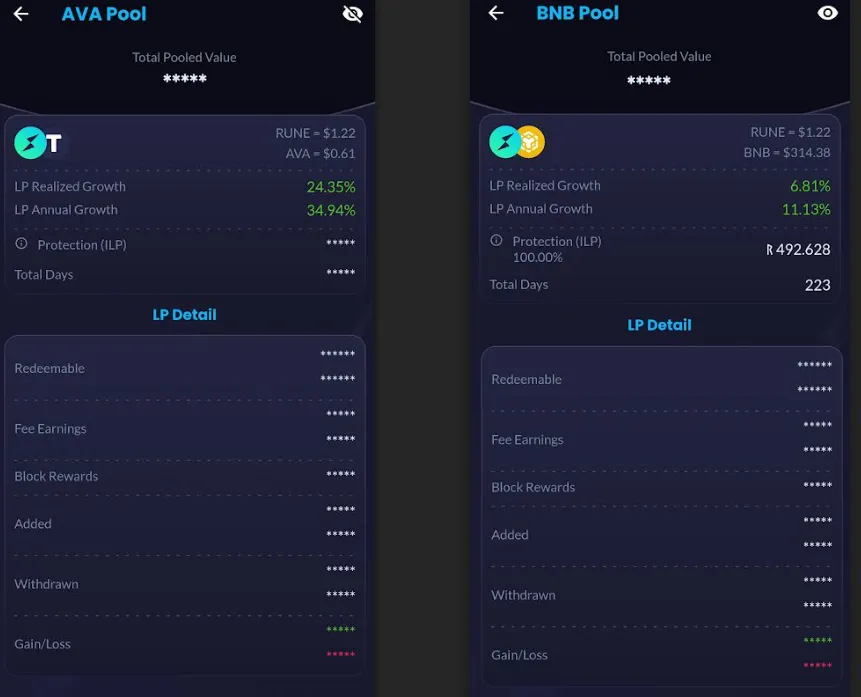

I am a Liquidity provider on ThorChain and am currently involved in two pools: RUNE:AVA and RUNE:BNB. As the entire market deflated most of the crypto assets went down in value, but there are some exceptions from that and one of them is represented by BNB.

- In the first pool RUNE:AVA as both assets went down the report of provided assets remained quite the same and I could reap the rewards from block rewards and fee earnings and which provides me an LP Realized Growth of 24.35% and an LP Annual Growth of 34.94%.

- On the second pool RUNE:BNB, the BNB evolved positively or rather stood stronger while RUNE plummeted alongside the other cryptos, so even if I am entitled to the rewards from block rewards and fee earnings, I would still be on the negative side on a return. But with the Impermanent Loss Protection which kicks in fully (100%) after 100 days while being a Liquidity Provider, I could reverse that to a positive gain which means an LP Realized Growth of 6.81% and an LP Annual Growth of 11.13%.

This shows that Impermanent Loss Protection from ThorChain is simply a lifesaver and motivates long-term Liquidity Providers by ensuring that while they provide liquidity in the end the worse case that can happen is as if they would just HODL their assets. If only all DeFi will have a mechanism like this I believe that it would strengthen the trust of investors participating in it and boost this entire industry.

The math behind the Impermanent Loss Protection (ILP) is pretty simple and Liquidity Providers will receive linear IL protection over the course of 100 days. Essentially this translates into the fact that you are receiving an additional 1% protection for every day that you provide liquidity.

- 15 days provided = 15% IL protection

- 75 days provided = 75% IL protection

- 100 days provided = 100% IL protection.

As can be seen above, after 100 days+, your pool will be fully protected until you withdraw from it which simply puts your mind at ease and ensures that you will be waking up on the right side of things, whether the market goes up, or down or assets get unbalanced. I am not taking it easy to participate in Liquidity Pools due to the Impermanent Loss, but having this protection mechanics makes me trust it more and be involved in ThorChain.