Economic Downturn & Recovery

I know that some of you might say, what downturn? Stock market is still near all-time high! Yeah, that's correct. However, I might request you to get away from your trading terminal and look outside a bit :) Jokes aside. I don't think we never really got out of the financial depression of 2008-09, at least in certain areas. I live in southern Texas, which in terms of job growth and availability of job, is perhaps in the high end in the US in general for the last 10 years. But when I go out there, I still see Malls that are closed for the last 10 years. We are adding more store closure to that number daily and at an exponential rate due to Covid lately. Add to that the oil price depression that started from 2015 and never really recovered. With that backdrop, I was reading an article that talks about the 'recovery' during post-covid times. It polled 600 CEOs from all over the world and lists their expectation of a recovery in a graphical manner, which I like a lot:

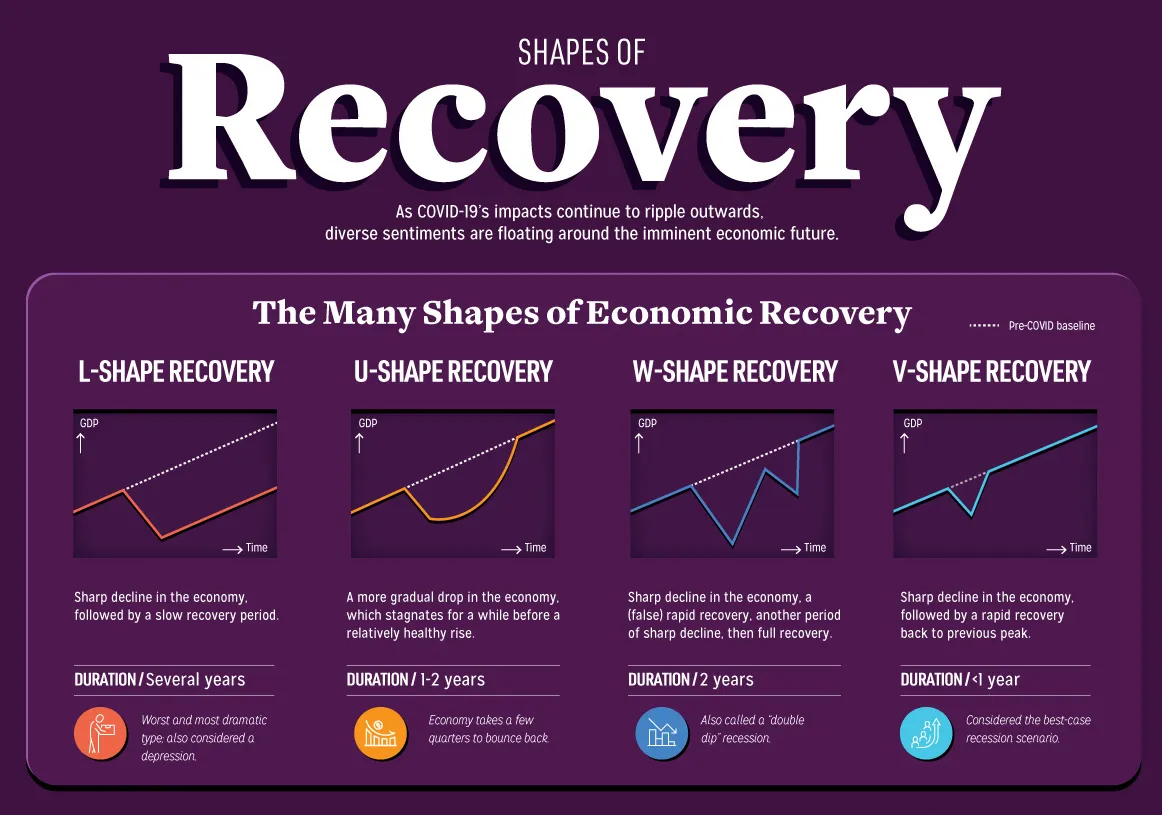

These plots are Time vs. GDP plots. The general assumption is, in a healthy economy the GDP should show a steady linear increase. That is the baseline assumption, shown by the dotted line in each of the four insets above. Therefore, the thought process is that an economic downturn is essentially a departure downwards from that steady up trending line. The 4 sub-types described above is quite revealing:

- L-Shaped: Long-lasting (3-5 years, think great depression or its modern equivalent)

- U-Shaped: Intermediate (1-2 years, or less, normal bear market)

- W-Shaped: Intermediate (2-3 years, a variation of the previous, but with a false start)

- V-Shaped: Short (< 1-year, best case scenario, sharp bounce back)

What is a general expectation?

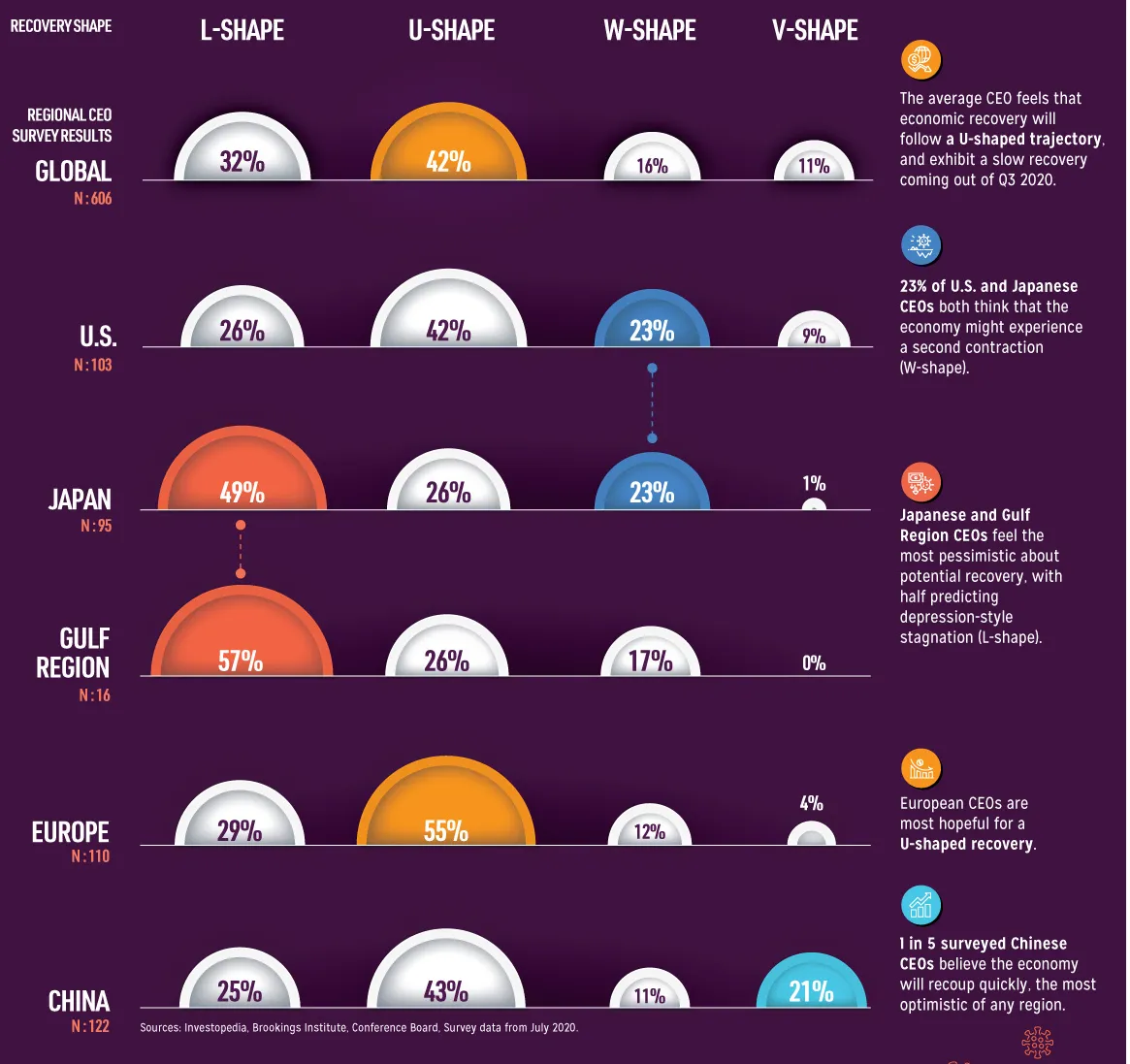

Currently, global average based on a sample of 600 CEOs favors the U-shape recovery (42%), however, L-shape is a close second at (32%). It is important not to pay attention to the exact number, but take learning form the trend in general. From this information, it is obvious, that we are not getting a V-recovery. If we assume Covid related problems become widespread during March 2020. I think it is safe to assume, things are not going back to normal by March 2021, no matter whatever S&P500 tells you (stock market is not the Economy).

Another interesting trend is to look at the spread between different parts of the world in terms of ‘hopefulness’. The data suggests that CEOs from Japan and Middle East are more pessimistic and expect L-shape recovery. While European, American and Chinese CEOs are leaning more towards a U-shape recovery. It is critical to note; statistically almost no one is expecting a V- shape recovery, so we can potentially rule that one out.

Light at the end of the tunnel

I am personally an optimist. I always see light at the end of the tunnel. So, from my personal point of view I see many changes to the workplace that will be permanent:

- Work from home will become norm, as opposed to exception

- Working parents will spend more time with family

- Traffic will be less, global oil demand will be less for an extended period

- Air quality globally will improve

- Commercial Real Estate demand will be less, there will be less construction

- Residential Real Estate prices in vacation area will probably see some support

Obviously there are many negative things that may come out of these changes, but let us focus on the positives for now.