Ya-ay, we're halfway there !

It's Saturday, and we're exactly halfway through 2023. So that means I'm going to torment you all with the obligatory half-year progress review.

If you're not familiar with SaturdaySavers, it's a fabulous initiative run by @shanibeer writing as @sally-saver on the @eddie-earner account, where we all support each other in getting to our savings goals.

Image by Deborah Jackson from Pixabay

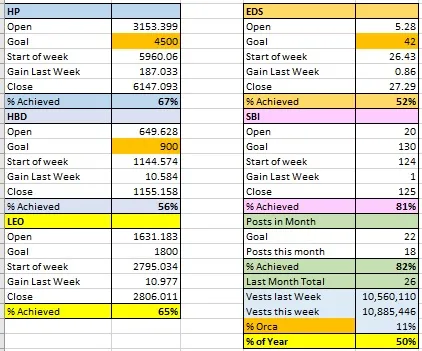

Let's start (as always) with the spreadsheet of last week's progress;

For the first time, I'm actually hitting all my goals.

There's a bit of fudgery here, because I'd recently adjusted the EDS goal down to match the reality of what was happening. But what I am hoping is that the compounding effects will start to kick in and I'll be able to return the goal to it's original value.

HPUD

As well as being Saturday and the middle of the year, it's also HPUD day. I've powered up 150 HIVE, and so far have managed to make HPUD happen every month this year. Makes me feel all warm and fuzzy, like a little bumblebee !

Blocktrades

I was incredibly sad to see that Blocktrades are closing down their exchange, although I fully understand and support their reasons for doing so.

Unfortunately, that was the on-ramp I've been using, converting fiat to LTC in centralised exchanges, then using Blocktrades to convert the LTC to HIVE. By being a bit cunning with how I bought LTC, the fees plus slippage worked out at around £1.60 per £100.

If anyone knows a way of turning GBP into HIVE with fees that come close to that, I'd love to hear about it !

Half Year Crypto Overview

Looking at the cryptoverse generally, it's disappointing that prices continue to basically just bump along at the bottom. Although it's a personal opinion, I don't think it likely prices will drop much further.

What I think I am seeing is that there is a lot of upward pressure on prices, but that they are deliberately kept down by a relentless and highly calculated tide of regular FUD from the SEC, US Government and legacy financial institutions. I'll call it what it is; price manipulation.

I think it's political and about killing a competitor to the incoming CBDC's. As we just saw here in the UK, with the closure of Nigel Farage's bank accounts and refusal of all banks to provide him any banking services (which, no matter what you think of his politics, is a worrying development), and a little while ago in Canada with the closure of accounts and confiscation of assets, the banks are becoming increasingly used as a tool to delete opponents of the establishment.

Luckily, HIVE, Monero and similar genuinely decentralised crypto's are best placed to resist this, even if their prices get dragged around with the others.

Half Year Winners and Losers

I'm going to pick just a couple of winners and losers in crypto so far in 2023. I'll do lesers first, just so I can end this post on a positive note. It's all totally just my own opinion, of course !

Losers

A Lot of Tribe Tokens - sadly, a lot of Tribe tokens seem to be on a downward slide towards zero prices. This includes even popular ones with large followings like POB, LOLZ, SCRIBE and PIZZA. To a certain extent, I think it's a natural evolution; not every project can succeed. With so many tokens out there, I feel there are too many which are just filling the same niches. What I'd love to see (although I have no idea how it could be done on a technical level) is for tribe tokens filling the same niches with very similar use cases to be able to merge, enabling larger teams of devs and mods, and hopefully hitting the critical mass of users needed to keep them growing.

Algorand - yeah, this is definitely my biggest crypto mistake, and a good object lesson in ineffective DYOR. I invested in it when it was touted as a to invest and get a return through staking rewards. They claimed to be decentralised. Then they changed the rules unilaterally, creating a governance programme that was just a rubber-stamp for a totally centralised business. the process to register as a governor is Byzantine, and you get to vote on the same 3 questions each quarter over and over until they get the answer they wanted. In the meantime, they took away most of the staking rewards. No wonder the price has dropped from an ATH of around £1.66 to today's price of £0.09.

Winners

HBD - without a doubt, HBD is one of the very few places indeed where you can put savings and get a rate of return that keeps up with inflation. Although no investment is 100% safe, my view is that HBD is a lot less risky than many of the centralised DeFi options out there, and is just as safe or safer than savings held in legacy banks.

LEO - just look at that price go !! LeoFinance have made huge strides so far this year in creating new functions that fill gaps in Web3's ability to deliver a decentralised version of monopoly-owned Web2 tools. The price is finally starting to reflect this, although I reckon it is still massively under-valued. What I'd like to see is for Hive as a whole, and LeoFinance especially, to find ways to really get mass adoption by "ordinary" internet citizens. We're still an absolutely tiny fish compared to big monsters like Twitter and Reddit.

Hive - although the price of HIVE itself has been dragged down by all the FUD, the Hive ecosystem continues to be awesome and develop at an astonishing rate. I feel like I'm starting to make actual friends here, rather than it being just anonymous internet-people I happen to bump into every so often. Most of all, I love how non-toxic Hive is compared to legacy social media :)

Okay, I think I've written enough for now..... I've run out of steam, time for more coffee ! I hope you all have wonderful weeks, and look forward to seeing everyone's posts same time, same place next week :)