Be it the stock, commodity, interest, crypto or exchange markets, they all have one thing in common: cycles, which are nothing more than the relationship of the collective psyche to greed and fear. In other words, the behavior and emotions of agents that are part of the market and drive prices.

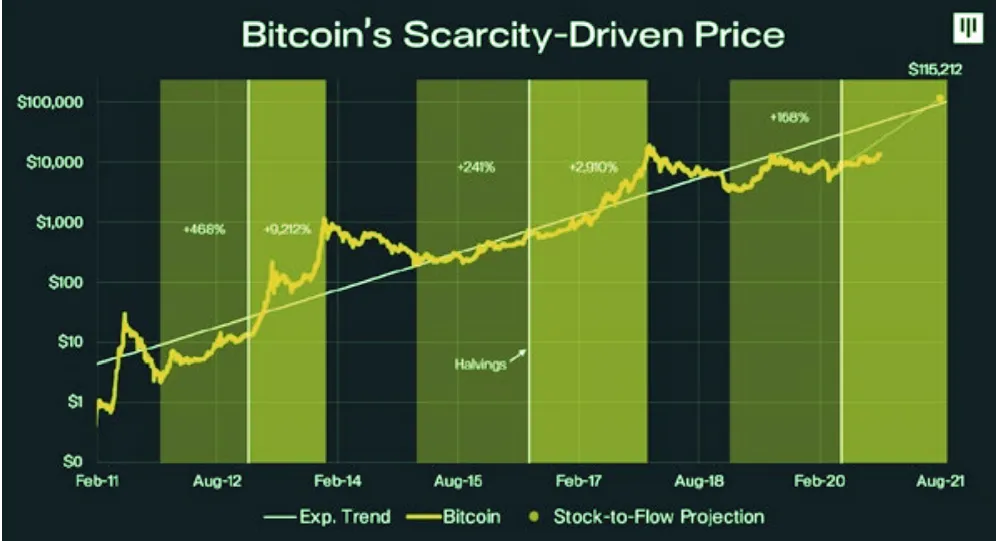

In the crypto market we can use as an example the cycle that ended in 2018, when Bitcoin reached its peak $20k, a cycle that ended after clear signs of investors' irrationality. In the case of the American stock market, we can highlight the cycle between the years 2000 and 2008, which culminated with the bursting of the bubble the collapse of the market real estate and subprime mortgages.

The cycles cause unsubstantiated projects and unprepared investors to leave the market, consolidating projects with real value and also giving space for new and better projects, allowing new money to enter.

The exact duration and amplitude of these cycles are difficult to predict. However, we know that markets do not remain high forever or fall indefinitely to zero.

Among distortions, volatilities, fear and greed, one thing is certain, the market tends at some point to return to fundamentals.

Seeking to understand the dynamics of market cycles is fundamental to our survival and success as an investor.

Although not a guarantee of profit, being aware of which cycle we are in, is a guide that will help us to increase considerably

the probabilities of correctness when taking a position, be it buyer or seller.

Although history does not necessarily repeat itself, it mirrors the standard human behavior which makes certain

movements are replicated, giving rise to the cycles that we will see below.

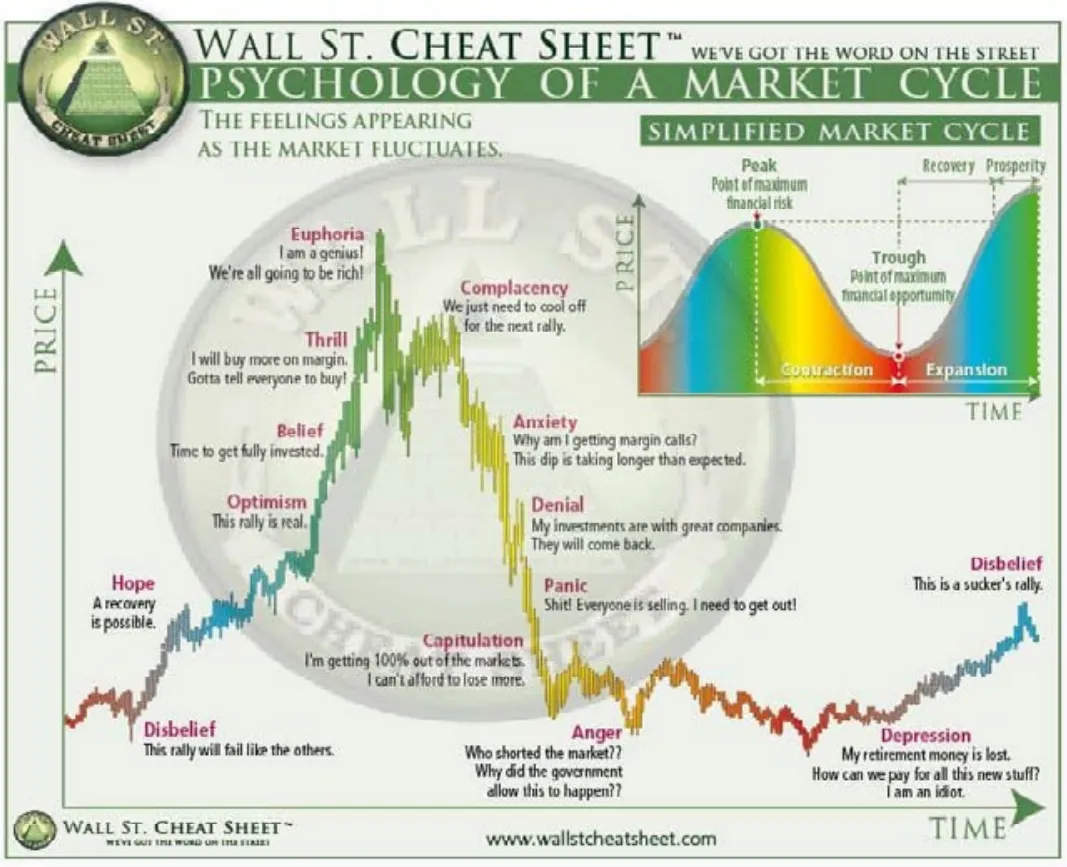

Karen Bennett created a chart that shows the psychology of market cycles. It describes the most common emotions that people experience as prices fluctuate.

Not every market cycle will follow this exact graph and the exact time it takes. Some cycles can take months, others years. At the

However, it can provide some valuable insights into the psychology of market cycles.

REPAIR HOW HUMAN EMOTIONS DRIVE MARKET CYCLES AND HOW IT IS POSSIBLE TO IDENTIFY SIMILARITIES WITH THE BITCOIN MARKET CYCLE IN THE LAST BULL MARKET.

Let's understand more about some of the stages of the market cycle by looking at 13 possible stages.

STAGE 1: DISCRETION

This is the first stage after a market's total decline. The asset finds no interest from the mainstream and is totally off the radar of the majority. It happens after the market has experienced a sharp drop.

STAGE 2: HOPE

This is the first sign of recovery in the market, which has been showing positive signs and is beginning to show greater volume. However, investors are still lacking the courage to enter. This is where an accumulation movement can take place, with smart money beginning to build a position by identifying an advantageous risk/return relationship, preparing to ride a possible wave of appreciation.

STAGE 3: OPTIMISM

Here, the market has already seen an upward trend for a few weeks and a stronger impact. This positive outlook makes investors more comfortable to enter, which gradually attracts new capital and gives the first signs that we may be heading towards a bull market.

STAGE 4: BELIEF

Here the signs of a bullish market are starting to become more evident and beginning investors are beginning to show excitement about the possibility of making a lot of money. Indicators point upwards and the upward trend is gaining more and more momentum (term applied in physics that refers to continuity or momentum).

STAGE 5: ADRENALINE

Here the emotion already speaks louder and especially the beginners are easily led to act on impulse, often entering any random altcoin just because it is rising, underestimating the market and thinking that nothing can go wrong. In the media, the news is also mostly positive and the price on the chart shows a parabolic and directional movement.

At this stage, almost everyone begins to think they are real geniuses, because at any time a purchase is made, profit is obtained, as the price practically only goes up.

STAGE 6: EUPHORIA

Here emotions have taken over and most are now "sure to be a genius". Irrationality takes over, but some are already beginning to question whether the bullish movement actually goes further. Indicators show exhaustion and price differences, but are often ignored and give rise to euphoria, which practically defines the end of the valuation cycle.

Experienced investors already understand that perhaps the movement may be coming to an end and begin to realize profits, selling to those who entered the market late and not sure what they were doing. The media makes articles, articles and promotes people who have become the new millionaires and whoever is out there wants to enter the market thinking they will still be able to enjoy something.

It seems that nothing can go wrong. But at any moment someone can take the "ladder" and the prices that just went up, without meeting any resistance, can now collapse without finding any strong support.

STAGE 7: COMPLIANCE

At this stage, the first signs of trend reversal begin to appear and those who entered the top begin to regret it and some believe that it is just a pause, a breath, until the price resumes its upward trend. However, the truth is that from now on those who have positioned themselves badly will feel the price going against their positions.

STAGE 8: ANXIETY

Finally, people realize that the bull market cannot last forever. They see that the market is reversing and moments of tension begin to form. At this point there is the realization that at some point prices may fall. A bear market may be starting here

STAGE 9: DENIAL

Even with clear signs of falling, many investors refuse to sell, in the hope that prices will rise again. Investors act defensively, as they are convinced that they invested their money wisely and seek information that strengthens their opinion. The famous confirmation bias.

STAGE 10: PANIC

The bear market is already established and those who have not yet sold end up falling in reality, selling desperately (bitterly suffering large losses), trying to save some of the money invested. We often see a big sale. If greed (FOMO) is what drives majority decisions in the euphoria stage, here fear (FUD) predominates.

STAGE 11: CHAPTER

At this stage, the investor begins to accept the loss and leave the market, because he can no longer see his capital melting.

People lose all hope and their belief that the market can be profitable.

STAGE 12: ANGER

The market is at its lowest point and people who have done all the losses start to suffer losses trying to understand why the market has collapsed.

While this investor is reflecting and lamenting, this is where stabilization and consolidation begin to be built again.

STAGE 13: DEPRESSION

Here they have already lost all hope in the markets. In extreme cases, assets are destroyed due to greed, lack of knowledge and care for their own capital. Because they have been seriously injured, many never return to the market believing it is a casino.

Meanwhile, it is also here that the most experienced investors analyze fundamentals and the price of assets, in order to identify new entries. Here is the point at which the market begins a new process of accumulation. The depression stage can last for a long time.

WHERE ARE WE IN BTC'S CURRENT MARKET CYCLE?

It is difficult to affirm and point out the exact beginning and end of the cycles, nobody knows for sure. It is only possible to have an estimate. Apparently, we may be in a stage of optimism, with prices in an upward trend and more and more new capital.

The market is highly complex and, instead of looking for ready and simple answers, we need to analyze and learn lessons from previous cycles, thus preparing ourselves to be well positioned for the next stages.

HOW TO PERFORM WELL DURING MARKET CYCLES

Who has more experience in the market has gone through many moments of joy / stress, this helps to better identify the types of movement and their nuances.

Seek to train the following skills to be able to take better advantage of market cycles:

- Always manage risks. Success cannot happen without it;

- Learn to make partial profits during a parabolic movement;

- Make an effort to analyze the possible scenarios and the probabilities;

- Eliminate or try to control emotions as much as possible as they can make your worst enemy;

- Look for positive and negative catalysts that can trigger a new phase;

- Have patience and think about probabilities, seeking to find moments and opportunities that offer a good risk / return ratio;

- Be active and disciplined, try to be guided by well-defined strategies and fundamentals;

- If you went through the 2017 bullrun and survived, we're sure you've learned a lot;

These experiences are what make us evolve and we become more consistent investors. Do your own analysis, your own research (DYOR), try to identify which cycle we are in and position yourself wisely to make the most of the movement. And remember: