Continuing the analysis on DeFi projects, today we bring one that has been gaining prominence and that has presented interesting innovations for the ecosystem.

The protocol is called Aave and is one of the most successful in this new market.

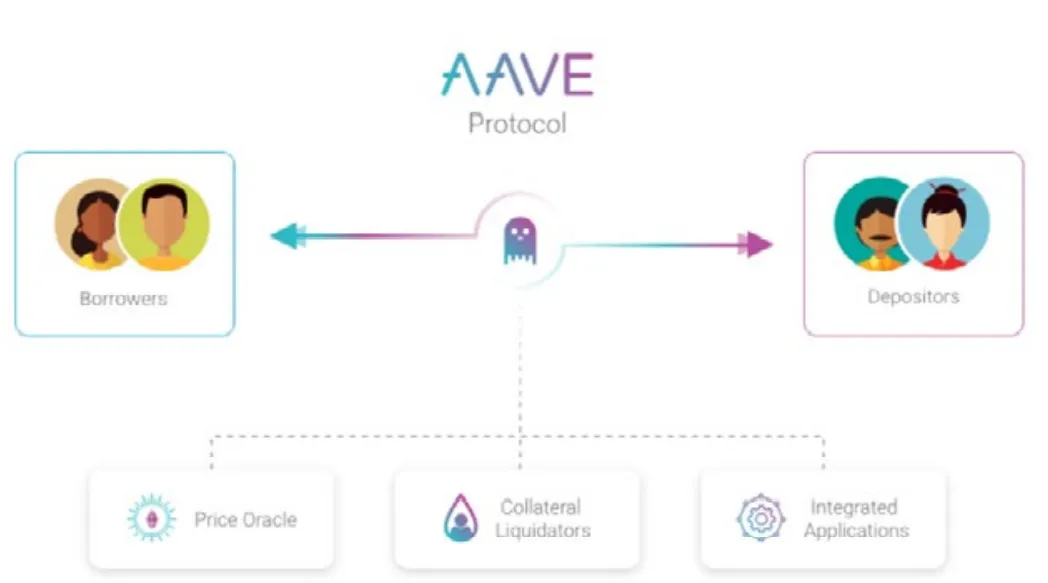

It proposes to bring investors closer to borrowers in a decentralized, open, transparent and unauthorized financial market format and also brings an exclusive innovation, flash loans.

Before delving into the protocol, let's look beyond price and reinforce the fundamentals that are driving this sector to grow.

Have you ever wondered how curious it is that a few individuals, gathered in a room and drinking coffee, have the power to decide on very important things that have a direct impact on the lives of many people?

Yes, they decide on interest rates, how much money will circulate in the economy, etc. This does not appear to be sustainable and was, among other things, what gave rise to alternatives such as Bitcoin and decentralized finance protocols.

When DeFi arrives with the proposal to allow the financial sector to be used and influenced by everyone, then we have a change in the route of how the financial market works and the beginning of a major change. That said, let's go to the details of Aave.

Aave is a lending and borrowing platform, that is, used to lend money and borrow. It is based on Ethereum, has open source and users can access a wide variety of digital assets, from stablecoins to altcoins.

Depositors provide liquidity to the market to obtain passive income while borrowers can acquire loans, with parameters such as interest rate, loan amount and term, specified and executed autonomously, through smart contracts.

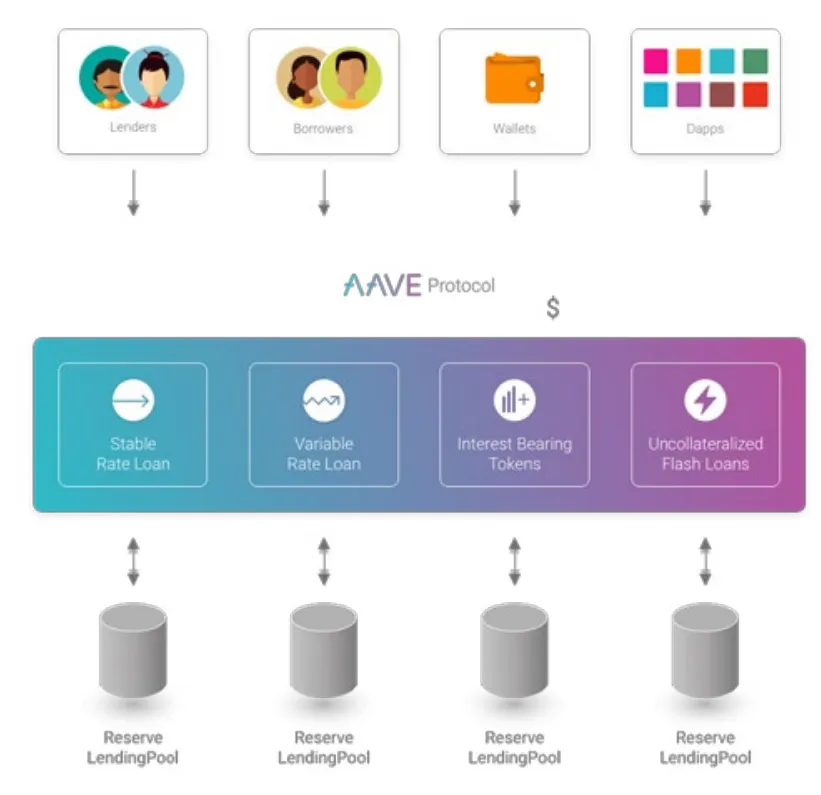

Aave brings two innovations to the credit ecosystem.

- Stable rates to assist borrowers' financial planning.

- Flash Loans, which are quick and unsecured loans, made during a single transaction.

The dynamics of granting and taking credit is an important mechanism existing in the economy and that allows people to receive interest on idle capital and the possibility of leverage to borrowers. When you have platforms like Aave, which allow this to happen in a decentralized way, then more people can have access and choose the form that has the most advantage in terms of fee and security.

The platform creates an alternative mechanism to the traditional financial market, joining a growing list of projects like Compound, which bring decentralized financial tools to the masses.

Depositors provide liquidity by depositing cryptocurrencies in loan pools that will allow them to earn interest. In the meantime, borrowers can obtain loans using these pools in an over-collateralized or sub-collateralized way. Loans do not have to be combined individually, that is, a lender to a borrower. Instead, users access this liquidity pool, where deposits and guarantees are.

Although Synthetix is a complex protocol with several mechanisms involving stake, creation and burning of synths and governance with respect to SNX holders and Synthetix users, the basic principles of the protocol are very simple and can be divided into three steps.

Historic

The origins of Aave date back to 2017, when Stani Kulechov and a team of developers launched ETHLend in an ICO (Initial Coin Offering) in November 2017, which raised more than $ 16 million. The idea was to allow users to borrow and lend cryptocurrency loans to each other and, at that time, ETHLend was the first protocol in this segment in DeFi.

Although ETHLend had been relatively successful, the founders saw that they could improve the proposal and in late 2018 launched Aave, with the intention of integrating a wider range of features and features into the platform and offering more services than just loans in Ether.

Aave's goal is to fill the gaps left by centralized fintech industry giants like PayPal, Skrill and Coinbase.

Founder and Team

The platform was founded by Stani Kulechov, an entrepreneur and programmer with extensive experience in mentoring and consulting on various blockchain projects.

Stani Kulechov (CEO) and Jordan Lazaro Gustave (COO) migrated their roles from ETHLend bringing their wealth of knowledge to the Aave. In the team, Aave has 18 professionals with extensive experience in start-ups.

How it works

In essence, Aave allows the creation of liquidity pools, where users deposit the funds they wish to lend and borrowers can access them to make loans. The platform allows you to do this with 20 different cryptocurrencies and also uses Chainlink's oracle service to determine the real-time value of assets.

Borrowers deposit guarantees in order to be able to access the liquidity pool and take loans and must maintain the stipulated guarantee index, which ranges from 50% to 75%. If they don't, their positions may be liquidated.

Creditors receive an aToken linked to the value of 1: 1 with the asset they deposited and begin to receive interest.

Example: A user can deposit guarantees in DAI and borrow in ETH. This allows him to gain exposure to different cryptocurrencies without having them immediately.

The entire process takes place in a decentralized manner, that is, Aave users do not need to trust a particular institution or person to manage funds and transactions.

They just need to trust that the code will run automatically, as written in smart contracts.

A percentage of each of these pools is placed in the reserve, which will assist in times of volatility within the protocol.

Borrowers are obliged to provide more guarantees for their loans and there are various amounts of guarantees required, depending on the asset. If the guarantee ratio is lower than that required by the protocol, the assets are offered for settlement.

A loan can be paid off when there is insufficient collateral.

Interest Rate

The interest rate charged depends on the rate of use of the assets in the pool. If almost all of the assets are being used, the interest rate will be high, to attract liquidity providers to deposit more capital.

Otherwise, if almost no assets in the pool are being used, the interest rate charged will be low to attract loans.

Rate Switching (change of rate):

Another unique feature of Aave is that it allows users to switch between these two rates in real time based on the market trend, to minimize the cost of the loan. Something useful in a volatile market. If a user predicts an increase in interest rates in the protocol, he can change his loan to a fixed rate in order to lock his costs into the future and if he expects rates to decrease, he can re-fluctuate to lower his borrowing costs.

Token and Governance

The Aave protocol is administered by the holders of the ERC-20 LEND token, which has a total supply of 16,000,000 tokens. Tokens are used to propose, vote and decide on the inclusion of new features and on the future of the protocol parameters.

Owners can also receive fees in exchange for acting as an emergency reserve in the event of liquidity events, caused by malicious borrowers, settlement risk and oracle failure.

Tokens are burned based on the rates collected by the protocol, making it a deflationary asset. In addition, loan holders can vote with their loans deposited on the Aave platform, even if they are being used as collateral.

How to lend at Aave

Depositing and earning interest at Aave is a simple process. Before you start, you must visit the app.aave website and connect using a web 3.0 wallet, such as Metamask. Depositing is easy, just choose the desired asset to invest in and allow Aave access to the asset.

Once the transaction is processed and the interest rate is confirmed, you can check the rate changes in the Aave application. Tokens that earn interest are called a Tokens, which are similar to Compound C tokens.

Assets with Aave support

Aave supports 20 Ethereum-based assets, including:

Basic Attention Token (BAT), Dai (DAI), Ethereum (ETH), Kyber Network (KNC), Aave (LEND), ChainLink (LINK), Decentraland (MANA), Maker (MKR), Augur (REP), Synthetix ( SNX), TrueUSD (TUSD), USD Coin (USDC), Tether (USDT), Wrapped BTC (WBTC), 0x (ZRX), Synthetix USD (SUSD), Uniswap (UNI) and Ren Protocol (REN).

AAVEGOTCHIS

They are collectible crypto NFTs built on the ERC721 standard and used in popular blockchain games, such as Cryptokitties, Axie Infinity and Cryptovoxels.

FLASH LOANS

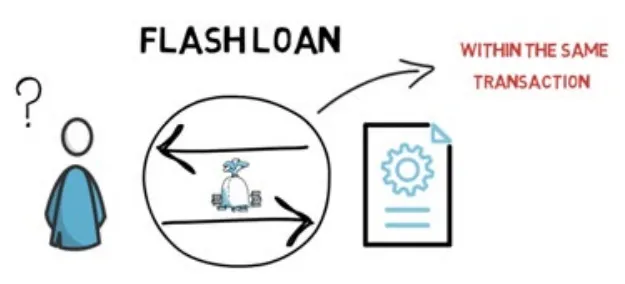

A concept that did not come from the traditional financial market and that is totally new thanks to DeFi is called Flash Loans or instant loans.

As the name suggests, these loans need to be repaid extremely quickly.

Basically, a quick loan allows the user to borrow cryptocurrencies without having to place collateral, with the condition that, afterwards, the return occurs in the same transaction, before it is closed, that is, the loan is fully repaid within the same block in that was issued.

For example, if you see Ethereum being traded for 500 USDC on Uniswap and 505 USDC on another decentralized exchange, you can try to arbitrate the price difference by borrowing a USDC amount and doing arbitrage quickly.

If the loans are not repaid, the entire transaction is canceled and the money is returned to the pool.

The idea is to feed the funds into a smart contract (or chain of contracts), make a profit and return the initial loan at the end of the transaction.

EXAMPLE:

If you purchase a flash loan at Aave, for example, you can take advantage of arbitration opportunities in some DEX as follows:

- Take out a $ 5,000 loan

- Use the loan to buy tokens on DEX A for $ 10

- Resell tokens on DEX B for $ 15

- Return the loan (plus interest)

- Keep profit

All in one transaction!

The concept of unsecured loans, flash loans, opens up a world of possibilities in a new financial system, but it is good to make it clear that they are complex and risky operations.

Basically, it is possible to get a loan quickly and try to make a profit until it is time to return the money. It happens quickly, but it’s not that easy. Transaction fees, combined with high competition, interest rates and slippage, make the margins for arbitrage very narrow.

In doing so, the user will be competing against thousands of other users who try to do the same.

License Obtained

In August 2020, Aave received a license called Electronic Money Institution (EMI) from the FCA (Financial Conduct Authority) of the United Kingdom Financial Conduct Authority, the same that Coinbase has in Europe.

It allows for the provision of alternative digital money and payment services, which means another step forward towards integrating new users into the decentralized finance ecosystem.

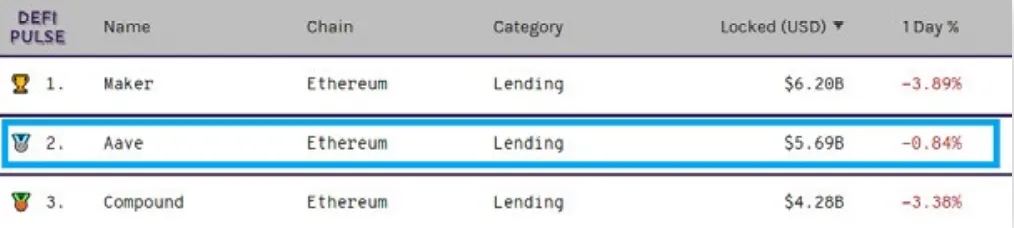

Aave is the second largest DeFi protocol and currently has $ 5.69 billion in value locked within the platform.

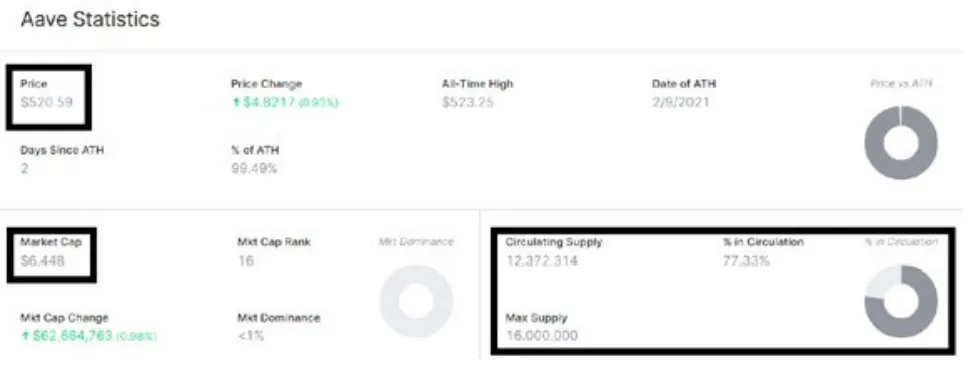

CURRENT CAPITALIZATION OF AAVE IS CURRENTLY US $ 6,438,666,839 BILLION AND ITS QUOTATION IS US $ 520.59.

MAXIMUM SUPPLY IS 16,000,000 AND CURRENT SUPPLY IS 12,372,314

Traditional loan systems are fraught with challenges that involve trust, centralization, interference from third parties, lack of transparency and lack of incentives. Decentralized money markets, such as Aave and its competitor Compound, pave the way for a more open and accessible financial system.

However, as with most DeFi projects, Aave is still in its early stages and faces some challenges. Among them, attracting people accustomed to the traditional world of finance to decentralized alternatives and also having to wait for implementations that will improve the operation of the Ethereum network.

The high level that the gas rate is found prevents the growth of DeFi projects from being even greater and also drives away start-up investors with little available capital and who are interested in exploring this new world.

Another limitation is that in Aave users are required to place large amounts of capital as collateral to obtain loans, which somewhat limits access.

We believe that in the coming years more innovative solutions will be tested and implemented, making user interaction cheaper and simpler, continuing the growth of the adoption of this great innovation represented by DeFi projects.

Protocols such as Aave can become a very viable alternative that will pave the way for greater adoption of DeFi and crypto protocols. However, try to understand the risks involved in order to have a good experience.