I don't know why but it seems easier to make bad decisions than it is to take good ones. Or, it's probably that the bad choices we made stick in our memory longer than the good ones.

2022 sure feels a lot like 2018 now. I refused to believe we're gonna have another 2018 alike bear market when it was all that clear because I got drawn into the "super cycle theory" haze which was not about any steep correction for BTC(-80%).. ever. We were supposed to hit something like $200k sometime in 2021 and slide back to $50k from where a new uptrend would commence...

Supercycle. Super trap...

It didn't happen. That bad choice of falling for this theory led me to not take enough profits in 2021. Case closed. Now's just another painful to remeber bad choice I took in crypto in the past couple of years.

In the 2018-2020 corrective period I once held something like 566,000 DOGE and about 10 ETH which at that point had a value of less than $3,000. At that time the crypto gurus were saying that coins such as DOGE will never pump like in 2017 because cryptos that have no use case would not survive the bear market, thus I exchanged my DOGE for some other shitcoin, I don't even remember which one.

Pretty much the same thing happened with my ETH. The same shitheads telling us on Twitter that DOGE won't make it were also saying that Ethereum will be killed by other "cheaper-to-use projects". Well, here we are, four years later, and Ethereum is still doing fine while Solana needs to be halted and paused every here and now.

I have lost potential gains of over $450,000 in two years because I've listened to all sorts of cartoon accounts on Twitter, sold my ETH and DOGE, and switched from one shill to another missing on important rallies all the way up and end up buying some coins that I held to for the most part of the 2021 bull market until LUNA rekt me...

I could be easily called dumb money for such behavior in crypto, but let's have a look at the mainstream smart money and how they fuck up investments sometimes too.

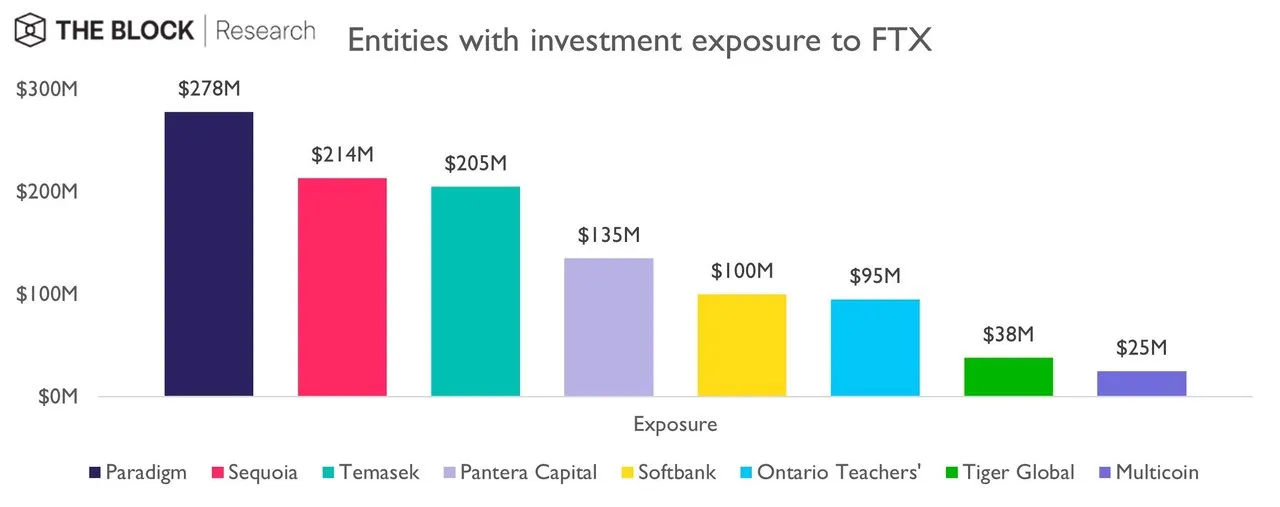

Above you have a couple of charts with some of the biggest investors in FTX. The likes of Paul Tudor Jones, Van Eck, and BlackRock are not entities you could call dumb money, but seeing them present on such charts it's clear that the so-called smart money is also taking bad choices in investments.

Why does that happen? Pretty simple: fear/greed and herd mentality. We're all human beings, whether one is a trader of a multi-billion dollar investment fund or just a retail motherfucker trying to make some cash. Fear, greed, and herd mentality may affect at some point any of these two cases.

I once used to have admiration for these so-called big guys and although I was never excited about institutions entering crypto I still considered them as smart money. I was so damn wrong, they were so damn wrong when putting money into FTX.

We all make mistakes, good trades, and bad trades, but the meat in between is what matters. I have clearly not bought the bottom of this bear market and I will for sure not sell the top, I'm not even chasing that anymore, but I will happily put my hands on some meat in between these swings.

Have a great Saturday everyone and sees you next time.

Thanks for your attention,

Adrian