Crypto has become a specialty in itself. A person who has studied investment consulting about traditional markets can feel like a fish out of water when she/he steps into the crypto world. Because all the setup is different and not easy to learn. Fortunately, there are information resources such as Hive that we can use for this purpose.

From the return on investment perspective, the main difference is that it is necessary to follow the trends in the crypto market using logarithmic graphs. Instead of percentage increases, we have to think in terms of multipliers. When we look at price charts using logarithmic tables, it is much easier to interpret long-term trends.

Yesterday I looked at the logarithmic charts of the top 100 cryptocurrencies one by one. My goal was to identify coins that are gaining value consistently. To put it more bluntly, my goal was to find coins that exhibited a smooth logarithmic upward trend over their lifetime. The coins I gave the highest marks were: Bitcoin, Ethereum, Solana, BNB, FTX, Axie Infinity, Quant, Ohm, and Ren. The smoothest graphic belonged to Quant.

Then it occurred to me that most of the coins I found as a result of the chart analysis were favorites of the Coin Bureau Youtube channel. I'm convinced again that Guy, the creator of the channel, knows the crypto business well. His only shortcoming is that he does not mention Hive in his videos.

Another feature that caught my attention is the extraordinary diversity in investment schemes. Earnings can arise from value increase, content creating, staking, liquidity pools, and yield farming. The main items that can cause losses are value loss, transaction fees, trading commissions, and realized security risks. In my last Evergrow investment, for example, there was a 14% cut in buying and 14% in sales. A large group of people, myself included, seems to have easily adopted such a practice. Of course, we took that risk expecting high incomes in return.

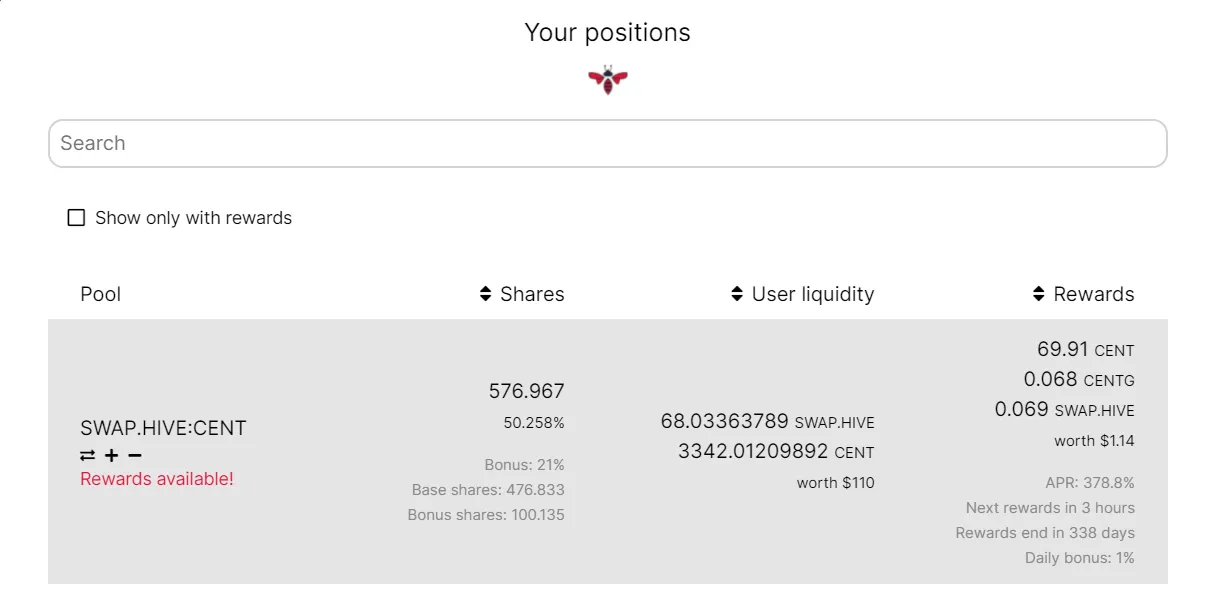

Not every investment has to be as exotic as EverGrowCoin. Recently I started to invest in a Defi application on Hive and I think the https://beeswap.dcity.io/swap application should be more prominent. This application, where we can buy and sell Hive tokens instantly without encountering a large margin, also allows us to generate income from these tokens. As seen in the image below, we can see all kinds of information about liquidity pool investment in practice. There are small, experimental volumes at the moment but will grow over time.

Today I took another look at the Solana ecosystem. I used a Dex called Orca through my Phantom wallet. Trading on Solana is a real pleasure. Transaction fees are close to zero and transactions are concluded quickly. I also liked Orca's look and feel.

My intention is to sell some of the Steems and move the funds I have obtained onto the Solana ecosystem. I intend to concentrate my money on popular coins like Bitcoin, Ethereum, BNB, and Solana. I want to consolidate these investments on Defi applications such as Pancakeswap, SushiSwap, and Orca. Let me invest in solid coins, and earn regular income from them through liquidity pools.

Of course, I also have investments in the Hive ecosystem. Thanks to the Hive ecosystem, I get some income from what I write, and I believe that the future of Hive will be bright. So I will also increase my Hive, POB, Leo, and Cent investments.

Sometimes I ask myself if I am making the crypto investment too complicated. However, in any case, it is necessary to create a portfolio with an optimum distribution. I feel like I've reached a level of maturity over time by trial and error, but I don't know how well that's better than buying Ethereum and HODLing :)

The opinion leaders of the crypto market say that we have a bull market ahead of us. I want to enjoy that market as soon as possible.

Thank you for reading.

Cover Image Source: https://unsplash.com/photos/OlSGcrLSYkw