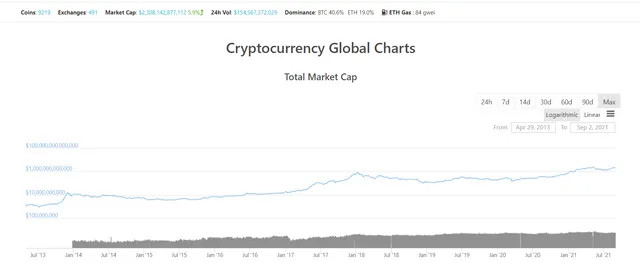

Cryptocurrencies are significantly different from other investment instruments. Prices are rising so fast that we can't show them on a linear scale. As an example, I would like to give below a chart of Bitcoin's price to date from 2013.

Because of the scale problem, prices before 2017 are shown in a straight line on the chart. However, when we show prices on a logarithmic scale, the graph becomes clearer.

The price of all types of financial assets increases exponentially, creating a combined increase effect. The difference with cryptocurrencies is that the speed of exponential growth is quite high. To give an example, the price of Bitcoin is increasing on average about twice every year, and this has been the case since the day Bitcoin was released.

For Ethereum, there is a more dramatic increase multiplier, but let's continue our narrative based on Bitcoin. We are facing a situation that has not happened before in the history of World Finance. Although it goes through periods of extreme enthusiasm and pessimism, the price of an asset doubles every year on average, and this has been going on for more than a decade.

I think the most important question in the crypto-verse is how long this trend can continue.

We see strong exponential increases that persist for a long time in microscopic living beings in nature. As long as the amount of food in the environment supports their population, their numbers can increase exponentially. How long can the exponential increase in the crypto market last, since the food of cryptocurrencies is the flow of funds?

Currently, the total market for cryptocurrencies is $ 2.3 trillion. The estimated size of the world financial system is around $ 400 trillion. What percentage can cryptocurrencies get from the world financial system? Even with a conservative estimate of 20 percent, it reaches $ 80 trillion, and we see that there are 5 doublings to go reach that size.

Bitcoin is often characterized as digital gold. Currently, Bitcoin's total market capitalization is $ 941 million. Due to https://companiesmarketcap.com / total market capitalization of gold is $ 11.5 trillion. Here, too, there is a difference of about 12 times. Of course, when making this comparison, we also need to keep in mind that Bitcoin is easier to store and transfer.

According to Statista data, crypto adaptation in the countries with the greatest economies range from %4 to %9 (India: 9%, China: 7%, U.S.: 6%, Germany: 5%, Japan: 4%) If we take the average as %6,5 we see that we need 5 doublings to reach to %100.

It's not the first time we've encountered strong exponential increases in the tech world. Moore's law has been valid in computing technologies for more than 50 years. We can also link the exponential price development seen in cryptocurrencies to the exponential growth in computing technologies. In areas such as processing, memory, data transmission, costs have been falling exponentially over the years.

Distributing data and transactions that occur on hundreds of computers instead of keeping them on a server becomes more feasible as the years go by. As such, the real-life application areas of blockchain technologies are also expanding.

Several analyses have been put forward over the years regarding the exponential increase in the price of Bitcoin. One of them was that Bitcoin should be bought when it is near its 200-week simple average price and sold when it was well above the 200-week average.

According to the famous stock-to-flow model, the price of Bitcoin was closely related to the amount of bitcoin produced annually. Bitcoin was entering a strong upward trend when bitcoin inflation declined every 4 years.

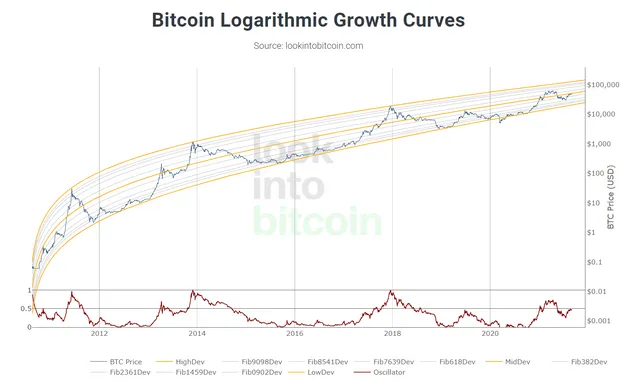

According to the bitcoin logarithmic growth curve chart below, produced by Cole Garner, it is possible to see whether Bitcoin is above or below its 'reasonable' value.

Numerous similar analyses can be reached via https://www.lookintobitcoin.com/charts/

Going back to the most important question of the crypto world, I think that the exponential increase in crypto prices can continue in the next five years. Benjamin Cowen, in his YouTube channel, Into the Criptoverse, expresses the opinion that the multiplier of Bitcoin price growth has declined over the years. If that is the case, we can experience a mild increase in prices in the next five years and the opportunity window extends to 6 to 10 years.

Finally, I would like to make a brief assessment of the impact of Bitcoin price on altcoins. We all know that altcoin prices have a close relationship with Bitcoin prices. But unfortunately, many altcoins have regularly lost value against Bitcoin and Ethereum over the years. At times like today, when Bitcoin is on an upward trend, it is possible to make serious profits on altcoins. But when the weather deteriorates, the price drops become quite dramatic.

As a result, cryptocurrencies will remain a unique investment opportunity for the next couple of years. As long as there is no bubble in prices similar to the end of 2013 or 2017, it would be wise not to miss the opportunity window.

Thank you for reading.

Image source: https://unsplash.com/