UST’s death spiral chapter showed us how the death spiral took place - Let’s learn

Luna and UST crash, makes an interesting story however tragic it is. As a UST and Luna Holder, I never fully understood the death spiral risk UST had, which was a mistake, but now I am understanding the death spiral drama that played out with UST.

A postmortem analysis of UST’s death spiral will give us insights on what went wrong, and this in turn will grow our understanding of a particular aspect in crypto, which will help us in our crypto investment journey.

We have to learn from our investment mistakes, so we don’t make similar mistakes again, that’s the logic.

Severe depegging for UST began on May 9th, which thrashed Luna’s price

Luna’s UST severely began to lose its peg on May 9th, which was Monday last week as can be seen in the trading view chart.

While Luna broke the strong support it had on 77$ on May 6th, Luna’s price fell drastically on May 9th from 64$ to 30$. This time was characterised by UST’s complete slippage from the peg, a depeg that just kept getting bigger and finally ended in UST’s death spiral!!

UST’s depeg chapter begins with huge withdrawals of UST deposits from Anchor Protocol

Now, everything was fine until May 6th as a major portion of UST’s circulating supply was locked up in Anchor Protocol. This high yield savings protocol with its 19% interest lured a lot of investors to acquire and deposit UST. This ensured that there was always good liquidity for UST algorithmic stablecoin.

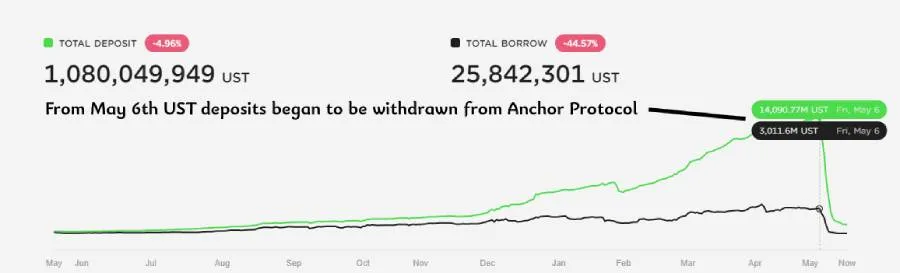

However, on May 6th, depositors began withdrawing their UST, as you can see in this chart.

From Anchor Protocol

The chart shows that till May 6th, UST deposits were increasing in Anchor with it having 14,090.77 M UST locked. However, after this date, there were sudden steep withdrawals so on May 9th when UST was slipping into its death spiral there was 9,829 M UST locked which was also getting withdrawn by large sums every time.

Therefore, UST withdrawals from Anchor can be correlated to initiating the depegging problems for UST. This is because this UST was getting sold, rather dumped, increasing its circulating supply in the market which kept bringing down its 1$ peg.

It’s pretty obvious that Anchor Protocol was the main reason there was demand for UST. However, of late since Anchor Protocol was not able to provide 20% interest as it was earlier because there were more depositors than borrowers so accordingly Anchor had to decrease interest rates for depositors.

As this was happening, investors wanted to withdraw UST and sell it. This as discussed leads to UST’s depeg because UST’s supply suddenly increases in the market.

Now, the period began where Luna’s mechanisms to maintain UST peg kick started

Now, here’s where we can understand how the mechanism of Algorithmic stablecoin UST to maintain its 1$ peg, failed this time.

It is important to note that all this happened in a falling crypto market as well, where crypto market prices were falling, although UST and Luna’s crash accelerated the crypto market’s super heavy falls.

Tradingview

Crypto Market Cap had a big red candle on May 9th, the day UST was losing its peg terribly.

UST burns through Luna mints caused dilution of Luna’s supply accelerating luna’s price fall

When depegging of UST began, the usual way of bringing the UST peg back by the UST-Luna mint and burn mechanism happened but that was leading to UST’s death spiral because Luna’s price was falling.

As UST’s peg was below $1, Lunatics did go and burn UST for 1$ of Luna. How this works is that the UST that’s at a discount is burned for 1$ worth of minted Luna which in general conditions is profitable.

Now, more Luna was getting minted to burn UST, so this increased the supply of Luna, and with the dilution of Luna, its price that was falling was falling further.

There was a lot of rush in the Mint and burn UST mechanism that issues cropped up with gas fees, and since only a certain amount of UST and Luna burn/mint transactions could happen at a time, there were stangnancies.

UST dumping at Curve without buying back of discounted UST depegged UST further

There was another way, for people to sell UST and that’s for swapping it for a stablecoin that’s maintaining its peg in Curve, which has good liquidity in the ‘UST + 3Crv” pool. Here, loads of UST were dumped which also depegged this algorithmic stablecoin making it unstable.

Furthermore as more UST was swapped for USDC or USDT, the pool became unbalanced with more UST coins than other stablecoins and Curve had to activate a mechanism that aims to rebalance the pool with equal balanced amounts of all the pool’s stablecoins.

Here, Curve made UST available at a discount, so arbitrage traders will be lured to buy the discounted UST by swapping their other stablecoins for it. This process logically would have rebalanced the pool and brought back the peg of UST, as more UST is brought so UST’s circulating supply is decreased in the market.

Unfortunately, even though generally one would have expected arbitrage traders to have brought the UST, this did not happen. While Curve kept discounting the price of UST for rebalancing the pool. All this only depegged UST further and further!!

Death Spiral point was touched so it was not feasible to use Luna to mint UST any more!

Also UST market cap increased more than Luna, so there came a point where not going to be enough Luna to absorb the excess UST.

Meanwhile, Luna was also getting sold with its price tumbling and finally it’s price became so low that it was not possible to mint UST out of it. There was just too much bad debt now.

LFG was helpless with its actions failing to restore UST’s peg

Of course Luna Foundation Guard, did step in to restore peg, by selling other assets for UST, however that did not work. One can imagine whales dumping large amounts of UST with LFG’s restoring peg actions and other mechanisms not having the power to restore the peg of UST anymore.

So, the Luna death spiral occurred. Ahem! Enough said.

Good day everyone. I hope all those who felt wrenched due to Luna and UST rekt have began their recovery process, because we have to move on to build a better future for ourselves.

Link to helpline to counsel depressed Luna and UST investors all over the world here

https://www.reddit.com/r/terraluna/comments/un57df/for_everyone_panicking_here_are_some_national/