I was scrolling through Splinterlands and notice there were some interesting opportunities with liquidity pools. The Apr on these are near 40% even with stable coins!

When we know DEC is now close or at peg for a while it is safe to say investing in DEC to USDC would be a low risk pool. Of course nothing is certain and I learned that first hand with Luna and UST.

The challenge to partake in the pool for me is that I need a ETH account and store funds in pancake exchange. On the flip side an easy 40% Apr is not bad. Furthermore by supplying to the liquidity pool more players can swap tokens into DEC which makes adoption to the game easier.

If we focus just hive pools there are still decent options.

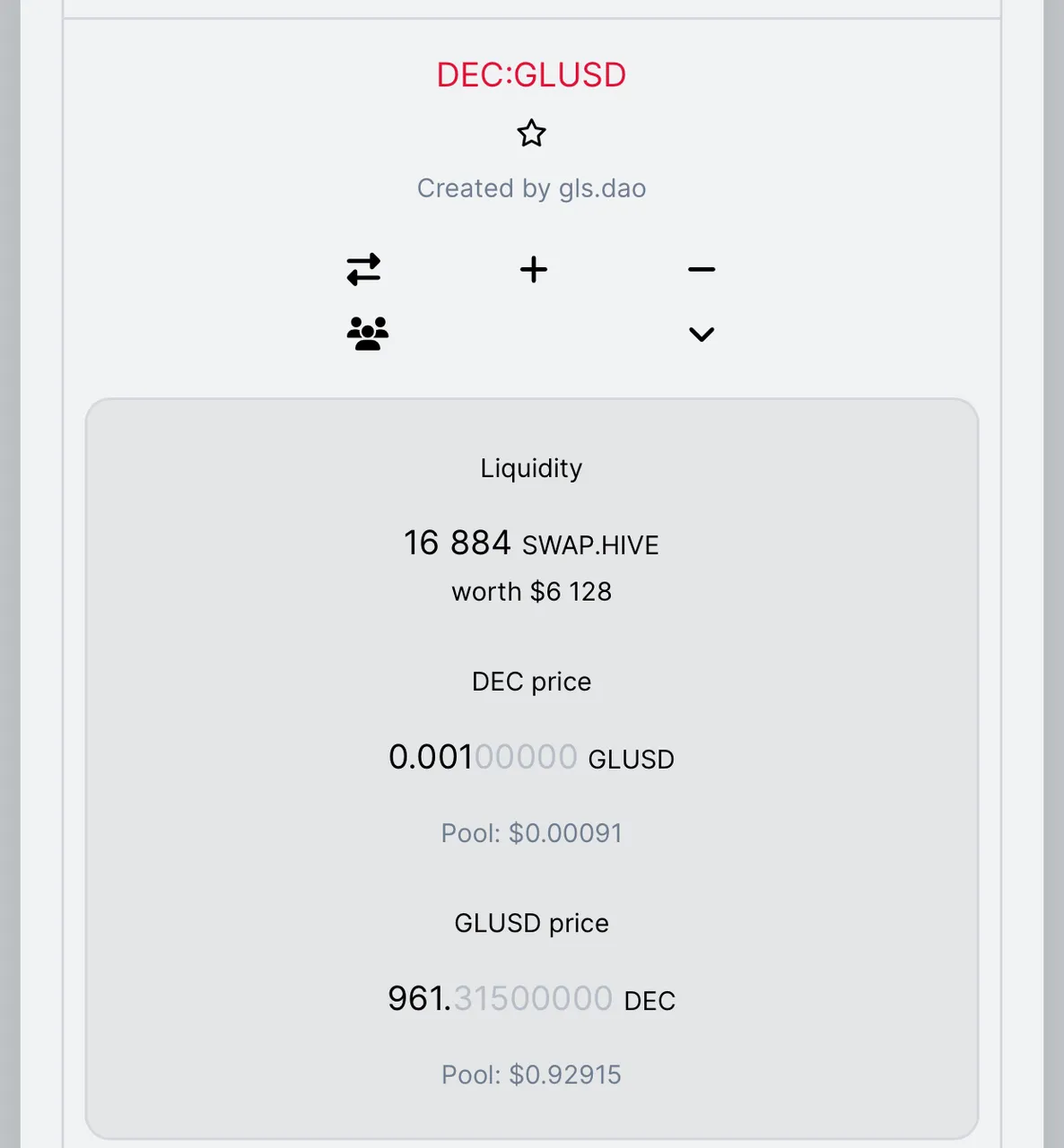

I am saving up for the DEC to GLUSD pool as both are stable tokens to a certain extent. The most familiar one is DEC to SPS but I feel SPS has a ton of room for value growth and would rather stake for 15% Apr. if the liquidity pools Apr rose I may change my mine on the DEC to SPS pool. The pool gives 50% Apr but could potentially drop as more liquidity is provided. Liquidity right now in the pool stands at $600k.

Until next time thanks for reading!!!

I have plenty of other cards for rent! Just go on peakmonsters and check out the market place and if you are curious what I offer here is a link:

If You have yet to take part in playing this great game called Splinterlands please click on my referral link. It is free but in order to earn real assets such as cards and token you would have to invest in a starter deck or purchase game cards. Join the discord to learn more. Good luck!

THANKS FOR READING! CONTINUE TO PLAY SPLINTERLANDS!