he ZING token is the in-game token of the new and upcoming game on Hive, Holozing. The token has been live for a few months now and its distribution is ongoing and slowly taking shape.

The game itself has not launched yet, although there is a dedicated web for it with multiple features already built in.

The ZING token was announced in October 2023 and shortly after started with its distribution. At the moment of writing this there are four ways to earn the token, as follows:

- HP delegations, 200k daily

- ZING staking, 20k daily

- POSH holdings, 40k daily

- Liquidity provider, 40k daily

A total of 300k daily ZING tokens are set to be distributed.

The rewards for POSH holders will end soon. Later when the game is live there will be more ways to distribute tokens, mainly for playing the game. More info in the official whitepaper https://whitepaper.holozing.com/.

Here we will be looking at:

- Daily issued

- Supply

- Top Earners

- Staked supply

- Liquid vs Staked

- Top Stakers

- Price

The period that we will be looking at is from October 2023 to January 2024.

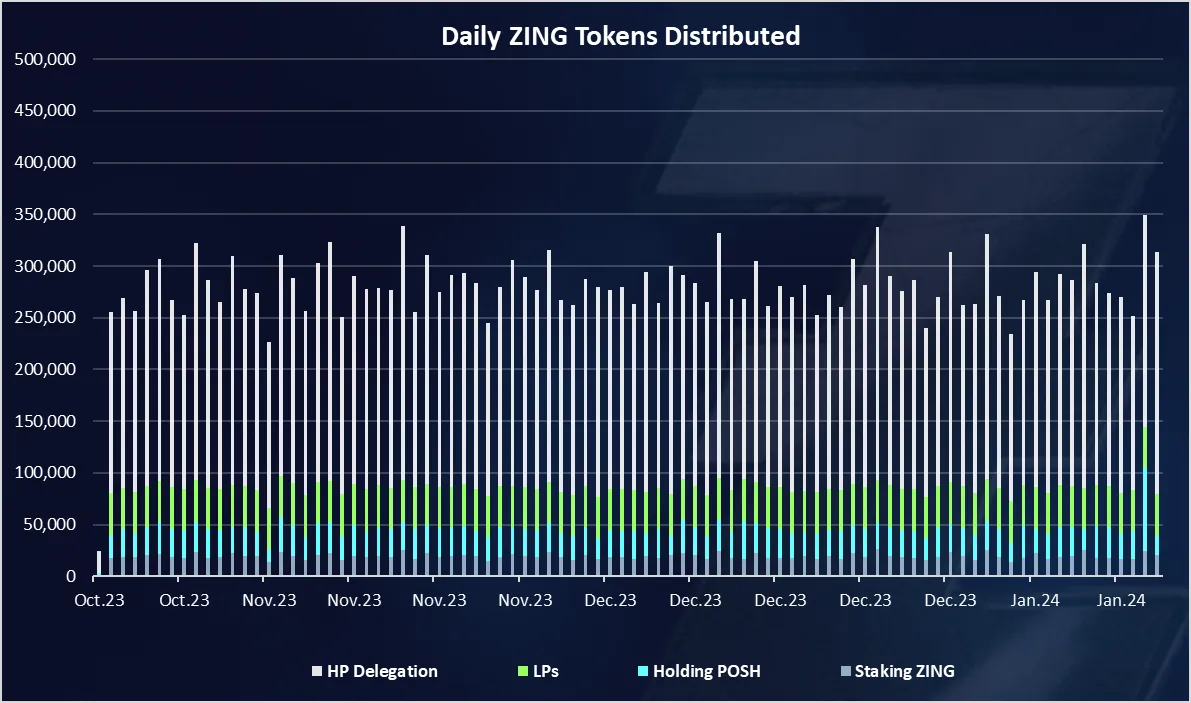

Daily Issued Tokens

How many ZING tokens are issued daily? From what category? Here is the chart.

The amount of daily distributed tokens is a bit lower than the 300k projected ones. On average somewhere around 285k daily ZING tokens have been distributed in the period. The HP delegations is the main way for tokens distribution, followed by liquidity rewards and then staking ZING.

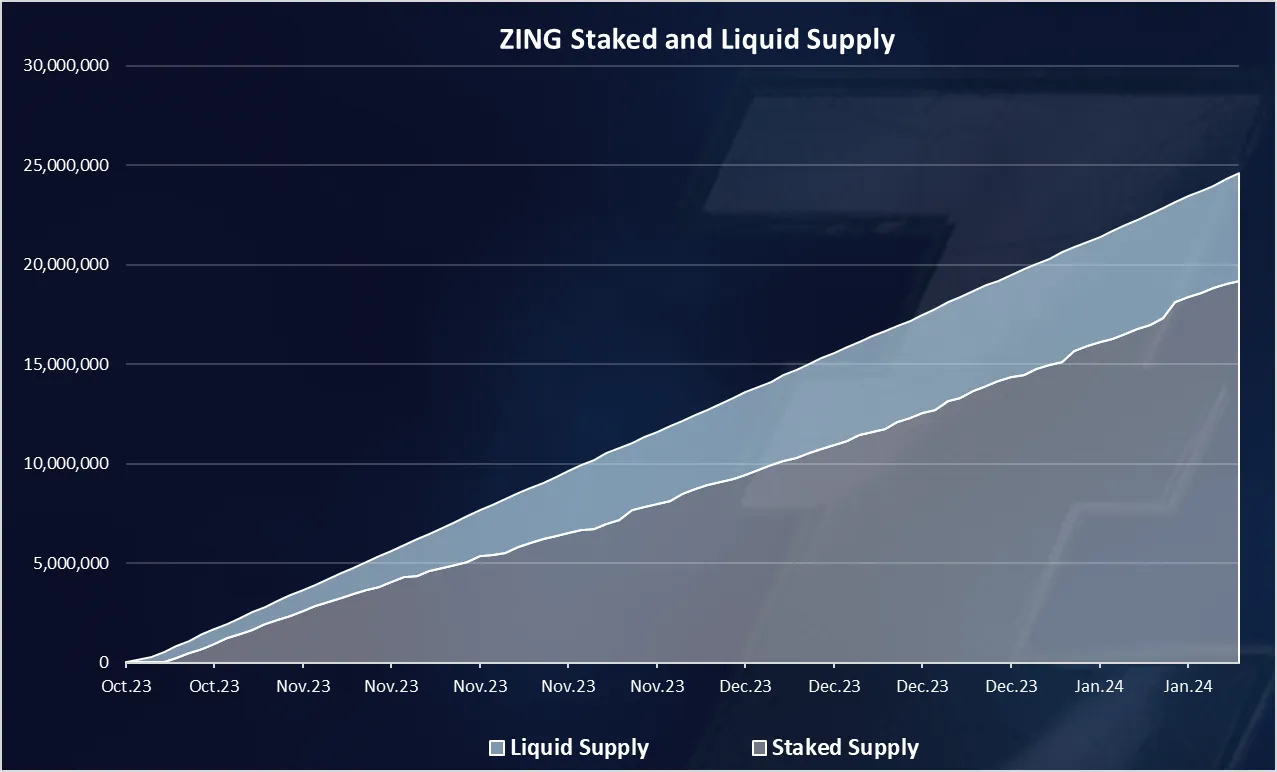

When we add the above the current token supply looks like this:

A straight line up, since there is no changes in the emissions in the first months, but soon this line will become less inclined since the POSH rewards will stop. At the moment there is 25M ZING tokens in circulation, somewhere around 8.5M have been issued on a monthly level, and on a yearly basis this number will reach 100M.

Top Earners

Who has been earning the most in the period? Here is the chart.

@vcelier is on the top here with almost 1.4M tokens earned, followed by the @poshtoken.wallet account and @acidyo. The top earners all have more than 400k tokens.

Note that the liquidity providers rewards LPs are not included above. The way that they are distributed by the HE contract is not recorded on chain and I can’t get that data. All the other ways of distribution, delegation, staking and POSH are included.

Staked Supply

What about staking? What percentage of the distributed tokens are still staked?

We can notice that all of the days are with positve net staked tokens. Usualy this is in the range around the 200k, but recently there was a day with 800k tokens staked in a day.

When we math the liquid and the staked supply we got this:

We can notice that staking has been constantly high in the period. From the very beginning of the token distribution. There are LP rewards, so even the tokens that are not staked, a big part of them are locked in the liquidity pool.

Note that all the rewards, except for LPs are distributed as staked tokens, so majority of the tokens are entering in circulation as staked tokens. Still from the chart we can notice that a lot of them remain staked and users are not unstaking.

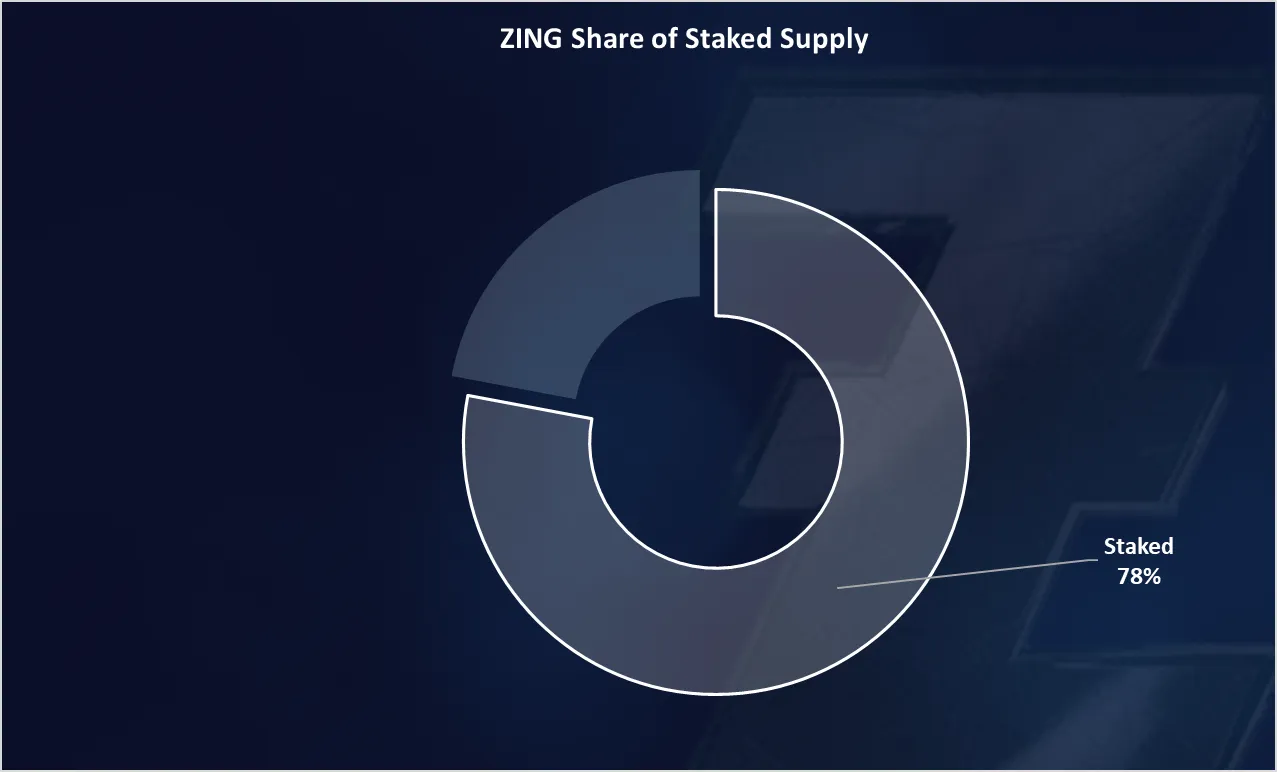

Share of Staked Supply

The current share of the staked ZING tokens is as follows:

A 78% of the tokens staked. A 20M out of the total 25M of the current supply. Out of the rest 5M, 3.5M are in the liquidity pool.

Top Accounts that Staked ZING

Who has been staking the most.

Note that these are users who have staked additional ZING outside of the rewards that they are reciing as staked tokens. The period is for January 2024.*

@empoderat has entered the ZING game in a massive way and staked more than700k tokens in January only. @queengaga has also been staking aggressively with more than 400k tokens.

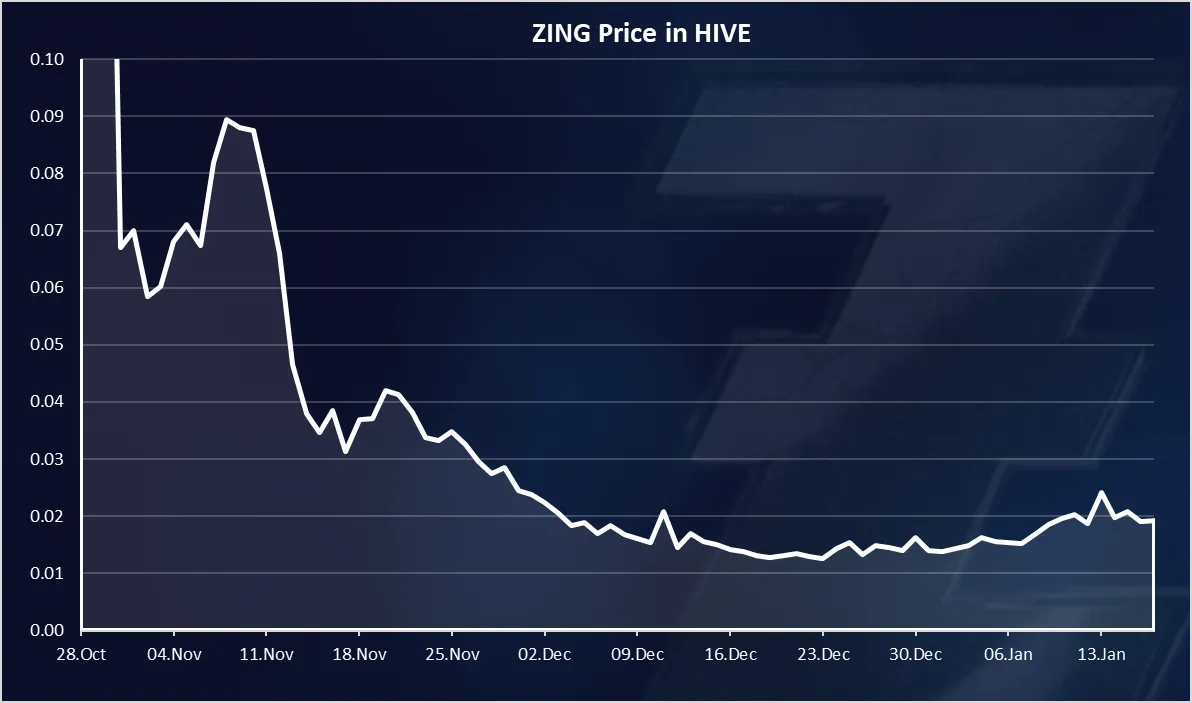

Price

At the end the price. How has it been holding in the period? Here is the chart in HIVE.

At the very start the price was quite high, but this is to be expected, as the supply was non-existent, nobody had any tokens, no team allocation, no presale, and the APR for all the pools were high so users rushed in.

Afterwards the price stabilized between 0.01 and 0.02 HIVE, and even increased a bit in January. These are early days of the project, there seems to be excitement about it in the Hive community and the project is of to a good start. The token is still in early distribution and there will be a lot more tokens put in circulation in the following period. But even with this it is worth noting that at the current prices the market cap of the project is still barely above 100k. So, if executed properly, there is a lot of room to grow.

All the best

@dalz