Launch of Uniswap's token UNI has taken the DeFi market by storm with about $3 billion in trading volume in just 24 hours. And this is when the Ethereum Network gas fee are at its peak. Many users are not able to participate in this frenzy despite their attempts.

So the whole market is thinking on how to capitalize on it.

Some new platforms have come up with some interesting models to attract more liquidity to them.

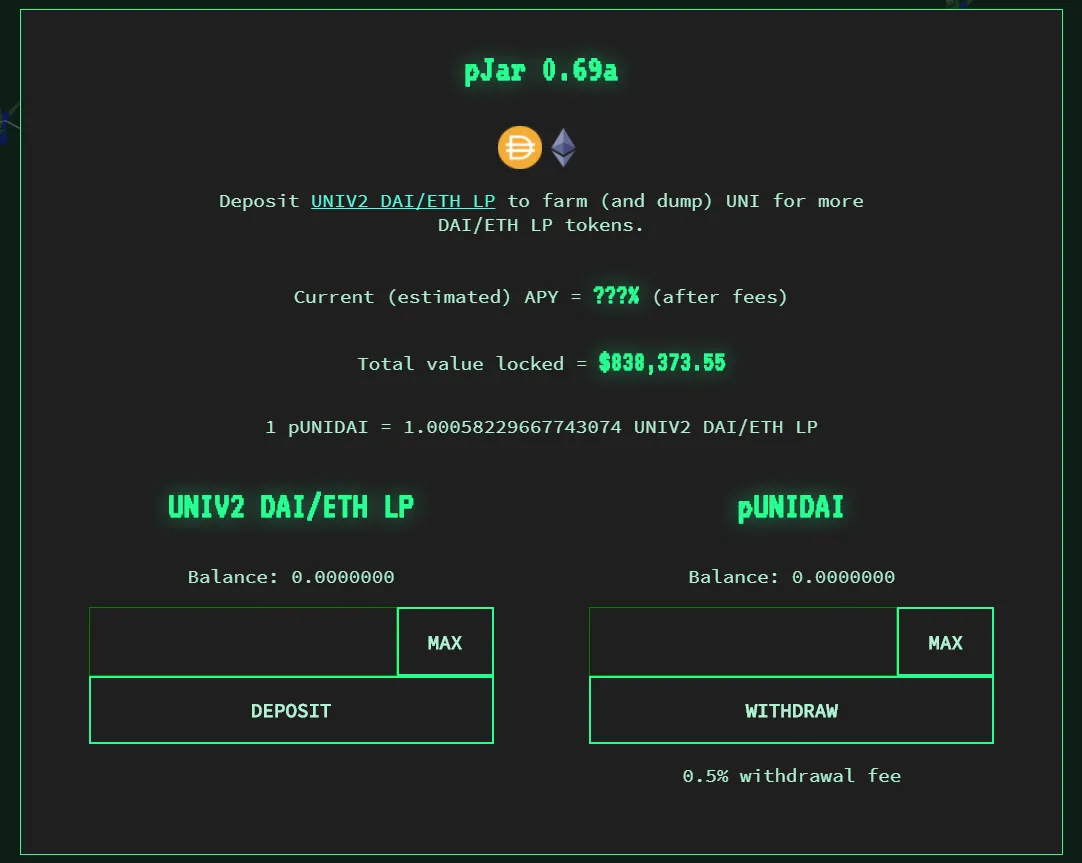

Pickle Finance has made provision of specialized jars with its pJar a, pJar b & pJar c.

You can pickle your LP tokens in these jars

Yes, you can put your UNI v2 LP tokens for ETH/DAI, ETH/USDC & ETH/USDT pools into one of these jars and keep earning more LP tokens. What essentially happens is that LP tokens inside pJar 0.69 automatically farm UNI tokens and auto-dump them for more LP tokens. Thus your liquidity keep on increasing with extra LP tokens.

In addition to this, you may also earn PICKLE tokens subject to approval of a pending proposal that seeks to distribute PICKLE to whoever make a deposit into pJar 0.69.

This seems quite a secure bet to make which almost guarantees to not to lose your principal investment. The only major risk you face is that its code is still not audited.

Harvest Finance has also come up with something:

There must be many more such innovative offers around. If you came across some, please do share it with me here.

Thanks!

P.S.::

Personally, I'm not putting up any LP tokens on these platforms. I'm just being curious.