These days, everyone in crypto industry wants to ride on the DeFi wave ...even centralized crypto Exchanges are somehow trying to enter into DeFi rush. Recently, Hive-Engine has expressed its intention to start some sort of decentralized liquidity pools on its Exchange. Other big centralized Exchanges like OKEx & Huobi are partnering with various projects to offer a good yield on staking of DeFi tokens on their platform.

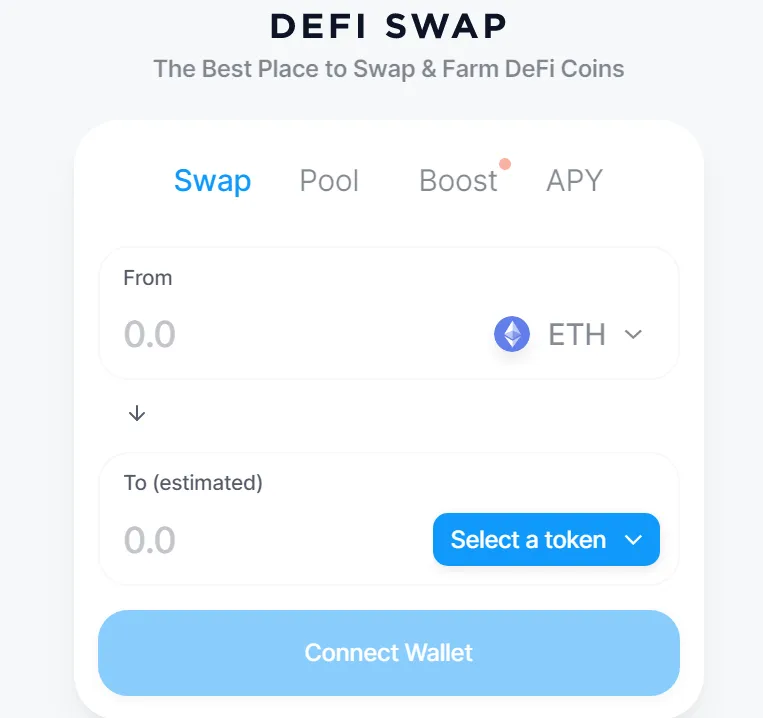

But one should not forget the "De" in DeFi. How can centralized Exchanges get benefitted through decentralization needs some innovative thinking. This Friday, a Centralized Exchange viz Crypto.com came up with its own fork of Uniswap Exchange called Defi Swap.

It raises some questions like why would anyone use this DeFiSwap and how would Crypto.com derive any benefit of it.

First part is easy to answer. Give more incentives to Liquidity Providers ...and may be, traders. Crypto.com has come up with Triple Yield offer for Liquidity Providers.

- The standard 0.3% swap fee.

- CRO DeFi Yield for staking its own coin CRO for 1-4 years.

- Bonus LP Yield for selected pools in the form of tokens redeemable for coins of partnered DeFi projects.

The central idea of this project seems to boost the price of its own coin CRO through long term staking (which again will be rewarded in its own coin CRO!). Crypto.com has so far been very sucessful in leveraging its CRO token through its various staking offers. People keep buying CRO to stake it and Crypto.com keep coming up with new proposals for staking it more. All these keep CRO's prices pumping.

So DeFi Swap seems to be the next idea that can boost CRO prices through staking. This time, Crypto.com got the courage to invite users for long term staking and offering higher rewards for locking it for longer periods. 1 to 4 year period is quite long to stake an Exchange coin in my humble opinion. But who knows, how long it could be pumped!

Crypto.com says it's open-sourcing the core codebase of DeFi Swap (which is a fork of already open-sourced Uniswap). But if you want to add any token or pool to DeFi Swap. it's the Crypto.com' team that take a final call on it!

But every project will get a pie of the ever expanding DeFi cake. DeFi swap has already got about $16M in liquidity with a daily volume of about $800,000. Thus there seems to be some rush in investing on this platform too!

You know why?

Just like zombie mining technique employed by other DeFi projects for first two weeks, Crypto.com is offering a reward of 1M CRO everyday for the first 14 days. With current liquidty of 16M, you get 1 CRO for every $16 invested as LP.

Curently 1 CRO is about 16 cents. This means LPs are getting additional 1% daily reward in form of CRO. So yeah, looks to be a good idea to get some additional reward in the first 14 days. How will it turn out later remains to be seen.

How do you see Crypto.com's DeFi Swap initiative on Ethereum chain? Would you like to participate in it?