Decentralized finances from the Ether ecosystem smoothly migrate to Binance and this is easily explained. The speed and low cost of transactions on the Binance Smart Chain are critical. I don’t know about you, but my Ether commission costs are at least $ 150 per month, which is very frustrating. Therefore, in November, I actively began to observe the BSC and, of course, started with Yield Farming. Despite the high risks in this type of earnings, the benefits can be very high. To begin with, Ill tell you about the farm in which I have been participating for a week. Despite the fact that I consider the Thugs project to be high-risk and can easily turn into a scam exit, Im satisfied with it. Of course, you shouldn't mindlessly repeat my actions or join this club too, DO YOUR OWN RESEARCH. Well, for a start, I'll tell you about my own experience.

The Thugs.finance project appeared in early October and its essence is the distribution of tokens. In the truest sense of the word😊 A game universe of gangster life in the crypto space with guns, drugs, hoes and other mob romance was invented. The main token of the project is Thugs, then tokens Guns, Drugs, Hoes, Cred appeared. A closed-loop system has been created, when you are encouraged to stake some tokens and farm them for others. This whole system has no practical application. More precisely it exists, but only during this period of time, allowing you to earn high interest for staking. How it looks like, I'll tell you by my own example.

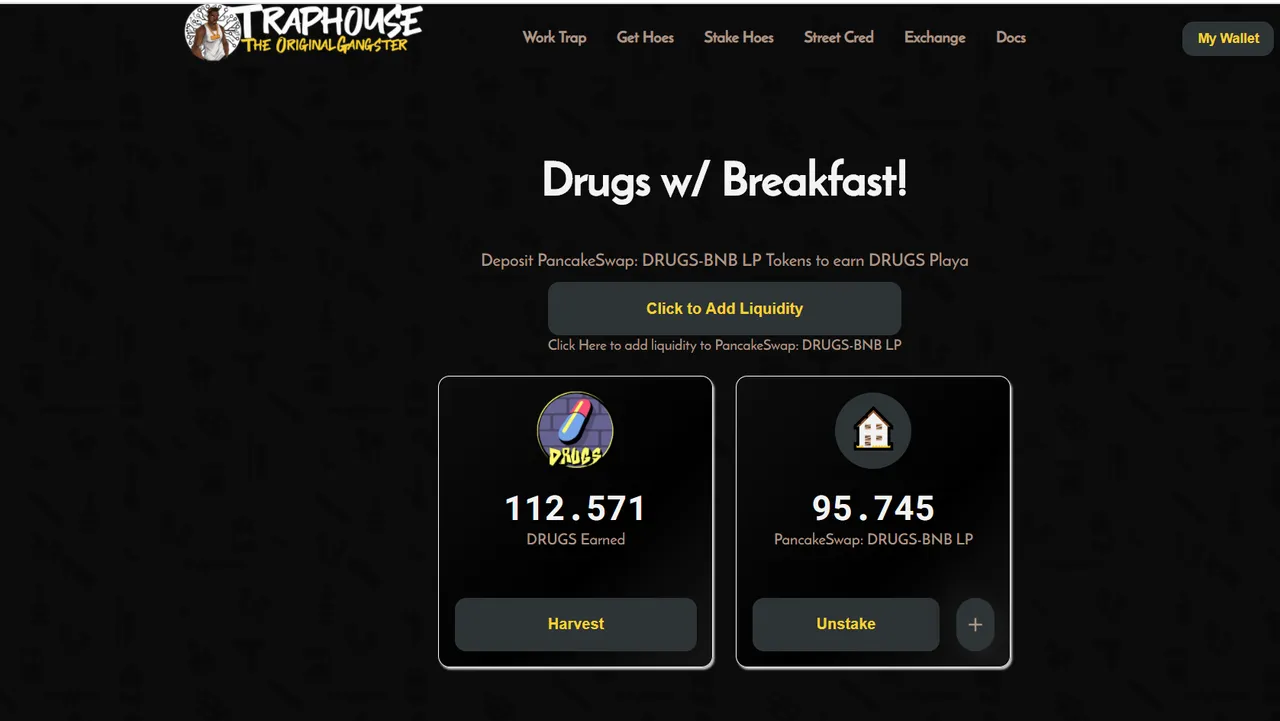

So, I purchased Drugs tokens in Pancake for 7 BNB tokens (1 BNB = 248 Drugs), after which I immediately poured liquidity into the same pool, on a 50/50 basis, BNB / Drugs. AMM Pancake works on the Uniswap principle, so everything is clear and simple here. Next, I went to the Traphouse staking site, where I chose the Drugs w / Breakfast pool, where the yield ranges from 580 to 600 % APY. I added to the pool all the liquidity tokens I have, which eventually bring me Drugs tokens. Impermanent Loss is still at an acceptable level here, and I farm 40-50 Drugs per day, which is a pretty good figure. The only problem is that it isnt clear how long the Thugs pyramid will last and whether Ill have time to at least fully return the BNB spent. And although in theory, when the liquidity pool disappears, I will remain with my original 7 BNB, in practice it may turn out that by signing a smart contract I gave unlimited permissions to use tokens from Metamask, which means I can be left with nothing. Then why such a risk, you ask? It's simple, as long as this is the most profitable farm, which attracts with different staking schemes, and yesterday

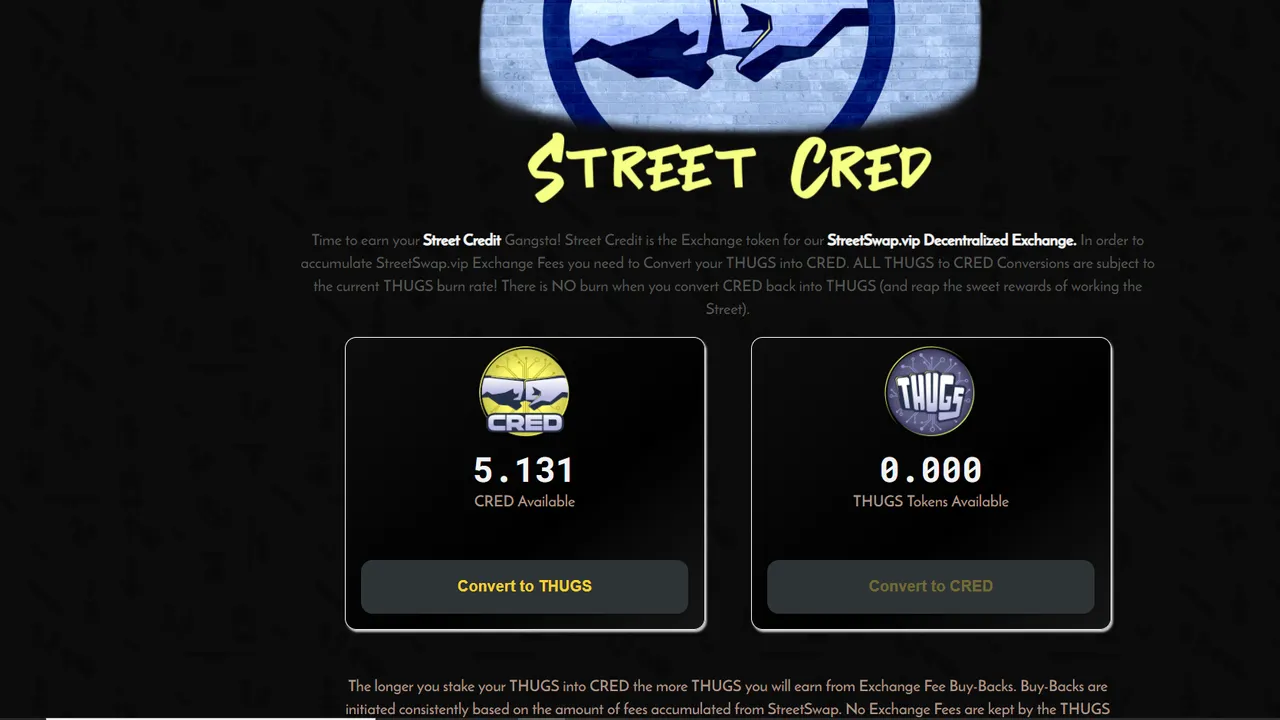

I entered another traphouse pool, staking existing Thugs, in exchange for a new Cred token, which gives the right to receive commission from exchanges in the project's own AMM Exchange, which was launched the other day. When investing our money in the system of decentralized finance, we must beware of the risk of losing everything. Actually it`s a gambling, so the whole question is in the bets. If you risk an acceptable amount of money for you, then maybe it's worth it? :)