In this post I'm gonna show why, in my opinion, connecting HIVE with Ethereum blockchain is a huge thing and how the whole HIVE ecosystem can benefit from it. Let's go!

tldr: with WHIVE you can use your BTC and ETH to buy HIVE and still keep your BTC and ETH. Sounds weird but it works!

Now, I'm not gonna write about some theoretical possibilities - instead I will show my own perspective on the HIVE DeFi and how I use it to support HIVE (and get profit ;).

I want to have more HIVE but I don't want to sell my BTC and ETH savings. Solution: DeFi.

I hold some BTC and ETH savings because we all know fiat money is worth sh!@t and will be worth even less soon. But there's one problem - I hodl them in my wallets and they're doing nothing there. They don't generate any income, they don't provide anything useful for me or anyone else other than store of value, they're just sitting there waiting to be cashed out in maybe 10 years or more. This is a huge loss of potential profit, especially in this time-frame but at the same time I don't want to sell them - they're my savings, with 0% APR.

Then there's HIVE - a token where you can get 10%+ APR by supporting other's people work. And you can do it manually or automate it and just check your balances once a month. But even with automated curation, a large number of people will get rewarded for the value they add to the HIVE ecosystem thanks to your investment. Nice.

But as much as I love HIVE community, I won't sell my BTC and ETH to buy HIVE tokens - those are my savings. And here's where we finally get to the point - with DeFi you can keep control over your crypto savings and at the same time use it to invest into new tokens.

Here's how it works: let's say I have ETH worth of 200 USD. I can deposit it on a DeFi lending platform - immediately after doing so I can take a loan worth of 100 USD in other crypto - for example BAT. This locks up my ETH but I can easily get it back by sending back the borrowed BAT plus some small interest.

Now, why would I do that, why not just sell ETH and buy BAT? By doing so I would loose my ETH - and that's not good. ETH has huge potential, it is a backbone of an enormous amount of projects and basically you want to have it in your portfolio. If ETH price goes up x10 and BAT goes up only x2, I would lost a lot of money by selling my ETH for BAT. With DeFi lending I keep my ETH and at the same I can do whatever I want with my borrowed token.

One last thing before we move on - the D in DeFi is quite important. It stands for decentralized and it basically means, that there's no one to steal your funds. The whole lending procedure is executed using smart contracts so someone would need to bring down the whole ETH network to stop it from working. Also - there's no KYC ;)

Next stop: DAI

DAI is a stablecoin worth around 1 USD and it's a central part of the DeFi move - because anyone can create new DAI tokens.

Just go to https://oasis.app/borrow, deposit any of the supported tokens and you will be able to mint new DAI coins backed by your deposit. To get back your deposit, send DAI back. Easy!

Now, the reason why this is a big thing you need to realize that with DAI you are creating additional value. You can basically print money, but not from thin air but from crypto assets, that would otherwise sit in the wallet doing nothing. And most importantly, you're not selling those assets, you still own them and you have new DAI at the same time.

This simple, brilliant idea allowed crypto to thrive in 2020 and unlocked many new possibilities - this is where we get back to HIVE.

Finally: WHIVE

If you wanted to trade, borrow or lend HIVE in the DeFi space - well, you couldn't, because DeFi runs on ETH network. But, as you probably already know - now you can.

WHIVE is a 1:1 HIVE token on a ETH blockchain crated by @fbslo - you can check the announcement post here. Anyone can create WHIVE and use it in the on the DeFi platforms. Currently WHIVE is supported on the uniswap decentralized exchange and you can check the stats here - we hope to bring it to more services soon.

Quick disclaimer: WHIVE is in early stage and it's still under development so that's why it has no icon or you can't see it on uniswap tokens list yet. But we'll get there.

Now, back to buisness - ideally I would like to have WHIVE native support on platforms like aave or compound - this would allow me and others to borrow HIVE and by this:

- increase demand for HIVE

- increase HIVE price

- get nice 10%+ APR

- still keep my BTC and ETH

But this will take time. No problem tho - we have the DAI :)

Here's the plan: I will deposit my ETH to create new DAI, use the DAI to buy WHIVE on uniswap and finally convert WHIVE to HIVE.

Few words about ETH fees: the ETH is actually cheap and fast to transfer, around $0.60 for a transaction in 30 seconds. What's really expensive lately are the interactions with smart contracts, used by all DeFi platforms. Hopefully the situation will get better with both updates to the ETH network and moving to ETH 2.0 later this year maybe?

About the risks: Please be aware that this is not 100% risk free operation. The main problem comes from the smart contracts code - because no software is prefect. The code may have bugs that can be exploited by experienced hackers. Another problem can be ETH network congestion that prevents it's users from performing operations and in result loosing part of the funds. You can read about one of those cases here: https://blog.makerdao.com/the-market-collapse-of-march-12-2020-how-it-impacted-makerdao/

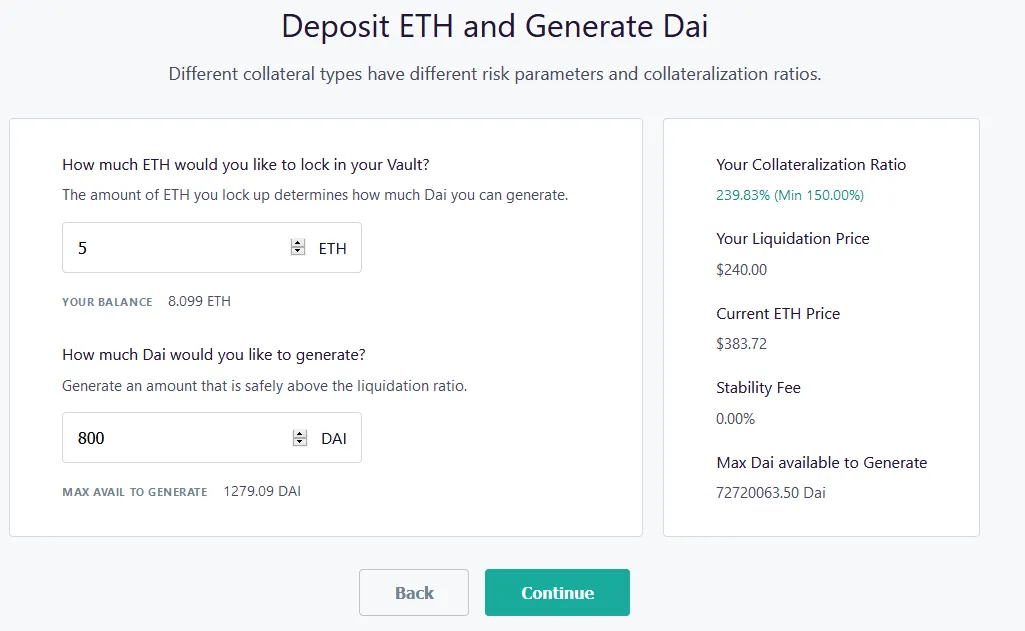

Step 1: creating DAI

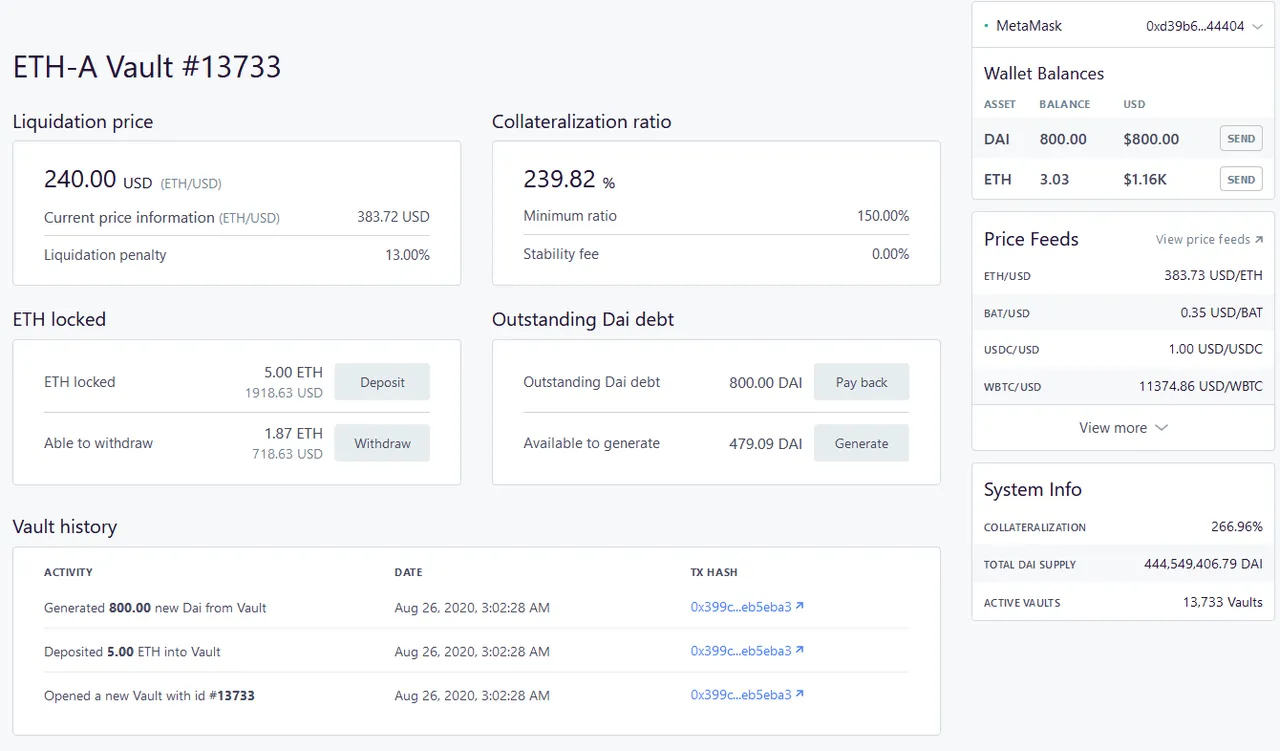

Step 2: DAI created and transferred to the wallet

Don't worry, I will cover this one in one of the next episodes.

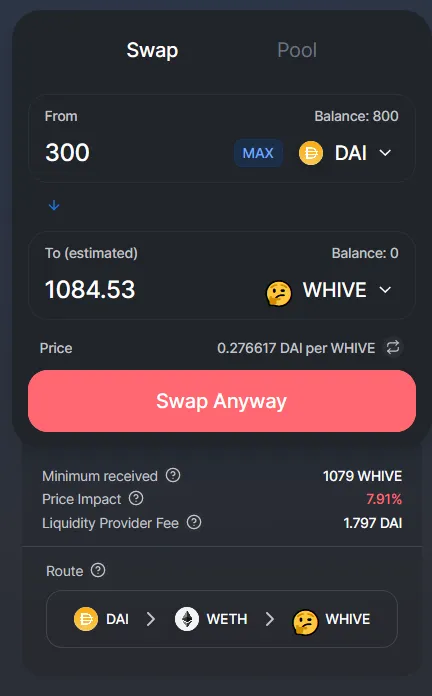

Step 3: uniswap trade

You can see we have a small problem - out trade will move the price by over 7%, even though I'm trading only 300 DAI at the moment. That's because WHIVE liquidity on uniswap is pretty low right now. Anyone can fix it by providing liquidity and earning passive income by doing so - but we'll talk about it in one of the next episodes ;)

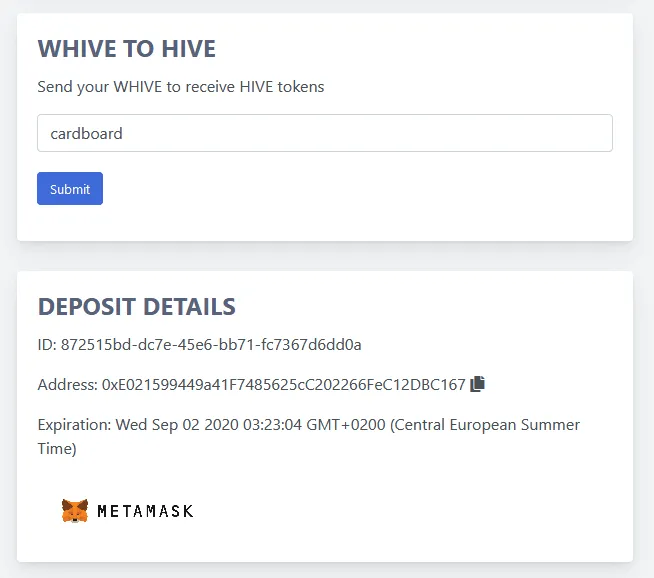

Step 4: bringing HIVE home (WHIVE -> HIVE)

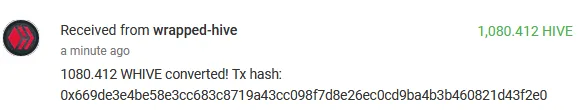

Now all I have to do is go to https://www.whive.network and deposit my WHIVE to provided address to receive HIVE :)

And here it is!

Now, it wasn't a perfect experience - the total fees required to complete all the steps was around $30 :O The bright point is that the most expensive fee (creating DAI vault) needs to be paid only once. Also the fees are not dependent on the transaction volume so paying $30 to move $10,000 sounds a lot better than paying $30 to move $100.

In summary:

This post is already way to long so I will keep this one short: thanks to ability to move HIVE token to the ETH network, we can now invest into HIVE without need to sell our crypto savings. More over, we can use HIVE to generate nice APR, which would be not possible by just holding those mentioned savings. It's like having the cake (locked in your fridge), eating the cake and getting additional 10%+ of the cake per year ;)

Of course there's more so see you soon in DeFi for new-bees part 2!