Image by Gerhard G. from Pixabay

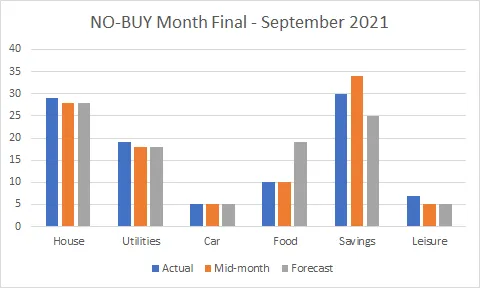

I've been participating in a NO-BUY month in the Saturday Savers Club, over on the @eddie-earner account. I published a halfway report with my NO-BUY rules and this post has the final results for September.

A few variations between the mid-month and final results for the house and utilities, after I had made some amendments for bills that only happen quarterly. My main focus for reducing spending was my non-essential food bill - mainly casual purchases when I went for a pint of milk.

Overall, I was pleased with the results. I was aiming to save 10% of my food expenditure. I achieved about 35% savings on food and housekeeping. I did have a well-stocked freezer and pantry and we had a lot of produce from the garden during the month. There was one unscheduled trip for essentials but I went to a very basic convenience store where there were few goodies to tempt me; and a mercy dash because I was unwell and needed something quick and easy to heat up.

I made a few mistakes with the leisure spending, but at the end of the month, everything was still within the NO-BUY rules I had set myself and I achieved about 25% savings in that category. The NO-BUY fails were buying £4.50 worth of yarn and forgetting my £7.99 Audible subscription (I could have included this in my rules and I still achieved my savings, so not too bad).

I've introduced some simple changes that save money without making any difference to me:

- turning off devices on stand-by and with LED displays.

- setting my washing machine to run at night on a cheaper energy tariff.

- using supplies I already had to carry out some small repairs, rather than buying new.

I also postponed any large or non-routine expenses and put them on a list for planned purchases.

I found this a really useful exercise and was really pleased with what I achieved. I've also done a fair bit of sorting out during the month and discovered that I still have lots of housekeeping, toiletries, housekeeping and pantry supplies.

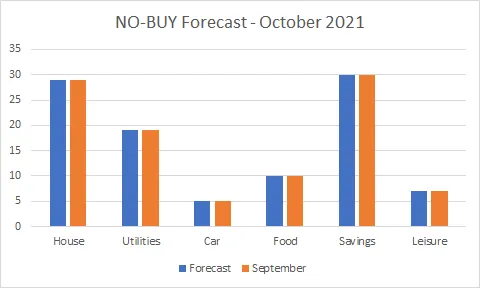

October NO-BUY Month

I'm going to continue with another NO-BUY month through October. I still have so many supplies and it would be good to get through more of them and increase my savings by 10% again this month.

I've set my budget for October to be the same as the expenditure for September, although I expect the actual purchases to be a little different. My pantry is still well-stocked but there are a few things I want to replace including bread flour and some tinned foods.

ALLOWED EXPENSES

- Food - but aiming to use up items in the pantry, freezer and garden.

- Replacing toiletries, household and cleaning products.

- Essential repairs or replacements.

- 1 eat-in or take-out each week, including coffee and going to the pub.

- 2 performances or films during the month.

- Adult education classes or workshops.

- 1 Audible subscription.

- Postage/carriage.

- Travel or fuel.

NO-NO BUY

- Non-essential shop bought treats.

- No new clothes, other than planned purchases below.

- Books, stationery, yarn, fabric or notions.

- No new household, office or IT items.

PLANNED PURCHASES

- Compost, seeds, bulbs and winter protection items for the vegetable garden.

- Winter boots, replacement tops and underwear.

- Visits to the hairdressers, opticians and dentist.

These come from short-term savings, money put aside through the year for these purchases.

FURTHER SAVINGS

The UK is facing a huge surge in energy prices with many small providers collapsing, unable to finance the increased costs. Estimates are that energy prices will increase by 30%-50% over the next year. I am on a fixed price tariff until August 2023 and I am hoping that the provider will be able to honour this. However, I will be looking where I can continue to make savings, especially around keeping warm and reducing energy costs.

OCTOBER SIDE-GIG

I love saving, I enjoy implementing anything which doesn't cost me anything, especially if it doesn't cost me any time, and brings me extra value. But it looks like I have reached the limits of what it is possible to save within my current income. In addition, I will eventually get to the end of my surpluses and have to start buying replacements.

May be it is time to start looking for side-gigs, especially anything where I can build a passive income over time. Luckily, the Saturday Savers Club will be doing just that throughout October.

Saturday Savers Club

I run a savings club every Saturday over on the @eddie-earner account. We're aiming to save £670 ($800) by the end of the year using the 365 day savings challenge. You can join any time of the year and set your own goals and plans (some people are saving Hive, others Bitcoin, some their local currency). We share savings tips and there's a free giveaway every week.

Wednesday Wellbeing Club

I'm hosting a Wellbeing Club on Wednesdays from 11 August until 24 November 2021 in the Natural Medicine community. It's for anyone who wants to make a lifestyle change. We have a weekly check-in and share wellbeing tips, and a weekly giveaway. Here's the back story and the launch post with more information. Everyone is welcome.

First Monday - NeedleWorkMonday Community

Every First Monday of the month, I host a Live Chat for an hour from 7pm for the Needlework Monday Community. Bring your knitting, sewing, crochet (or nothing, that's okay, too), a nice cup of something, and join us for a relaxing hour of chat. Find our more in this post

Three things newbies should do in their first week and, for most things, forever afterwards!