It’s been a while since my last video on Ethereum fundamentals or why ether will be worth more than Bitcoin in terms of capitalization (I uploaded it on 20th of March 2017). In this video I forecasted that price would reach $210. Well, now the price is more than $300. The only exception is that Bitcoin is now worth certainly more than $18.9bln. Let’s now see what has changed fundamentally for Ethereum. Why Ethereum is the most attractive investment. What are the risks that can undermine long-term value of Ether. What can be long-term forecasted price of Ethereum if it absorbs value of certain assets.

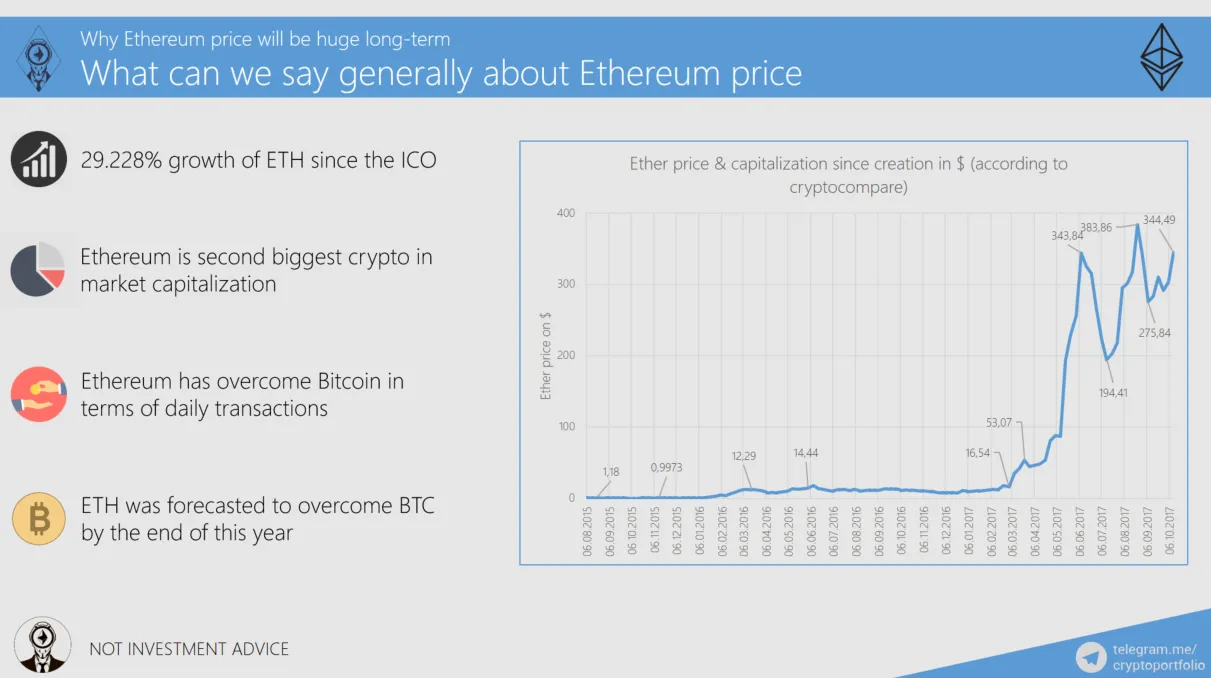

Ether has experienced 29.228% growth since its initial coin offering. As it always happens, the ones who bought a lot of ethers had better ROI than the ones who invested in ETH mining. Remember that mining is not that profitable as it was in the past. If you have some cash, better buy cryptoassets than mining hardware. If you want to know more, listen to the Bitcoin Uncensored with Simon Dixon. He invested in the Ethereum mining and concluded that buying ethers would be much profitable.

Ethereum is the second biggest cryptocurrency and it seems to be rock solid, no other crypto can take its place. Seeing how many projects are launched on Ethereum, we should expect this crypto to be number one, right? In reality, ICOs are double-edged sword. Why? I will explain later.

On 16th of October 2017, ETH has reached 408k transactions, while BTC had 314k transactions on that day. The same applies to number of nodes, 22k in Ethereum and about 9k in Bitcoin.

If you watched one of my livestreams, I covered the forecast of Fred Wilson, who is Union Square ventures partner. In his forecast, Fred predicted that Ethereum would overcome Bitcoin in market capitalization until the end of current year. And we still got time.

What are the main reasons for Ethereum to be one of the most attractive long-term investments?

First, convenience. With all those ICOs, it is still much faster and easier to send ethers than it is to send bitcoins. Some huge initial coin offerings can really sometimes clog the network, but just remember that soon Ethereum will have Raiden Network, Plasma, and other state channels, which will solve the transaction time problem. All transactions will be instant, it will be even faster than VISA. Also, do not forget about Proof-of-Stake adoption by Ethereum, it will also dramatically decrease the block time.

More projects and ICOs which will use Ethereum as its main blockchain. In the long-term, projects are certainly very beneficial for the ETH price but in the short term… In the short term, initial coin offerings are a double-edged sword. From one side, investors need to buy some ETH to acquire tokens. From the other side, projects try to hedge themselves by dumping collected Ether on the secondary market. In the long-term, such projects as Melonport will attract even more people into Ethereum ecosystem.

Even though, the Ethereum foundation doesn’t recognize Ether as a currency, it is already used as one. The more we use Ether as a currency, the more value it has.

Recently, Ethereum decreased rewards for miners from 5 ETH to 3 ETH , but now more blocks are mined. This situation kind of evens out everything. In the future, Proof-of-Stake protocol will be adopted by Ethereum. What does it lead to? To non-existent inflation. There will be simply no miners, only validators. You will be able to stake ethers and receive transaction fees as a reward.

Ethereum Enterprise Alliance is a very big deal for our blockchain, because in the end it leads companies to adopt Ethereum public chain. This will dramatically increase Ether price. If you want details, just watch my video about EEA( ), I was one of the first youtubers to report on this new organization.

), I was one of the first youtubers to report on this new organization.

Finally, we have price discovery. We are a very young blockchain and we need time to understand the true value of ETH. I am sure that we will not get disappointed when we find the way to value cryptocurrencies.

What are the main risks that can undermine growth of Ether price?

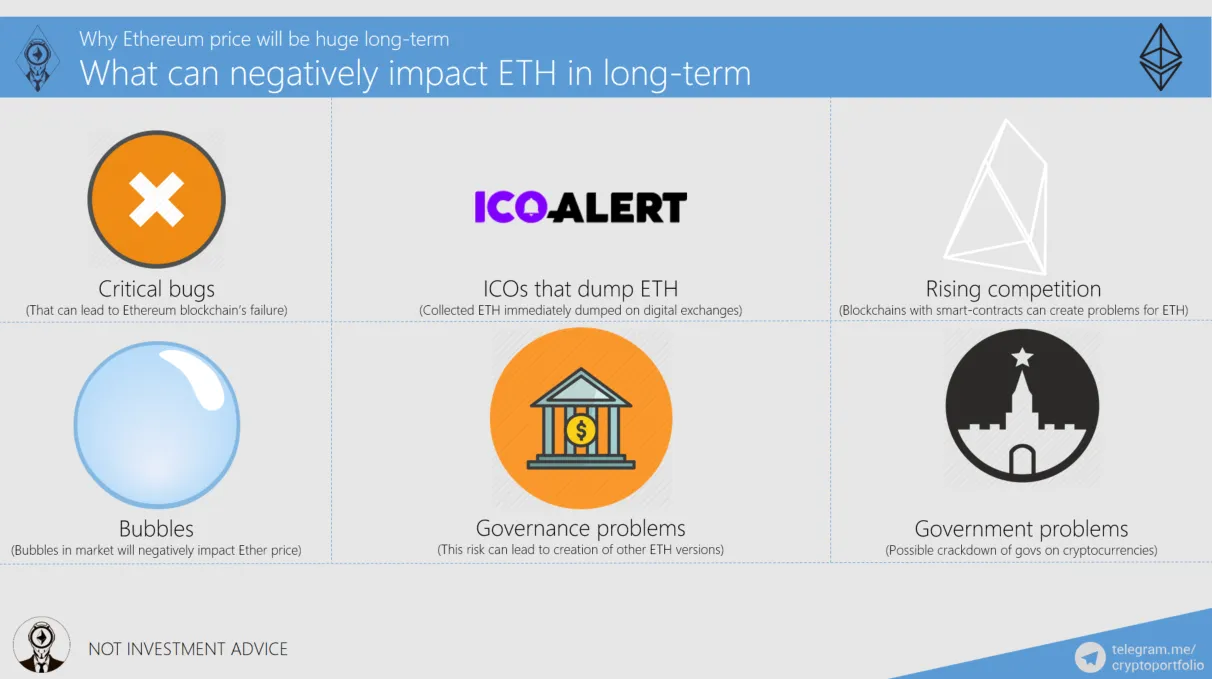

From my point of view, critical bugs are what can bring Ether to its knees. Developers from Ethereum foundation understand it too, so they test their code very meticulously before letting people use it.

A lot of projects that collect funds and dump ETH on digital exchanges for other assets. This hedging really suppresses ETH price.

Then, we have competition. Competitors like EOS, Aeternity, QTUM, and others. Well, ETH has certainly advantage here. We have working blockchain which is already capable of smart contracts. Also, our community has a lot of developers who will be reluctant to move to any other chain if Ethereum satisfies their needs.

Market bubbles usually burst. So, any cryptocurrency’s price can be affected during this event.

Then, what if there is a conflict inside developers’ house? What if the developers will be divided by different future vision for Ethereum? That may be a giant problem, actually. It may lead to hardforks and creation of new chains. It will certainly be a negative event for Ether price. I hope that in case Ethereum developers will have different views, they will turn to community to decide. That can be done by voting with ether.

Finally, what if governments start banning cryptocurrencies. Yes, I get it that cryptocurrencies have no borders. Still, if the main countries, which buy and sell crypto, (like USA, Germany, Russia) declare cryptocurrencies illegal, there will be negative consequences for ETH price. I hope it will not ever happen, but risk still remains

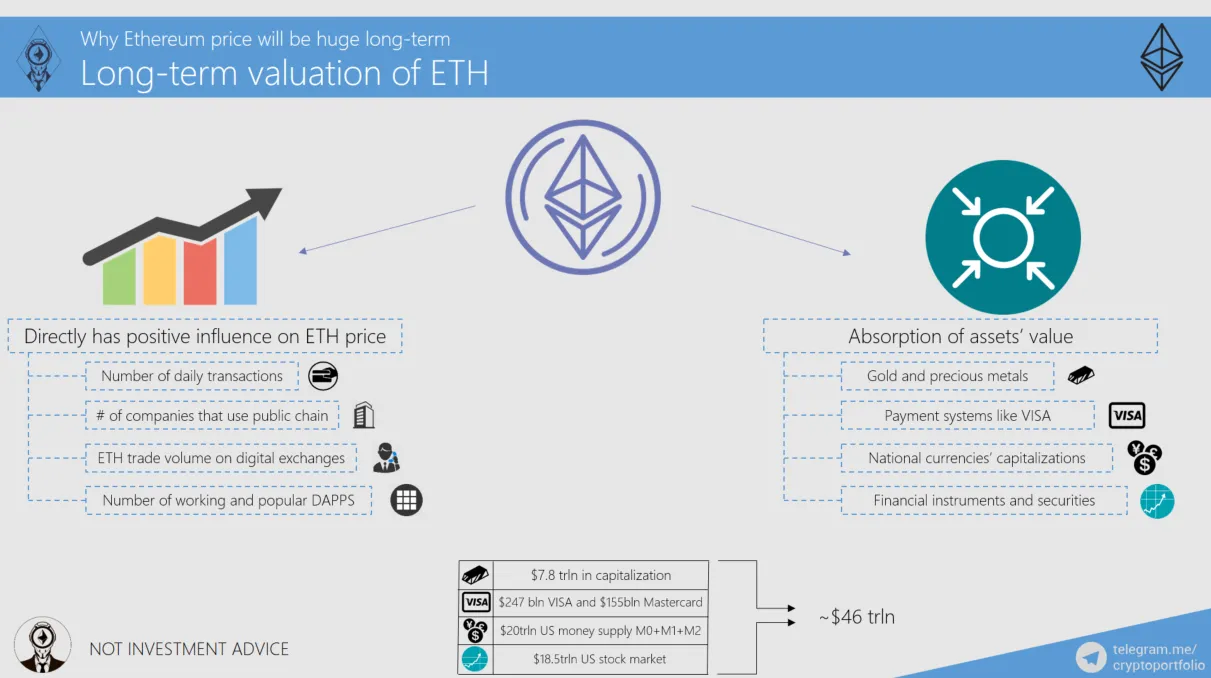

Let’s now examine the main drivers of Ethereum price.

• There is direct relation between number of transactions and Ether price

• The same applies to number of companies that actively participate in the life of public chain (transfer from point a to point b or use smart contracts, doesn’t matter if they do it on PUBLIC chain)

• The most attractive assets are actively traded on digital exchanges like Poloniex

• DAPPs have the biggest significance on ETHER price. Decentralized applications will be the gateway of ordinary people to Ethereum blockchain. The more DAPPs are used, the more transactions there will be, the bigger positive effect it will have on the price.

Do you know that you sometimes can compare shares of one company to similar company’s shares? This way you can find whether shares are overbought or oversold. Let’s try to compare Ethereum capitalization to assets which may be will be absorbed by Ether.

• Gold and precious metals. How can I compare those two assets? They both have limited supply (after ETH Proof-of-Stake adoption), they are means of exchange (even though, gold is not very popular at the moment), both assets are valuable to society.

• Payment mechanism. This is the closest comparison, because the only thing VIZA does is it accommodates cashless transactions between people to organizations and people to people. This is what ether also can do. Scalability solutions of Ethereum will create the strongest competitor to VISA and Mastercard.

• Currencies. Can Ether absorb value of a national currency? Well, Ethereum capitalization is already higher than the money supply of Ukraine. Right now, Russian government is so frightened by cryptocurrencies, it wants to create cryptoruble. They understand that cryptocurrencies are a direct threat to national currencies. The reason? It is not only much more convenient to use, it doesn’t have significant inflation, you can send it anywhere in the world, and there is no commissions. It is a threat to any currency. That is why Ether can absorb the value of national currencies if it becomes scalable enough.

• Financial instruments and securities. Some tokens on Ethereum blockchain are already called securities, I do not think we are too far away when money from financial institutions will flow into our blockchain. It is actually already happening. Maybe Ether is not a security itself, but I am certain that there will be a lot of money infusions into Ethers from Wall Street.

What about capitalizations of the assets mentioned above?

• Gold $7.8 trln in capitalization

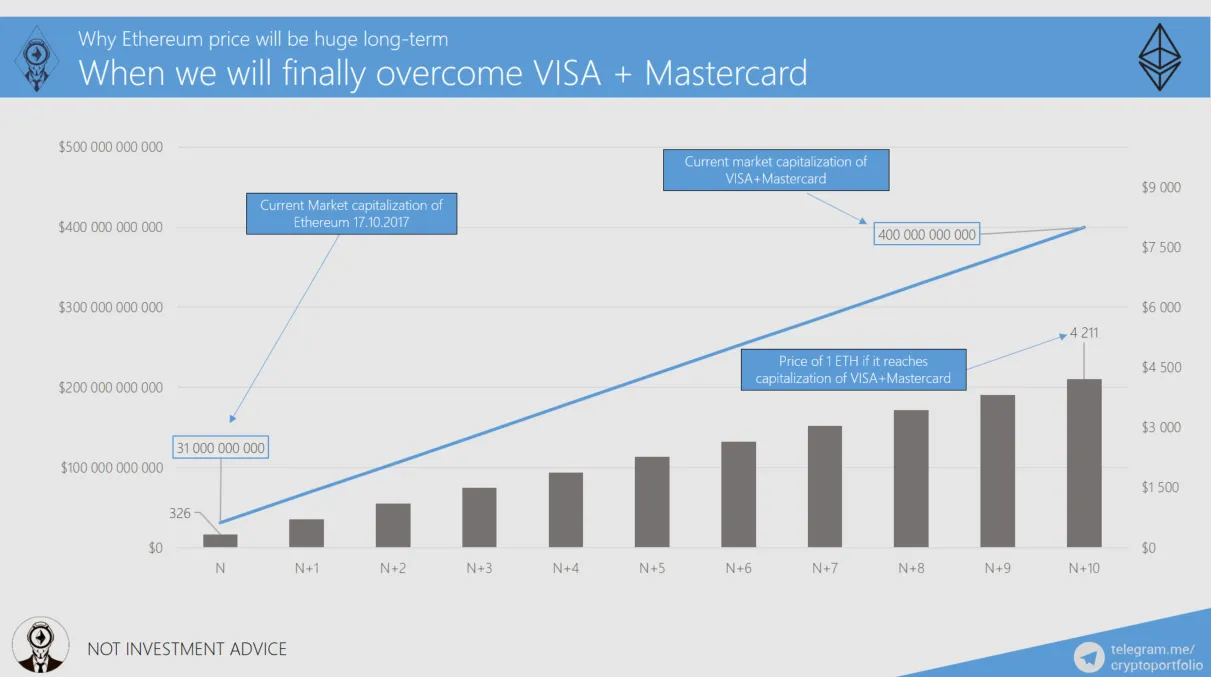

• $247 bln VISA and $155bln Mastercard

• $20trln US money supply M0+M1+M2

• $18.5trln US stock market

$46trln in total.

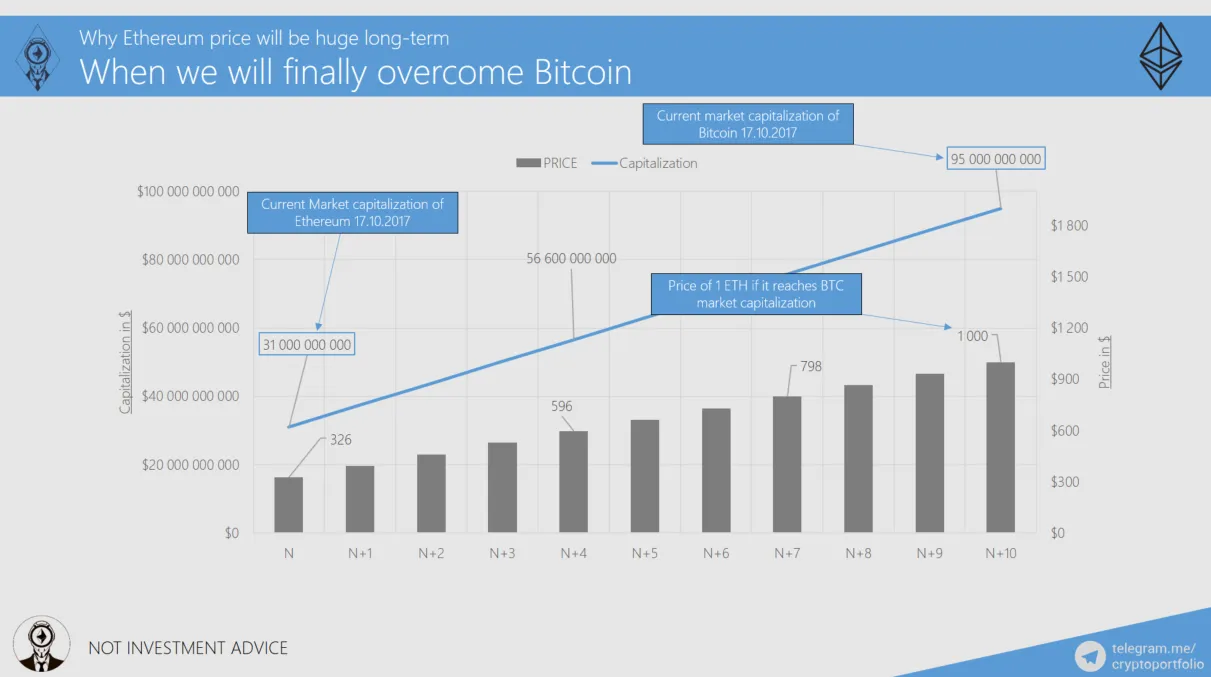

When will we overcome Bitcoin? It will happen when the capitalization of Ethereum will exceed the capitalization of Bitcoin.

Even though, Ethereum currently is twice as big as Bitcoin was in March 2017, it is still behind Bitcoin. Let’s assume that the Fred Wilson’s forecast comes true, what will be the price for ETH then?

First of all, this is the current market capitalization of Ethereum, a little bit more than $30bln.

Here you can see the current market cap of Bitcoin.

Finally, on the right, there is approximate price for ETH, it is $1000. If we are to overcome Bitcoin in 2017, price for 1 ETH will be bigger than $1k.

Finally, let’s see what will be the price for 1 ETH if Ethereum conquers the business of VISA and Mastercard.

If Ethereum happens to steal payment systems’ business, market capitalization of Ethereum will exceed $400bkn, and price for 1ETH will be more than $4200.