Hi Everyone,

I am finally posting my last written post in my market structure series. I have taken quite a break from this series. My previous post ‘Market Structure #6 – Monopsony’, was posted just over two months ago. I thought about wrapping up the series a little earlier but instead I decided to post about economics in relation to the Steem platform. I felt I needed to understand as much about the Steem environment as possible. This is because I believe that oligopsony market structure applies to many users on the Steem platform.

Before I describe what I mean by an oligopsony market structure. I want to provide a quick recap of the work I have done in my market structure series as well as my work relating to the Steem platform.

Quick recap of my market structure series

The market structure series began about 5 month ago. I started the series with a very broad introduction to the market structures that I intended to cover in the series. I then covered each market structure in more detail in individual posts. These market structures are as follows:

- Perfect Competition

- Monopolistic Competition

- Oligopoly

- Monopoly

- Monopsony

- Oligopsony

I have provided links to all the posts in the market structure series at the end of this post.

Oligopsony is the final market structure to be covered. This is the market structure that I believe has the most relevance to Steem. It is also the market structure that I believe gets the least attention. Therefore, I hope this post is a valuable read to both economists as well as those trying to understand how the Steem ‘content’ market works (I still find I am learning something new every day).

Quick recap of my economics posts relating to Steem

About 2 months ago, I started writing posts explaining various aspects of Steem from the perspective of an economist. I started with a post where I covered the areas of the platform that I considered most important. I then focused on various aspects of the platform such as the ‘Trending’ page, bots, and voting. The work put into these post made me feel more comfortable regarding how economics can be used to analyse the Steem platform.

I have provided links to my posts relating Steem at the end of this post after the market structure series.

What is the oligopsony market structure?

An oligopsony has only a few buyers and usually many sellers. This generally gives the buyers greater control over price and quantity than the sellers. An oligopsony can be considered the opposite to an oligopoly market structure, which has many buyers and just a few sellers. Oligopsonies can be considered to operate very similarly monopsonies. Quantity demanded and price are generally below the allocative efficient quantity and price.

There are normally very few barriers to entry in regards to the sellers, though low prices can be considered as a deterrent. There are likely to be quite strong barriers to entry for the buyer or there are no other buyers interested in what the sellers are offering. Oligopsonies are generally not very profitable to sellers in either the short-run or the long-run.

Oligopsonies, just like Monopsonies, are rare. Supermarket demand for agricultural products and publisher demand for book manuscripts are two commonly cited examples of oligopsonies. @honeybee provided the oligopsony example of schools hiring teachers in a particular area, see his post, ‘Tackling underpaid teachers?’

Does Steem resemble an oligopsony market structure?

Before I started this market structure series, I was casually looking at where the top Steem content creators were getting the majority of their upvotes. It did not take long to realise that most of our top content creators were getting the majority of their rewards from just a few accounts. A post may have a thousand upvotes but, most of the time, the top five highest upvotes account for more than half the value of the posts payout.

I have collected vote data for 30 days for some of the most successful Steem authors (I put myself in their just for fun). Table 1 contains the percentage of total payout received from each author from their top 5 upvoters (I am using the terminology upvoter rather than curator as not all upvoting, in my opinion, should be considered as curation).

Table 1: Percentage of payout from the top 5 highest value upvoters (14/07/2018 to 12/08/2018)

| User | 1 | 2 | 3 | 4 | 5 | Total | Rep |

|---|---|---|---|---|---|---|---|

| @acidyo | 26.1% | 20.7% | 11.4% | 6.2% | 4.2% | 68.6% | 76 |

| @adsactly | 34.5% | 7.8% | 7.2% | 6.9% | 5.8% | 62.2% | 77 |

| @africa | 79.5% | 6.4% | 5.0% | 2.8% | 1.2% | 94.9% | 71 |

| @aggroed | 12.9% | 10.8% | 9.8% | 7.3% | 6.9% | 47.7% | 74 |

| @berniesanders | 46.4% | 19.6% | 8.4% | 4.6% | 4.4% | 83.4% | 69 |

| @donkeypong | 23.2% | 14.9% | 10.0% | 8.6% | 6.7% | 63.4% | 74 |

| @exyle | 13.5% | 13.3% | 9.7% | 8.9% | 7.4% | 52.8% | 75 |

| @good-karma | 47.4% | 25.5% | 1.9% | 1.3% | 0.7% | 76.8% | 75 |

| @gringalicious | 16.2% | 10.2% | 8.9% | 6.2% | 5.3% | 46.8% | 75 |

| @haejin | 72.4% | 25.0% | 0.2% | 0.1% | 0.1% | 97.8% | 81 |

| @kafkanarchy84 | 17.5% | 11.3% | 9.0% | 7.9% | 5.5% | 51.2% | 74 |

| @kaylinart | 28.7% | 28.0% | 14.9% | 2.8% | 2.6% | 77.0% | 74 |

| @kevinwong | 42.5% | 11.7% | 11.2% | 9.5% | 1.6% | 76.5% | 75 |

| @kingscrown | 16.6% | 15.7% | 12.0% | 8.5% | 6.8% | 59.6% | 77 |

| @krnel | 35.4% | 20.1% | 8.1% | 7.7% | 7.6% | 78.9% | 77 |

| @michelle.gent | 44.6% | 9.5% | 6.9% | 6.0% | 5.7% | 72.7% | 74 |

| @opheliafu | 32.2% | 28.0% | 19.4% | 2.0% | 1.9% | 83.5% | 75 |

| @papa-pepper | 28.0% | 7.8% | 3.9% | 3.6% | 2.6% | 45.9% | 77 |

| @sirwinchester | 45.7% | 17.5% | 9.6% | 6.0% | 5.3% | 84.1% | 75 |

| @slowwalker | 16.5% | 12.2% | 5.7% | 5.2% | 3.9% | 43.5% | 76 |

| @spectrumecons | 54.5% | 9.3% | 8.5% | 6.2% | 4.8% | 83.3% | 64 |

| @steemsports | 22.0% | 11.9% | 8.3% | 8.1% | 6.4% | 56.7% | 78 |

| @sweetsssj | 45.6% | 10.8% | 4.0% | 2.6% | 2.4% | 65.4% | 75 |

| @teamsteem | 17.6% | 10.6% | 9.5% | 7.7% | 5.7% | 51.1% | 73 |

| @timsaid | 38.8% | 12.9% | 11.3% | 7.9% | 4.5% | 75.4% | 73 |

| @tuck-fheman | 17.2% | 15.0% | 14.7% | 13.0% | 8.5% | 68.4% | 74 |

| @velimir | 62.3% | 16.5% | 2.8% | 2.5% | 1.9% | 86.0% | 75 |

Source of data: http://www.steemreports.com/

Note: Bot upvotes do not seem to be included in the data

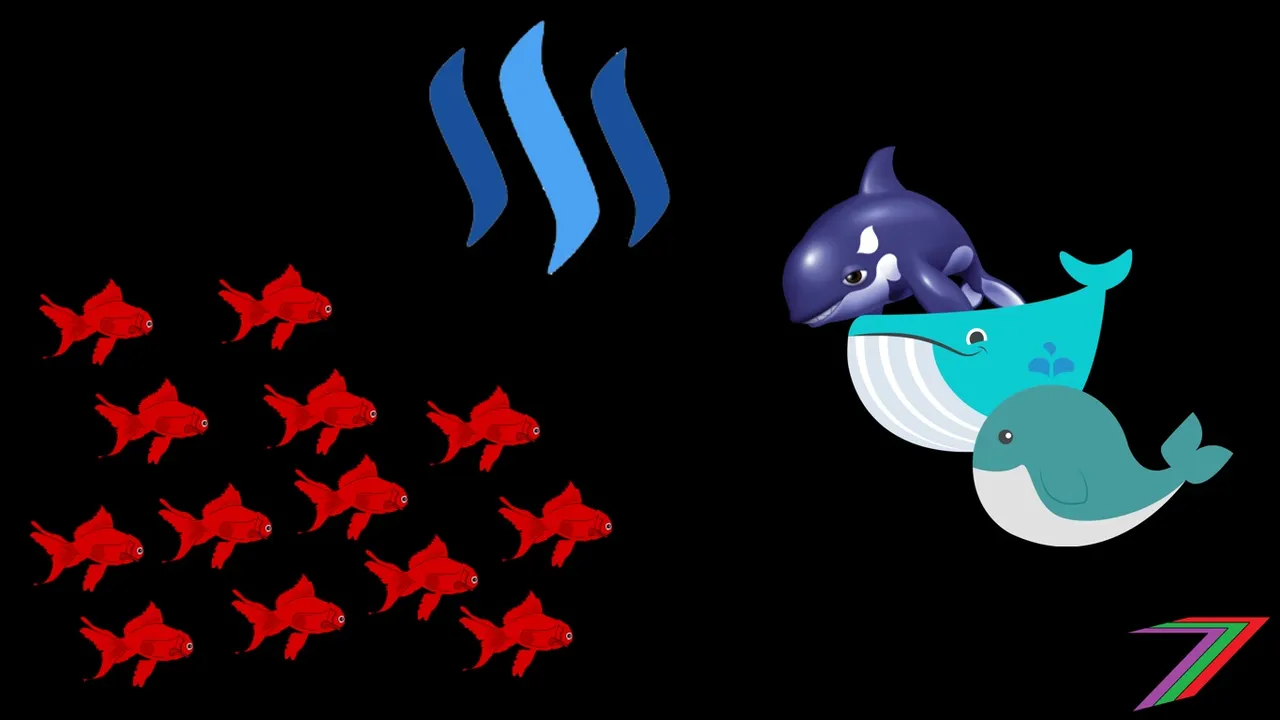

As can be seen from the table, most of Steem’s most successful authors are relying on just a few accounts to earn most of their rewards. For many of these content creator’s, their own account is also included in their top five upvoters. So many of these content creators rely on 4 or less other accounts for their rewards. If we treat those rewarding content as buyers and the content creators as sellers, we have what appears to be a market structure similar to that of an oligopsony.

This can be further supported by the distribution of stake (MVests) across accounts. The top 0.2% of accounts (approximately 2041 accounts) hold slightly more than 90% of the stake in Steem. If a post is not getting votes from any of these 2041 accounts, the payout is going to be very low. On the same date, in 2017, the top 0.2% of accounts had an even larger stake; approximately 95% of the stake in Steem. We can expect, as the supply of Steem increases, the concentration of stake with the largest accounts to fall. The following tables contain the number of users for each user rank as well as the percentage stake they hold in Steem.

Table 2 contains the number of accounts and MVests in 2018 and Table 3 contains the number of accounts and MVests in 2017.

Table 2: Accounts and total number of MVests for each rank in 2018

| User | Number | Percent | MVests | Percent |

|---|---|---|---|---|

| 980689 | 89% | 8545 | 2% |

| 109878 | 10% | 4968 | 1% |

| 8571 | 1% | 24828 | 6% |

| 1728 | 0% | 46964 | 12% |

| 276 | 0% | 69218 | 18% |

| 37 | 0% | 236838 | 61% |

| Total | 1101179 | 100% | 391361 | 100% |

Source: https://steemit.com/statistics/@arcange/steemit-statistics-20180811-en

Table 3: Accounts and total number of MVests for each rank in 2017

| User | Number | Percent | MVests | Percent |

|---|---|---|---|---|

| 258415 | 85% | 1339 | 0% |

| 39730 | 13% | 46 | 0% |

| 5018 | 2% | 7123 | 2% |

| 1157 | 0% | 23843 | 7% |

| 230 | 0% | 50065 | 15% |

| 42 | 0% | 254980 | 76% |

| Total | 304592 | 100% | 337396 | 100% |

Source: https://steemit.com/statistics/@arcange/steemit-statistics-20170811-en

In regards to barriers to entry, anyone with internet access can set-up a Steem account (easy access to sellers of content). Anyone can also be a buyer of content (upvoter) but not everyone can afford to invest in a significant amount of Steem. To become a whale someone will need to acquire over 500,000 Steem Power. At the current price of Steem that is almost US$500,000. This barrier becomes greater if the price of Steem increases.

Competition in the Steem oligopsony

Oligopsonies favour the buyers rather than the sellers. Sellers need to fiercely compete in order to obtain rewards from the buyers. This competition can be through quality or price. In regards to Steem, quality would refer to content that is going to attract more users and investment to the platform. More users and investment will increase the price of Steem and the value of the investment.

In regards to Steem, price relates to the value of the upvote given. Content creators can lower the price by paying the upvoter (vote selling). This sounds extremely counterintuitive, it appears the seller is paying the buyer. The upvoter is using their stake in Steem to reward content using newly created Steem from the rewards pool. The creation of the rewards pool is the dilution of the upvoters stake. It is like the stake holder has mandatorily paid for content in advance and is then just required to allocate this payment. If the content creator pays the upvoter, it is like offering them a discount on their upvotes. This could be another reason to support the existence of the Steem bid-bots.

Which form of competition is better, quality or price? This is normally a more straight forward answer. The buyer aims to maximise their utility or profits from their purchase. In regards to Steem, competition based on price works that way. The content creator that offers the highest payment for a vote (lowest price to the buyer), will receive the highest valued votes. Competition based on quality does not work in the same way. Upvoting the highest quality content is beneficial to the whole community and not just to the upvoter. The benefits are not going to be immediately obvious but in the long-run the overall benefit from upvoting based on quality will be greater than the benefit from upvoting based on price.

Potential problems of the Steem oligopsony

Typically in an oligopsony, there is some assurance that the buyers are going to be around in the long-run. All the large supermarket chains are not going to close down over night. They have invested in infrastructure to receive the seller’s goods. They have established markets they can sell the goods. Steem content creators do not have that same assurance. An upvoter can just decide to stop upvoting any time they like with zero cost to them. This is very risky for a content creator that relies on just a few upvoters for almost all of their rewards. If content creators received the majority of their rewards from many users, the risk is greatly reduced.

There is also additional risk to the buyers as well. Determination of rewards lies in the hands of just a few. This could lead to the wrong content (content that does not attract many users or investors) getting rewarded at the detriment of the platform as a whole. If the rewards come from more upvoters, this risk is reduced, as the upvoters are more likely to be representative of potential users and investors in the platform.

Solution

There is not a straight forward solution. Content creators could try to be more proactive to obtain a greater number of upvoters. This will be difficult as there are so few accounts that hold a large stake in Steem. Another solution would be if the large stake holders delegated to more users. This would imitate a market structure with many buyers (I am thinking monopolistic competition) and this should produce a more efficient outcome for Steem. This might not be popular, as this strategy is less favourably in the short-run to the large stake holders. It will reduce their capacity to accumulate more Steem.

The oligopsony market structure may only be a temporary problem as the concentration of wealth should be expected to fall. The increased amount of Steem Power tied up in bid-bot accounts will likely slow this process down; hence the growth of the platform. Let’s just hope this process does not take too long.

End of the series

I have reached the end of my market structure series in regards to written posts. I will return to the series on video. I think presenting my content in both written and video format helps make it easier to digest for my audience. I have not put many videos together recently but that is going to change very soon. I have quite a backlog of written posts that should be presented as videos. I will most likely be presenting these videos on DLive. This platform has a lot to offer, I have also been very impressed with the professionalism shown by their team.

Thank you for taking the time to read my post. I appreciate any feedback or comments that you may have.

The other posts in the market structure series

All the posts in the market structure series can be accessed using the links below. Reading these posts should add a little more perspective and understanding to this post

If you want a quick overview of the market structures I that I have covered in this series, you can use the link below to view the introduction post.

Perfect competition post can be accessed using the following link.

Monopolistic competition post can be accessed using the following link.

Oligopoly post can be accessed using the following link.

Monopoly post can be accessed using the following link.

Monopsony post can be accessed using the following link.

Applying economics to Steem

To also further supplement this post, I have included links to my other posts that investigate Steem from the perspective of an economist.

Here is the link to the post ‘The economic implications of the existence of the rewards pool’

Here is the link to the post ‘Bid bots and the possible economic implications’

Here is the link to the post ‘Bid bots and the possible economic implications’

Here is the link to the post ‘The trending page aka the front page of Steemit’

Here is the link to the post ‘Changing the way voting works to improve fairness and rewards – My little fantasy’

Here is the link to the post ‘Steem explained by an economist’