Hi Everyone,

In this post, I will be continuing my series on market structure. I will be looking at the monopoly market structure. Monopolies are often looked at in disdain. The producer controls the price and quantity of a good or service. If the monopolist acts purely in their own interests, buyers will appear to be exploited. This post will investigate if monopoles deserve such a bad reputation.

Quick recap

Before I explain monopoly any further I will provide a quick recap of the series so far. I started this series about 3 month ago. So far, I have provided a brief introduction to market structures. I have covered perfect competition, monopolistic competition, and oligopoly market structures. The introduction provides a brief outline of the six market structures that I am covering in the series. The other posts delve into a lot more detail regarding each market structure.

The market structures covered in this series are as follows:

- Perfect Competition

- Monopolistic Competition

- Oligopoly

- Monopoly

- Monopsony

- Oligopsony

The first four market structures in the list are typically discussed in detail in academia. Monopsony is sometimes discussed but in less detail. Oligopsony is rarely discussed. I will be covering oligopsony because of its real life relevance to Steemit and the Steem platform. The oligopsony post will be a little less theoretical than the other posts in this series.

What is the monopoly market structure?

Monopoly in its purest sense is a market with just one seller. There are normally many buyers but this is not always the case. A monopoly could exist where there are several sellers but one firm has almost the entire market share. This is not the textbook monopoly of purely one seller but the market behaves in exactly the same way. There are very significant barriers to entry. These barriers are so significant that no other firms, in any capacity, can enter the market or compete with the monopoly firm.

Monopolies have the opportunity to be profitable in both the short-run and the long-run (supernormal profits in economics terminology). Barriers to entry ensure lack of competition, this allows monopolies to charge whatever price they like. Inefficiency could result in loss of profitable. Inefficiency may occur when monopolies become complacent from lack of competition and this causes costs to rise. Inefficiency can occur because of diseconomies of scale. Diseconomies of scale occur when a firm becomes too big to operate efficiently. This is very common in large Government bureaucracies. Monopolies are also considered allocative inefficiency, this will be elaborated in the monopoly pricing section of this post.

Monopolies are generally Government owned. The Government prohibit other firms from entering the market to compete. These monopolies may include services such as the provision of electricity, water or transportation. Many Governments claim that public goods can only be provided by Government as the private sector cannot profitably provide these goods in sufficient quantity. Possible examples of public goods are as follows:

- Roads

- Clean air

- Street lighting

- Sewers

- Public parks

- Lighthouses (Paul Samuelson has an interest argument around lighthouses)

- Provision of law enforcement

- Defence services.

Private monopolies exist as well but are less common than Government monopolies. Private monopolies are generally not pure monopolies but instead have considerable monopoly power. Microsoft was considered a monopoly back in the 1990s. Google has considerable monopoly power, some argue it could be called a monopoly. These cases are generally not clear cut. Many large firms operate in several markets. The monopoly power in each market may vary quite substantially.

Monopoly Pricing

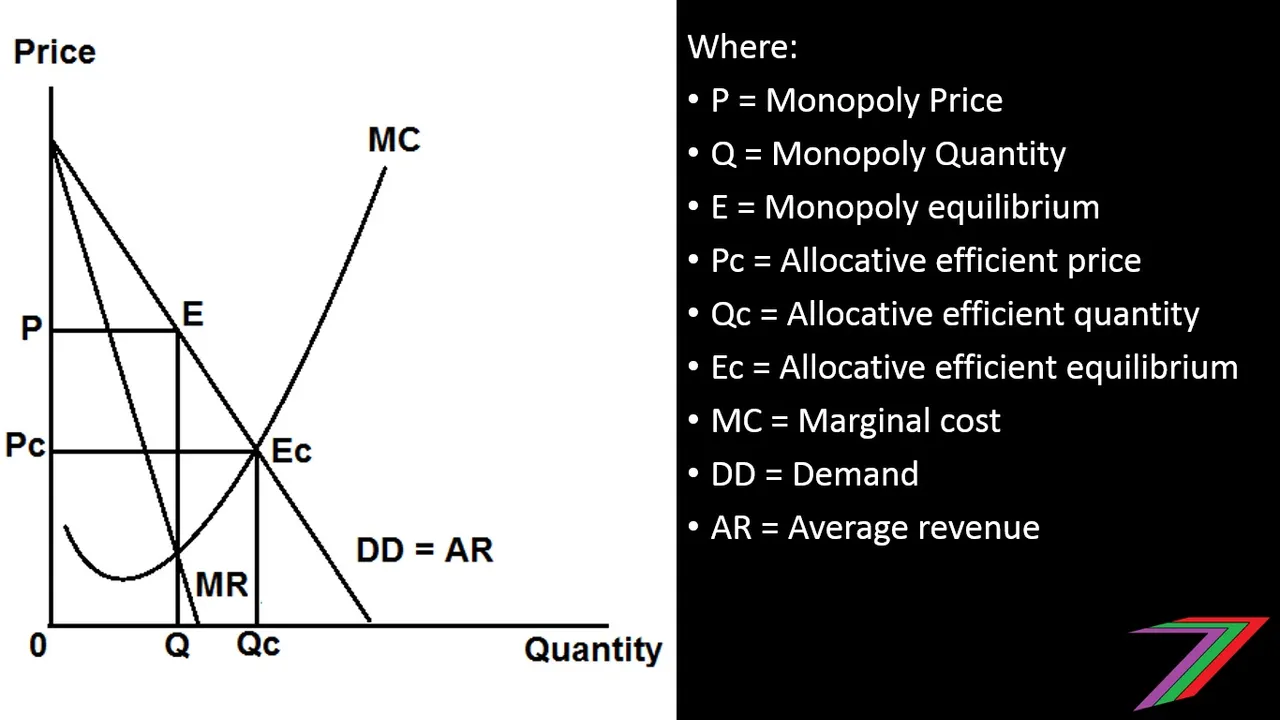

Monopolies that aim to maximise profits will produce output until marginal revenue equals marginal cost. Producing a higher quantity will reduce profits as the marginal cost of producing an extra unit will exceed the marginal revenue obtained from that unit. Monopolies will set the price at the demand where marginal revenue equals marginal cost. See the figure below for more information on how, in theory, monopolies set price.

Figure: Monopoly Prices

The figure also shows the allocative efficient price and quantity. The price monopolies charge is usually well above the allocative efficient price as the demand for a monopoly’s goods and services are more inelastic; this is mostly because of lack of alternatives. Monopolies can be expected to charge more than monopolistically competitive firms and oligopolies because of this inelasticity.

Government Regulation

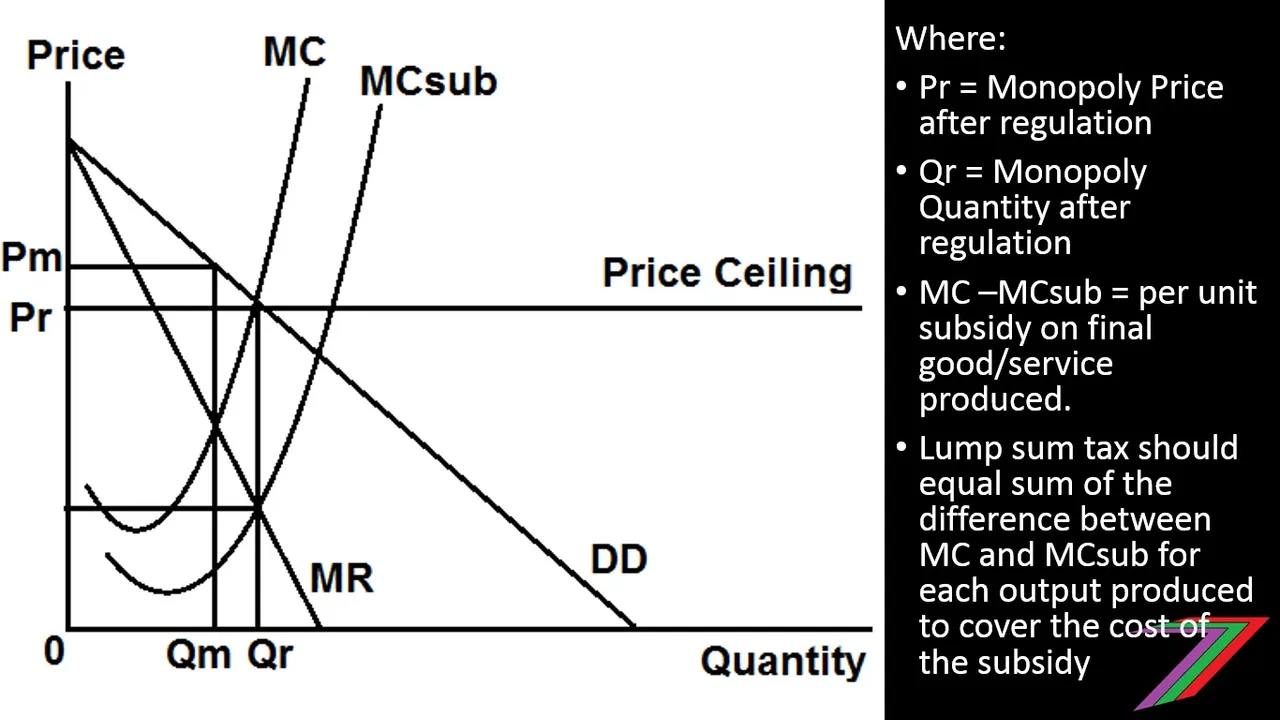

Monopoly pricing can be regulated by Government. There are several ways this can be done. One approach is to impose a price ceiling. A price ceiling is a maximum price a monopoly can charge for a good or service. The price ceiling should be below the price a monopoly would charge to maximise profits but not below the price for allocative efficiency to be achieved.

Subsidies and taxes can be used to regulate monopolies. Per unit subsidy can be used to reduce the marginal costs to the monopoly so that the monopoly is more inclined to set the price closer to that of the desired allocative efficient price. This per unit subsidy can also be followed up by a lump sum tax which can be used to fund the per unit subsidy. Lump taxes are not linked to output produced, therefore, monopolies will not respond by reducing output. Price ceiling, subsidies, and taxes relating to monopolies are explained in the figure below.

Figure: Monopoly Regulation

Note: Above figure is just a theoretical representation of regulation. Above approaches are rarely applied as described in the figure

If the monopoly is Government run, the Government should be able to charge the allocative efficient price. Considering the inefficiency of Government run industries, maintaining the lower price will result in losses and will burden tax payers.

Are monopolies bad?

Monopolies have a bad reputation but many people put that into the context of privately owned monopolies that exploit the people. Privately owned monopolies rarely exist and when they do, they are quite heavily regulated.

I will therefore focus more on Government monopolies. Governments will claim that they are acting in the best interest of the people by providing public goods as explained earlier in the post. It is still quite debatable as to what goods can be called 100% public goods (goods that are available to everyone without exclusion). There are examples when even law enforcement can be provided by the private sector.

Government monopolies and agencies are notorious for being bureaucratic and inefficient. The privatisation of monopolies is expected to improve quality of goods and service and as well making them available at lower prices. This is more likely to be true, if Government monopolies are privatised to become private sector oligopolies instead of private sector monopolies (see link at the end of this post for information on oligopolies). Increased competition along with the incentive to produce profit improves efficiency. Privatisation also reduces the size of Government and hence reduces costs to the taxpayers as well as the extent of bureaucracy in Government.

Privatising Government monopolies does not always work out. If privatisation occurs without the introduction of competition, the Government monopoly becomes a private sector monopoly, inefficiency may still continue and prices may in fact be higher as the private sector monopoly attempts to make a profit by passing on the inefficiencies through higher prices. Is it better to pay for inefficiencies through taxes or through higher prices?

There are many real world examples of privatisation. The success rate is quite mixed. It appears that telecommunications have been a success of privatisation. Whereas privatising water, electricity and rail has been less successful. This is mostly because telecommunications fits nicely into an oligopoly structure and water, electricity and rail do not. This indicates that the monopoly market structure is more problematic than if the monopoly is publicly or privately run.

Key points of post

The following are key points that you should take away from this post.

- Monopoly is a market structure that has one seller and normally many buyers.

- Monopolies does not produce an allocative efficient price or quantity for goods or services. Monopolies set their own price and quantity. Normally demand for goods and services of a monopoly are inelastic and therefore monopolies charge higher than firms in other market structures such as monopolistic competition or oligopolies.

- Monopolies have the opportunity to produce supernormal profits in the short-run and in the long-run. Monopolies can still make losses if they become inefficient to the point that marginal costs exceed marginal revenue. This is often the case for Government owned monopolies.

- Barriers to entry are very significant. These could be natural barriers or enforced barriers by the Government.

- There are several real world examples of monopolies but it is not a particularly common market structure. Most examples of monopolies are Government entities. It is very rarely the case that a monopoly is the only viable market structure for a market.

- Monopolies have a reputation for exploiting buyers. This is often not directly the case as private monopolies (there are very few) are regulated to maintain lower prices. Government monopolies often fail because of inefficiency rather than a direct intention to exploit buyers.

- Privatisation of monopolies can improve efficiency, lower costs, improve quality etc., if the privatisation also involves introducing competition. That is, if the monopoly market structure becomes oligopoly or even monopolistic competition.

Thank you for taking the time to read this post. I think we can certainly understand the bad reputation of monopolies. Not all monopolies intentionally directly exploit the people but ‘inadvertent’ inefficiencies certainly do.

My next post in the series will be on monopsony. Monopsony is rarely discussed in detail and has very few real life examples but it is an important market structure to know because of its unique nature. Monopsony also provides a very good precursor to oligopsony which has some interesting implications from Steemit and the Steem platform.

The links below contain the other posts in this series. To get a better idea regarding market structures as well as some of the terminology used in this post, please take a look at the other posts in this series.

If you want a quick overview of the market structures I am covering in this series, you can use the link below to view the introduction post.

Perfect competition post can be accessed using the following link.

Monopolistic competition post can be accessed using the following link.

Oligopoly post can be accessed using the following link.