Hi Everyone,

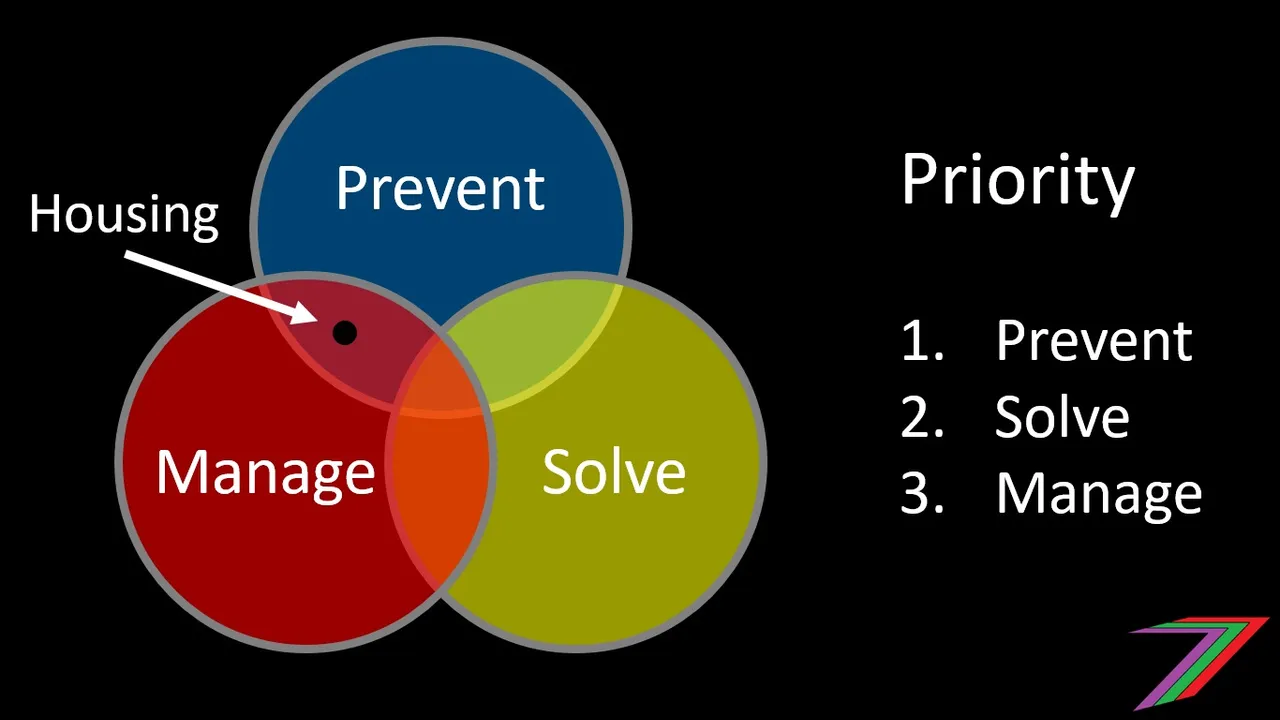

Everyone needs somewhere to live. Thus, housing can be considered one of the most important necessities. However, housing affordability is a huge problem in many countries. I have written a post and made a video both titled ‘The Mortgage Slave’. Both of these focused on the increasing price of housing in respect to household incomes. This post will focus on how the housing problem should have been and eventually can be tackled. I will apply the prevent, solve, or manage approach that I have discussed in several of my other posts.

Brief analysis of housing shortages and affordability problems

Why do we have housing shortages and affordability problems? We can easily argue that housing is a private good. It is excludable, i.e. you need to pay for it in order to obtain it. It is scarce, i.e. your consumption reduces the ability of others to consume it. Therefore, the market should be able to provide a sufficient number of homes at a price people can afford. In economics, we call this equilibrium. However, this is not the case in many countries; read my post and watch my video for more information.

Equilibrium price and quantity are determined by demand and supply. There are many different housing markets. These markets vary depending on house size, house type (i.e. detached, semi-detached, single-story, apartment, etc.), location (urban, suburban or rural), prestige, reputation, and ambience of the area. This can be split further into rental and buying markets. For the purpose of this post, I will refer to housing as a single market.

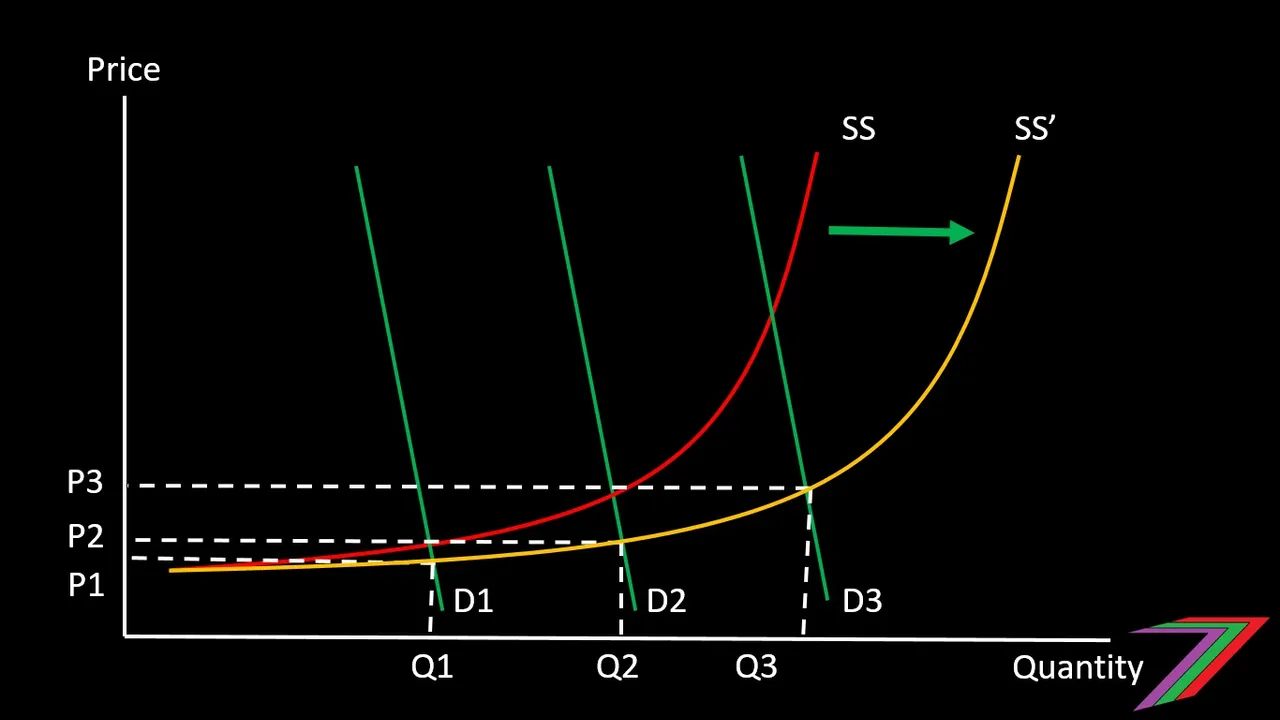

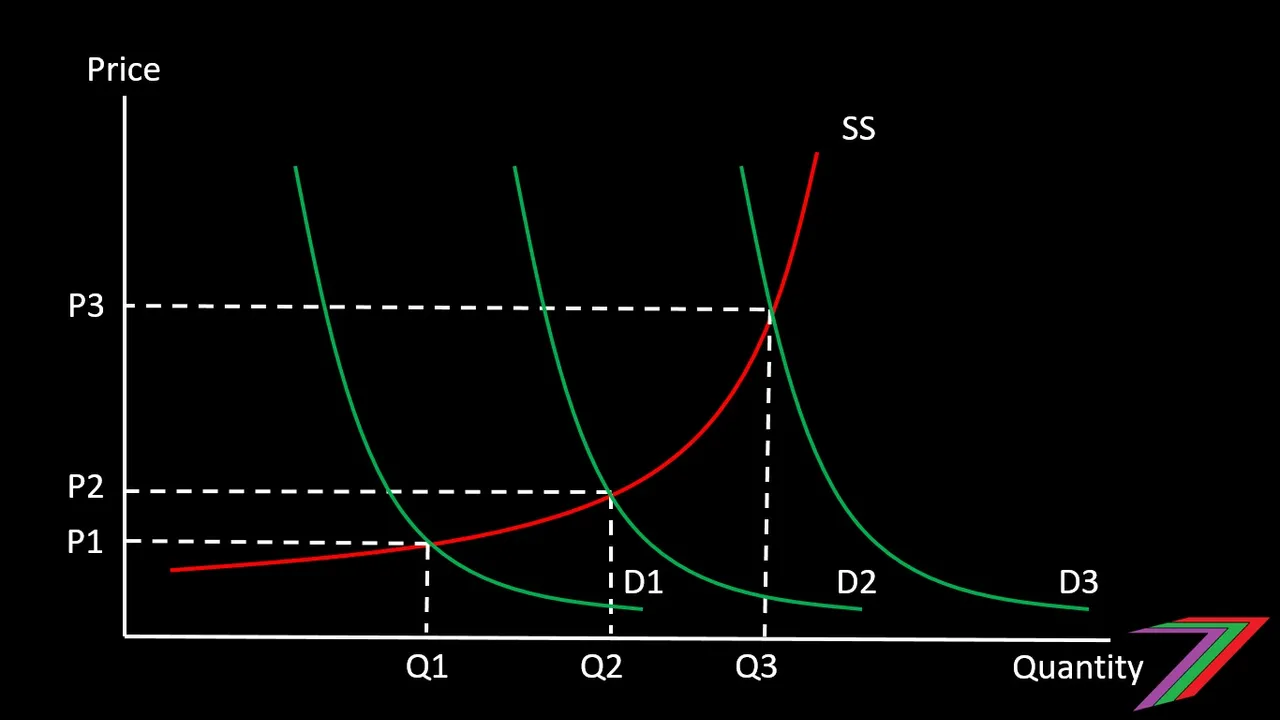

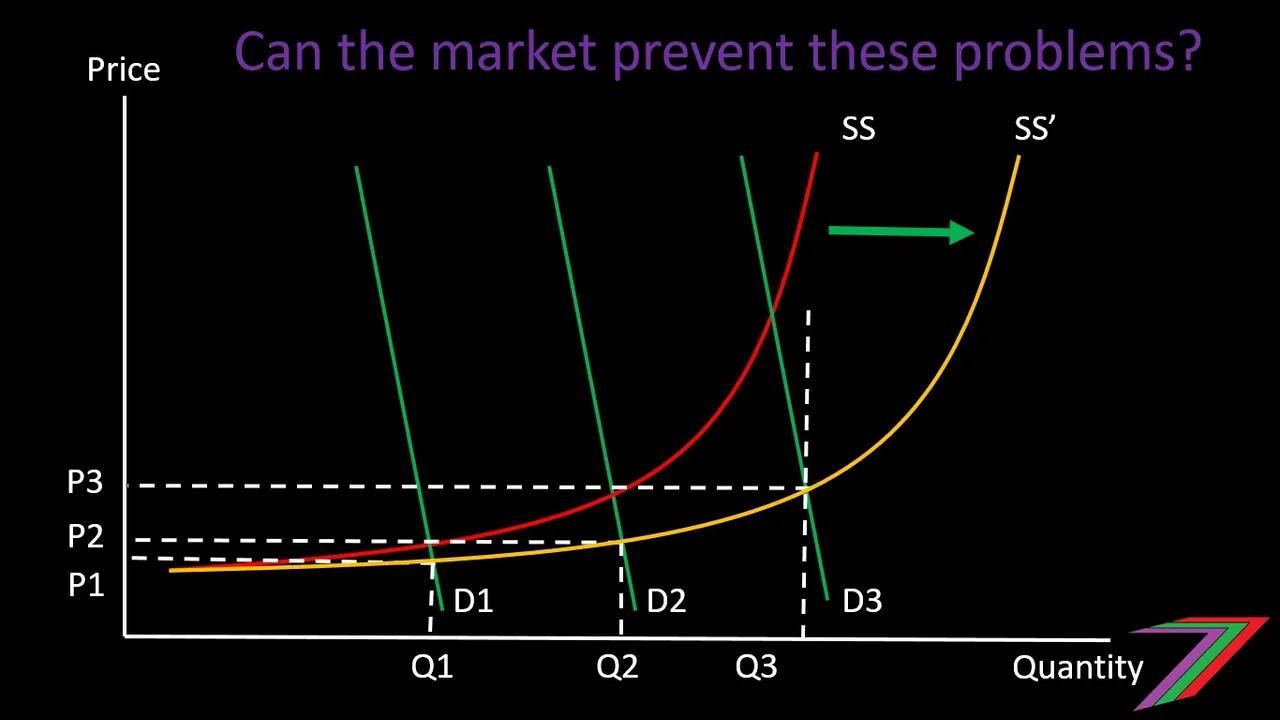

I would expect the demand for housing to be inelastic, as everyone needs somewhere to live. Supply could be either elastic or inelastic. I would expect supply to begin as elastic and become inelastic as supply of housing and residential land becomes scarcer. Figure 1 shows what I believe should represent the overall market for housing.

Figure 1: Housing Market

Note: D1, D2, and D3 represents demand increasing over time.

If we assume land to be fixed in quantity and demand for housing to continuously increase because of population growth, house prices will start to increase at an increasing rate as demand enters the more inelastic portion of the supply curve. However, I would expect the market to respond before house prices start to climb excessively. New houses could be built on smaller pieces of land. Existing land with one property could be divided to fit additional homes. More apartments could be built. Young people could remain living with parents for longer before moving out. If house prices are increasing, those building houses have incentive to build more houses. This increase in supply should prevent house prices ever becoming too unaffordable. Likewise, those who want to buy a house will either buy a smaller house or wait until they have saved sufficient money to buy their desired house. Equilibrium prices might adjust according to Figure 2.

Figure 2: House Market as Supply adjusts to increased demand

What I have described above is what I would expect to happen if the housing market were allowed to operate based on regular market forces. However, in most countries, that does not happen. A major reason for this occurrence is that the supply of houses does not respond to market forces as expected. There are several possible reasons for why this might be the case. One reason is zoning. Governments often zone land according to intended usage. This usage could be commercial, agricultural, industrial, forestry, or residential. The zone greatly influences the price of the land. This is because the land is required to be used according to the zone it has been allocated. Zoning greatly hinders the function of the market in determining land values. Supply of land is artificially limited and therefore puts greater pressure on the price of houses. Forbes outlines this problem in detail with links to several articles.

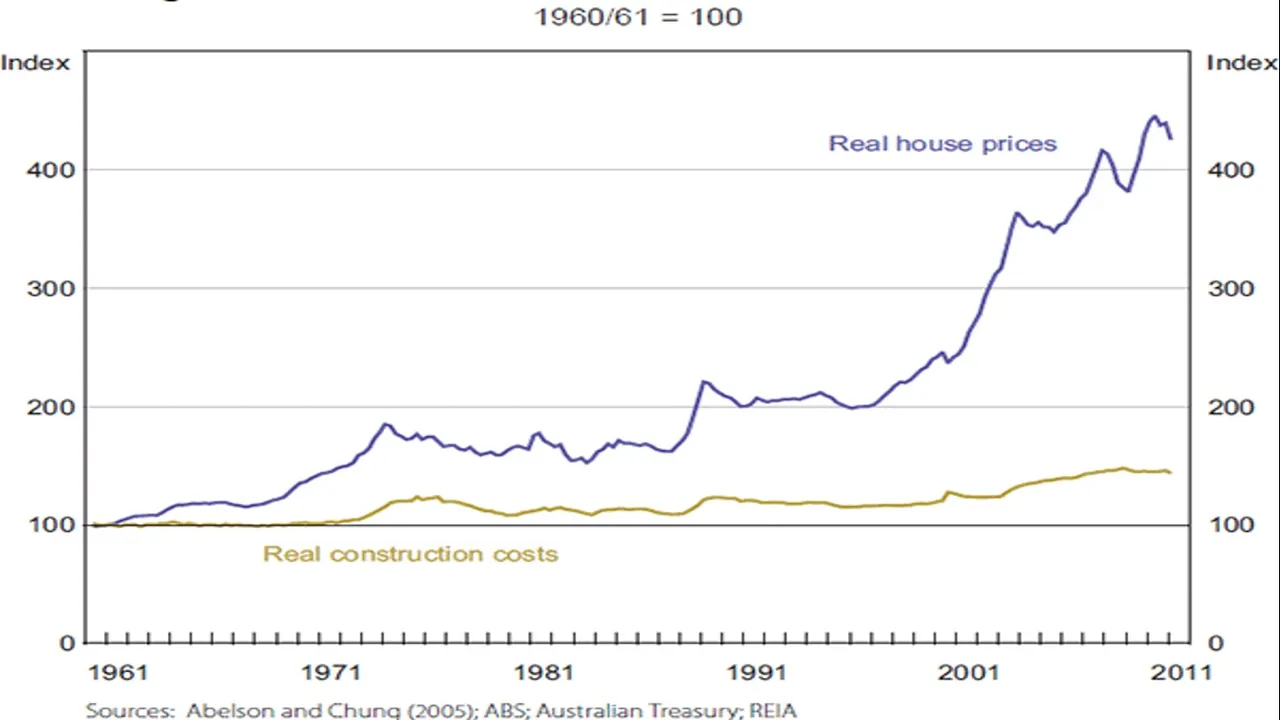

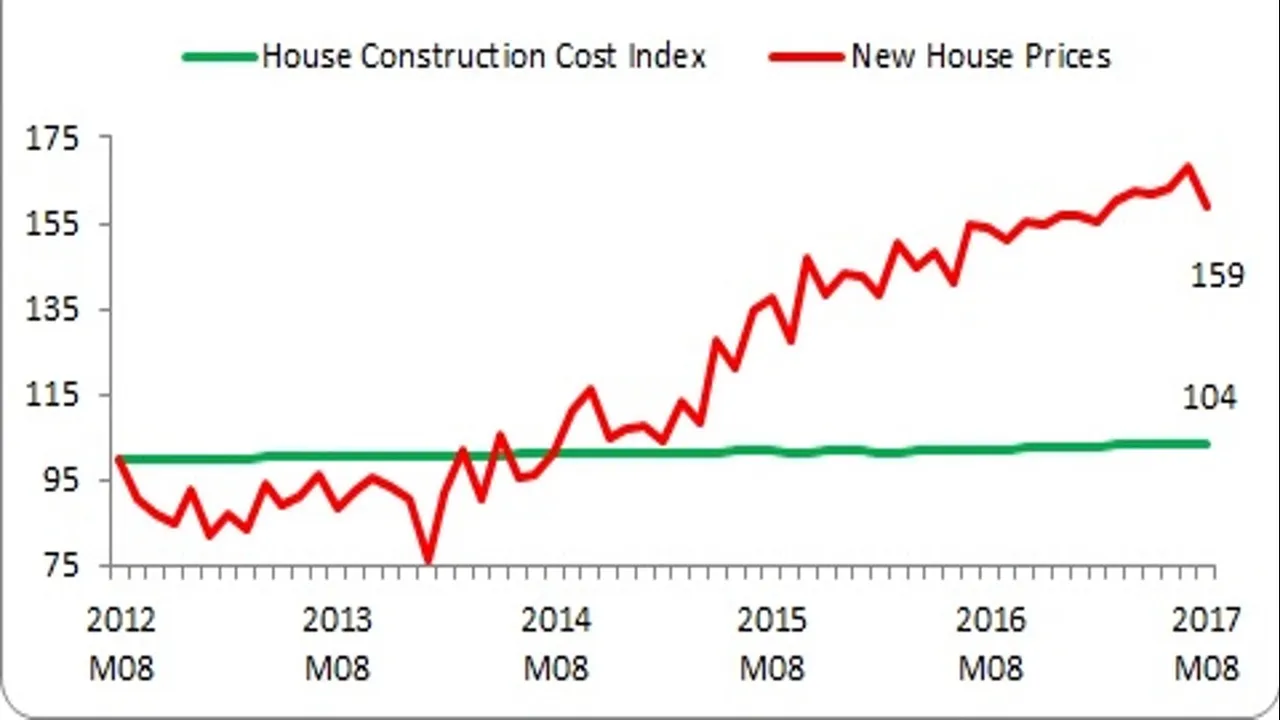

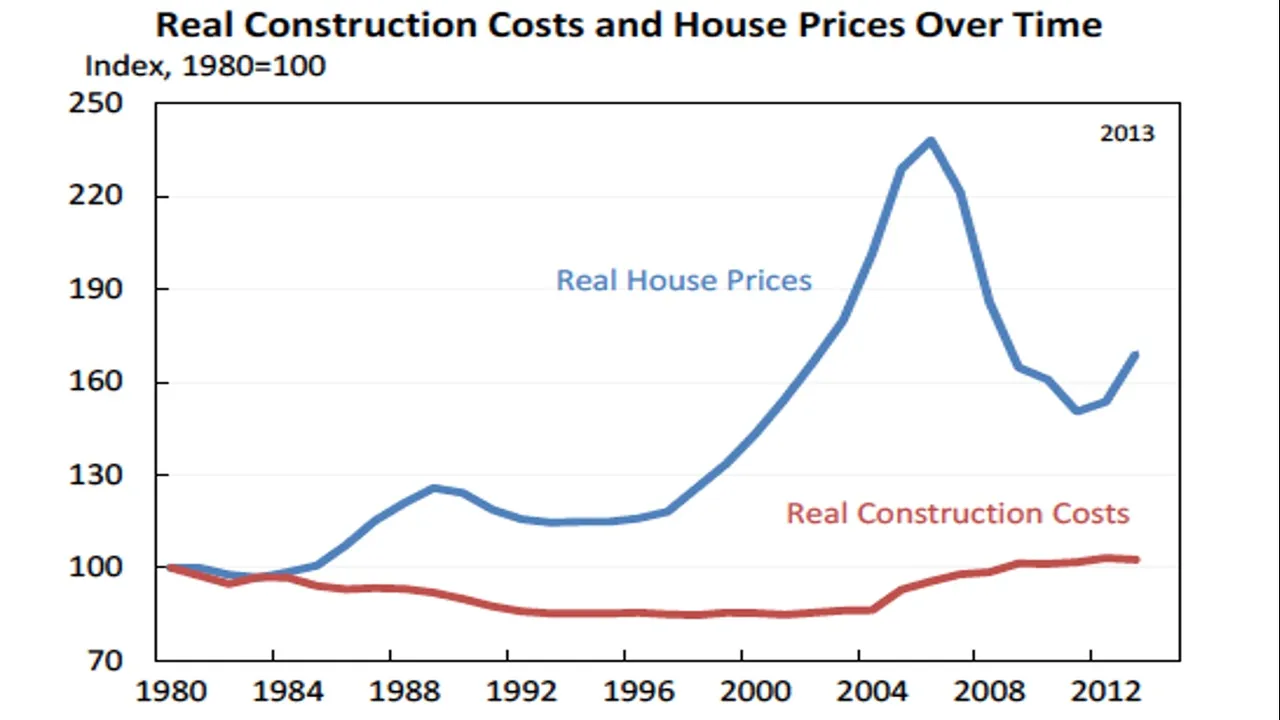

House prices are more effected by the price of land than the costs of construction. The figures below contain the price of construction and houses for Australia, Ireland, and the USA,

Figure 3: House prices and construction costs (Australia)

Source: RBA

Figure 4: House prices and construction costs (Ireland)

Source: Notes on the front

Figure 5: House prices and construction costs (USA)

Source: The Grumpy Economist

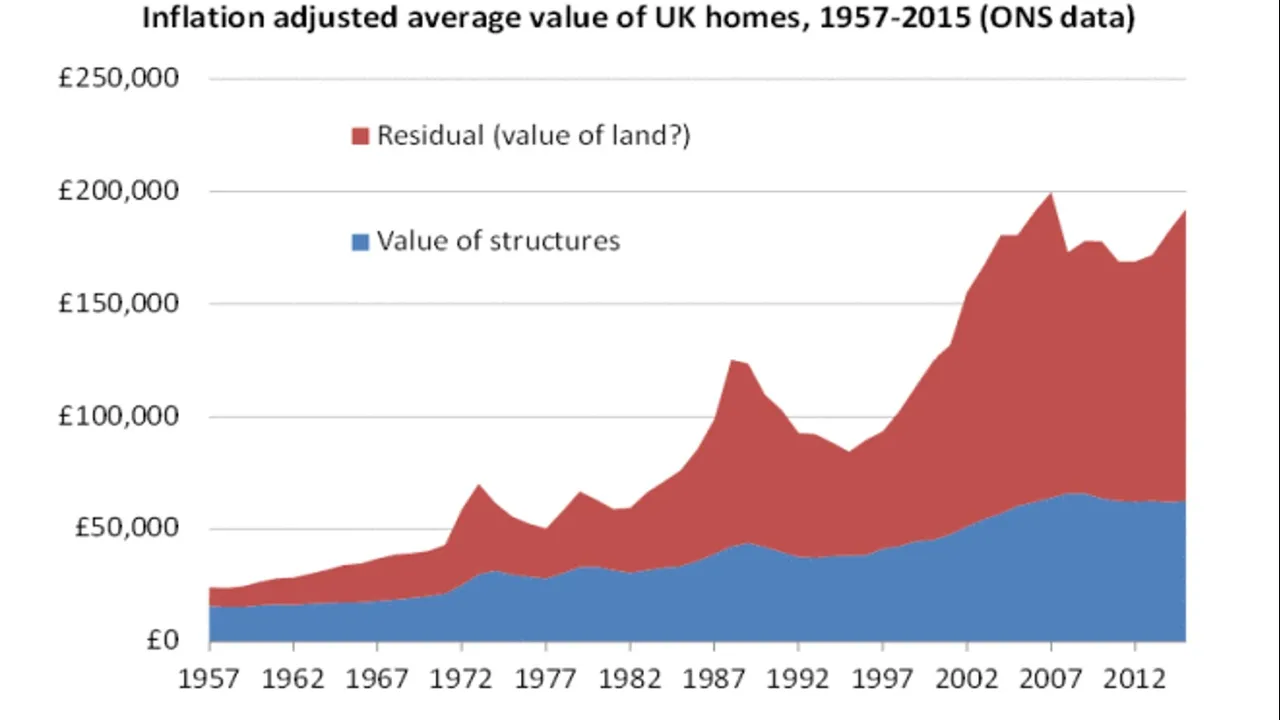

The cost of construction does not increase significantly. This is not surprising, as technology has enabled lower costs of extracting and obtaining raw material for construction. Advanced machinery is available to build houses more efficiently. Costs of labour would most likely be the main source of any form of increased construction costs. However, land values have increased significantly and are a major reason why house prices are increasing. Figure 6 contains the value of residential land and structures for UK homes from 1957 to 2013.

Figure 6: Value of Land and Physical Structure of UK homes

Source: James Gleeson

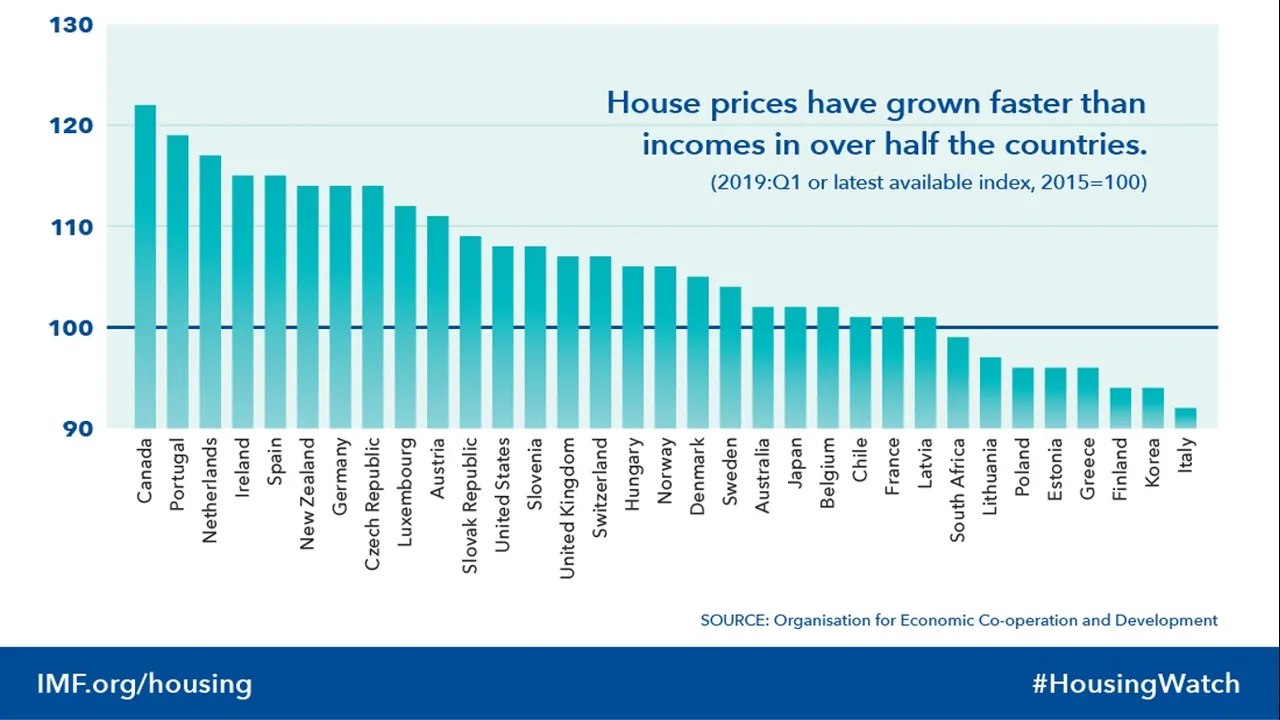

If supply cannot respond to demand, price will increase. The data in Figure 7 from imf.org, shows a strong positive trend in global house prices.

Figure 7: Globally Increasing House Prices

Source: imf.org

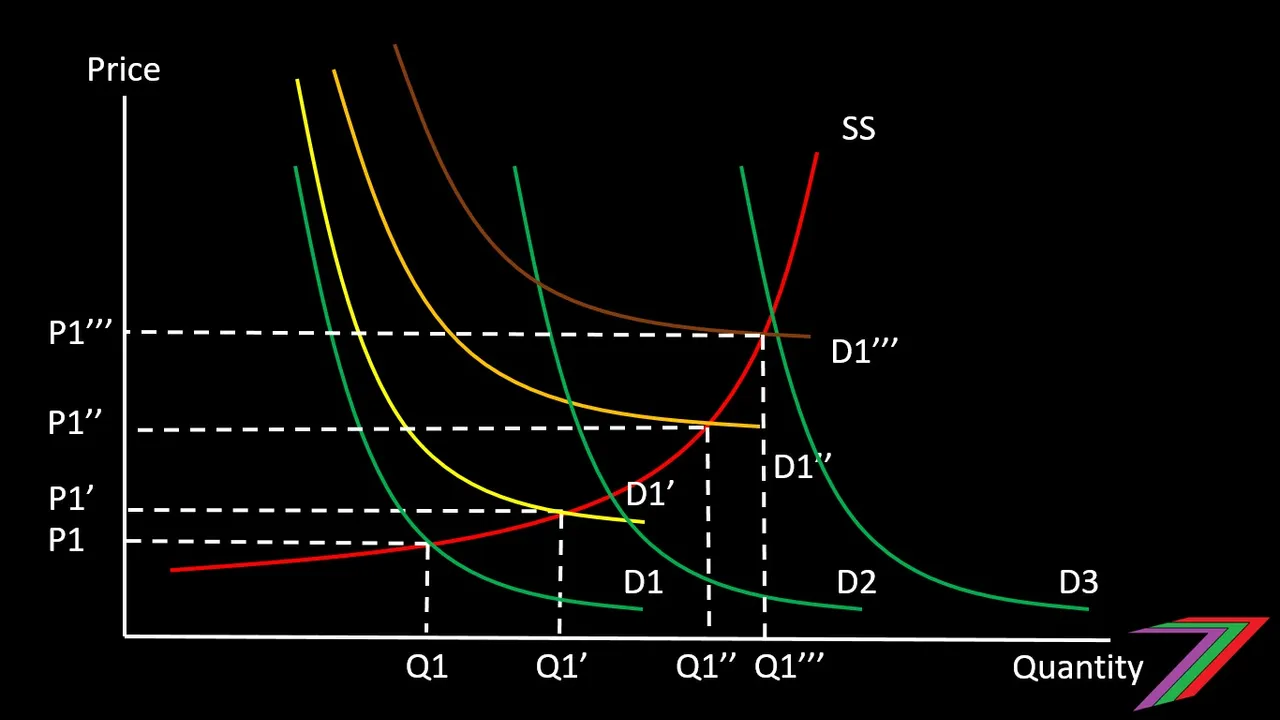

Consistently increasing house prices creates another problem. Housing begins to look like an investment opportunity. In my initial demand and supply graph, I assumed housing was purely sort after as a home (i.e. consumer durables). If housing is perceived as an investment opportunity because of increasing prices, demand for housing increases further. The shape of the demand curve also changes. Once a person or family have obtained a home, they may seek a second or even third property as an investment to earn from rent as well as eventually sell at a higher price. In Figure 8, I have altered the shape of the demand curve to include this effect.

Figure 8: Demand for Housing as homes and Investments

The effect on price is likely to be limited if only a few people are able to afford several houses as investments. However, this problem may become dramatically more apparent if mortgages become easier to obtain. For example, banks could lower the down payment requirements to obtain a property. With lower down payment requirements, houses becoming easier to obtain even though the price of houses have not fallen. In fact, easily available mortgages are likely to add further upward pressure on the price of houses. Figure 9 contains an example of increases in demand because of easier to obtain mortgages.

Figure 9: Effect of higher demand on house prices

Even though the population has not increased, the demand and house prices will increase as mortgages become easier to obtain. If this increase is sustainable, as it has been for a prolonged period, investors stand to gain. However, the biggest winners are likely to be the banks as they can earn more from interest payments from larger loans. The people that lose out are those that have yet to purchase a home. They can choose to either obtain a large mortgage and become ‘a slave’ to mortgage repayments or not buy and choose rented accommodation. However, the higher mortgage repayments will force the rental prices up. Therefore, there is a choice of high rent or high mortgage payments.

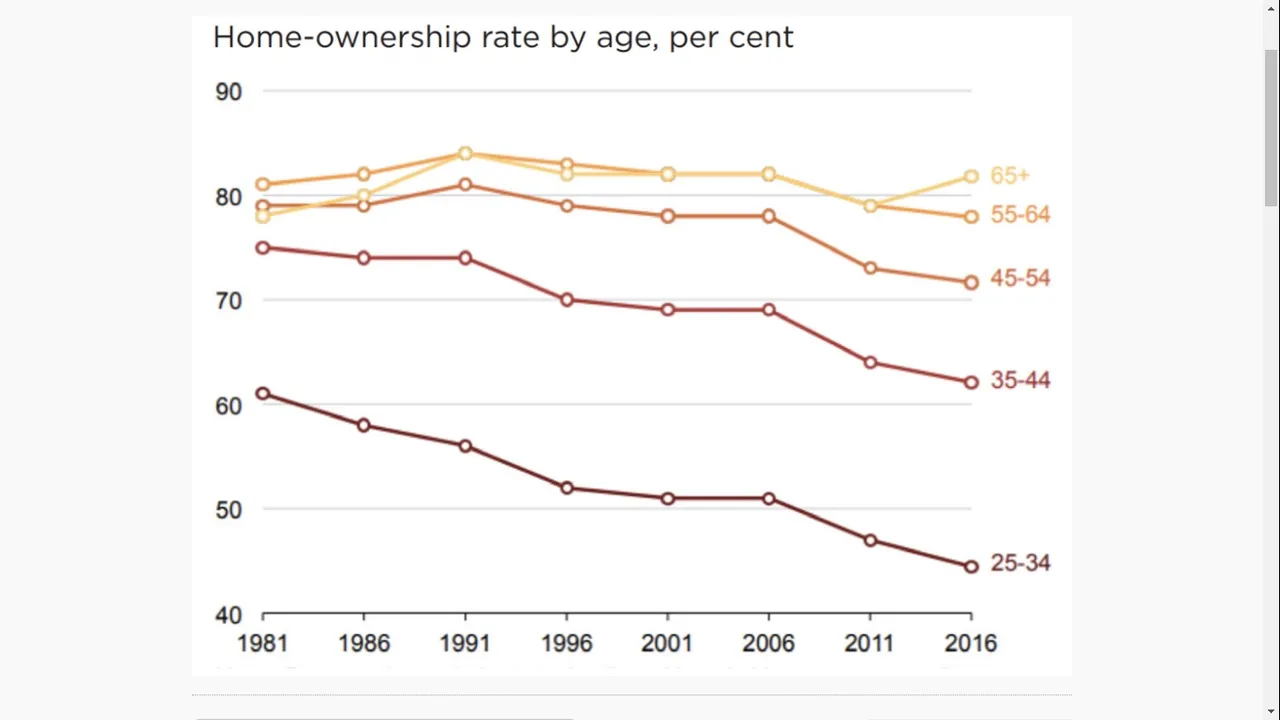

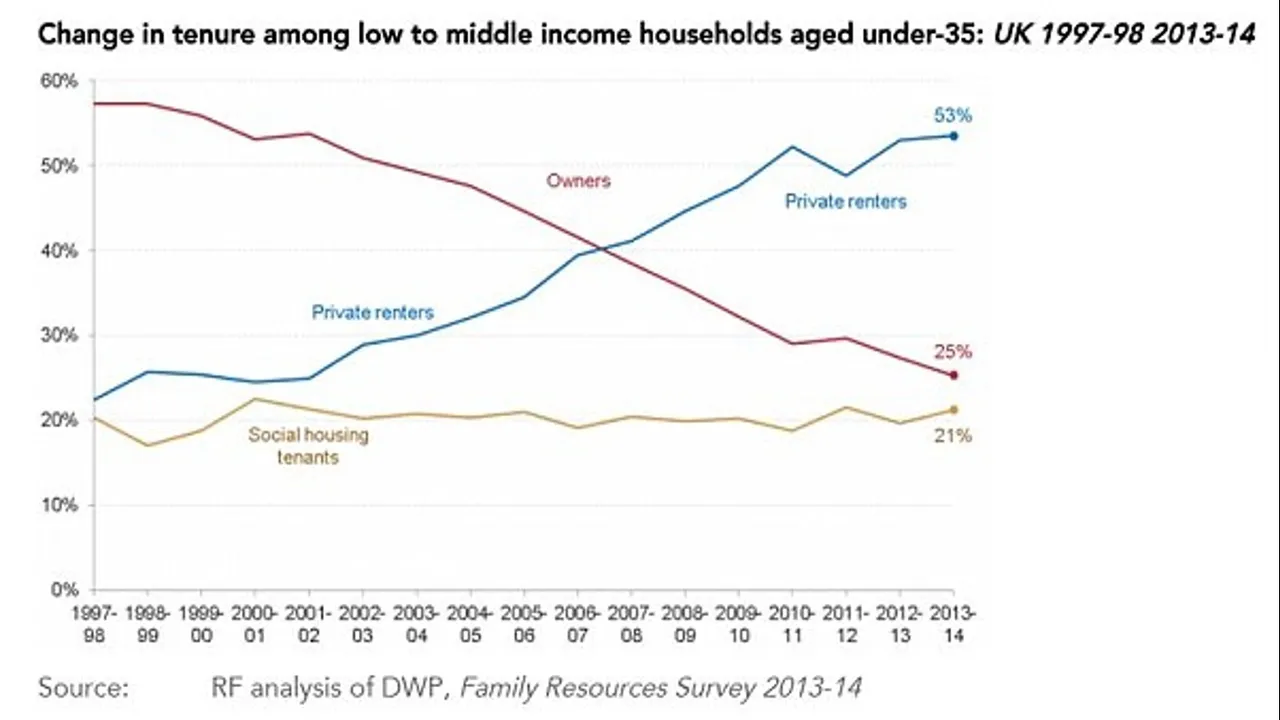

Figure 10 contains an example of the declining percentage of young people that own homes in Australia. Figure 11 demonstrates a similar trend in the United Kingdom with more young people choosing not to buy homes.

Figure 10: Home Ownership in Australia

Source: ABC

Figure 11: Young people shift towards renting accommodation in the UK

Source: This is money

I suspect this trend is occurring in many other countries as the rise in house prices far exceeds the growth in annual income as can be seen from data by the IMF in Figure 12.

Figure 12: House prices rising faster than incomes in many countries

Source: imf.org

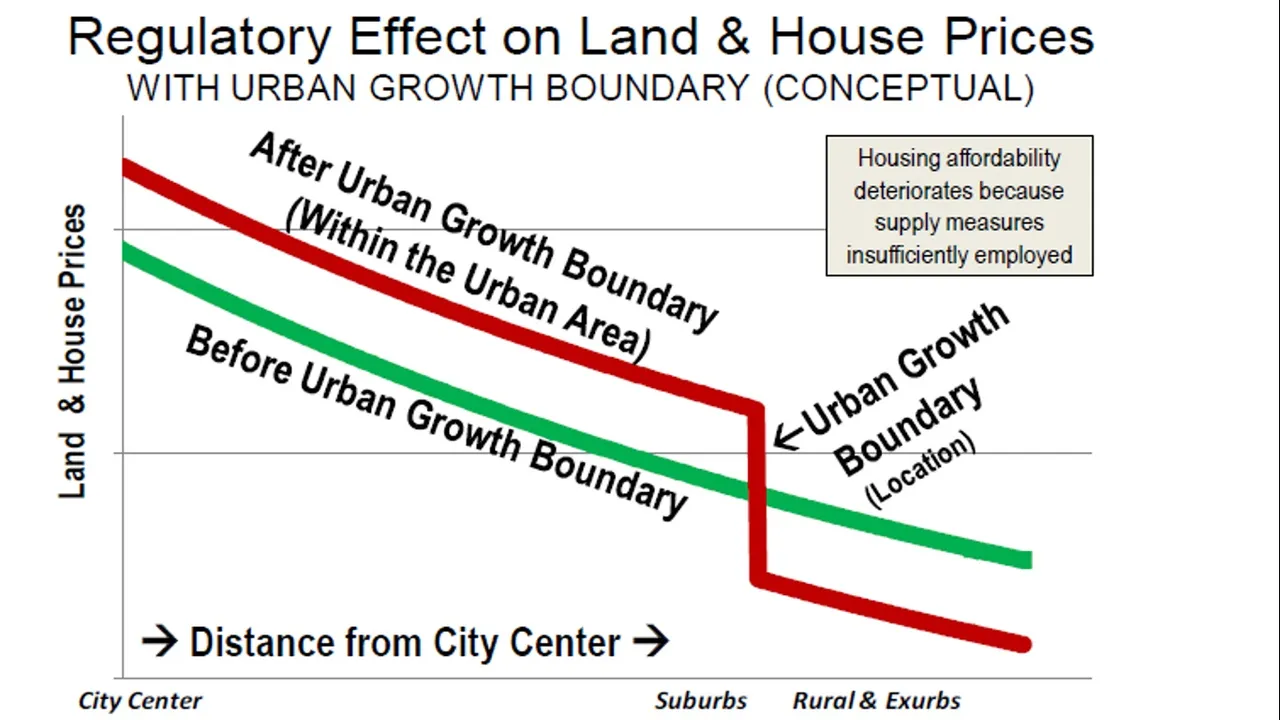

Another problem is the design of settlements and cities. Populations are concentrated in areas where work can be found. Therefore, the demand for housing is high but land is constrained. This results in significantly higher house prices. Figure 13 demonstrates the relationship between proximity to the city centre and house prices. House prices are further increased by the implementation of urban boundaries.

Figure 13: Land values and proximity to the city centre

Source: New Geography

Centralised location of activity has its advantages; these can be described as external economies of scale (i.e. benefits of business being located close to each other). However, if activities become too compressed in a particular area, these economies become diseconomies of scale (i.e. higher costs because of over competition for scarce resources).

How do we prevent housing shortages and affordability problems?

I believe prevention is quite simple. The market needs to function freely. This involves removing land restrictions and zoning. This will give housing supply a chance to keep up with demand. This will greatly slow the increase in price and therefore, housing will look less like an attractive investment. As house prices are not increasing by as much, people will not need large mortgages to be able to afford their first homes, thus putting less pressure on the price to increase.

Less intervention on land usage may encourage people to locate in smaller communities outside the cities. There is less need for large cities as people can work and communicate effectively online without needing to congregate in an urban centre. Less Government spending on infrastructure, which facilities mass daily movements into the city would also discourage working in the city.

How do we solve housing shortages and affordability problems?

Preventing housing shortages and maintaining affordability could be handled by the market. However, once the problem has occurred, it is considerably more difficult to solve. If the above prevention approaches are adopted to solve housing shortage and affordability problems, house prices will crash. This make it easier for first-time buyers but all the people that currently own property will suffer, as they will likely owe more money to the banks than what their houses are worth. Therefore, actions that will cause a housing market to collapse cannot be implemented.

The Government could intervene by providing affordable housing, which does not directly compete with private housing. I would expect the Government to offer low rents to people that are unable to buy or even rent privately. The Government could eventually sell these properties to the tenants at a lower price after several years of tenancy; this like a form of third degree price discrimination. This solution does not fully address the housing affordability problem for all. A likely outcome is that the number of people that cannot afford private housing will switch to public housing. This will result in more and more public houses being provided. This will lower the overall quality of housing and increase the burden on taxpayers to fund the construction of these houses.

How do we manage housing shortages and affordability problems?

A more logical approach would be to attempt to stop the price of housing from increasing further. I would consider this as managing the problem rather than solving it immediately. Rather than removing regulation and zoning, it could be relaxed so that the supply of housing can increase to meet demand without causing housing markets to crash. I would also suggest reducing Government expenditure on infrastructure in the cities as a method of discouraging the further growth of cities. Instead, Government expenditure could be directed towards towns and smaller urban areas to encourage growth. This will attract people and business to less populated areas and exert less pressure on house prices.

Where does housing fit in the prevent, solve, or manage approach?

I believe housing shortages and affordability problems could have been avoided if the market was allowed to function, as it should. However, Government intervention appears to be a predominant cause of housing shortages and lack of affordability. Once housing becomes unaffordable, it is very difficult to correct. Falling house prices will be disastrous to those that owe large amounts of money to banks as mortgages. However, if house prices continue to increase, the housing affordability problem only becomes worse. Therefore, if prevention has failed. The housing shortage and affordability problem should be managed. This should involve policies that target maintaining house prices until household income can catch up so that there is the eventual possibility of affordable housing for all.

Quick Summary of Key Points

- Market forces cannot function, as supply is artificially restricted (i.e zones, boundaries, and other regulations).

- Increasing prices from restricted supply has created the perception that houses should be bought as investments.

- Lower down payments and easier to acquire mortgages has increased demand for housing particularly as an investment opportunity.

- The growth of large urban areas has put pressure on house prices because of limited land and growth boundaries.

- Young people are struggling to enter housing markets because of the high and increasing house prices.

- Housing shortages and unaffordable housing appears to be a problem in many countries.

- The housing problems could have been prevented but are now very difficult to solve.

- Some Governments are likely to increase social housing, which is likely to only be a short time solution that will eventually create even more problems.

More posts

If you want to read any of my other posts, you can click on the links below. These links will lead you to posts containing my collection of works. These posts will be updated frequently.

Guide to the Steem Ecosystem (Udemy Course)

I have launched my Udemy course ‘Guide to the Steem Ecosystem’. This course takes you on journey through the Steem Ecosystem. The course consists of 6 sections. These sections are as follows:

- Getting Started

- Navigating Steem Frontends

- Becoming a Steem User

- Behind the Scenes

- The Wonders of the Steem Ecosystem

- Additional Content (SteemFest 4, SMTs, Communities, etc.)

The course contains 56 video lectures (about 13.5 hours of viewing), 56 multiple-choice questions (10 to 12 at the end of each section), and 59 downloadable resources (presentation slides and additional material such as white and blue papers). The course is free-of-charge. Click the link above to access the course.

I also have an economics course, titled Economics is for Everyone, which contains about 4 hours of video content.

Steem - The Future of DApps