Hi Everyone,

Do you find yourself annoyed by noisy neighbours? Do you dislike dirty smelly streets and the fumes from vehicles? Do you dislike dirty polluted rivers? Do you like the view of your neighbours beautiful garden? These questions focus on externalities. Externalities are the third party affects from other people’s production and consumption. Externalities are not automatically factored into the price and quantity of goods and services provided by the market. Externalities can be either positive or negative.

Positive externalities

It seems generally harder to find examples of positive externalities. This could be because those that produce positive externalities are more likely to find methods to obtain a reward for the positive externalities that they create. Those that produce negative externalities are more likely to avoid paying for the negative externalities that they create. Below are a few examples of activities that produce positive externalities:

- Good property upkeep

- Busker performances

- Tree planting

- Community work

- Social blogging (only in some cases)

- Education and skill acquisition

- Open source projects

- Social infrastructure

Some positive externalities benefit consumers while others benefit producers. Consumers can benefit from the positive spill over of a good or service that cannot be confined to those that directly purchased it. For example, those that have not decided to tip a busker can still enjoy that busker’s performance. Producers can benefit from cost reductions as a spill over effect from the activity of others. For example, open source projects can reduce costs through the sharing of research and information. This information can help lower the costs to other producers.

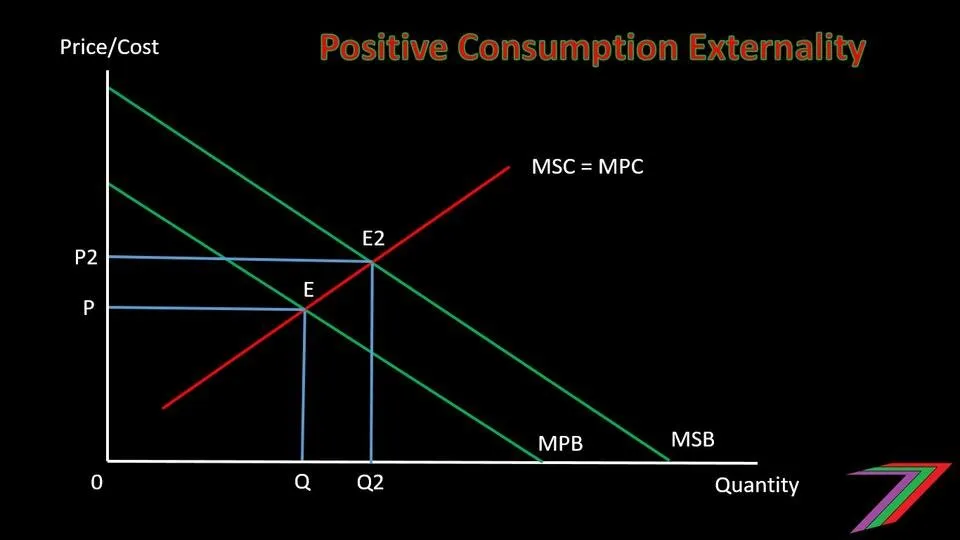

Activities that generate positive externalities are generally under produced as the activities are under rewarded. Positive externalities can be analysed using simple demand and supply models. A positive externality that effects consumers can be graphically explained in Figure 1.

Figure 1: Positive Consumption Externality

Equilibrium price and quantity are determined when marginal private cost (Supply) equals marginal private benefit (demand). As shown in Figure 1, the marginal social benefit (MSB) is more than the marginal private benefit (MPB). The external benefits (positive externality) are not factored into determining the equilibrium price and quantity. This causes the good or service to be under produced.

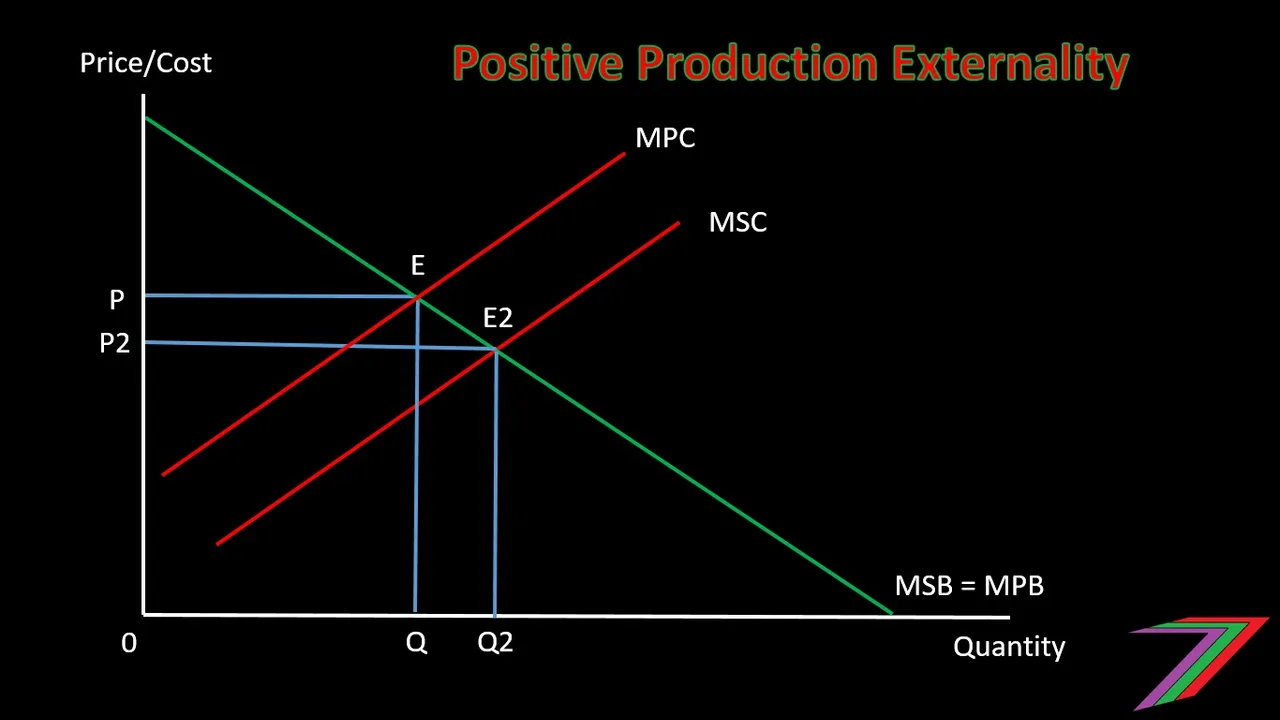

A positive externality that effects producers can be graphically explained in Figure 2.

Figure 2: Positive Production Externality

As shown in Figure 2, the marginal social cost (MSC) is less than the marginal private cost (MPC). Activities that create positive production externalities tend to be under produced as the firms that create the costs savings do not reap all of them. Therefore, the firm has less incentive to produce an optimal output for society.

Negative externalities

Negative externalities often garner the most attention. As mentioned earlier, there is less incentive for a producer to find methods of paying for a negative externality than there is to earn from a positive externality. Below are a few examples of activities that produce negative externalities and the types of externalities these activities are likely to cause:

- Manufacturing that creates pollution (water, air, noise, etc)

- Agriculture that creates pollution (water, air, deforestation, animal abuse, etc)

- Mining activities that creates pollution (water, air, soil erosion, etc)

- Transportation that creates pollution (water, air, noise, etc) and congestion

- Smoking tobacco or other substances (air, unpleasant smell, health cost to passive smokers, etc)

- Criminal behaviour (damage to property, injury to others, etc)

- Waste disposal (harm to wildlife, water and land contamination, etc)

- Entertainment and sports (noise pollution, littering, disturbance to the community, etc)

As with positive externalities, some negative externalities affect consumers and some affect producers and many affect both. For example, air pollution negatively affects anyone who encounters it. It is often very difficult to avoid and not all air toxins are detectable visibly or through smell. Another example, is land pollution which can lower the quality of land so that crops cannot be grown.

Negative externalities can come from the consumption of a particular product. For example, sports events can generate a lot of noise. Supporters often litter the surrounding areas and can sometimes become rowdy and damage property.

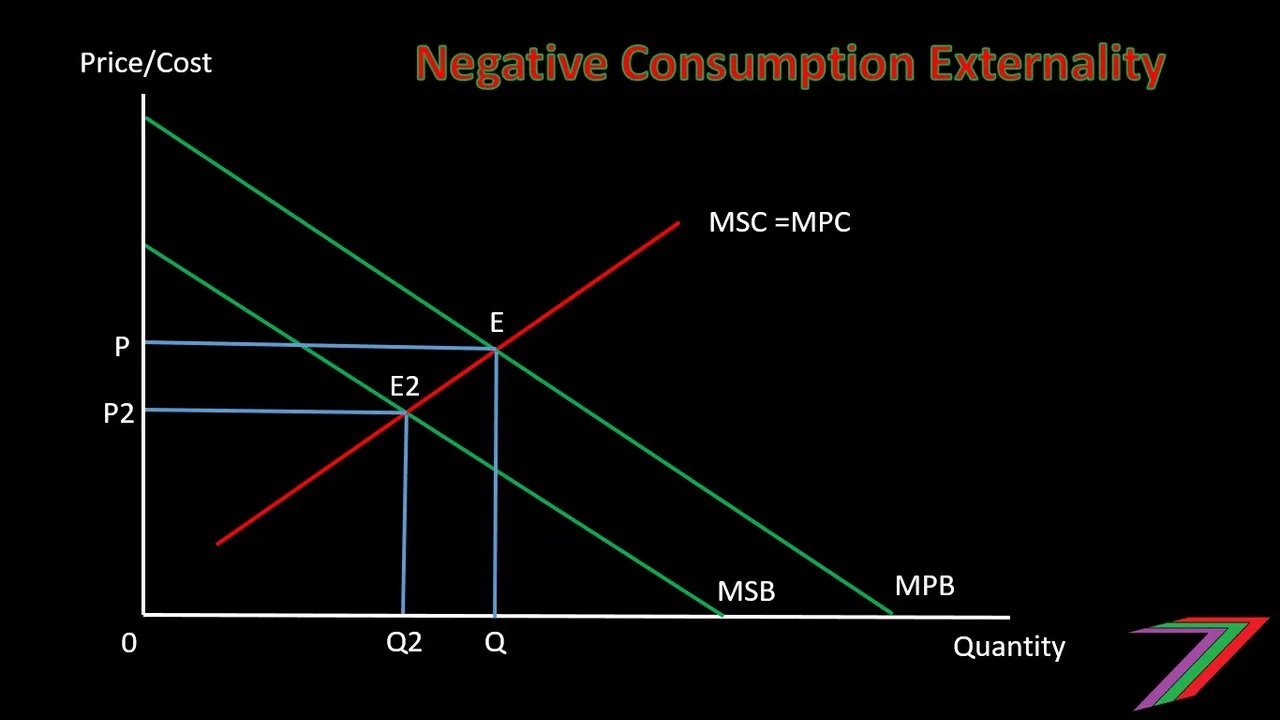

Activities that generate negative externalities are generally over produced, as those engaged in the activities do not bear the full costs of the activity. A negative externality that effects consumers can be graphically explained in Figure 3.

Figure 3: Negative Consumption Externality

As shown in Figure 3, the marginal social benefit is less than the marginal private benefit. The price and the quantity produced are higher than if the negative external benefit had been considered. The producer does not need to consider these negative effects as those negatively affected are not involved in the transaction.

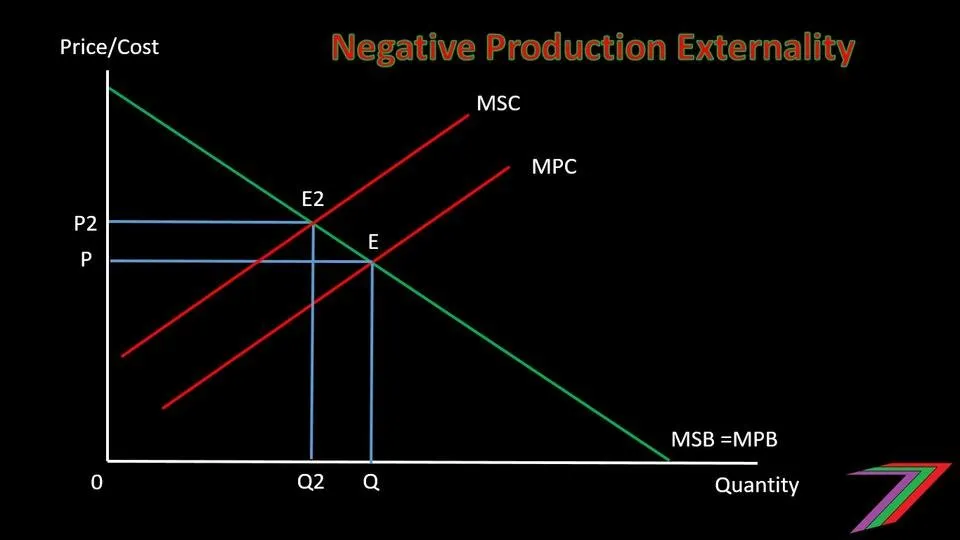

A negative externality that effects producers can be graphically explained in Figure 4.

Figure 4: Negative Production Externality

As shown in Figure 4, the marginal social cost is more than the marginal private cost. The price is lower and the quantity is higher than if the external costs had been considered. Other firms, individuals, and organisations bear some of the costs of production. These costs could include cleaning up the pollution caused.

Coase Theorem

Ronald Coase offered a market solution for incorporating the external costs and benefits into the pricing mechanism. Coase developed his theorem when considering radio stations that used the same frequency. When radio stations use the same frequency, the broadcasts interfere with each other. Coase believed this problem could be resolved, if property rights could be established. The radio station that valued the frequency more would pay the other stations not to use their desired frequency. This would be mutually beneficial as one radio station can have a frequency to themselves and the other stations benefits from a payment.

One of the best-known examples of Coase Theorem relates to positive externalities obtained from collecting fallen apples from the neighbour’s apple trees. In this example, a person has apple trees and some of the apples from these trees fall into the neighbour’s garden. The neighbour collects these for free (positive externality). The person with the apple trees believes his neighbour should pay for the apples. To enforce this payment, the person with the apple trees threatens to increase the height of the fence to prevent apples from falling into his neighbour’s garden. As the neighbour does not want to lose access to the apples, he agrees to offer some payment for the apples. The payment also offers the person incentive to grow another apple tree. In this case, the externality problem of under production of a good with a higher marginal social benefit than marginal private benefit is resolved.

However, Coase Theorem has limited application. Transaction costs of bargaining and insufficient information limit the benefits of the Coase market solution. Reaching an agreement can be time consuming and expensive. For example, a factory that pollutes the environment are imposing a cost on many people and possibly at an unknown magnitude. Negotiating with such a large group of people will be very difficult. Even identifying all parties will be a tedious task.

Intervention solution

An alternative solution is outside (Government) intervention. Some consider externalities as market failure. Therefore, Government should become involved. Government can intervene by taxing activities that produce negative externalities and subsidizing activities that produce positive externalities. The tax will raise the cost of producing the negative externality and therefore increase the price and reduce the quantity demanded. The subsidy will lower the cost of producing the positive externality and therefore reduce the price and increase the quantity demanded.

The intervention approach has the problem of determining the value of the externalities (both positive and negative). It is likely that Governments will either overestimate or underestimate these values. There is also the problem of distribution of the tax collected from an externality. Those effected by the negative externality should be compensated from the tax collected from those causing the negative externality.

Broader/alternative approach to externalities (food for thought)

Externalities are typically described as third parties effects not accounted for by markets. Externalities should also include any indirect effect of any activity. This could even include paid employment. This could be true for people working in Government Bureaucracies where a person’s output cannot be clearly defined or measured. The person in the Government position is likely to be paid based on a fixed scale, which is not linked to any measurable return on output. Could the product of this person’s work be considered an externality? Sometimes the key objective of Government hiring is to provide employment rather than employ people to facilitate the provision of any particular service. Does the product of this work provide a negative, a positive, or no effect on society? I will pursue this idea further in another post.

Conclusion

Externalities can be negative or positive. They can affect either or both the demand side or the supply side of the market. Markets can cause the over production of products that cause negative externalities and the under production of products that cause positive externalities. The market has been mostly ineffective at addressing the problem of externalities. Government intervention is often seen as a solution. Government’s can tax negative externalities to lower output and subsidise positive externalities to increase output. However, the extent of the cost or benefit of externalities cannot be reliably determined by Government. Those affected by the externalities, cannot be reliably or consistently compensated.

More posts

If you want to read any of my other posts, you can click on the links below. These links will lead you to posts containing my collection of works. These posts will be updated frequently.

Steem - The Future of DApps