This is Part 2 of my ‘Dark Side of Economics – Cost Benefit Analysis’ post. Part 1 is available at: https://steemit.com/economics/@spectrumecons/cost-benefit-analysis-dark-side-of-economics-4

What was covered in the Part 1

The first post covered the following areas:

- Base Case

- Assumptions

- Exaggerate Future Growth

- Insufficient Sources Cited

- Long Evaluation Periods

- More effort to find benefits than costs

- Qualitative discussion around benefits and not costs

Quick Recap – What is cost benefit analysis?

Cost benefit analysis is a technique economists use to determine if an initiative is worth investing in. Costs and benefits are identified, measured and converted into dollars. A process known as discounting is used to convert future costs and benefit into present day dollars. The theory behind discounting is that a dollar received today is worth more than a dollar received tomorrow. After both costs and benefits have been converted to dollars and discounted, they are compared with each other. If benefits are greater than costs, the initiative is considered economically viable and the initiative is recommend to proceed.

Cost benefit analysis is intended to inform decision-makers regarding investment decisions. If cost benefit analysis is done correctly it can be a valuable aid to making decisions. Unfortunately, that is a surprisingly big ‘if’. There are numerous tricks that be used to misinform decision-making and lead decision-makers to make the wrong decisions. It can also be used to support bad decisions and be used to misinform the public once the cost benefit analysis reports are made publicly available.

What will be covered in this post?

This post will cover the following areas:

- Lack detailed options analysis

- Select modelling or models that produces best results

- Exclude Negative effects on the network

- Don’t discuss negative externalities

- Use Generic Sensitivity tests

- Exclude profits from construction from analysis

Lack detailed options analysis

Cost benefit analysis is considerably more valuable when it is applied to several competing options rather than one preferred option. Cost benefit analysis can be used to objectively determine the optimal option. Making comparisons between options is easier than making comparisons between projects. This is because of greater consistency between options in regards to:

- Base case definition

- Assumptions

- Models

- Unit values

- Referent group

- Definition of benefits and costs

Having several options to compare makes it considerably more difficult to manipulate the results in favour of one particular option. This is because of the required consistency for the above mentioned areas for each option.

Multi-criteria analysis is often the preferred approach to determining the preferred option. Unfortunately, multi-criteria analysis is even easier than cost benefit analysis to manipulate as it is largely a qualitative exercise. The multi-criteria analysis can be used to select the option preferred by Government which is often a large infrastructure solution. The best option is unlikely to be selected using this approach.

Select modelling or models that produces best results

There are normally several models that can be used to model demand. This is particularly true for transport projects. There a variety of microsimulation and mesoscopic models (fancy names for models that produce inputs into a cost benefit analysis). Each of these models have their strengths and weaknesses. The analysts should select the model that is most suited to the project type and the network. Unfortunately, this does not always happen. Some analysts select the model that produces the highest projected demand, which normally produces the highest benefits for the project. Models that incorporate more of the network generally produces outputs that produce a higher value of benefits for the project.

Exclude negative effects on the network

Network effects are typically not incorporated in the cost benefit analysis. There is generally due to a lack of confidence in the reliability of outputs produced for the network. When network effects are included, network benefits are considered and network costs are almost never considered.

In many cases network benefits are included as an approach to increase the value of the project’s benefits when the benefits appear low or lower than project costs. Network effects can be included by using sophisticated models that include the broader network. Unfortunately, these models generally favour benefits or cost savings rather than costs. This typically happens as most models are not particularly good at constraining demand based on capacity constraints. What typically happens is that demand is allowed to grow unhindered, this produces a larger stream of benefits to the project. The larger network, the larger these streams of benefits tend to be. If capacity could be sufficiently incorporated, network bottlenecks could be identified. This could have the effect of lowering project benefits or providing evidence of additional costs.

Don’t discuss Project Negative Externalities

Project externalities (external costs such as environmental and third party costs) are generally considered as a benefit to the project. Externalities in the base case are viewed as negative externalities. The project is viewed as reducing these negative externalities. Hence, externalities are treated as cost savings. The investigation of negative externalities that increase because of the project, new negative externalities, and reductions in positive externalities rarely happens.

Future environmental costs are often identified as part of the project’s environmental impact assessment but these costs are rarely monetised for inclusion in the cost benefit analysis. Environmental costs related to construction are generally included in the cost estimate which is part of the cost benefit analysis.

Third party costs relating to the project are rarely discussed. An example would be infrastructure in flood prone areas. Construction of infrastructure such as bridges, culverts, dams, and weirs can cause flood related problems to areas further downstream of the project. These areas are not investigated and these costs are not monetised for inclusion in the cost benefit analysis.

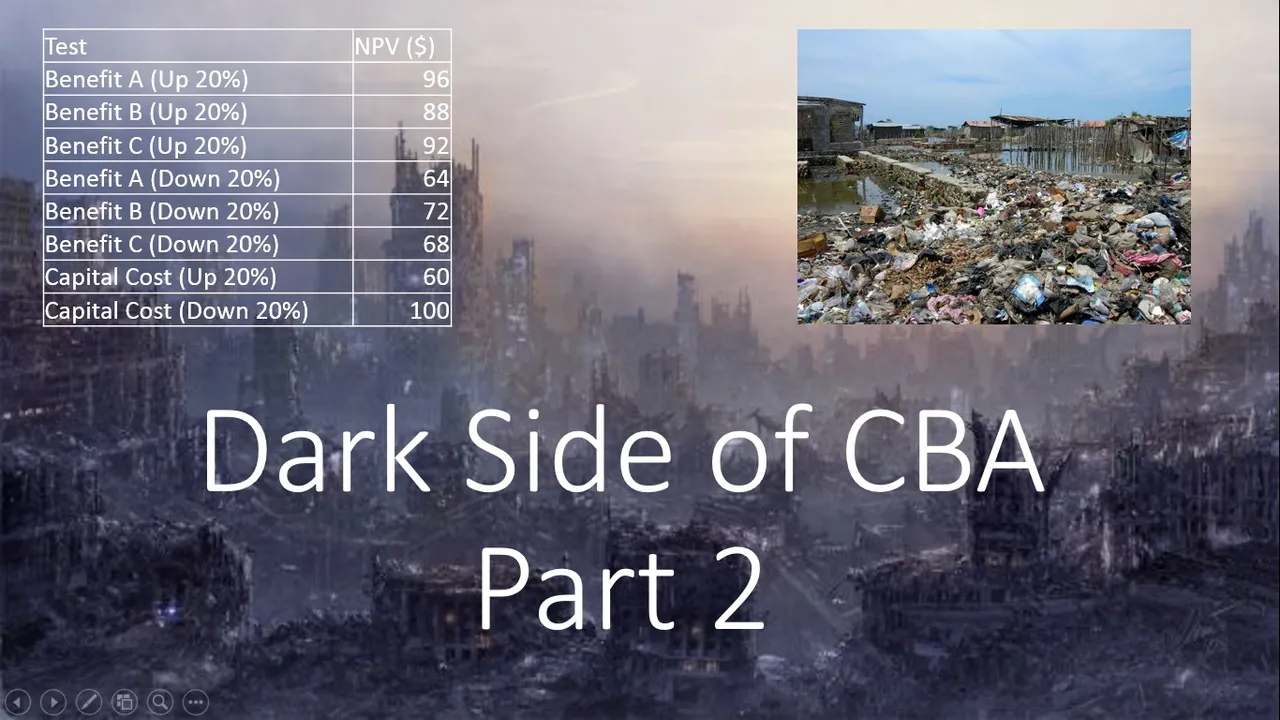

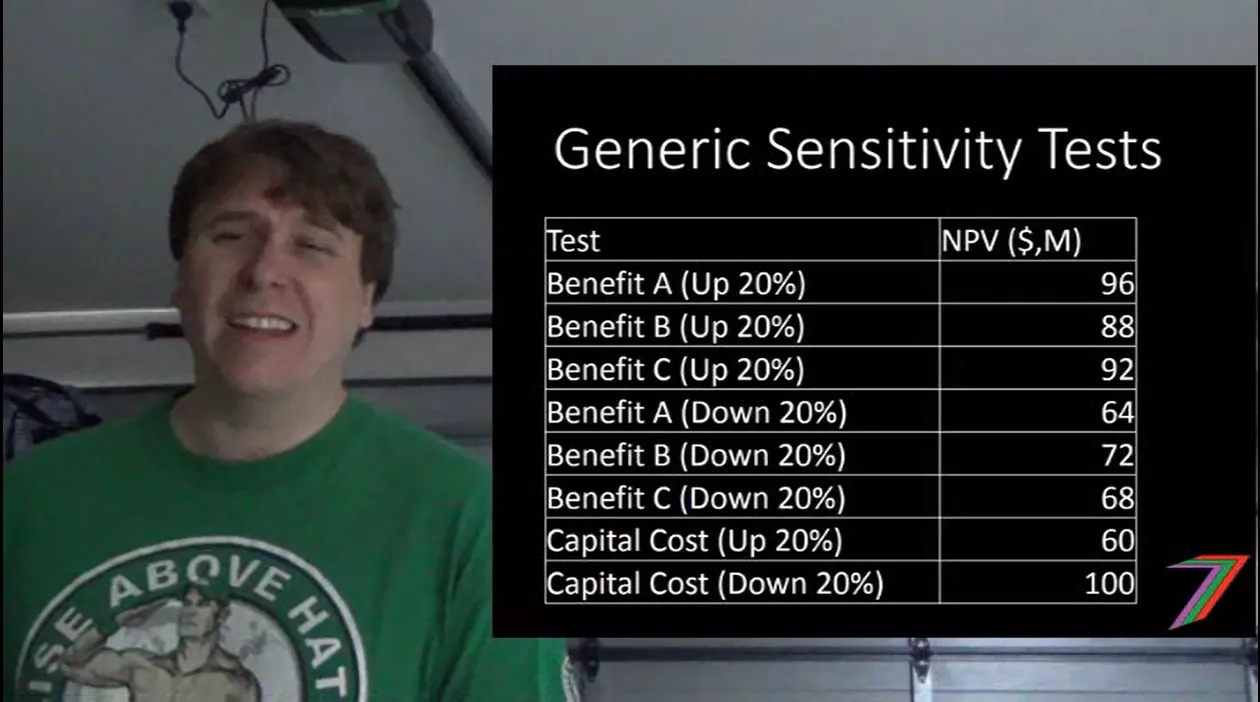

Use generic sensitivity tests

Sensitivity analysis is one of the most important elements of a cost benefit analysis. Sensitivity analysis factors risk into the cost benefit analysis. This is essential as cost benefit analyses are subject to many assumptions. These assumptions, as mentioned in Part 1 of this post, can greatly influence the results of the analysis. Therefore, the most logical step is to sensitivity test all of the key assumptions (assumptions most likely to have an impact on the results of the analysis).

Instead, what normally happens is that generic sensitivity tests are applied to the cost benefit analysis. Generic tests typically include increases and/or decreases in costs or benefits by about 20% or 30%. These tests are meaningless. Key assumptions and drivers are not tested. If the benefit cost ratio (BCR) is greater than 2, all tests will still show that the BCR will remain above 1 for all scenarios.

Monte Carlo Simulation (calculation of distributions based on probabilities assigned to various outcomes) is typically applied to cost estimates but almost never applied to benefits. Benefit are likely to fluctuate far more than costs as benefits are spread across the life of the project; whereas, investment costs typically only occur early in the life of the project. A good sensitivity analysis should include a distribution of benefits. This can be used to determine the median, mean, lower and upper quartiles, maximum and minimum results (net present value (NPV and BCR)).

Exclude profits from construction from analysis

An interesting but controversial observation I want to make is in regards to profit to consultants and construction companies. The cost estimate provided for the cost benefit analysis includes profits to external parties. These profits are not identified as individual items but incorporated with other elements of the estimate. Profits should be identified as separate items as profits are transfer payments and not real costs to society. From a financial perspective profits should be included in the cost estimate as they are outgoings for the project.

I personally feel profits should be included in the costs but they should also be stated so that readers know what value or percentage of project costs go to profits. If profits are included as costs they should also be included as benefits. This will give the readers a good idea of where the benefits are going and who is benefiting the most. Including profits under both costs and benefits will not alter the results of the analysis but will provide the reader with relevant information about who benefits. Currently, profits are hidden in the cost estimate and not matched in the total benefits calculated. This actually underestimates the results of the cost benefit analysis, first point that I have mentioned that does that. This is done to mask the fact that some Government investments are done to benefit the private sector rather than the community.

Conclusion

This brings me to the end of ‘Dark Side of Economics – Cost Benefit Analysis’. I hope you have found the information in this post and the previous post useful. The content is more directed at readers with some knowledge and background in economics and cost benefit analysis. If you go back and read some of my other posts and/or watch some of my videos relating to cost benefit analysis. You should be able to gain a reasonable understanding of how cost benefit analysis is applied.

The information in this post is important as it helps explain how cost benefit analysis is being used as a tool of manipulation to promote wasteful Government expenditure. I strongly believe that cost benefit analysis can be used to greatly improve the quality of investment made but it needs to be be done correctly and with integrity.

I would like to thank you for taking the time to read this post or watch the video provided in the link below.

Below is the full video for Parts 1 and 2:

Below are links to some of my other posts relating to cost benefit analysis

https://steemit.com/economics/@spectrumecons/cost-benefit-analysis-video

https://steemit.com/economics/@spectrumecons/cost-benefit-analysis-discount-rate

https://steemit.com/economics/@spectrumecons/cost-benefit-analysis-dealing-with-capacity-constraints

https://steemit.com/economics/@spectrumecons/cost-benefit-analysis-criteria-for-decision-making

https://steemit.com/economics/@spectrumecons/cost-benefit-analysis-sensitivity-analysis

The official Spectrum Economics website can be accessed at:

https://www.spectrumecons.com

The dark side of economics series is available at:

For more exciting videos go to my YouTube channel at:

https://www.youtube.com/channel/UCILwyLtjl7ZTlYOqFkAwLzw

You can find me on LinkedIn at:

https://www.linkedin.com/in/waynedavies-spectrumecons/

You can find me on Facebook at:

https://www.facebook.com/SpectrumEconomics/

You can find me on Steemit at:

https://steemit.com/@spectrumecons