The most elaborate working crypto-economic model, however, is Steemit, an online forum which rewards its 1m or so registered users for posting contributions or rating content with real money in the form of steem, another sort of token. One type is liquid and can be cashed out using an exchange, which is meant to provide near-instant gratification and attract users. The other, called “steem power”, is less easily convertible and supposed to keep members engaged: the more they own, the more weight their votes have.

The Economist, June 30th, 2018

Thereafter I try to explain the crypto-economic model of the steem blockchain in 2 animated PowerPoint slides. You can watch the 1' animation by clicking on the YouTube link at the end of the article.

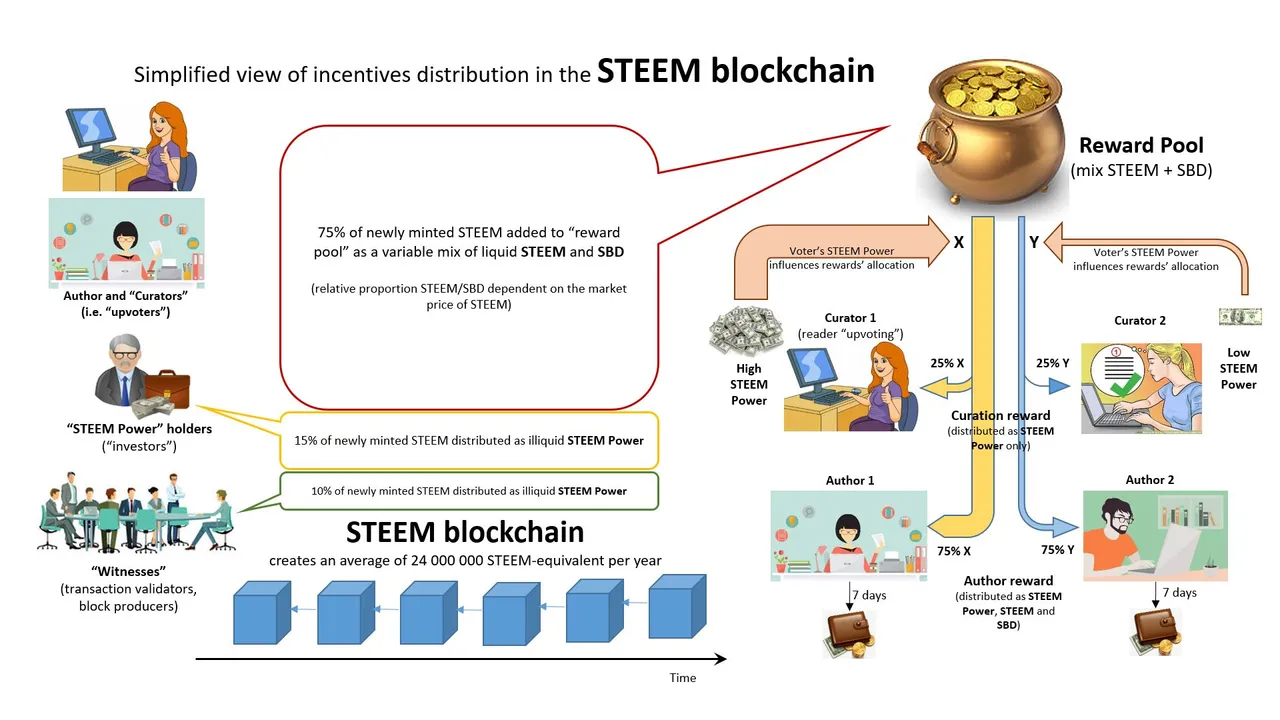

Several key features of the steem crypto-economics are apparent in the first slide:

- unlike in first generation public blockchains, where all the rewards were distributed to the "miners" operating the network, steem sets aside only 10% of the generated value for them. Even that is provided in a non-transferable form, as VESTS (usually shown as "STEEM Power").

- Proof of Stake blockchains tend to reward "investors" as well, for keeping their stake in the system rather than trading it. Steem makes no exception, providing an incentive to whoever has "powered up" (transformed liquid STEEM into non-transferable VESTS a.k.a. "STEEM Power").

- The most distinctive feature of steem is the common "Reward Pool", which receives 75% of the minted STEEM and SBD (the platform's "stable coin", pegged to 1 USD). It is the cryptocurrency mix from the reward pool which incentivizes users to create, thus becoming authors, and to read and upvote their preferred creations, thus acting as curators.

The Reward Pool is fundamental, as it allows even people with almost no investment ("nothing at stake") to earn STEEM, SBD and STEEM Power through an effort as little as upvoting an article ("curating"), and even more so by producing original creations. It thus gives all comers an easy path to earning cryptocurrencies and a reason to behave in a responsible manner.

As both authorship (75%) and "value signaling" through upvotes (25%) are rewarded and the proportion of rewards depends on the STEEM Power of the Curator, further incentive is provided to lock rewards as STEEM Power and to form communities.

Steem Communities

The mechanism of steem, dubbed "Proof of Brain" by its authors, fosters the aggregation of communities of interest: "Writers' Block" for aspiring fiction writers, "D-A-CH" for German-speaking Steemians, "SteemSTEM" for researchers and scientists with a pedagogic streak, etc.

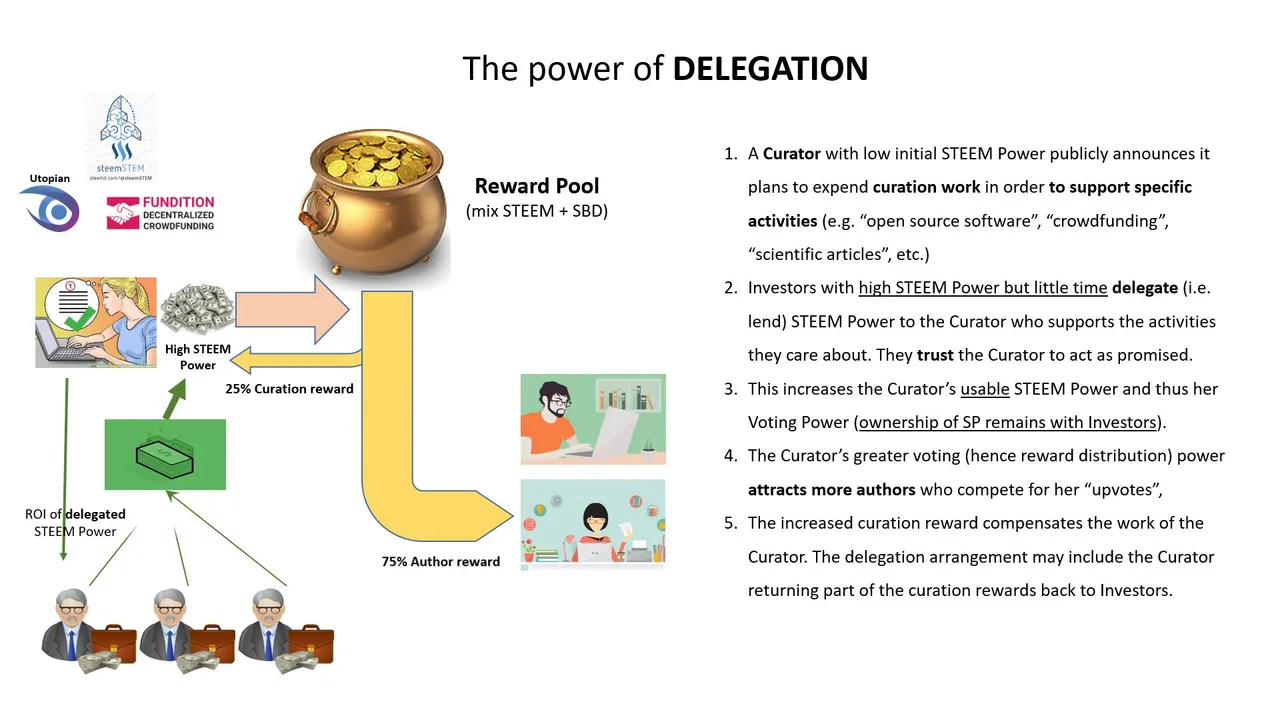

These communities may benefit from the leverage of STEEM Power delegation as they offer other users the possibility to act as "investors". The investment is secured by the fact that STEEM Power (SP) is only "lent" to the requesting community and can be reclaimed at any moment of the investor's choosing (involving a 7 days "cool-off" period). The SP thus lent continues to accrue "interest" for its owner.

But for the purpose of "upvoting", it is controlled by the Borrower. This increases the influence of the Borrower who can now distribute much bigger amounts, thus stimulating creation in the area it targets. The Borrower also earns higher curation rewards, of which he can keep part or all to compensate for the effort of seeking and rewarding the best authors.

As the work of the Community Curator is recorded and available to all on the blockchain, it encourages the Borrower to stay loyal to its initial stated mission lest the Investors pull off their STEEM Power.

Finally, some arrangements may include the Borrower returning part of the extra curation rewards back to the investor, thus increasing the return on investment for STEEM Power on top of the blockchain-generated interest. We can thus say that the delegation mechanism creates a "capital market" where different communities vie for the attention and, especially, the VESTS of big SP holders

Note that I did not attempt to explain several other important aspects such as:

- Beneficiaries (for dApps creators)

- Witness election (for system governance)

- Bots' "advertising" economy

and other aspects which contribute to making steem the undisputed leader of the crypto-economy.

Other posts on blockchain technology that you might enjoy:

- Blockchain revolution: the CIOs' dilemma

- Toward a pan-EU blockchain infrastructure

- Sovereign identity on blockchain

- Blockchain revolution: Money and Credit

- The Holy Blockchain

- Decentralized Learning: The Future of Student Mobility in Europe

- Small worlds

- Steem $10Bln!

- A New Hope

- Blockchain in large organizations

- Why Blockchain Is a Revolution

- European Financial Transparency Gateway

If you know what witnesses are and agree that people commited to keeping this blockchain ticking play an important role ...

(by simply clicking on the picture - thanks to SteemConnect)